Australia Generative AI Market Size, Share, Trends and Forecast by Offering Type, Technology Type, Application, and Region, 2025-2033

Australia Generative AI Market Size and Share:

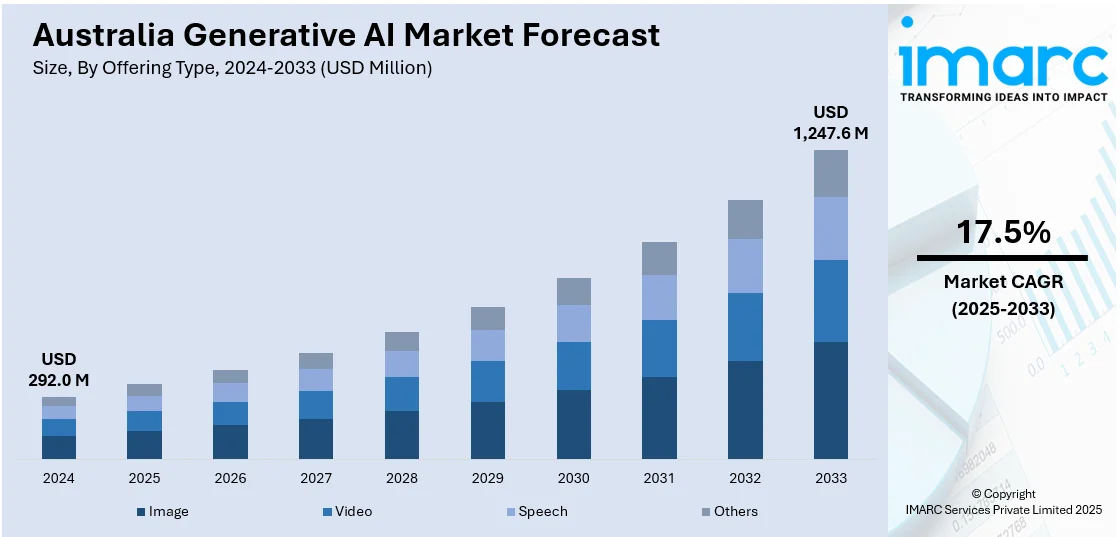

The Australia generative AI market size reached USD 292.0 Million in 2024. Looking forward, the market is expected to reach USD 1,247.6 Million by 2033, exhibiting a growth rate (CAGR) of 17.5% during 2025-2033. The market is witnessing substantial growth, driven by enterprise integration, legal tech adoption, and rising demand for secure, scalable solutions. Investments by major firms and sector-specific applications are pushing AI from pilot use to business-critical implementation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 292.0 Million |

| Market Forecast in 2033 | USD 1,247.6 Million |

| Market Growth Rate 2025-2033 | 17.5% |

Key Trends of Australia Generative AI Market:

Enterprise Demand for Scalable AI Solutions

Australia is witnessing a sharp rise in demand for generative AI technologies that can meet enterprise-scale requirements. Businesses are looking beyond experimentation, aiming for deep integration of AI into their operations from customer service and data analysis to strategic planning and decision support. This shift is creating a strong pull for consulting firms to offer not only technical tools but also advisory services that help ensure compliance, ethical use, and measurable outcomes. Large companies are prioritizing AI systems that can scale securely, integrate with existing infrastructure, and offer measurable efficiency gains. Responding to this need, PwC Australia introduced an AI Centre of Excellence in August 2024 as part of a USD 12 Million commitment to grow its generative AI capabilities. The firm added 30 new AI-specific roles to support this expansion, covering areas such as model training, governance, and client implementation. The center is designed to help businesses unlock real-world value from AI while managing associated risks. With this move, PwC is not only boosting enterprise adoption but also contributing to Australia’s emergence as a key player in the global AI delivery market. The trend signals long-term investment in making AI a central part of corporate strategy and operations across industries.

To get more information on this market, Request Sample

Legal Sector Push for Efficient AI Tools

The adoption of generative AI is moving from pilot use to core workflow integration within the legal sector. Law firms and in-house teams are looking for tools that can reduce the time spent on routine research, improve drafting accuracy, and help summarize lengthy legal texts without compromising on security or quality. AI solutions that are tailored to legal databases and offer verifiable sources are increasingly being prioritized. This demand is especially strong in Australia, where firms are under pressure to deliver faster and more cost-effective services while managing large volumes of information. In June 2024, LexisNexis formally launched Lexis+ AI in Australia, following a test run with 300 legal professionals. The tool is built to support research, drafting, and summarization while ensuring that outputs are encrypted and citation-verified. Its trial phase saw strong feedback on improved speed and precision, which led to its full release. Lexis+ AI has since been adopted by multiple legal practices, where it is helping lawyers handle complex cases more efficiently. This trend highlights the legal industry’s growing confidence in AI tools that offer both productivity gains and risk controls. It also points to a broader movement toward practical, secure AI use in professional service domains.

Growth Drivers of Australia Generative AI Market:

Government-Led AI Investment and Policy Support

The Australian government is playing a proactive role in accelerating generative AI adoption through targeted investments, policy development, and regulatory guidance. Initiatives such as the National Artificial Intelligence Centre and the AI Action Plan focus on building industry capability, supporting research, and fostering ethical AI use across sectors. Funding programs aimed at AI startups, public–private partnerships, and sector-specific pilots are further enabling the commercialization of generative AI applications. Additionally, the government is working with academia and industry leaders to establish responsible AI frameworks, ensuring safety, transparency, and public trust in AI technologies. According to the Australia generative AI market analysis, this structured approach not only boosts innovation but also provides a stable foundation for scalable deployment of generative AI across Australia’s economy, making the country a strong regional player in AI advancement.

Advancements in Cloud and Compute Infrastructure

Massive adoption of generative AI in Australia is being set by rapid developments in cloud infrastructure and data center development. The investments in all of this are so huge that Amazon Web Services, Microsoft, Google, and other global tech leaders have invested billions in the expansion of their cloud down under so that they can access the high-powered computer resources needed to train and deploy complex AI models. These infrastructures will facilitate real-time data processing, scalable storage, and high-performance computing needed by generative AI applications. Such increased accessibility of cloud gives businesses of any size, including startups and large corporations, access to GenAI tools without the need to create their compute infrastructures. This democratization of access is accelerating innovation and fostering a competitive edge for Australian companies across industries, which is further fueling the Australia generative AI market share. As the country continues to modernize its digital backbone, the availability of advanced cloud capabilities will remain a key growth enabler.

Academic and Research Ecosystem Strength

Australia boasts a robust academic and research ecosystem that plays a crucial role in driving generative AI innovation. Renowned universities such as the University of Melbourne, ANU, and UNSW are conducting cutting-edge AI research in natural language processing, computer vision, and ethical AI. These institutions often partner with tech firms, startups, and government bodies to co-develop AI applications and provide real-world test environments. The presence of AI-focused research centers and collaborative networks accelerates the pace of innovation and supports the development of advanced GenAI solutions. Moreover, these institutions contribute to talent cultivation through specialized AI programs and PhD research, helping to build a skilled workforce. By linking academia with industry, Australia is creating a pipeline of knowledge and technology that strengthens its position in the global AI landscape.

Opportunities of Australia Generative AI Market:

Integration with Creative and Media Industries

Australia’s creative economy, encompassing media, design, film, publishing, and advertising, is well-positioned to benefit from the rise of generative AI. These technologies are increasingly being used for automated content generation, including article writing, script development, video editing, and image creation. Tools powered by GenAI also enable voice cloning, synthetic media production, and animation, significantly reducing production time and cost. In the entertainment industry, AI is enhancing personalization, virtual character development, and interactive storytelling experiences. Australian media companies and content studios are experimenting with GenAI to streamline workflows and meet the growing demand for digital-first content, thus influencing the Australia generative AI market demand. As audiences shift toward immersive and dynamic formats, the integration of generative AI promises to boost creativity, improve efficiency, and open new revenue channels in the country’s creative sectors.

Healthcare and Life Sciences Innovation

Generative AI is poised to transform Australia’s healthcare and life sciences industries by enabling more precise, efficient, and scalable solutions. In diagnostics, GenAI models can rapidly analyze imaging data, medical records, and genomic sequences to assist in early disease detection and treatment planning. In drug discovery, AI accelerates compound generation, simulation, and testing processes, reducing research costs and time-to-market. Additionally, generative tools are enhancing patient engagement through AI-driven chatbots, personalized health advice, and natural language summaries of clinical information, further driving the Australia generative AI market growth. With strong public and private funding, Australia’s healthcare sector is well-positioned to integrate GenAI across hospital systems, research labs, and pharmaceutical companies. These innovations hold promise for advancing personalized medicine, improving patient outcomes, and strengthening the country’s global reputation in medical technology and research.

Start-up Ecosystem and Cross-Sector Collaborations

Australia’s dynamic start-up ecosystem is a key catalyst for generative AI innovation, with numerous early-stage ventures building tailored AI solutions for finance, education, agriculture, and cybersecurity. Supported by a network of incubators, accelerators, and university spin-offs, these start-ups are developing niche applications, from automated compliance tools and AI tutors to crop monitoring and threat detection systems. Collaboration across sectors is also growing, as corporations partner with AI start-ups to co-develop and pilot GenAI solutions. Government initiatives and venture capital investment are further fueling experimentation and commercialization. This cross-pollination of ideas and expertise is fostering a culture of innovation and agility. As generative AI matures, Australia’s start-up-driven approach will be essential for bringing creative, sector-specific solutions to market quickly and effectively.

Challenges of Australia Generative AI Market:

Regulatory Uncertainty and Ethical Risks

Australia’s generative AI market is advancing rapidly, but the absence of a clear, GenAI-specific regulatory framework presents significant challenges. While discussions around responsible AI, data privacy, and digital ethics are ongoing, there is still no unified policy to address the unique risks associated with GenAI. This regulatory ambiguity creates uncertainty for developers and enterprises, particularly in areas like intellectual property, algorithmic bias, misinformation, and accountability. Without clear standards, companies may be hesitant to fully deploy GenAI solutions due to potential legal and reputational risks. Additionally, ethical concerns about the misuse of AI-generated content, such as deepfakes or deceptive narratives, remain unresolved. Establishing robust, future-ready legislation is essential to ensure safe, transparent, and responsible generative AI deployment across Australia’s public and private sectors.

Limited Access to High-Quality Local Datasets

The development of effective generative AI systems depends heavily on access to large, diverse, and contextually relevant datasets. However, many Australian organizations, particularly start-ups and research institutions, struggle to obtain high-quality, ethically sourced local datasets. Data scarcity limits the performance and applicability of GenAI models, especially those intended for specialized domains such as healthcare, law, or agriculture. Additionally, restrictive data-sharing policies, fragmented data infrastructure, and concerns around privacy and consent further hinder dataset accessibility. As a result, Australian developers often rely on foreign datasets that may not reflect local linguistic, cultural, or regulatory nuances. Addressing this challenge will require investment in open data initiatives, public–private data partnerships, and national frameworks to facilitate secure, equitable, and representative data access for training domain-specific GenAI solutions.

Talent Shortage and Skills Gap

Despite growth in AI-related educational programs and research funding, Australia faces a persistent shortage of skilled professionals needed to support advanced generative AI development. The rapid evolution of technologies such as large language models (LLMs), multimodal systems, and AI safety frameworks has created demand for specialized expertise that outpaces current workforce capacity. This skills gap is particularly acute in sectors like defense, healthcare, and finance, where the complexity and sensitivity of AI applications require both technical and ethical proficiency. Many companies struggle to recruit talent proficient in AI architecture, model fine-tuning, and interpretability. While universities and training centers are beginning to address the gap, the current talent pipeline remains insufficient. Closing this skills deficit is vital for Australia to remain globally competitive in the fast-moving generative AI landscape.

Australia Generative AI Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on offering type, technology type, and application.

Offering Type Insights:

- Image

- Video

- Speech

- Others

The report has provided a detailed breakup and analysis of the market based on the offering type. This includes image, video, speech, and others.

Technology Type Insights:

- Autoencoders

- Generative Adversarial Networks

- Others

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes autoencoders, generative adversarial networks, and others.

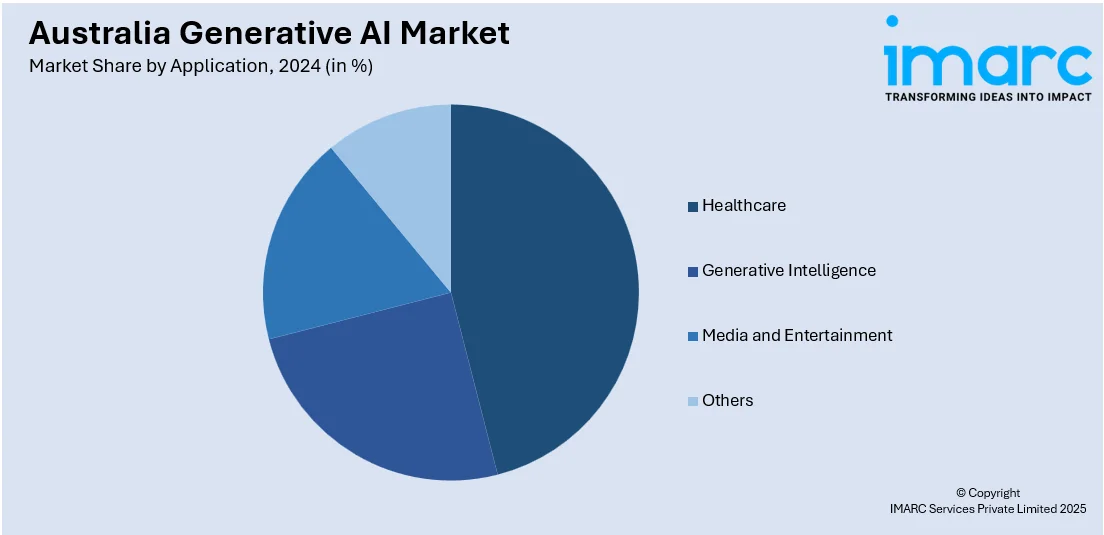

Application Insights:

- Healthcare

- Generative Intelligence

- Media and Entertainment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes healthcare, generative intelligence, media and entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Generative AI Market News:

- January 2025: Infosys and Tennis Australia launched generative AI innovations at the Australian Open, including 'Beyond Tennis', the world’s first Gen AI tennis league, AI commentary, and VR AI Stadium. These launches expanded market potential by showcasing real-time fan engagement and AI-driven content creation.

- June 2024: Deloitte launched MyAssist, a generative AI platform for 13,000 employees in Australia. The tool supported tasks like content drafting, coding, and data analysis. It boosted workplace productivity, accelerated task completion, and marked a major shift in enterprise AI adoption in Australia.

Australia Generative AI Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Offering Types Covered | Image, Video, Speech, Others |

| Technology Types Covered | Autoencoders, Generative Adversarial Networks, Others |

| Applications Covered | Healthcare, Generative Intelligence, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia generative AI market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia generative AI market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia generative AI industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generative AI market in Australia was valued at USD 292.0 Million in 2024.

The Australia generative AI market is projected to exhibit a CAGR of 17.5% during 2025-2033.

The Australia generative AI market is projected to reach a value of USD 1,247.6 Million by 2033.

Key trends in Australia’s generative AI market include rapid enterprise adoption across sectors, integration into core business tools like CRMs, design software, and IDEs, and rising use of AI-as-a-Service platforms. Multimodal models and growing investment in AI innovation are also accelerating market expansion and competitiveness nationwide.

Key growth drivers of Australia’s generative AI market include strong government support through funding and regulatory frameworks, rising enterprise adoption to boost productivity and innovation, and expanding cloud and data infrastructure. A vibrant research and development (R&D) ecosystem and growing AI talent pool also fuel long-term market scalability and competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)