Australia Generic Drug Market Size, Share, Trends and Forecast by Therapy Area, Drug Delivery, Distribution Channel, and Region, 2025-2033

Australia Generic Drug Market Overview:

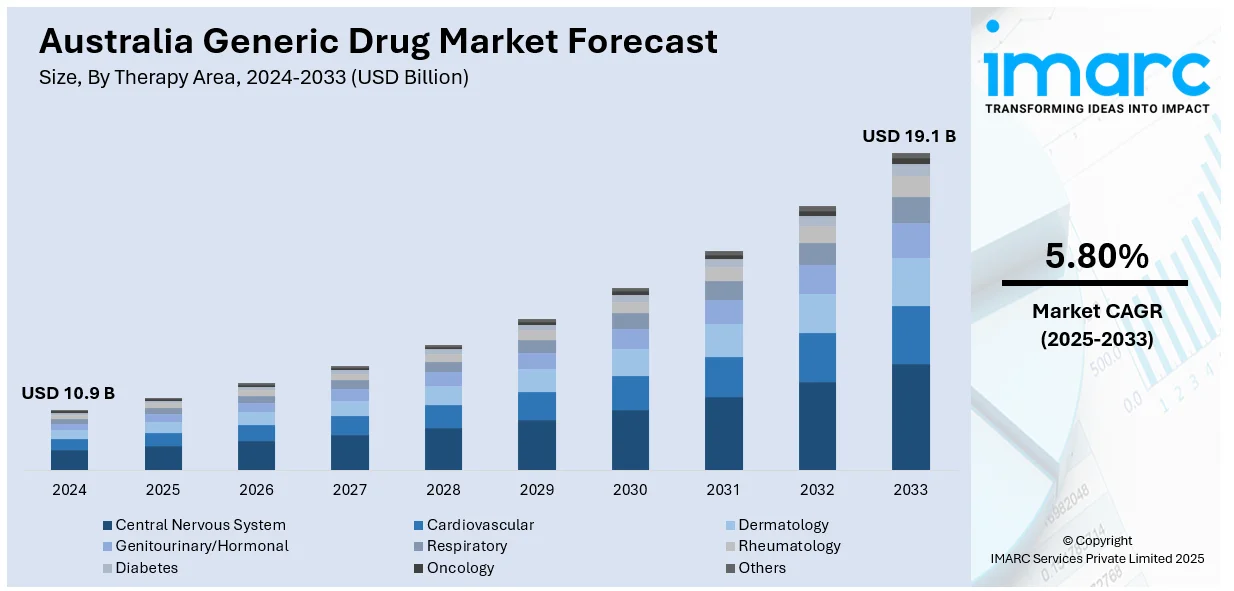

The Australia generic drug market size reached USD 10.9 Billion in 2024. Looking forward, the market is expected to reach USD 19.1 Billion by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market involves rising healthcare costs pushing demand for affordable alternatives, strong government support through regulatory frameworks and reimbursement schemes, growing acceptance of biosimilars, increasing chronic disease prevalence, and investments in local manufacturing to ensure stable supply and reduce reliance on imports.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.9 Billion |

| Market Forecast in 2033 | USD 19.1 Billion |

| Market Growth Rate 2025-2033 | 5.80% |

Key Trends of Australia Generic Drug Market:

Rising Popularity of Biosimilars

Biosimilars are increasingly playing a significant role in the Australia generic drug market outlook. These are substitutes for biologic drugs that treat diseases such as cancer and autoimmune disorders. With healthcare providers and patients looking for cheaper treatment alternatives, biosimilars provide a cost-saving but clinically equivalent alternative to original biologics. Government programs and healthcare policies are facilitating their uptake through ensuring safety, quality, and accessibility. Moreover, physicians are increasingly confident in prescribing biosimilars as a result of increased awareness and favorable clinical experiences. This change not only benefits patients in terms of reduced costs but also assists the healthcare system in managing budgets more effectively, making biosimilars a major growth area in the generics sector.

To get more information on this market, Request Sample

Regulatory and Policy Support

The Australian government has consistently championed the use of generic medicines through robust healthcare policies and strategic pricing mechanisms. A key element is the Pharmaceutical Benefits Scheme (PBS), which subsidizes around 80% of all prescription drugs, with annual funding exceeding $5.1 billion. This significant investment reflects a strong commitment to making medications, including generics, widely accessible and affordable. Regulatory agencies enforce strict quality and safety standards in generics, motivating their replacement for branded drugs. National reimbursement systems also promote their use, whereas educational programs among healthcare providers as well as in the general public build confidence to use them. All these taken together have culminated in widescale use and acceptance of generics further contributing to the Australia generic drug market share. Policy support is hence still an essential growth and sustenance driver for the country's generic drug industry.

Growth in Local Manufacturing

Australia is experiencing a movement towards the development of its local pharmaceutical manufacturing base. Instead of keeping heavily dependent on foreign imports, pharma companies are investing in domestic manufacturing facilities to have a stable and localized supply base for generic drugs. The movement is backed by both the government and increasingly by awareness of the imperatives for supply chain resilience, following recent global disruptions. Through the increase in local production, firms can lower costs, enhance turnaround times, and customize production for local requirements. It also provides job opportunities and stimulates technological development in the pharma sector. This focus on indigenous production is redefining the future of generics in Australia, making the industry stronger and more responsive thus aiding the Australia generic drug market growth.

Growth Drivers of Australia Generic Drug Market:

Increasing Healthcare Cost Pressures

Rising healthcare expenditures are placing growing financial pressure on both public systems and individual consumers in Australia. Generic drugs offer clinically equivalent alternatives to branded medications at significantly lower costs, helping control pharmaceutical spending. This affordability aligns with the objectives of healthcare providers and insurance bodies aiming to maximize treatment accessibility while managing budgets. With hospital formularies and retail pharmacies increasingly adopting cost-effective drug policies, generic utilization continues to gain traction. Consumers, particularly those managing chronic illnesses, are also becoming more price-conscious and open to switching to generics. As healthcare cost containment remains a policy priority, generics present a scalable solution that supports wider access to essential treatments while reducing national health expenditure over time.

Patent Expiration of High-Volume Brand Drugs

The Australia generic drug market demand is experiencing a steady boost from the expiration of patents on numerous blockbuster branded drugs. When patents lapse, generic manufacturers are permitted to produce bioequivalent versions, creating opportunities to penetrate lucrative therapeutic areas such as cardiovascular, oncology, and diabetes care. This transition drives competition and improves patient access to affordable medicines, especially under the Pharmaceutical Benefits Scheme (PBS). Additionally, generic entry typically leads to sharp price reductions, forcing branded players to reduce costs or exit certain segments, further opening market space. With multiple upcoming patent cliffs anticipated in the next few years, the pace of generic approvals and launches is expected to accelerate, contributing significantly to the market’s long-term volume growth.

Expanding Role of Pharmacists in Generic Substitution

Pharmacists in Australia are increasingly empowered to influence patient medication choices, particularly through generic substitution. Under PBS guidelines, pharmacists can substitute prescribed branded medicines with generics unless marked “no substitution” by the prescriber. This professional autonomy, coupled with pharmacist-patient trust, enhances the uptake of generics at the dispensing level. Additionally, government-funded programs and continuing education initiatives equip pharmacists with knowledge to educate patients on the safety and effectiveness of generics. Community pharmacies also promote generics through incentive programs and affordability messaging. As the role of pharmacists in primary care continues to expand, their influence on patient choices will play a growing role in driving generic drug penetration across urban and regional Australian markets.

Opportunities of Australia Generic Drug Market:

Personalized Generics and Niche Formulations

Advancements in pharmaceutical technology are creating opportunities to develop personalized generics and niche formulations tailored to specific demographics. For example, pediatric and geriatric patients often require modified dosages or delivery forms, such as dissolvable tablets or liquid suspensions. These specialized generics fill treatment gaps where branded drugs may not offer ideal options. Additionally, innovations in compounding and pharmacogenomics open doors for individualized therapies using generic APIs. Manufacturers that focus on these underserved segments can build a competitive advantage through differentiation and therapeutic precision. With growing demand for patient-centric care in Australia’s healthcare system, such specialized generics represent a promising path for market expansion, especially as clinicians increasingly seek more adaptable and cost-effective treatment options.

Export Potential to Asia-Pacific Markets

Australia’s stringent pharmaceutical standards and reputation for quality make it a trusted exporter within the Asia-Pacific region. As neighboring countries experience rising demand for affordable healthcare solutions, Australian generic drug manufacturers are well-positioned to supply safe and effective products. Free trade agreements and regulatory harmonization across ASEAN countries enhance the ease of cross-border drug approvals. Australian firms can also leverage regional proximity, logistics capabilities, and language familiarity to build market share abroad. Furthermore, producing generics locally at high standards strengthens Australia’s credibility as a reliable source during global shortages. With targeted investment in manufacturing scale and international partnerships, the generic drug industry in Australia can expand beyond domestic borders to tap into high-growth regional markets.

Digital Transformation and E-prescriptions

The digitalization of healthcare in Australia offers strong growth prospects for generics through improved prescription and dispensing processes. With the expansion of e-prescriptions, pharmacists can access real-time prescription data and suggest cost-effective generic alternatives more efficiently. Digital health platforms allow for better tracking of medication usage, facilitating patient education about generics' safety and efficacy. Telehealth integration also increases opportunities for generic promotion in virtual consultations, particularly for chronic conditions where long-term medication is needed. Digital marketing, patient apps, and e-pharmacy services further expand consumer access to generics. As Australia’s health infrastructure continues embracing digital transformation, these systems will increasingly support generic awareness, reduce prescribing errors, and ensure broader acceptance across both urban and rural populations.

Government Support of Australia Generic Drug Market:

Pharmaceutical Benefits Scheme (PBS) Price Structuring

The PBS remains a cornerstone of government support for generic drug usage in Australia. Through its price disclosure mechanisms and reference pricing system, the PBS encourages substitution by reimbursing generic equivalents at reduced costs compared to original brands. This cost-based incentive benefits patients, pharmacists, and insurers, fostering affordability without compromising treatment quality. Furthermore, listing more generics under the PBS ensures widespread access, particularly for chronic and high-volume conditions like hypertension, diabetes, and asthma. Government policies also support tiered pricing models that favor early generic adopters. This structured reimbursement framework not only strengthens the value proposition of generics but also enhances transparency in pricing, making it a key enabler of the market’s sustained growth and competitiveness.

Prescriber Guidelines and Awareness Campaigns

The Australian government promotes generic usage through prescriber guidelines and public education campaigns aimed at dispelling misconceptions. General practitioners are encouraged to prescribe using the active ingredient name, enabling pharmacists to substitute with an available generic product. Additionally, the Therapeutic Goods Administration (TGA) provides clear labeling standards to distinguish generics while reinforcing their clinical equivalence. Public awareness efforts via healthcare institutions, media, and pharmacist networks educate patients about the safety, quality, and affordability of generics. These initiatives reduce resistance and build trust, especially among older or more cautious patient groups. By targeting both prescribers and patients, the government ensures that the benefits of generics are well understood and widely accepted in daily medical practice.

Support for Community Pharmacy Involvement

Community pharmacies play a central role in generic drug distribution, and the Australian government actively supports their involvement through funding and professional development programs. Under the Community Pharmacy Agreement, pharmacists are incentivized to promote cost-effective treatments and engage in medication management services. These services include patient consultations, dosage advice, and education on the use of generics, especially for chronic diseases requiring long-term therapy. In rural and underserved areas, community pharmacies often act as the first point of care, making their role in increasing generic access even more critical. Continued investment in pharmacist training and support services ensures consistent messaging, improved adherence, and a stronger link between affordability and patient care outcomes.

Challenges of Australia Generic Drug Market:

Market Consolidation and Pricing Pressure

One of the most pressing challenges facing generic drug manufacturers in Australia is intense pricing pressure caused by market consolidation and PBS price disclosure policies. Large pharmacy chains and procurement groups exert strong bargaining power, often negotiating steep price reductions that reduce manufacturers’ margins. Moreover, the frequent price revisions under the Pharmaceutical Benefits Scheme (PBS) force generic suppliers to operate on thin profits. These economic constraints can limit investment in innovation, discourage smaller players, and reduce the number of generic products entering the market. Over time, this may impact competition and drug availability. Sustaining profitability while maintaining affordability remains a delicate balance that generic companies must manage to survive and grow in a highly commoditized environment.

Limited Public Awareness and Perception Gaps

Although generics are clinically equivalent to branded medications, a significant portion of the Australian population still lacks full trust in their quality and efficacy. According to the Australia generic drug market analysis, this perception issue is particularly prevalent among older patients and those managing multiple prescriptions. Misinformation or unfamiliarity can lead to reluctance in accepting generic substitutions, even when advised by pharmacists or doctors. Cultural attitudes, brand loyalty, and fear of reduced effectiveness contribute to low conversion rates in certain demographics. Addressing these gaps requires sustained public education campaigns, transparent labeling, and stronger collaboration between healthcare providers and pharmacists. Until consumer confidence is universally established, this lingering skepticism will remain a barrier to the full-scale adoption of generic drugs in Australia.

Supply Chain Disruptions and Import Dependence

Despite increasing local production, Australia still relies heavily on imported active pharmaceutical ingredients (APIs) and finished generics, making the supply chain vulnerable to global disruptions. Events like pandemics, geopolitical tensions, and shipping delays can result in drug shortages and stockouts. These vulnerabilities were exposed during COVID-19, prompting concerns about national medicine security. Additionally, limited domestic API manufacturing capacity and dependence on overseas suppliers—especially from India and China—mean that pricing and availability remain subject to external risks. While the government has taken steps to diversify and strengthen supply chains, unpredictability remains a critical challenge. Ensuring a stable and resilient flow of essential generics is key to maintaining trust and access in the Australian market.

Australia Generic Drug Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on therapy area, drug delivery and distribution channel.

Therapy Area Insights

- Central Nervous System

- Cardiovascular

- Dermatology

- Genitourinary/Hormonal

- Respiratory

- Rheumatology

- Diabetes

- Oncology

- Others

The report has provided a detailed breakup and analysis of the market based on the therapy area. This includes central nervous system, cardiovascular, dermatology, genitourinary/hormonal, respiratory, rheumatology, diabetes, oncology, and others.

Drug Delivery Insights:

- Oral

- Injectables

- Dermal/Topical

- Inhalers

A detailed breakup and analysis of the market based on the drug delivery have also been provided in the report. This includes oral, injectables, dermal/topical, and inhalers.

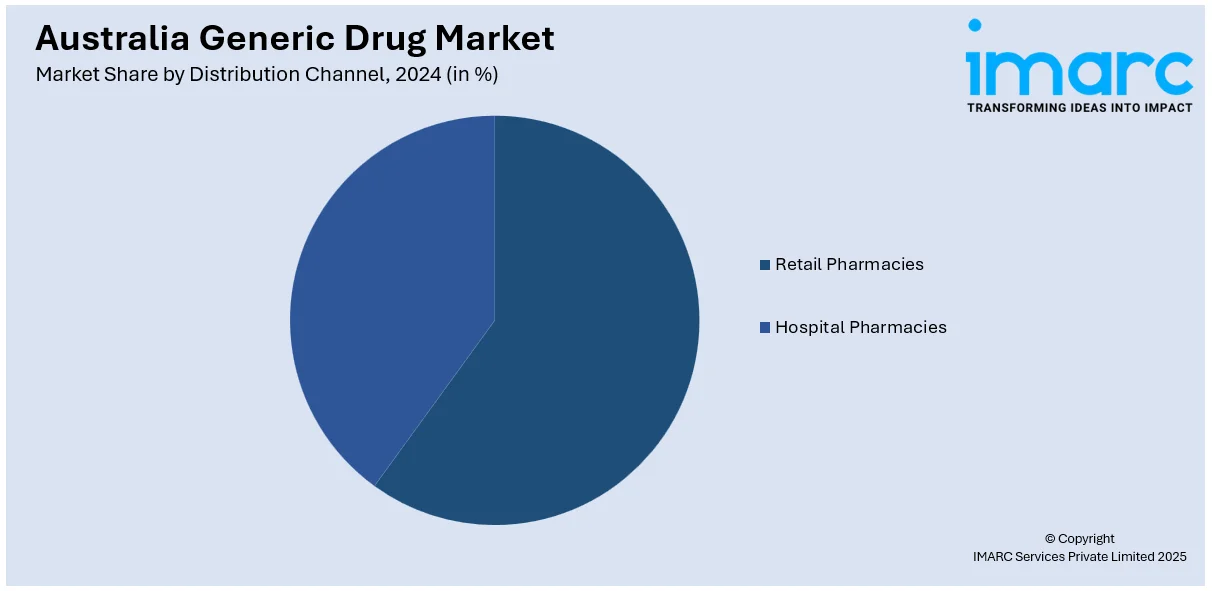

Distribution Channel Insights:

- Retail Pharmacies

- Hospital Pharmacies

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes retail pharmacies and hospital pharmacies.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided , including:

- AstraZeneca

- Cipla Ltd

- Dr.Reddy’s Laboratories Ltd

- Generic Health

- Noumed Pharmaceuticals Pty Ltd

- Sandoz AG

- Sun Pharmaceutical Industries Ltd.

- Teva Pharma Australia Pty Ltd

- Viatris Inc.

Australia Generic Drug Market News:

- In August 2024, Wegovy, a new semaglutide drug for weight loss, launched in Australia on 5 August. Despite ongoing Ozempic shortages, manufacturer Novo Nordisk says supply planning for Wegovy has been prioritised. The high price may limit demand, easing pressure on availability. GPs remain cautious, noting past supply issues. The drug targets obesity and weight-related conditions like diabetes and high blood pressure. Novo Nordisk insists efforts were made to avoid repeat shortages.

Australia Generic Drug Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Therapy Areas Covered | Central Nervous System, Cardiovascular, Dermatology, Genitourinary/Hormonal, Respiratory, Rheumatology, Diabetes, Oncology, Others |

| Drug Deliveries Covered | Oral, Injectables, Dermal/Topical, Inhalers |

| Distribution Channels Covered | Retail Pharmacies, Hospital Pharmacies |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | AstraZeneca, Cipla Ltd, Dr.Reddy’s Laboratories Ltd, Generic Health, Noumed Pharmaceuticals Pty Ltd, Sandoz AG, Sun Pharmaceutical Industries Ltd., Teva Pharma Australia Pty Ltd, Viatris Inc., etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia generic drug market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia generic drug market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia generic drug industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The generic drug market in Australia was valued at USD 10.9 Billion in 2024.

The Australia generic drug market is projected to exhibit a CAGR of 5.80% during 2025-2033.

The Australia generic drug market is projected to reach a value of USD 19.1 Billion by 2033.

Growth in Australia’s generic drug market is driven by increasing chronic disease cases, an aging population, strong government support through the pharmaceutical benefits scheme, regulatory encouragement for generic substitution, and rising investment in local manufacturing to strengthen supply chain resilience.

Key trends in Australia’s generic drug market include rising demand driven by chronic disease prevalence and an aging population, increased adoption of generic substitution, and growing investment in local manufacturing to enhance supply chain resilience and reduce reliance on imported medicines.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)