Australia Geosynthetics Market Size, Share, Trends and Forecast by Product, Type, Material, Application, and Region, 2025-2033

Australia Geosynthetics Market Overview:

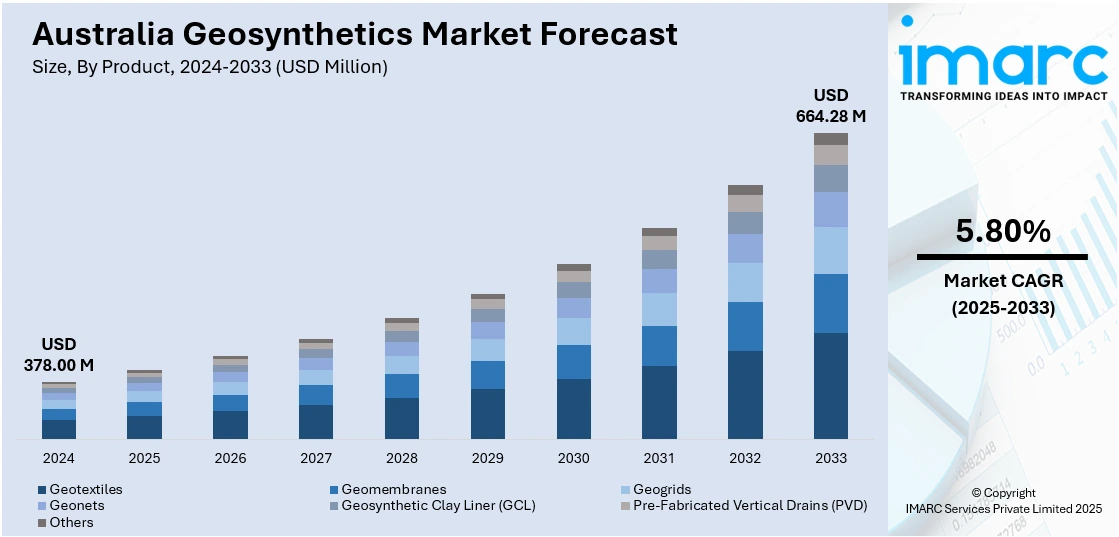

The Australia geosynthetics market size reached USD 378.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 664.28 Million by 2033, exhibiting a growth rate (CAGR) of 5.80% during 2025-2033. The market is driven by infrastructure modernization and climate-resilient engineering. Also, environmental regulations and sustainable waste management are fueling the product adoption. Additionally, urbanization and demand for durable, cost-effective construction materials are increasing geosynthetics usage. Government investments, stringent building codes, and sustainable development goals are further expanding the Australia geosynthetics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 378.00 Million |

| Market Forecast in 2033 | USD 664.28 Million |

| Market Growth Rate 2025-2033 | 5.80% |

Australia Geosynthetics Market Trends:

Infrastructure Modernization and Climate-Resilient Engineering

Australia's commitment to upgrading its infrastructure to withstand climate challenges is a significant driver for the geosynthetics market. Major projects, such as the Inland Rail and various flood mitigation initiatives, are increasingly incorporating geotextiles, geogrids, and geomembranes to enhance durability and resilience. Geosynthetics offer solutions for soil reinforcement, erosion control, and drainage, making them ideal for urban development projects. Their application in road construction, retaining walls, and foundation stabilization contributes to longer-lasting infrastructure with reduced maintenance requirements. The versatility and adaptability of geosynthetics to various construction needs make them a preferred choice among engineers and builders. These materials offer solutions for soil stabilization, erosion control, and drainage, essential for infrastructure longevity in diverse terrains. Government investments in sustainable infrastructure, coupled with stringent building codes, are propelling the adoption of geosynthetics and such strategic initiatives are instrumental in advancing Australia geosynthetics market growth, particularly as demand shifts toward long-term ecological viability and structural integrity. On 16 July 2024, Geofabrics Australasia launched the next-generation Tensar® geogrid technology across Australia and New Zealand, enhancing its suite of soil reinforcement solutions. The updated products offer improved rib geometry and junction efficiency, designed to cut aggregate use by up to 40% and extend pavement service life across civil, mining, and infrastructure projects. This advancement reflects Australia's increasing demand for performance-driven geosynthetics that support cost-effective and sustainable construction.

To get more information on this market, Request Sample

Environmental Regulations and Sustainable Waste Management

Australia's stringent environmental regulations are fostering the use of geosynthetics in waste management and containment applications. Geomembranes and geosynthetic clay liners are increasingly utilized in landfills, mining operations, and hazardous waste containment to prevent soil and groundwater contamination. The federal government's enforcement of environmental standards has led to a surge in demand for impermeable and durable materials that ensure compliance and environmental protection. Additionally, the mining sector's expansion necessitates effective tailings management solutions, where geosynthetics play a critical role in lining and containment. The integration of these materials not only aids in meeting regulatory requirements but also enhances the operational efficiency and environmental stewardship of industrial activities. As environmental concerns continue to shape policy and industry practices, the reliance on geosynthetics for sustainable waste management solutions is expected to grow, reinforcing their position in Australia's environmental infrastructure. A 2025 study detected perfluoropropionic acid (PFPrA) in HDPE geomembranes used in Australian infrastructure, with concentrations ranging from <LOQ to 0.44 µg/g. Geomembrane 1 showed levels ~10× higher than others, highlighting manufacturing variability and rising need for PFAS-free processing aids.

Australia Geosynthetics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, type, material, and application.

Product Insights:

- Geotextiles

- Geomembranes

- Geogrids

- Geonets

- Geosynthetic Clay Liner (GCL)

- Pre-Fabricated Vertical Drains (PVD)

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes geotextiles, geomembranes, geogrids, geonets, geosynthetic clay liner (GCL), pre-fabricated vertical drains (PVD), and others.

Type Insights:

- Woven

- Non-Woven

- Knitted

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes woven, non-woven, knitted, and others.

Material Insights:

- Polypropylene

- Polyester

- Polyethylene

- Polyvinyl Chloride

- Synthetic Rubber

- Others

The report has provided a detailed breakup and analysis of the market based on the material. This includes polypropylene, polyester, polyethylene, polyvinyl chloride, synthetic rubber, and others.

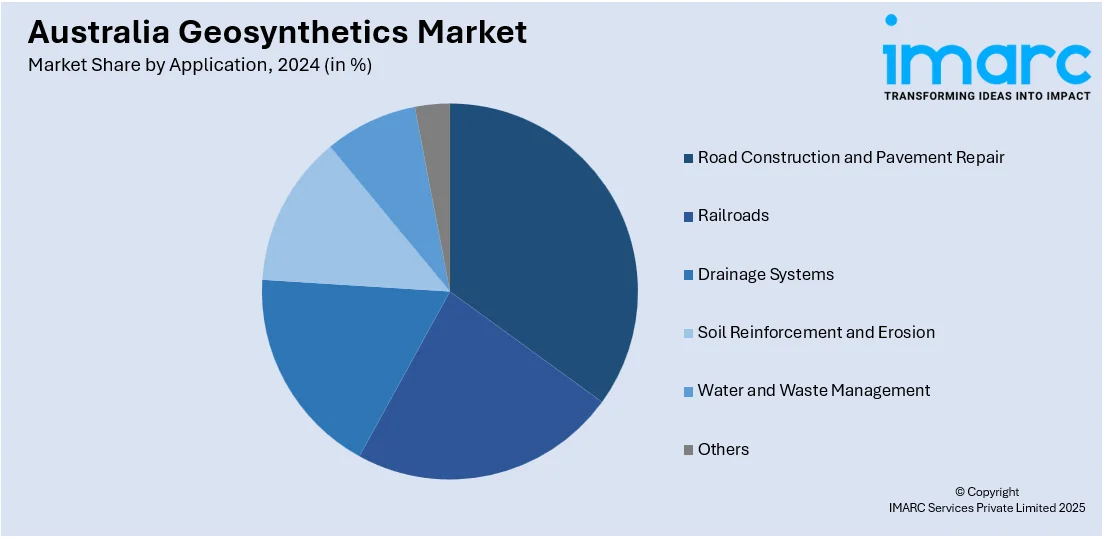

Application Insights:

- Road Construction and Pavement Repair

- Railroads

- Drainage Systems

- Soil Reinforcement and Erosion

- Water and Waste Management

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes road construction and pavement repair, railroads, drainage systems, soil reinforcement and erosion, water and waste management, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Geosynthetics Market News:

- On 26 February 2024, Hexa-Cover A/S reported the successful implementation of its modular floating cover system in Australian water reservoirs to reduce evaporation and improve water quality. Made from recycled plastic, the system reduces water loss by up to 90%, limits algae growth, and prevents debris contamination, making it a cost-effective geosynthetic solution for drought-prone regions. Its application in Australia highlights the growing role of geosynthetics in climate-resilient water management.

Australia Geosynthetics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Geotextiles, Geomembranes, Geogrids, Geonets, Geosynthetic Clay Liner (GCL), Pre-Fabricated Vertical Drains (PVD), Others |

| Types Covered | Woven, Non-Woven, Knitted, Others |

| Materials Covered | Polypropylene, Polyester, Polyethylene, Polyvinyl Chloride, Synthetic Rubber, Others |

| Applications Covered | Road Construction and Pavement Repair, Railroads, Drainage Systems, Soil Reinforcement and Erosion, Water and Waste Management, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia geosynthetics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia geosynthetics market on the basis of product?

- What is the breakup of the Australia geosynthetics market on the basis of type?

- What is the breakup of the Australia geosynthetics market on the basis of material?

- What is the breakup of the Australia geosynthetics market on the basis of application?

- What is the breakup of the Australia geosynthetics market on the basis of region?

- What are the various stages in the value chain of the Australia geosynthetics market?

- What are the key driving factors and challenges in the Australia geosynthetics market?

- What is the structure of the Australia geosynthetics market and who are the key players?

- What is the degree of competition in the Australia geosynthetics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia geosynthetics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia geosynthetics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia geosynthetics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)