Australia Ghee Market Size, Share, Trends and Forecast by Source, Distribution Channel, End User, and Region, 2025-2033

Australia Ghee Market Overview:

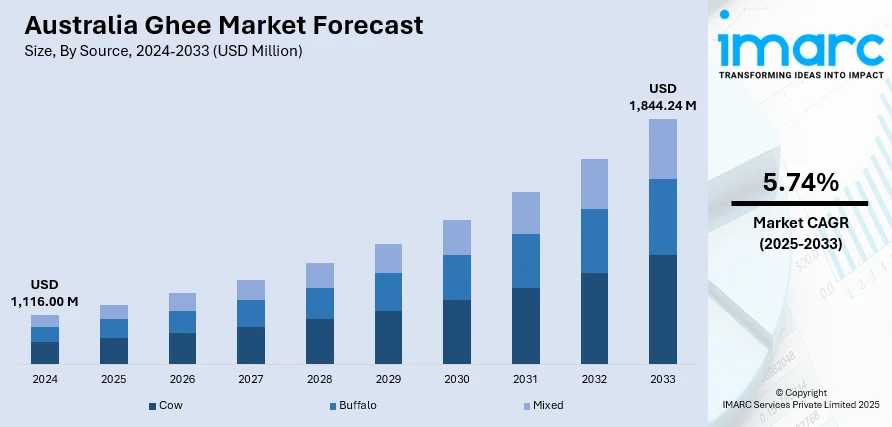

The Australia ghee market size reached USD 1,116.00 Million in 2024. The market is projected to reach USD 1,844.24 Million by 2033, exhibiting a growth rate (CAGR) of 5.74% during 2025-2033. The market is driven by increasing consumer preference for natural and traditional dairy products, particularly among health-conscious individuals and immigrant communities familiar with ghee's culinary and medicinal uses. Along with this, rising awareness about ghee's nutritional benefits, such as high smoke point, lactose-free composition, and richness in fat-soluble vitamins, is further supporting demand. Additionally, the expanding availability through both offline and online retail channels is augmenting the Australia ghee market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,116.00 Million |

| Market Forecast in 2033 | USD 1,844.24 Million |

| Market Growth Rate 2025-2033 | 5.74% |

Key Trends of Australia Ghee Market:

Growing Popularity of Premium and Organic Product Segments

Australia's maturing health food sector has spurred demand for premium and organic variants of ghee. Consumers are also increasingly looking for food safety, ethical sourcing, and environmental considerations, driving a move toward organic, grass-fed, and non-GMO ghee products. Premium ghee items, commonly sold as artisan or small-batch, appeal to consumers who are prepared to pay more for perceived quality and purity. Such products tend to emphasize traceability, eco-farming, and limited processing, which resonate with green consumers. All of these resonate with green consumers. Packaging plays an important role, as brands use environmentally friendly jars, tamper-evident seals, and sophisticated branding that reflects premium positioning. The trend is particularly evident in urban centers where health-oriented retail outlets, specialty grocery stores, and online platforms increase shelf space for specialist dairy products. Also, the growing prevalence of lifestyle diseases like lactose intolerance and dairy sensitivities is guiding consumers toward clarified butter products without casein and lactose, further enhancing the demand for premium ghee among wellness-driven segments.

To get more information of this market, Request Sample

Rising Health Consciousness and Functional Nutrition Preferences

The increasing shift toward health and wellness in the country is positively impacting the Australia ghee market growth. People are becoming increasingly aware of the nutritional balance of day-to-day food items, opting for ones that are thought to contribute to well-rounded well-being. Since ghee is lactose-free and a good source of fat-soluble vitamins like A, D, E, and K, it qualifies as a functional food with dietary regimes such as keto and paleo. Its great smoke point also renders it a good choice for pan-frying at high temperatures without giving off destructive free radicals. This positioning has enabled ghee to cross over from its conventional South Asian heritage to find support among a wider audience concerned with clean eating and natural fats. Additionally, increasing consciousness of the potential digestive and metabolic advantages of ghee, particularly in comparison to hydrogenated oils and processed fats, is compelling its use in daily cooking. This trend is supported by health influencers and dietitians promoting ghee as a healthy source of fat rich in nutrients for maintaining digestive health and energy levels, which further supports the growth of Australia ghee market demand.

Expanding Ethnic Diversity and Culinary Exploration

The growing multiculturalism of Australia has helped normalize ghee consumption, leading to urban homes increasingly adopting it. South Asian, Middle Eastern, and North African communities have used ghee as a staple for cooking and religious purposes, thus maintaining a consistent level of demand. At the same time, non-ethnic Australian consumers are discovering ghee as they become increasingly interested in international foods via food media, restaurants, and domestic cooking trends. This food receptivity has resulted in increased experimentation with ghee for baking, sautéing, and even as a spread or coffee topping. Additionally, the popularity of food influencers and content creators highlighting ghee recipes on social media platforms has brought new consumers. The fact that ghee can add flavor, texture, and richness to savory and sweet dishes makes it a preferred choice for gourmet and health-conscious cooks. With cultural cuisines increasingly being folded into mainstream food culture, the ghee's acceptance will be further deepened, making it a cross-cultural cooking fat that bridges tradition with contemporary culinary trends.

Growth Drivers of Australia Ghee Market:

Growing Demand from Fitness and Health Communities

The Australian market for ghee is witnessing high growth as a result of growing uptake among fitness and health communities. As more Australians turn to ketogenic, low-carb, and high-fat diets, ghee is emerging as a healthy alternative to fat. Fitness personalities, nutritionists, and wellness coaches are suggesting ghee due to its superior smoke point, CLA (conjugated linoleic acid) levels, and ability to aid weight control and energy levels. Ghee is typically included in "bulletproof coffee" and as an alternative cooking oil for individuals limiting processed seed oils. Australian fitness clubs, health blogs, and supplement stores are accepting ghee as part of overall clean eating and performance nutrition packages. The role of the health and well-being industry in informing consumers about functional fats has assisted in shifting ghee from ethnic aisles into general grocery stores and health food stores. This changing consumer perception keeps driving demand, especially among millennials and professionals looking for long-term health dividends.

Expansion of Direct-to-Consumer and Online Retail Channels

The fast expansion of online food retailing and direct-to-consumer food brands in Australia is opening up new markets for manufacturers of ghee. With increasing numbers of Australians making online purchases of specialty and health foods, such niche products as ghee have become increasingly available to consumers throughout Australia, including in urban and regional cities. Digital channels enable niche ghee makers to avoid retail gatekeepers and sell directly to health-focused consumers, frequently with extensive narratives on sourcing, advantages, and recipe usage. Subscription services, food box memberships, and influencer-driven marketing efforts have further helped build awareness for premium ghee brands. This retail digitization has enabled increased personalization and product education, which assist in eliminating trial barriers for new customers. With flexi-shipping arrangements and a growing demand for gourmet pantry essentials, internet shopping remains to fuel awareness and sales of ghee. Digital shopping convenience is particularly valuable within a wide, geographically dispersed nation like Australia, where physical retail exposure can prove highly unequal.

Influence of Food Tourism and Premium Dining

According to the Australia ghee market analysis, the active food tourism sector and high-end dining culture are also fueling demand for specialty, high-quality ingredients such as ghee. Locals and visitors alike are attracted to Australia's multicultural cuisine, which increasingly features authentic Indian, Middle Eastern, and Southeast Asian flavors, many of which feature ghee as a cooking staple. Upscale restaurants, trend cafés, and innovative chefs are using ghee as a gourmet ingredient, not simply a traditional fat. In Melbourne and Sydney, where culinary culture is diverse and trend-focused, ghee is being employed in everything from fusion cuisine to trendy desserts, raising its profile above traditional consumption. Cooking schools and cooking shows in Australia are also promoting traditional cooking fats, creating a modern appeal for ghee. This new emphasis on authenticity, artisanal preparation, and full flavor has made ghee a high-end, chef-recommended ingredient, further increasing its penetration. The impact of food tourism and upscale gastronomy thus assumes a critical role in defining contemporary consumer attitudes and stimulating demand for high-quality ghee items.

Australia Ghee Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on source, distribution channel, and end user.

Source Insights:

- Cow

- Buffalo

- Mixed

The report has provided a detailed breakup and analysis of the market based on the source. This includes cow, buffalo, and mixed.

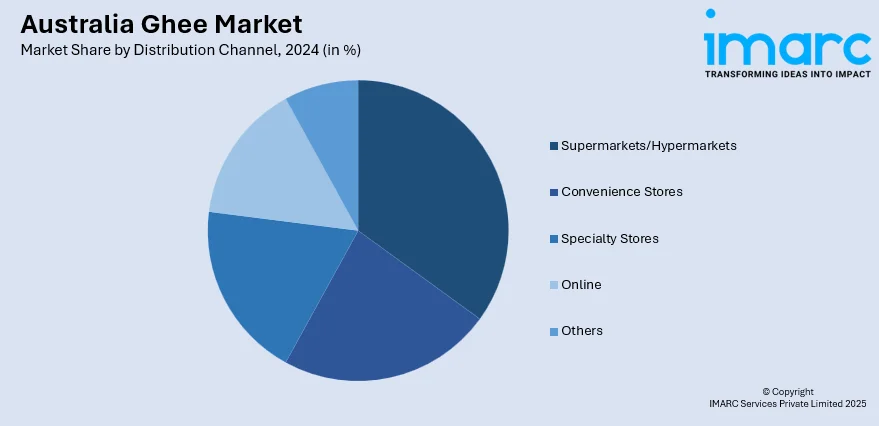

Distribution Channel Insights:

- Supermarkets/Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets/hypermarkets, convenience stores, specialty stores, online, and others.

End User Insights:

- Retail

- Institutional

The report has provided a detailed breakup and analysis of the market based on the end user. This includes retail and institutional.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Gold42

- Golden Farm Australia Pty Ltd

- Gopalji Global Foods

- NZAC Foods

- OMGhee

- Sharma’s Kitchen Pty Ltd

Australia Ghee Market News:

- On August 26, 2024, Fonterra announced the launch of a diverse range of new dairy products across Australia and New Zealand in the past twelve months. The products include indulgent lines such as Mainland Sweet Cinnamon spreadable butter in Australia and Mainland Special Reserve Chilli & Garlic Brie, Anchor Double Cream, and Anchor Ghee in New Zealand, tailored to festive and culinary occasions. The launches reflect Fonterra Oceania’s strategic emphasis on leveraging consumer insights and agile, market-responsive innovation to enhance supermarket dairy offerings.

Australia Ghee Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Cow, Buffalo, Mixed |

| Distribution Channels Covered | Supermarkets/Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| End Users Covered | Retail, Institutional |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Gold42, Golden Farm Australia Pty Ltd, Gopalji Global Foods, NZAC Foods, OMGhee, Sharma’s Kitchen Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia ghee market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia ghee market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia ghee industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia ghee market was valued at USD 1,116.00 Million in 2024.

The Australia ghee market is projected to exhibit a CAGR of 5.74% during 2025-2033.

The Australia ghee market is expected to reach a value of USD 1,844.24 Million by 2033.

Key trends in Australia ghee market include a shift toward organic and grass-fed variants, growing popularity of flavored and infused ghee, and increasing adoption in keto and paleo diets. Online sales, clean label preferences, and use in fusion cuisine are also shaping consumer demand and brand innovation in the market

The Australia ghee market is driven by rising health awareness, demand from fitness-focused consumers, and the popularity of traditional cooking fats. Growth in multicultural cuisines, online retail expansion, and the influence of premium dining further boost ghee’s appeal as both a functional food and gourmet ingredient across Australian households.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)