Australia Glass Packaging Market Size, Share, Trends and Forecast by Product, End User, and Region, 2025-2033

Australia Glass Packaging Market Overview:

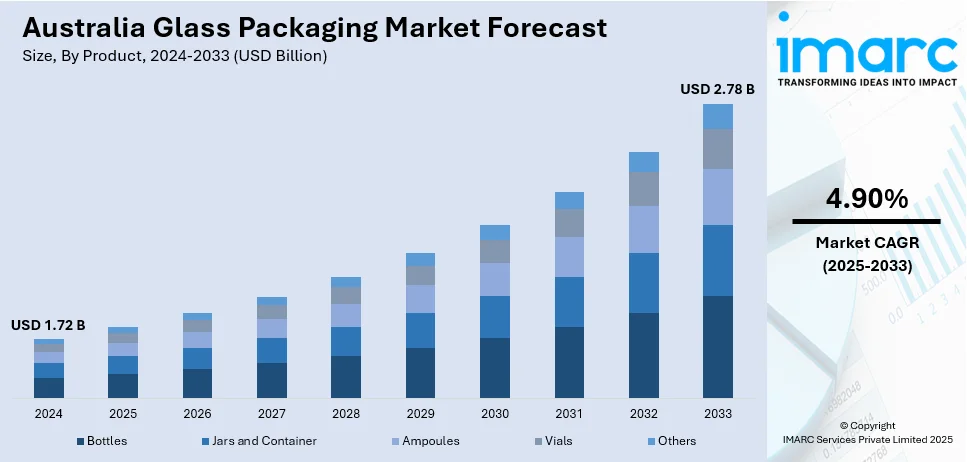

The Australia glass packaging market size reached USD 1.72 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.78 Billion by 2033, exhibiting a growth rate (CAGR) of 4.90% during 2025-2033. The market is driven by growing consumer demand for sustainable and eco-friendly packaging, increasing focus on premium and customized designs, and advancements in recycling technologies. Additionally, government initiatives promoting recycling and circular economy practices are encouraging companies to adopt glass packaging for its environmental benefits further Australia glass packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.72 Billion |

| Market Forecast in 2033 | USD 2.78 Billion |

| Market Growth Rate 2025-2033 | 4.90% |

Australia Glass Packaging Market Trends:

Sustainability and Circular Economy Initiatives

Sustainability is a key driver in the Australian glass packaging market, with a focus on reducing environmental impact. Glass, being fully recyclable, supports a circular economy where products can be reused indefinitely without quality loss. Government policies like Container Deposit Schemes (CDS) encourage consumers to recycle glass bottles, ensuring more glass is returned for reuse. This serves to decrease landfill waste and boost the proportion of recycled glass (cullet) being used in producing new products. Organizations, including Visy, are putting money into cutting-edge recycling technologies, such as the one at their Laverton glass beneficiation plant, in order to make recycling better. Visy's ambition of 70% recycled glass content within new packaging emphasizes the increased emphasis on sustainability. This transition is boosting the eco-friendliness of glass packaging and enabling the industry to decrease its carbon footprint, paving the way for a more sustainable future.

To get more information on this market, Request Sample

Premiumization and Customization in Packaging Design

The Australian market is observing an increasing demand for premium and customized glass packaging, especially in the food, beverages, and cosmetics industries. Glass is commonly associated with purity, sophistication, and higher quality, and thus, it is the most sought-after option for premium products. Consumers appreciate the haptic and aesthetic experience of glass, which makes the product experience more enjoyable. In order to stand out and appeal to sophisticated consumers, brands are spending on creative packaging designs with distinctive shapes, colors, and textures. Since customization enables brands to create a robust, strong brand identity and closer connect with their target consumers, the trend is indicative of wider consumer aspirations for customized, high-quality packaging that resonates with their lifestyle and brand values, fueling brand loyalty and premium positioning the Australia glass packaging market growth.

Integration of Smart Packaging Technologies

The Australian glass packaging industry is increasingly leveraging smart technologies like QR codes, Near Field Communication (NFC) tags, and augmented reality (AR) to heighten customer experience and product traceability. Such technologies allow consumers to gain information about the origin of a product, ingredients, and environmental initiatives, thus nurturing brand affinity. This trend is reinforced by the fact that 88.8% of industry experts polled believe connected packaging will be essential in the future. Beyond increasing customer interaction, these intelligent capabilities enable businesses to track inventory, deter counterfeiting, and optimize their operations. The convergence of such technologies not only fulfills the consumer need for more interactive and informative experiences but also enhances brands' competitive foothold in a fast-evolving tech-savvy market.

Australia Glass Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and end user.

Product Insights:

- Bottles

- Jars and Container

- Ampoules

- Vials

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bottles, jars and container, ampoules, vials, and others.

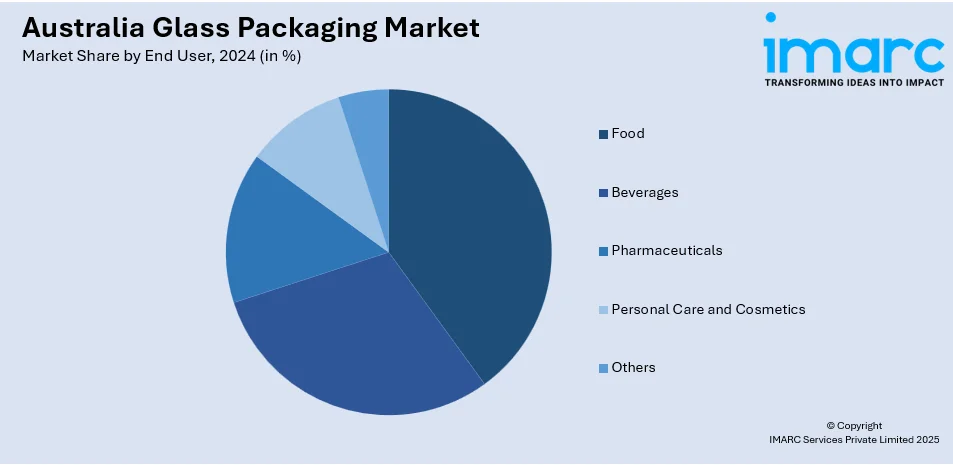

End User Insights:

- Food

- Beverages

-

- Alcoholic

- Non-Alcoholic

- Pharmaceuticals

- Personal Care and Cosmetics

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes food, beverages (alcoholic and non-alcoholic), pharmaceuticals, personal care and cosmetics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Glass Packaging Market News:

- In January 2025, Orora launched its new oxygen-fuelled glass furnace in Gawler, South Australia, enhancing energy efficiency and sustainability for wine bottle production. Powered by an onsite oxygen plant, the furnace is among the top 10% of energy-efficient global glass furnaces. Supported by a $12.5 million federal grant, it reduces nitrogen oxide emissions by 80%, cuts CO2 emissions by 20%, and lowers energy consumption by 25%, while incorporating more recycled cullet.

- In July 2024, Visy launched Australia's first oxygen-fuelled glass furnace at its Penrith facility, marking a $150 million investment in energy-efficient manufacturing. The furnace uses less than half the energy of its predecessor and will significantly increase recycled glass usage. Visy aims for 70% recycled content in its glass products, supporting Australia's food and beverage brands. This initiative underscores Visy's commitment to sustainability, recycling, and local manufacturing, with backing from NSW Premier Chris Minns.

Australia Glass Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Bottles, Jars and Container, Ampoules, Vials, Others |

| End Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia glass packaging market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia glass packaging market on the basis of product?

- What is the breakup of the Australia glass packaging market on the basis of end user?

- What is the breakup of the Australia glass packaging market on the basis of region?

- What are the various stages in the value chain of the Australia glass packaging market?

- What are the key driving factors and challenges in the Australia glass packaging market?

- What is the structure of the Australia glass packaging market and who are the key players?

- What is the degree of competition in the Australia glass packaging market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia glass packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia glass packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia glass packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)