Australia Gluten Free Food Market Size, Share, Trends and Forecast by Product Type, Source, Sales Channel, and Region, 2025-2033

Australia Gluten Free Food Market Overview:

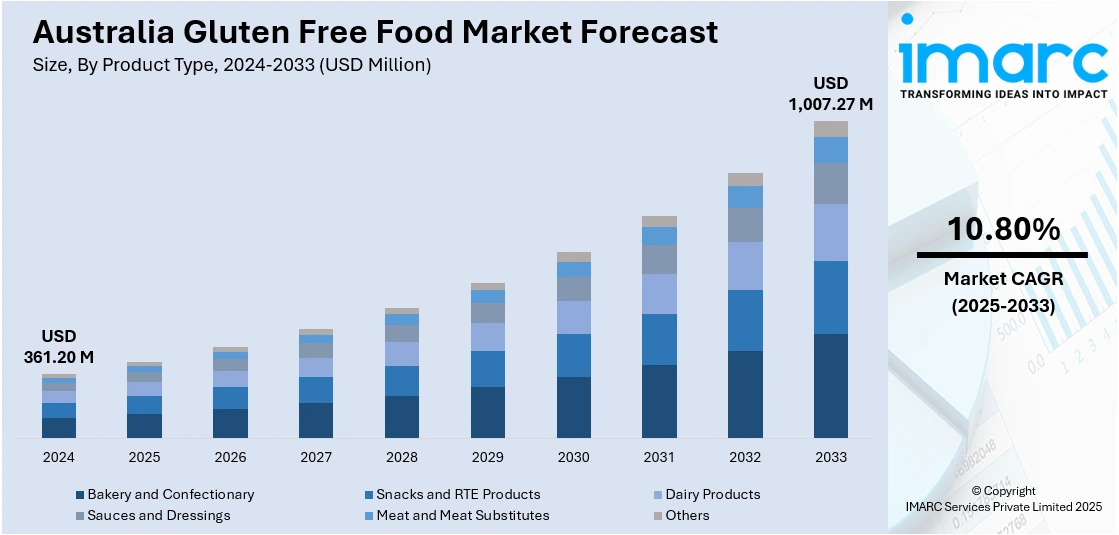

The Australia gluten free food market size reached USD 361.20 Million in 2024. Looking forward, the market is projected to reach USD 1,007.27 Million by 2033, exhibiting a growth rate (CAGR) of 10.80% during 2025-2033. The market is stimulated by heightened consumer health awareness, technological advancements enhancing product quality, and amplified retail availability. Consumers with health concerns are increasingly looking for gluten free products, and advancements in substitute ingredients add taste and nutrition. The widespread availability of the products in supermarkets and online channels guarantees convenience and variety. All these come together to ensure continued growth of the industry, which has a positive impact on the overall Australia gluten free food market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 361.20 Million |

| Market Forecast in 2033 | USD 1,007. 27 Million |

| Market Growth Rate 2025-2033 | 10.80% |

Key Trends in Australia Gluten Free Food Market:

Rising Consumer Health Awareness and Dietary Trends

Consumer health awareness is one of the key drivers of growth for gluten free food in Australia. In addition to the classic celiac disease demographic, more and more people are opting for gluten free food as part of overall health-conscious lifestyles. These consumers are looking for foods that enhance digestive health, minimize inflammation, or merely fit into personal wellness objectives. It has resulted in a strong demand for gluten free versions of foods in most food categories such as bakery products, snacks, and ready-to-eat (RTE) meals. Medical professionals and media have also promoted the trend by making the public aware of the possible advantages of gluten free diets. As a result, manufacturers and retailers have reacted by improving the range and availability of gluten free products to address changing consumer demand. This trend contributed significantly to the continued growth in Australia gluten free food, as accelerating numbers of Australians are adopting gluten free options for health and lifestyle purposes. For instance, in March 2024, Arnott's released gluten-free versions of their hit Barbecue Shapes and Jatz crackers, going on sale in early April at leading Australian retailers, delighting coeliac consumers nationwide.

To get more information on this market, Request Sample

Increased Application of Technology to Improve Product Quality

Advances in food technology have enhanced the quality and range of available gluten free products in Australia. Historically, gluten free products had poor texture and taste, making them less attractive. But with advances in food processing, manufacturers can now mimic the sensory properties of products made with gluten better. The addition of substitute flours and protein sources like sorghum, quinoa, and chickpea flours has enhanced nutritional profiles without compromising on gluten free standards. These developments also lengthen product shelf life and convenience, thus making gluten free choices appealing to a broader consumer base. Consequently, the Australia gluten free food market growth is being driven by an increasing demand for premium and functional gluten-free products that cater to both dietary restrictions and gourmet preferences. These developments play a vital role in maintaining the growth of Australia gluten free food by enhancing consumer and product acceptance.

Expanding Distribution and Availability in Grocery Stores

The availability and distribution of gluten free foodstuffs throughout Australia have increased considerably, which is an indicator of their growing market demand. For example, in May 2023, Melbourne's Well and Good released gluten-free Caramel Slice and Crumble Cake mixes in Australia, supported by Coeliac Australia and now in-store at Woolworths and online channels. Moreover, gluten free foodstuffs are no longer limited to specialty health shops but are more readily available throughout major supermarkets, online shopping stores, and convenience stores. Such widespread distribution accommodates various consumer groups, ranging from those handling medical conditions to well-being trend followers. Wholesalers and retailers have met this by establishing stand-alone gluten free sections and easy-to-read labeling to enable well-informed purchasing choices. Internet channels have also made it possible for consumers in distant or rural locations to have access to a broader range of gluten free options. The convenient availability and wide retail distribution support the category's mainstreaming and instill consumer trial and loyalty. This expansion in distribution is a key driver in the rise in Australia gluten free food, underpinning steady demand and market penetration.

Growth Drivers of Australia Gluten Free Food Market:

Rising Diagnoses of Gluten Sensitivity

The increasing prevalence of celiac disease and non-celiac gluten sensitivity in Australia is significantly driving the demand for gluten-free food products. As more individuals receive medical diagnoses for these conditions, the need to avoid gluten becomes essential rather than optional. This trend transcends age demographics, with both adults and children actively searching for safe dietary alternatives that do not provoke negative health reactions. Medical professionals and nutritionists are integral in recommending gluten-free diets for those experiencing digestive issues. This heightened awareness in the medical community and improved rates of diagnosis are steadily boosting demand, making gluten-free products a common feature in grocery stores and foodservice establishments. Consequently, diagnosed dietary requirements are directly influencing the growth of Australia gluten free food market share.

Expansion of Product Variety

A important factor driving demand in the Australia gluten free food market is the expanding range of products accessible to consumers. Gluten-free selections are no longer confined to specialized health food stores; they are now prevalent in mainstream supermarkets across various categories, such as bread, pasta, snacks, breakfast cereals, and beverages. This wider availability attracts those with gluten intolerance and also individuals choosing gluten-free diets for lifestyle preferences. Innovations in product development have enhanced taste and texture, making these options more appealing to a broader audience. Additionally, gluten-free labeling and branding have become more straightforward and visually attractive, facilitating purchasing choices. This increased assortment of convenient, delicious, and easily accessible products is directly enhancing Australia gluten free food market demand.

Rising Wellness Trends

Australia's heightened emphasis on fitness and wellness is significantly impacting consumer food preferences, with gluten-free diets gaining popularity as part of a comprehensive healthy lifestyle. Fitness enthusiasts, influencers, and wellness coaches often promote gluten-free options as being lighter and easier to digest, even for those without gluten intolerances. This perception, bolstered by social media and health-oriented content, has led many consumers to link gluten-free eating with enhanced energy levels, effective weight management, and improved gut health. As a result, gluten-free foods are increasingly regarded as a proactive wellness choice rather than merely a medical requirement. This cultural shift toward mindful eating and diet-focused lifestyles is a key driver of Australia gluten free food market growth, as health-conscious consumers actively pursue gluten-free alternatives in their daily meals.

Opportunities of Australia Gluten Free Food Market:

Expansion into Mainstream Categories

Gluten-free products are increasingly moving beyond niche health sections and are starting to penetrate mainstream product categories, presenting significant growth opportunities in the market. By broadening gluten-free selections in everyday items such as breakfast cereals, pasta, snacks, and baked goods, manufacturers can attract a wider array of consumers, including those who do not have gluten sensitivities. This evolution aligns with the rising demand for healthier choices in daily eating habits. Enhanced visibility in regular grocery aisles and convenience stores increases accessibility and normalizes gluten-free consumption. When these products are priced competitively and offer comparable taste, they can become popular alternatives rather than just specialty options. According to Australia gluten-free food market analysis, this integration into everyday consumer behavior has strong potential to foster widespread acceptance and drive long-term market growth.

Growth in Foodservice and Hospitality Adoption

The rise in gluten-related health issues is motivating more restaurants, cafes, and foodservice providers in Australia to add gluten-free options to their menus. This transition creates a valuable opportunity for brands to offer gluten-free ingredients, pre-packaged goods, and ready-made meals tailored to the hospitality industry. Diners and travelers are increasingly searching for establishments that cater to dietary restrictions, making the availability of gluten-free options a competitive edge for foodservice operations. By supplying trusted and certified products, manufacturers can forge partnerships with restaurants, airlines, schools, and hotels that aim to address diverse dietary needs. As gluten-free options shift from being a luxury to an expectation, expanding into the foodservice channel can vastly improve brand visibility, enhance customer loyalty, and broaden overall market reach.

Growing Focus on Clean-Label and Organic Gluten-Free Products

Consumers are becoming more selective about the ingredients in their food, leading to a rising demand for clean-label and organic gluten-free products. Items that are gluten-free and also devoid of artificial additives, preservatives, and genetically modified ingredients are increasingly favored by health-conscious buyers. This trend presents a valuable opportunity for brands to market their products as wholesome, transparent, and reliable. Highlighting certifications such as organic, non-GMO, and allergen-free can further bolster consumer trust. This approach is particularly appealing to those adhering to holistic wellness lifestyles or restrictive diets. As ingredient transparency becomes a crucial factor in purchasing decisions, merging gluten-free claims with clean-label principles can enhance brand value and tap into a premium market segment.

Challenges of Australia Gluten Free Food Market:

High Product Cost Limiting Market Accessibility

One of the major obstacles in the Australian gluten free food market is the elevated price of these products. Gluten-free alternatives often necessitate specialized ingredients, specific manufacturing equipment, and thorough testing to comply with safety regulations—all of which elevate production costs. Typically, these additional expenses are transferred to consumers, making gluten-free items pricier than their conventional counterparts. For budget-conscious shoppers, particularly those with medical conditions such as celiac disease, this can restrict regular access to vital food options. The disparity in pricing also creates hurdles for broader acceptance among the general populace. To address this issue, brands should look into cost-effective ingredient sourcing and efficient production techniques while still upholding quality and safety standards.

Cross-Contamination Risks Impacting Product Integrity

Upholding the purity of gluten-free products throughout the supply chain poses a continual challenge for both manufacturers and foodservice providers. Even trace amounts of gluten introduced during processing, packaging, or storage can pose significant health risks to individuals with celiac disease or gluten intolerance. Shared equipment, insufficient cleaning protocols, and inadequately trained staff can all lead to cross-contamination. This jeopardizes consumer safety and damages brand reputation and compliance with regulatory requirements. Manufacturers need to invest in dedicated gluten-free production lines, strict quality control measures, and transparent labeling to mitigate these risks. Ensuring the safety and integrity of products is crucial for maintaining credibility and boosting consumer confidence in the gluten free food market.

Consumer Confusion and Misinformation Slowing Market Clarity

Consumer knowledge regarding gluten-free diets remains variable, resulting in marketplace confusion. While some people adopt gluten-free eating due to diagnosed health conditions, others are influenced by trends or assumed health benefits without a clear medical necessity. This has led to misconceptions about the true value and purpose of gluten-free products. Consequently, demand may fluctuate because of misinformation, complicating brands' ability to anticipate consumer behavior and effectively plan product lines. Mislabeling and ambiguous health claims made by certain producers further hinder consumer trust. To counter this, companies should invest in educational initiatives, transparent advertising, and more precise nutritional information to empower consumers to make informed decisions. Clarifying the advantages and limitations of gluten-free diets is essential for cultivating sustainable demand.

Australia Gluten Free Food Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, source, and sales channel.

Product Type Insights:

- Bakery and Confectionary

- Snacks and RTE Products

- Dairy Products

- Sauces and Dressings

- Meat and Meat Substitutes

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes bakery and confectionary, snacks and RTE products, dairy products, sauces and dressings, meat and meat substitutes, and others.

Source Insights:

- Plant-Based

- Animal-Based

A detailed breakup and analysis of the market based on the source have also been provided in the report. This includes plant-based, and animal-based.

Sales Channel Insights:

- Hypermarkets/Supermarkets

- Convenience Stores

- Specialty Store

- Pharmacies

- Online Retail

- Others

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes hypermarkets/supermarkets, convenience stores, specialty store, pharmacies, online retail, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Gluten Free Food Market News:

- In October 2024, UK's number one bakery brand Warburtons rolled out its gluten-free range in Australia, meeting the nation's growing demand for gluten-free diets. Retailing at Coles, the range consists of loaves, rolls, and crumpets—providing Coeliac and gluten-intolerant consumers with high-quality, safe, and delicious bakery substitutes from a 148-year-old family-owned business that consumers know and trust.

Australia Gluten Free Food Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Bakery and Confectionary, Snacks and RTE Products, Dairy Products, Sauces and Dressings, Meat and Meat Substitutes, Others |

| Sources Covered | Plant-Based, Animal-Based |

| Sales Channel Covered | Hypermarkets/Supermarkets, Convenience Stores, Specialty Store, Pharmacies, Online Retail, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia gluten free food market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia gluten free food market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia gluten free food industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The gluten free food market in Australia was valued at USD 361.20 Million in 2024.

The Australia gluten free food market is projected to exhibit a compound annual growth rate (CAGR) of 10.80% during 2025-2033.

The Australia gluten free food market is expected to reach a value of USD 1,007.27 Million by 2033.

The market is seeing increased demand for clean-label and organic gluten-free products. There's also a rising preference for gluten-free options in convenience foods and snacks. Enhanced taste, improved texture, and broader product variety are driving consumer interest across different demographic groups.

Rising diagnoses of celiac disease and gluten sensitivity are fueling demand for safe dietary alternatives. Growing health consciousness and wellness-focused eating habits are encouraging consumers to choose gluten-free options. Expanding retail availability and supportive labeling regulations are also contributing to the market’s continued growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)