Australia Governance, Risk and Compliance Platform Market Size, Share, Trends and Forecast by Deployment Model, Solution, Component, Service, Organization Size, Industry Vertical, and Region, 2025-2033

Australia Governance, Risk and Compliance Platform Market Overview:

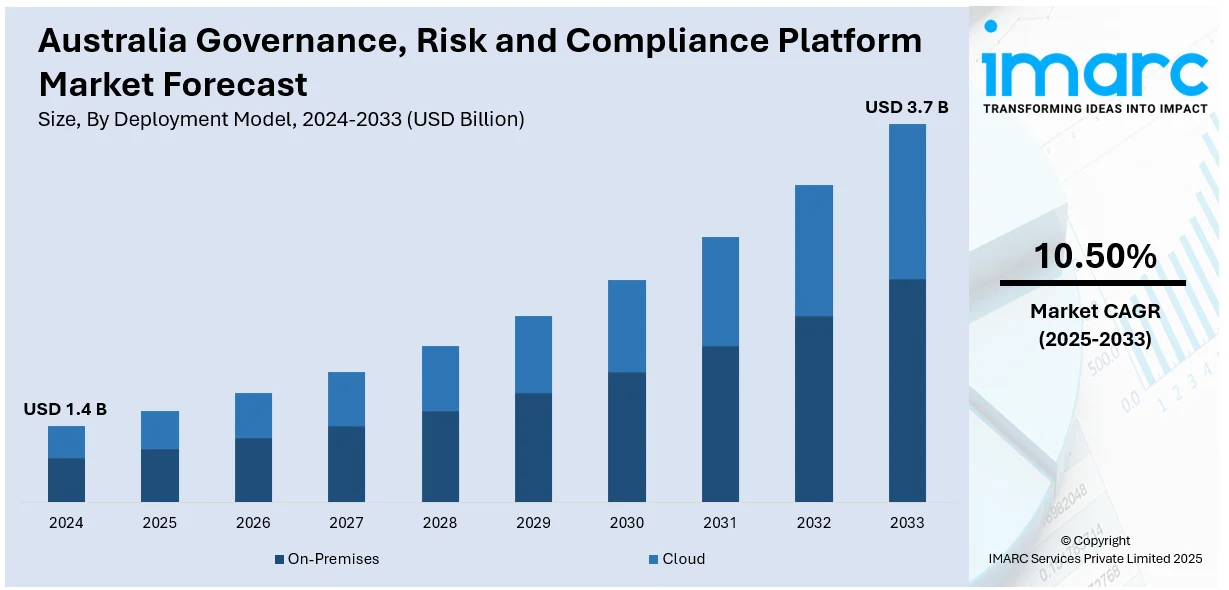

The Australia governance, risk and compliance platform market size reached USD 1.4 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 3.7 Billion by 2033, exhibiting a growth rate (CAGR) of 10.50% during 2025-2033. Stringent regulatory requirements, increased focus on data privacy, growing cyber threats, adoption of digital transformation, rising demand for integrated risk management, and emphasis on operational transparency are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.4 Billion |

| Market Forecast in 2033 | USD 3.7 Billion |

| Market Growth Rate 2025-2033 | 10.50% |

Australia Governance, Risk and Compliance Platform Market Trends:

Greater Board Vigilance on Global Risk and Compliance Pressures

In Australia, governance practices are being shaped by a heightened awareness of global risk factors and shifting regulatory landscapes. Board members are expected to take a more active role in understanding international developments that impact compliance expectations and strategic decisions. This shift calls for stronger, more agile frameworks capable of addressing both domestic and cross-border governance issues. The demand for platforms that offer real-time risk monitoring, policy management, and regulatory updates is growing, especially as organizations face mounting pressure to demonstrate transparency and accountability. With evolving stakeholder expectations and increasing regulatory scrutiny, the emphasis is firmly on proactive oversight and continuous improvement. Solutions that help align board activities with these requirements are becoming essential across sectors, indicating a marked change in how compliance is approached and integrated into corporate leadership. For example, in December 2024, the Australian Institute of Company Directors highlighted the increasing importance for boards to stay alert to global risks and regulatory developments shaping governance practices, emphasizing the need for robust compliance frameworks.

To get more information on this market, Request Sample

Rising Demand for Enhanced UI/UX in Compliance Platforms

In the Australian governance, risk, and compliance platform space, there's a growing focus on user-centric design to support evolving enterprise needs. As regulatory demands increase and risk environments become more complex, businesses are seeking platforms that not only deliver robust functionality but also offer intuitive, efficient interfaces. Enhanced UI/UX is no longer a secondary feature, it's central to adoption and effectiveness. Organizations are prioritizing solutions that streamline workflows, reduce training overhead, and improve user engagement across departments. Visual clarity, dashboard customization, and seamless navigation are emerging as key factors in platform selection. This reflects a broader shift toward integrating compliance systems more deeply into daily operations, making them more accessible and actionable. As a result, vendors offering advanced UI/UX capabilities are positioned to gain stronger traction in the competitive landscape. For instance, in February 2024, ReadiNow, a global leader in governance, risk management, and compliance (GRC) solutions, announced the launch of ReadiNow Nova, a groundbreaking enhancement to its digital transformation platform. Nova represents a revolution in user interface and user experience (UI/UX) design, meticulously crafted to meet the dynamic needs of modern businesses.

Australia Governance, Risk and Compliance Platform Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on deployment model, solution, component, service, organization size, and industry vertical.

Deployment Model Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises and cloud.

Solution Insights:

- Audit Management

- Risk Management

- Policy Management

- Compliance Management

- Others

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes audit management, risk management, policy management, compliance management, and others.

Component Insights:

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes software and services.

Service Insights:

- Integration

- Consulting

- Support

A detailed breakup and analysis of the market based on the service have also been provided in the report. This includes integration, consulting, and support.

Organization Size Insights:

- Small Enterprise

- Medium Enterprise

- Large Enterprise

The report has provided a detailed breakup and analysis of the market based on the organization size. This includes small enterprise, medium enterprise, and large enterprise.

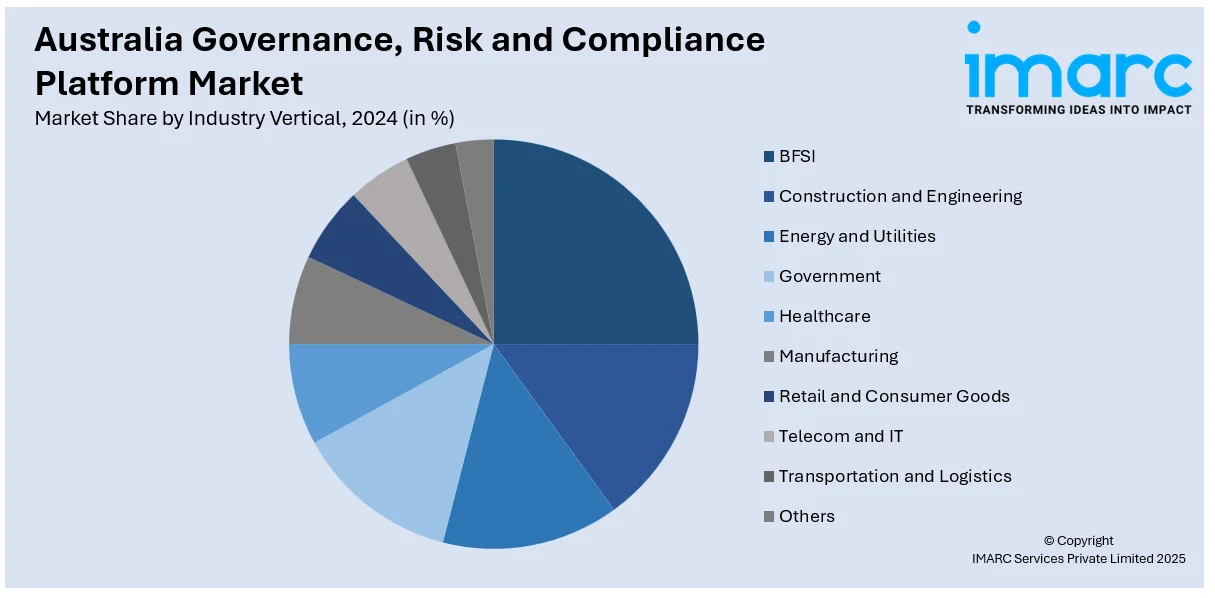

Industry Vertical Insights:

- BFSI

- Construction and Engineering

- Energy and Utilities

- Government

- Healthcare

- Manufacturing

- Retail and Consumer Goods

- Telecom and IT

- Transportation and Logistics

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes BFSI, construction and engineering, energy and utilities, government, healthcare, manufacturing, retail and consumer goods, telecom and IT, transportation and logistics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Governance, Risk and Compliance Platform Market News:

- In February 2025, Objective Corporation partnered with Innovation.is to expand its regulated communications management software, Objective Keystone, into Southeast Asia. This collaboration aims to enhance compliance capabilities for financial service organizations in the region.

- In May 2024, Sydney-based HyperGRC announced a new composable architecture for its governance, risk, and compliance (GRC) platform. The company has opened all application programming interfaces (APIs) within the platform and is now offering a free tier for the core risk management module.

Australia Governance, Risk and Compliance Platform Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Models Covered | On-Premises, Cloud |

| Solutions Covered | Audit Management, Risk Management, Policy Management, Compliance Management, Others |

| Components Covered | Software, Services |

| Services Covered | Integration, Consulting, Support |

| Organization Sizes Covered | Small Enterprise, Medium Enterprise, Large Enterprise |

| Industry Verticals Covered | BFSI, Construction and Engineering, Energy and Utilities, Government, Healthcare, Manufacturing, Retail and Consumer Goods, Telecom and IT, Transportation and Logistics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia governance, risk and compliance platform market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of deployment model?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of solution?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of component?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of service?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of organization size?

- What is the breakup of the Australia governance, risk and compliance platform market on the basis of industry vertical?

- What are the various stages in the value chain of the Australia governance, risk and compliance platform market?

- What are the key driving factors and challenges in the Australia governance, risk and compliance platform market?

- What is the structure of the Australia governance, risk and compliance platform market and who are the key players?

- What is the degree of competition in the Australia governance, risk and compliance platform market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia governance, risk and compliance platform market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia governance, risk and compliance platform market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia governance, risk and compliance platform industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)