Australia Grid Automation Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2025-2033

Australia Grid Automation Market Overview:

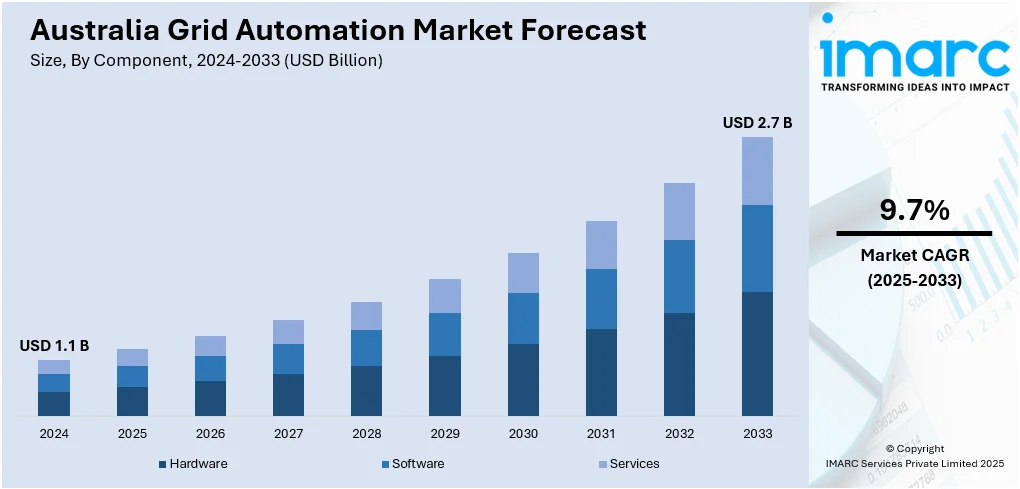

The Australia grid automation market size reached USD 1.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 9.7% during 2025-2033. At present, the growing adoption of renewable energy is creating the need for a more intelligent and adaptable power system, driving the demand for advanced grid automation solutions. Grid automation aids in handling variations through real-time tracking, load adjustment, and smooth incorporation of distributed energy resources. Besides this, the rising implementation of government initiatives that encourage the modernization of grids is contributing to the expansion of the Australia grid automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.1 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate (2025-2033) | 9.7% |

Australia Grid Automation Market Trends:

Increasing utilization of renewable energy

The growing usage of renewable energy is positively influencing the market. As solar, wind, and other renewable sources are becoming a larger part of the energy mix, the grid is facing challenges with variability and decentralization. As per the Quarterly Energy Dynamics report published by the Australian Energy Market Operator (AEMO), as of October 2024, 45.6GW of new renewable energy capacity was moving through the connection process from application to commissioning, marking a 36% rise from 33.4GW in October 2023. By facilitating load balancing, real-time monitoring, and the smooth integration of dispersed energy resources, grid automation aids in the management of fluctuations. Smart sensors, intelligent control systems, and data analytics are examples of advanced automation technologies that enable utilities to forecast energy utilization, identify defects, and optimize energy flow. This guarantees that even as the energy landscape is shifting towards clean sources, the power supply will continue to be steady and dependable. Additionally, grid automation enables two-way electrical flow, which is crucial as more individuals are using rooftop solar systems to generate renewable energy. It allows quicker decision-making and improves communication between various grid components.

To get more information on this market, Request Sample

Rising implementation of government initiatives

Increasing implementation of government initiatives is impelling the Australia grid automation market growth. The government is promoting smart grid development through national energy strategies and sustainability goals, aiming to reduce carbon emissions and improve energy efficiency. Incentive programs and grants are supporting the adoption of advanced technologies like smart meters, sensors, and automated control systems. Public investments in grid upgrades are encouraging utilities to implement automation projects that enhance reliability and performance. Government-led pilot programs and partnerships with private firms are fostering innovations and accelerating the deployment of intelligent grid solutions. These initiatives also include the promotion of renewable energy, driving the demand for automated systems to manage variable energy inputs. Educational campaigns and stakeholder engagement are generating awareness about the benefits of smart grids, encouraging broader employment. As the government continues to focus on building a sustainable and resilient energy system and incorporating new technologies, its initiatives play a central role in expanding the market across Australia. In May 2024, the Australian Renewable Energy Agency (ARENA) allocated USD 337,000 to GridWise Energy Solutions (GridWise) for its project titled ‘Dynamic Model Validation’. The initiative aimed to develop a standardized digital assessment platform (DMV tool) that enabled project creators to independently verify their renewable energy generator models prior to sending them to Network Service Providers (NSPs) and the Australian Energy Market Operator (AEMO). GridWise, collaborating with Coleman Laboratories and transmission networks AusNet and Transgrid, planned to develop software that would streamline the application process for incorporating new renewable energy sources, such as solar and wind, into the grid.

Australia Grid Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and end-user.

Component Insights:

- Hardware

- Sensors

- Programmable Logic Controllers (PLCs)

- Remote Terminal Units (RTUs)

- Communication Networks

- Software

- Supervisory Control and Data Acquisition (SCADA)

- Distribution Management Systems (DMS)

- Advanced Metering Infrastructure (AMI)

- Grid Optimization Software

- Services

- Installation and Integration

- Maintenance and Support

- Consulting and Training

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware {sensors, programmable logic controllers (PLCs), remote terminal units (RTUs), and communication networks}, software {supervisory control and data acquisition (SCADA), distribution management systems (DMS), advanced metering infrastructure (AMI), and grid optimization software}, and services {installation and integration, maintenance and support, and consulting and training}.

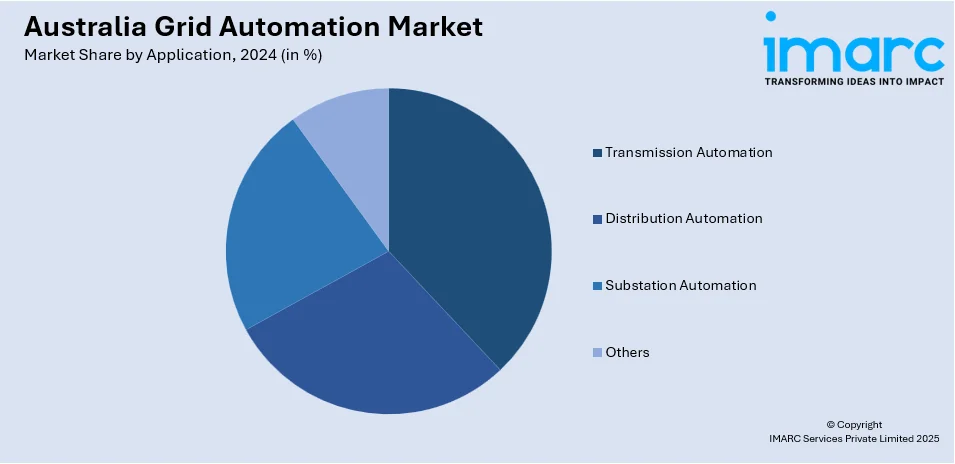

Application Insights:

- Transmission Automation

- Distribution Automation

- Substation Automation

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes transmission automation, distribution automation, substation automation, and others.

End-User Insights:

- Utilities

- Industrial

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes utilities, industrial, commercial, and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Grid Automation Market News:

- In April 2025, a collaborative effort between Essential Energy and CSIRO showcased vehicle-to-grid (V2G) technology utilizing commercially available systems. The initiative underscored the ability of V2G to revolutionize energy management within Australian homes. This advancement marked a crucial transition towards enhancing rooftop solar use and grid stability in Australia. The upcoming stage was set to emphasize enhancing the laboratory's functions, further perfecting the implementation of bi-directional charging technology, and investigating practical deployment situations. This involved improved automation along with enhanced communication standards and control technologies.

- In October 2024, Ausgrid, the biggest electricity distributor on Australia's eastern coast, teamed up with Schneider Electric, a frontrunner in energy management and automation's digital transformation, to decarbonize its grid operations. The updated kiosk included automation features through Schneider’s T300 technology, enabling the control room to execute switching commands from a distance. Moreover, it worked flawlessly with Ausgrid’s advanced distribution management system (ADMS) from Schneider Electric, guaranteeing peak grid dependability.

Australia Grid Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Transmission Automation, Distribution Automation, Substation Automation, Others |

| End-Users Covered | Utilities, Industrial, Commercial, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia grid automation market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia grid automation market on the basis of component?

- What is the breakup of the Australia grid automation market on the basis of application?

- What is the breakup of the Australia grid automation market on the basis of end-user?

- What is the breakup of the Australia grid automation market on the basis of region?

- What are the various stages in the value chain of the Australia grid automation market?

- What are the key driving factors and challenges in the Australia grid automation market?

- What is the structure of the Australia grid automation market and who are the key players?

- What is the degree of competition in the Australia grid automation market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia grid automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia grid automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia grid automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)