Australia Grid Modernization Market Size, Share, Trends and Forecast by Component, Application, End-User, and Region, 2025-2033

Australia Grid Modernization Market Overview:

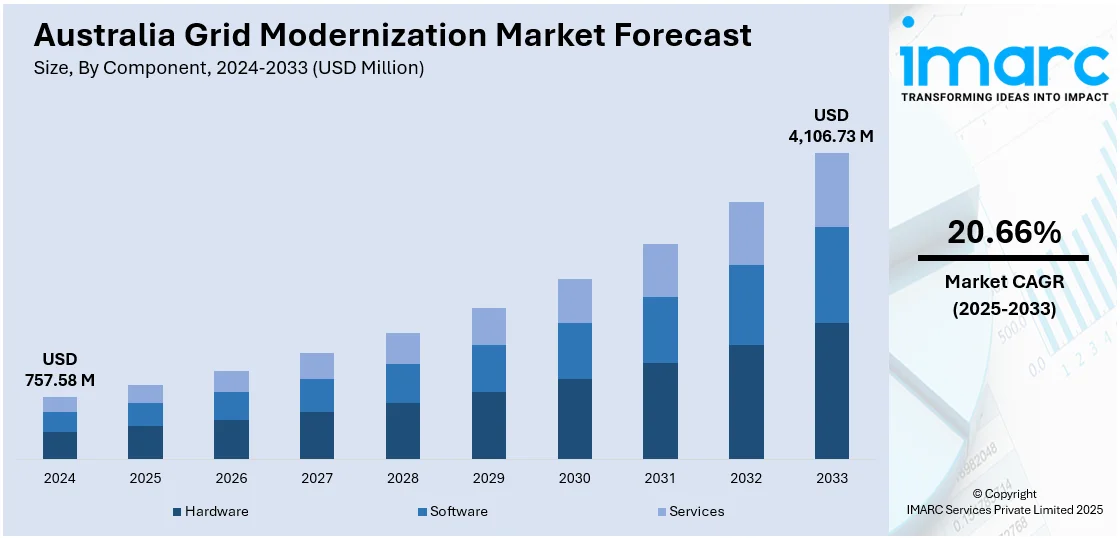

The Australia grid modernization market size reached USD 757.58 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 4,106.73 Million by 2033, exhibiting a growth rate (CAGR) of 20.66% during 2025-2033. The market is driven by the shift to decentralized generation and DER integration. Also, long-distance transmission expansion, REZ development, and sector electrification are fueling the product adoption. Additionally, policy-backed VPPs and flexible demand systems support real-time grid control. Smart technologies, renewable clustering, and prosumer integration are some of the factors positively impacting the Australia grid modernization market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 757.58 Million |

| Market Forecast in 2033 | USD 4,106.73 Million |

| Market Growth Rate 2025-2033 | 20.66% |

Australia Grid Modernization Market Trends:

Transition to Decentralized Energy and Advanced Grid Architecture

Australia’s power sector is undergoing a shift from centralized generation to a more distributed model, driven by rooftop solar, community batteries, and prosumer participation. Nearly one in three households now have solar PV systems, creating a complex two-way energy flow that traditional grid infrastructure was not designed to manage. This transition requires an advanced grid architecture capable of integrating decentralized resources while maintaining reliability and safety. Investments are being directed toward smart transformers, real-time grid visibility tools, and distributed energy resource management systems (DERMS) to support this shift. On November 26, 2024, GE Vernova announced a contract with Powerlink, Queensland’s state transmission utility, to supply 69 Dead Tank Circuit Breakers rated 245 kV and above as part of its Capital Work program. These circuit breakers will enhance grid stability and fault management, directly supporting Queensland’s renewable energy targets of 70% by 2032 and 80% by 2035. The equipment, scheduled for delivery between August 2025 and March 2026, will reinforce infrastructure reliability and facilitate the integration of renewable energy sources. State governments and national regulators have introduced reforms aimed at enabling dynamic operating envelopes and flexible export limits for prosumers. The introduction of these technologies and policy frameworks is directly contributing to Australia grid modernization market growth by enabling a scalable, intelligent network that reflects changing generation patterns. Regulatory bodies such as the Australian Energy Market Operator (AEMO) are playing a coordinating role by publishing detailed roadmaps for network transformation. This approach encourages collaboration between transmission companies, distribution service providers, and clean energy investors. The combination of local generation, storage, and digital coordination platforms is reshaping how energy is produced, managed, and consumed across urban and regional Australia.

To get more information on this market, Request Sample

Renewable Energy Zones and Long-Distance Transmission Projects

Australia’s geography and energy transition strategy have led to the development of Renewable Energy Zones (REZs) that cluster solar, wind, and storage projects in resource-rich areas. These zones require substantial grid extensions to connect remote generation to major load centers. As coal-fired plants are retired ahead of schedule, there is mounting pressure to fast-track new transmission lines and interconnectors across state borders. Projects designed to facilitate multi-directional energy flow and improve resilience against regional imbalances or disruptions that involve large-scale infrastructure are being developed to reinforce the national grid. Regulatory support under the Integrated System Plan (ISP) ensures that these initiatives receive coordinated planning and financial backing. As of January 17, 2023, Australia committed more than AUD 7.8 billion (approximately USD 5.3 billion) in joint federal and New South Wales state funding to upgrade eight major transmission and renewable energy zone projects. This forms part of the larger AUD 20 billion (around USD13.6 billion) Rewiring the Nation program aimed at grid modernization. The funding supports initiatives such as Snowy 2.0 and HumeLink, helping to resolve transmission constraints amid a surge in renewables, an estimated 446 GW of capacity in development compared to about 40 GW currently in use. The high voltage transmission build-out is not only about adding capacity but also about enhancing grid flexibility, redundancy, and renewable absorption capability. Grid-forming inverters, real-time frequency control, and wide-area monitoring systems are critical tools being deployed in tandem with physical infrastructure. These efforts align with the country’s long-term decarbonization targets, ensuring that the physical grid keeps pace with renewable investment and carbon neutrality milestones. Large-scale, high-impact transmission builds are now central to modernizing Australia’s energy backbone.

Australia Grid Modernization Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and end-user.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

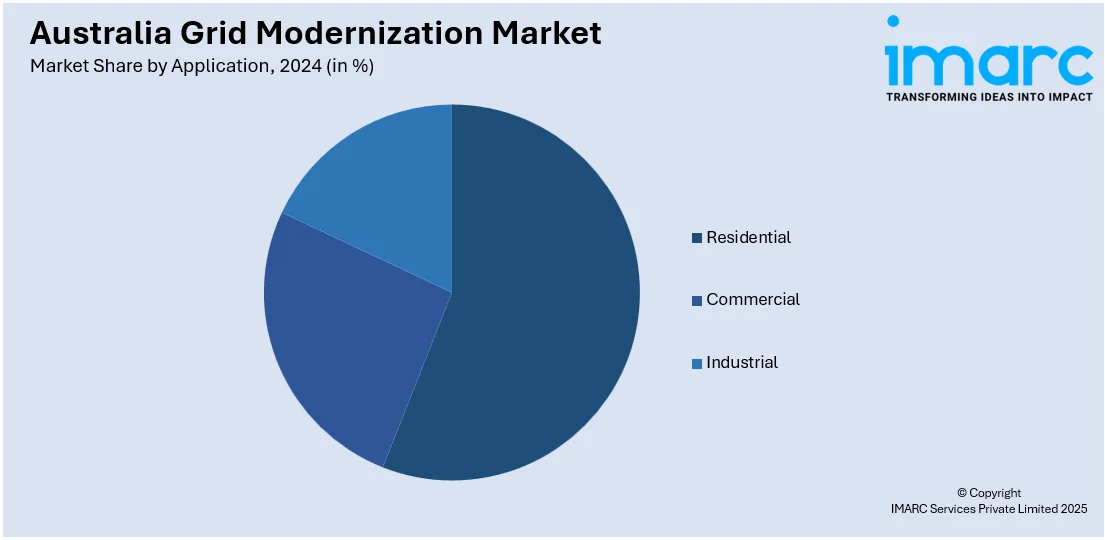

Application Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and industrial.

End-User Insights:

- Utilities

- Independent Power Producers (IPPs)

- Government and Municipalities

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes utilities, independent power producers (IPPs), and government and municipalities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Grid Modernization Market News:

- On March 19, 2024, during the Energy Networks 2024 conference in Adelaide, Itron introduced its Low Voltage Distributed Energy Resource Management System (LV DERMS) tailored for the Australian market. Designed to address growing challenges in low-voltage networks due to high rooftop solar uptake and increasing EV adoption, the system applies a bottom-up, data-driven approach. It offers capabilities such as real-time constraint calculation, Dynamic System State Estimation (DSSE), premise-level DOE validation, and seamless integration with existing grid management systems.

Australia Grid Modernization Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Hardware, Software, Services |

| Applications Covered | Residential, Commercial, Industrial |

| End Users Covered | Utilities, Independent Power Producers (IPPs), Government and Municipalities |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia grid modernization market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia grid modernization market on the basis of component?

- What is the breakup of the Australia grid modernization market on the basis of application?

- What is the breakup of the Australia grid modernization market on the basis of end-user?

- What is the breakup of the Australia grid modernization market on the basis of region?

- What are the various stages in the value chain of the Australia grid modernization market?

- What are the key driving factors and challenges in the Australia grid modernization market?

- What is the structure of the Australia grid modernization market and who are the key players?

- What is the degree of competition in the Australia grid modernization market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia grid modernization market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia grid modernization market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia grid modernization industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)