Australia Grocery Retail Market Report by Product (Food and Beverages, Non-Food Items), Distribution Channel (Hypermarkets and Supermarkets, Convenience Stores, Discount Stores, Online, and Others), and Region 2026-2034

Australia Grocery Retail Market Overview:

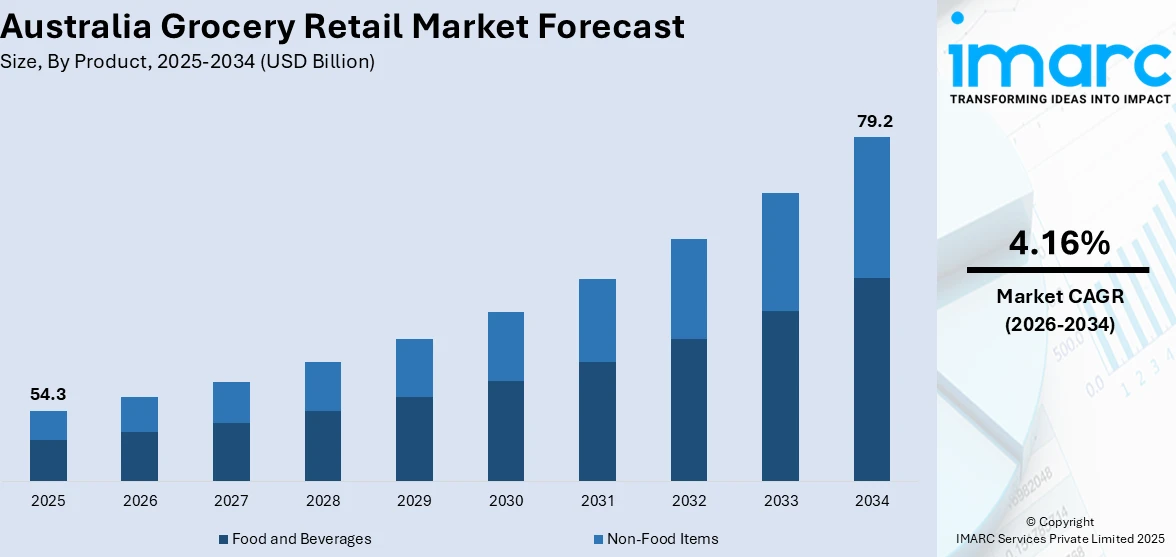

The Australia grocery retail market size reached USD 54.3 Billion in 2025. The market is expected to reach USD 79.2 Billion by 2034, exhibiting a growth rate (CAGR) of 4.16% during 2026-2034. Rapid population growth, rising consumer demand for convenience, the expansion of private-label brands, competitive pricing strategies, increasing health-consciousness, surging sustainability initiatives, rapid e-commerce expansion, technological innovations in-store, and supply chain optimization are some of the factors boosting the market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 54.3 Billion |

| Market Forecast in 2034 | USD 79.2 Billion |

| Market Growth Rate 2026-2034 | 4.16% |

Key Trends of Australia Grocery Retail Market:

Increased Demand for Locally Produced and Australian-Made Goods

One of the most prominent trends is increased consumer demand for locally produced and Australian-made goods. This movement is primarily fueled by an increase in food provenance awareness, sustainability, and support for the local economy, particularly following global supply chain disruptions and natural disasters affecting imports. Australian consumers are increasingly demanding transparency and traceability in what they eat and tend to favor products grown or made within their state or region. In response, retailers have allotted more shelf space to local foods, meat, dairy, and artisanal products, often accompanied by farm-to-shelf stories and sustainability values. Secondly, fears about carbon footprint and the environment have bolstered this trend since purchasing locally saves transport emissions. The trend is especially prevalent in suburban and regional markets where local grower support and community connections are strong. This increasing allegiance to local products is transforming supermarkets, merchandise, and market groceries throughout the Australian landscape.

To get more information on this market Request Sample

Consumer Preference for Convenience

Consumer preference for convenience has significantly shaped the Australia grocery retail market. Shoppers are increasingly seeking easy and quick access to products, driving the popularity of online shopping and home delivery services. Busy lifestyles and time constraints make consumers more inclined toward services that save time, such as click-and-collect options and same-day deliveries. This shift has encouraged retailers to enhance their e-commerce platforms, streamline their delivery services, and improve the overall shopping experience. Additionally, the convenience trend extends to store formats, with smaller, more accessible locations in urban areas gaining popularity. Retailers are also focusing on ready-to-eat (RTE) meals and pre-packaged foods to meet the demands of time-pressed customers.

Growth of Private-Label Brands

The growing popularity of private-label brands is a key factor influencing the Australian grocery retail market demand. Private-label products, often referred to as store brands, offer consumers a more affordable alternative to name-brand goods. As cost-consciousness rises, especially during economic uncertainty, many shoppers turn to these lower-priced options without compromising on quality. Major Australian grocery retailers, such as Woolworths and Coles, have significantly expanded their private-label offerings, covering a broad range of products, from household essentials to premium organic goods. Private-label brands allow retailers to control their supply chains better, reduce costs, and increase profit margins.

Growth Drivers of Australia Grocery Retail Market:

Population Growth and Urbanization

The Australia grocery retail market share is witnessing fast growth due to fast-paced urbanization and population growth. With more Australians moving to cities, the metropolitan area demand for grocery stores rises. The urbanization has given rise to new residential complexes, shopping malls, and supermarkets serving large groups of people and driving the market's growth. Moreover, the expanding diversity in the population has boosted demand for culturally targeted groceries, giving a push to the market. Growth in the proportion of the population resident in major metropolitan areas and the growing investments by major players in expanding their store networks further supplement this growth trend.

E-commerce and Online Grocery Shopping

E-commerce has revolutionized the Australian grocery retail market. Customers are using online shopping for groceries for convenience, particularly since the COVID-19 pandemic. The major retailers Coles and Woolworths have developed their online platforms further, with options like click-and-collect and home delivery. This change to shopping online has forced bricks-and-mortar retailers to think creatively and stay updated with evolving customer choice, fueling growth in the grocery retail sector.

Health and Sustainability

According to the Australia grocery retail market analysis, consumers in the region are increasingly health-aware and environmentally conscious, which is shaping their food choices when buying groceries. There is a rise in demand for organic foods, plant-based food, and products with sustainable packaging. Shoppers are answering by increasing the range of healthier, more sustainable products they sell. For example, the introduction of the Gander app in August 2023 saves shoppers money and reduces food waste by linking them with reduced-price products that have their sell-by or use-by dates fast approaching. These health and sustainability directions are influencing the future of the Australian grocery retail market and encouraging retailers to shift their strategies in alignment with shopper values.

Challenges of Australia Grocery Retail Market:

Supply Chain Weaknesses and Geographic Limitations

One of the greatest challenges for Australia's grocery food retail sector is its complicated and frequently fragile supply chain, as heavily dictated by the nation's immense geography and far-flung centers of population. Australia's extensive land area and correspondingly low population density present logistical challenges in shipping fresh produce and perishable products over great distances. These geographical limitations incur increased transportation costs and can influence the availability and freshness of the goods, especially in rural and regional zones. Moreover, Australia's dependence on both national agricultural production and global imports subjects the grocery retail industry to potential threats like severe weather conditions, trade interruptions, and international shipping delays. Incidents such as bushfires, droughts, and flooding have temporarily interrupted local agriculture and food production, putting a strain on grocery supply chains and inventory levels and prices. All these logistical issues demand that retailers spend heavily on infrastructure, cold storage, and contingency planning, adding to the complexity of operations and cost pressures in the market.

Increasing Competition and Price Sensitivity

Australia’s grocery retail market is highly competitive, dominated by a few major players like Woolworths, Coles, and ALDI, which exerts considerable pressure on profit margins and pricing tactics. These large supermarkets constantly compete on pricing and run promotions to draw in and keep consumers, which frequently lowers the profitability of suppliers and smaller, independent grocers. This competitive landscape is exacerbated by the increasing visibility of discount stores and online food shopping, which have changed price and convenience expectations among customers. Australian consumers are particularly price-conscious, tending to shop across a range of retailers in pursuit of best value. This compels grocers to continually refine prices, boost promotional activity, and maximize supply chain effectiveness. Smaller operators, especially, struggle to equal the size and pricing maneuverability of large chains. It is a fine balancing act between being profitable while competitive in price, guaranteeing product quality, and providing a differentiated customer experience in today's retail environment.

Evolving Consumer Expectations and Digital Revolution

Digital innovation and changing lifestyle choices contributing to swift changes in consumer behavior are yet another significant challenge confronting Australia's grocery retail industry. Consumers increasingly demand an integrated omnichannel experience that incorporates in-store shopping with online alternatives like click-and-collect, home delivery, and targeted promotions. To deliver these requirements, retailers must spend considerable amounts of money on digital infrastructure, sophisticated data analytics, and customer relationship technologies. Merging new digital systems with legacy retail operations is both expensive and complicated for mid-sized and regional retailers. Additionally, providing cybersecurity and data protection with the use of advanced consumer analytics also introduces a new level of responsibility and risk. In Australia, the urban-rural divide in digital access also translates to some areas being behind in the access to advanced e-commerce services. As customers increasingly get used to convenience, quickness, and customization, food retailers have to continually innovate their services, which can be a strain on resources and cause the industry multiple strategic and operational issues.

Australia Grocery Retail Market News:

- In 2024, Woolworths launched a major price drop campaign, cutting prices on over 800 essential grocery items to help consumers cope with rising living costs. This move aimed to provide more budget-friendly options to households across Australia.

- In 2024, ALDI Australia opened a new store in Woolooware Bay, NSW, as part of the Bay Central shopping centre. This store is located in Southern Sydney and created 15-20 new jobs, offering ALDI’s trademark low prices and popular special buys to the local community. This opening was part of the larger billion-dollar Woolooware Bay Town Centre project, which included significant residential and commercial developments.

Australia Grocery Retail Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product and distribution channel.

Product Insights:

- Food and Beverages

- Fresh Food

- Packaged Food

- Beverages

- Non-Food Items

- Household Cleaning Products

- Personal Care Products

- Pet Care Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes food and beverages (fresh food, packaged food, and beverages) and non-food items (household cleaning products, personal care products, and pet care products).

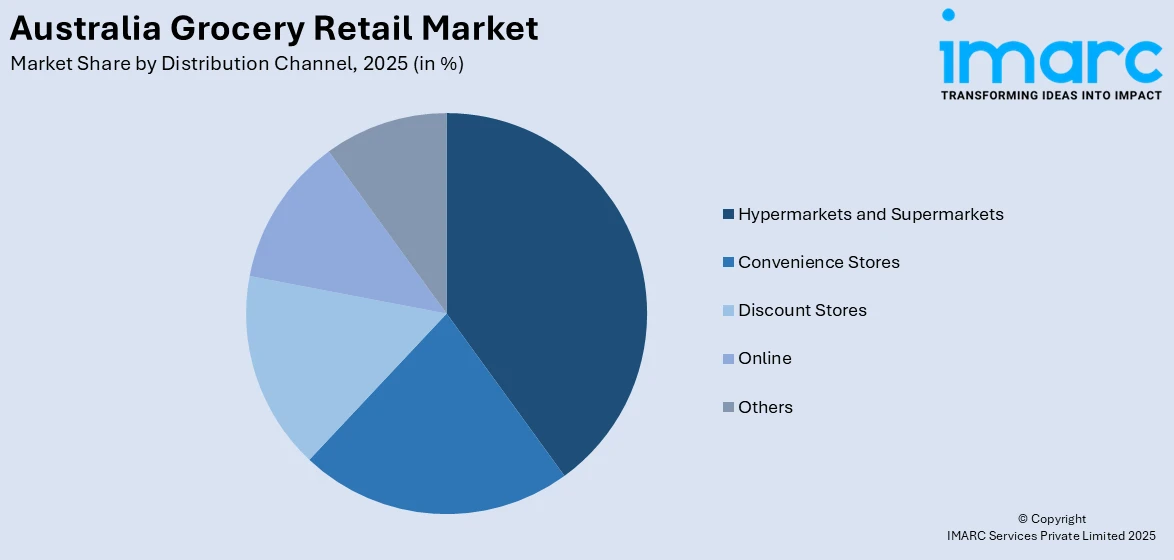

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Hypermarkets and Supermarkets

- Convenience Stores

- Discount Stores

- Online

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets and supermarkets, convenience stores, discount stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Grocery Retail Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Distribution Channels Covered | Hypermarkets and Supermarkets, Convenience Stores, Discount Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia grocery retail market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia grocery retail market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyse the level of competition within the Australia grocery retail industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia grocery retail market was valued at USD 54.3 Billion in 2025.

The Australia grocery retail market is expected to reach a value of USD 79.2 Billion by 2034.

The Australia grocery retail market is projected to exhibit a CAGR of 4.16% during 2026-2034.

Australia's grocery retail market is fueled by growing urbanization, greater consumer demand for health-related products, and the fast growth of online food shopping. Product ranges and digital competencies are expanded by retailers to respond to changing demand, while sustainability trends and multicultural consumer demographics further spur market growth in metropolitan and regional markets.

Major trends in Australia's grocery food retail market are the growth of online shopping, increases in demand for health-oriented and sustainable products, and rivalry among large retailers. Shoppers want ease, value, and moral options, which encourage retailers to innovate, invest in digital, and diversify to address shifting tastes and expectations.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)