Australia Hair Growth Products Market Size, Share, Trends and Forecast by Product Type, Gender, Age Group, Distribution Channel, and Region, 2025-2033

Australia Hair Growth Products Market Overview:

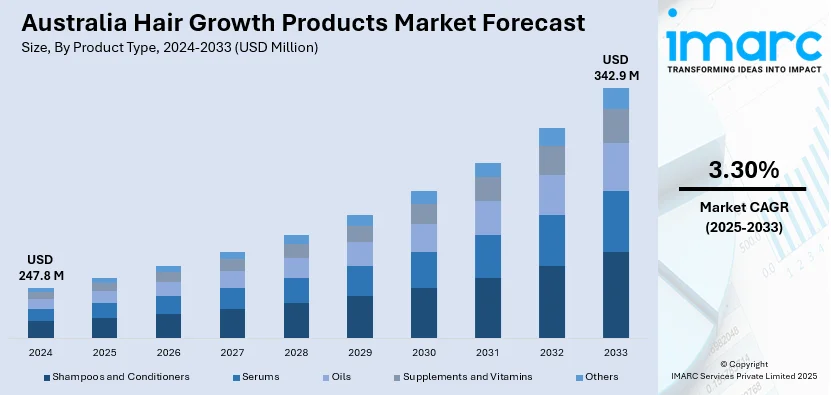

The Australia hair growth products market size reached USD 247.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 342.9 Million by 2033, exhibiting a growth rate (CAGR) of 3.30% during 2025-2033. The increasing awareness about hair health, increasing prevalence of hair loss, growing demand for natural and organic formulations, expanding e-commerce platforms, higher disposable incomes, and increased marketing by domestic and international brands are some of the major factors augmenting Australia hair growth products market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 247.8 Million |

| Market Forecast in 2033 | USD 342.9 Million |

| Market Growth Rate 2025-2033 | 3.30% |

Australia Hair Growth Products Market Trends:

Rising Consumer Inclination Towards Organic and Natural Hair Growth Products

The shift in consumer preference towards hair growth solutions that emphasize organic, plant-based, and chemical-free ingredients is facilitating Australia hair growth products market outlook. Additionally, the growing awareness regarding the long-term side effects associated with synthetic compounds, such as sulfates, parabens, and phthalates, is contributing to the growing popularity of natural alternatives. According to an industry report, about 39% of people in Australia look for natural ingredients in their hair care products. This shift is particularly pronounced among health-conscious consumers and those with sensitive scalps, who actively seek products with minimal allergens and no harsh additives. Besides this, the proliferation of brands promoting products made from botanical ingredients such as saw palmetto, biotin, aloe vera, and argan oil, which are perceived to be safer and environmentally sustainable is gaining momentum. Additionally, the Australian Therapeutic Goods Administration’s (TGA) regulations around cosmetic product labeling is encouraging manufacturers to enhance transparency and focus on cleaner formulations. Also, social media influencers and dermatologists are playing a key role in endorsing herbal-based products, further accelerating market adoption. As a result, companies offering certified organic solutions with proven efficacy are gaining competitive traction across both offline and online retail platforms.

To get more information on this market, Request Sample

Technology-Enabled Personalization and Scalp Diagnostics

Advancements in digital technologies are playing a significant role in redefining how consumers in Australia engage with hair growth treatments, which is also enhancing Australia hair growth products market outlook. There is a rising preference for personalized product recommendations that consider individual scalp conditions, hair health, and lifestyle factors. In response, several brands have introduced online diagnostic tools, virtual consultations, and artificial intelligence (AI)-driven assessment platforms that deliver tailored product and treatment recommendations. These digital interfaces allow users to upload scalp images or complete detailed questionnaires. The data collected is analyzed using algorithmic models to suggest customized solutions, which may include shampoos, serums, dietary supplements, or at-home laser therapies. The research article published on April 14, 2024, examined the efficacy of an artificial intelligence-based system in assessing scalp conditions and prescribing personalized scalp care products. The AI algorithm, trained on over 100,000 magnified scalp images, accurately evaluated five scalp features and recommended customized shampoos and serums. In a clinical trial involving 100 participants, this personalized approach resulted in a significant improvement in scalp health over 12 weeks. The move toward personalization reflects a broader consumer demand for evidence-based, results-oriented solutions.

Australia Hair Growth Products Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, gender, age group, and distribution channel.

Product Type Insights:

- Shampoos and Conditioners

- Serums

- Oils

- Supplements and Vitamins

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes shampoos and conditioners, serums, oils, supplements and vitamins, and others.

Gender Insights:

- Men

- Women

A detailed breakup and analysis of the market based on the gender have also been provided in the report. This includes men and women.

Age Group Insights:

- Under 35

- 35 to 50

- Above 50

The report has provided a detailed breakup and analysis of the market based on the age group. This includes under 35, 35 to 50, and above 50.

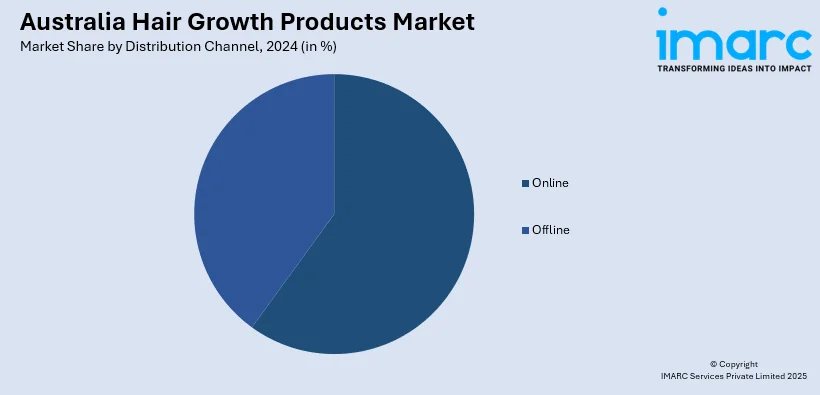

Distribution Channel Insights:

- Online

- Offline

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hair Growth Products Market News:

- On December 3, 2024, Oli G, a Miami-based haircare brand, launched its product line in Australia, offering professional solutions aimed at repairing damaged hair across various types, textures, and age groups. The range features natural ingredients, utilizing oligopeptides to enhance protein production, smooth the cuticle, and improve hair shine and health. The products include the Total Refresh Shampoo and Conditioner, Pure Detox Clarifying Shampoo, Atomic Hair Repair Leave-In Treatment, and Renew Porosity Balancing Oil, all designed to provide deep hydration and nourishment without necessitating salon treatments.

- On January 9, 2025, Australian beauty brand Coco & Eve introduced the Tripeptide Hair Density Serum, a clinically proven product designed to enhance hair volume and reduce hair loss. The serum utilizes advanced peptide technology, stimulates the scalp, and strengthens hair strands, promoting the appearance of fuller, denser hair. Suitable for all hair types, it is formulated to be lightweight and non-greasy, allowing for daily use without leaving residue.

Australia Hair Growth Products Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Shampoos and Conditioners, Serums, Oils, Supplements and Vitamins, Others |

| Genders Covered | Men, Women |

| Age Groups Covered | Under 35, 35 to 50, Above 50 |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hair growth products market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hair growth products market on the basis of product type?

- What is the breakup of the Australia hair growth products market on the basis of gender?

- What is the breakup of the Australia hair growth products market on the basis of age group?

- What is the breakup of the Australia hair growth products market on the basis of distribution channel?

- What is the breakup of the Australia hair growth products market on the basis of region?

- What are the various stages in the value chain of the Australia hair growth products market?

- What are the key driving factors and challenges in the Australia hair growth products market?

- What is the structure of the Australia hair growth products market and who are the key players?

- What is the degree of competition in the Australia hair growth products market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hair growth products market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hair growth products market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hair growth products industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)