Australia Hair Transplant Market Size, Share, Trends and Forecast by Type, Gender, End User, and Region, 2025-2033

Australia Hair Transplant Market Overview:

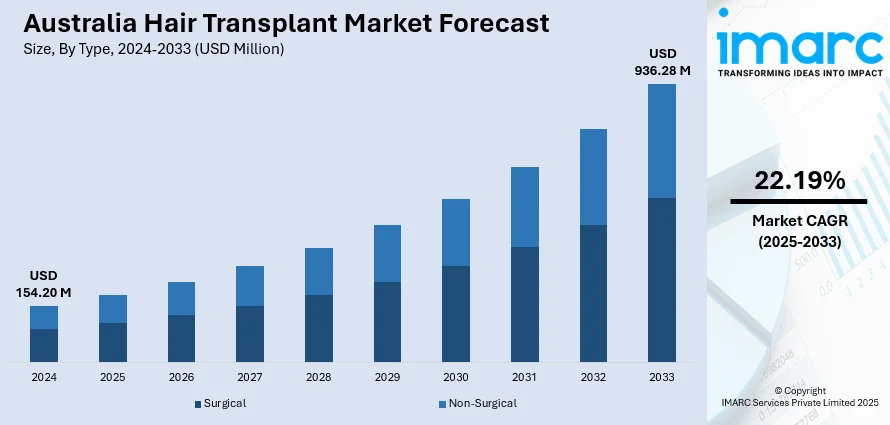

The Australia hair transplant market size reached USD 154.20 Million in 2024. Looking forward, the market is expected to reach USD 936.28 Million by 2033, exhibiting a growth rate (CAGR) of 22.19% during 2025-2033. The market is driven by increasing male engagement in cosmetic self-care, with hair restoration becoming a normalized component of aesthetic routines. Clinical advancements in FUE, PRP therapy, and robotic precision tools are improving outcomes and procedural safety across top-tier clinics, thereby fueling the market. Rising demand for trusted domestic procedures over overseas alternatives is further augmenting the Australia hair transplant market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 154.20 Million |

| Market Forecast in 2033 | USD 936.28 Million |

| Market Growth Rate 2025-2033 | 22.19% |

Key Trends of Australia Hair Transplant Market:

Increasing Male Aesthetic Awareness and Personal Grooming Trends

In Australia, aesthetic awareness among men is driving greater demand for cosmetic procedures, particularly those related to hair restoration. Cultural acceptance of male grooming and appearance-enhancing treatments has increased significantly, with many viewing hair restoration as a routine investment rather than a luxury. Hair thinning and male pattern baldness affect a large portion of the male population, leading to rising demand for minimally invasive, permanent solutions such as Follicular Unit Extraction (FUE) and Follicular Unit Transplantation (FUT). These methods offer natural-looking results with minimal downtime. Influencers, athletes, and public figures sharing their restoration journeys have also reduced stigma and normalized the procedure. Clinics are responding with tailored packages, financing options, and discreet service models to appeal to male clients, and as a result, Australian men are increasingly turning to hair transplant. Hair transplants for men typically cost between USD 6,000 and USD 15,000 and take 6 to 8 hours to complete. Most patients are aged 25-50, though some range from 20 to 60. Recovery is quick, with many resuming activities within a few days. Moreover, busy professionals are increasingly favoring outpatient solutions that provide visible improvements without affecting their daily routines. As men grow more proactive about their appearance, hair restoration is gaining traction as a core component of personal grooming. This transformation in consumer behavior is a major contributor to the Australia hair transplant market growth, especially as cosmetic procedures become more integrated into everyday lifestyles and social expectations.

To get more information on this market, Request Sample

Technological Advancements and Clinical Innovation

Hair loss affects about 20% of men in their 20s, 33% in their 30s, and 50% of men in their 40s in Australia, with nearly 50% of women showing signs of hair loss by age 50. Hair transplant procedures have increased by 80% from 2006 to 2014, with 50% of transplanted hairs growing immediately and 65-75% fully growing by 6 months. Cutting-edge technologies are reshaping the hair restoration landscape in Australia, allowing for higher precision, faster recovery, and better patient satisfaction. Clinics are investing in robotic-assisted FUE devices, advanced imaging software for follicle mapping, and regenerative treatments such as platelet-rich plasma (PRP) therapy to improve transplant success and post-procedure recovery. These innovations reduce the risk of scarring and donor site damage while enhancing graft survival and natural-looking outcomes. Automation is also helping lower operational errors, standardize procedures, and boost efficiency in high-volume clinics. As a result, both experienced professionals and new entrants are scaling services by leveraging smart tools and minimally invasive protocols. Additionally, software-based consultation models allow potential clients to assess their candidacy and visualize expected results, driving informed decision-making. The growing preference for customized solutions, such as combining transplants with pharmaceutical therapies, is also promoting bundled treatment models. Such clinical innovation ensures that the procedure remains relevant, safe, and appealing to younger patients exploring early intervention options. The availability of high-tech, high-precision treatments is shaping a competitive advantage for domestic providers and strengthening Australia’s standing as a medical aesthetics destination.

Growth Factors of Australia Hair Transplant Market:

Rising Prevalence of Hair Loss Conditions

Australia has seen a consistent rise in individuals experiencing hair thinning and alopecia, primarily due to aging, stress, genetics, hormonal imbalances, and lifestyle factors. Both men and women across various age groups are increasingly affected, creating a wider target base for hair transplant services. This growing incidence, especially among younger adults, is prompting early intervention. The emotional toll of hair loss, including reduced confidence and social anxiety, further drives people to explore permanent restoration solutions. As awareness around treatment outcomes and availability grows, so does the demand for surgical procedures like FUE and FUT. According to the Australia hair transplant market analysis, this expanding hair loss population continues to fuel the domestic hair transplant industry and encourages the opening of more specialized clinics nationwide.

Patient Trust, Testimonials, and Clinic Reputation

Positive patient outcomes and transparent clinic practices have become key drivers in Australia’s hair transplant market. Word-of-mouth recommendations, online reviews, and visible success stories shared on social media significantly influence consumer decisions. Clinics with a proven record of natural-looking results and professional aftercare generate stronger patient loyalty and recurring referrals. Additionally, medical practitioners associated with reputable cosmetic groups or dermatological associations enhance credibility. The growing accessibility of digital platforms allows prospective clients to research clinics, compare experiences, and seek peer feedback, shaping purchase intent, which is expected to drive the Australia hair transplant market demand. As the importance of trust grows in aesthetic healthcare, clinics that invest in ethical marketing, clear consultations, and real-world testimonials continue to attract steady patient volumes and expand their market presence.

Shift in Domestic vs. International Medical Tourism

While some Australians seek more affordable transplants abroad, many prefer undergoing procedures locally due to safety, regulation, and postoperative care concerns. Domestic clinics leverage Australia's strict healthcare standards, hygiene protocols, and qualified professionals to position themselves as premium, reliable options. The inconvenience of traveling overseas for follow-ups, language barriers, and quality uncertainties further discourages outbound medical tourism. In response, Australian clinics now offer competitive packages, installment plans, and comprehensive service bundles to retain local clients. Marketing campaigns also stress the benefits of continuity in care and ease of communication. This balancing act between outbound interest and domestic trust is shaping pricing strategies and patient retention, ultimately strengthening the local market's competitiveness and growth potential.

Australia Hair Transplant Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, gender, and end user.

Type Insights:

- Surgical

- Non-Surgical

The report has provided a detailed breakup and analysis of the market based on the type. This includes surgical and non-surgical.

Gender Insights:

- Male

- Female

The report has provided a detailed breakup and analysis of the market based on gender. This includes male and female.

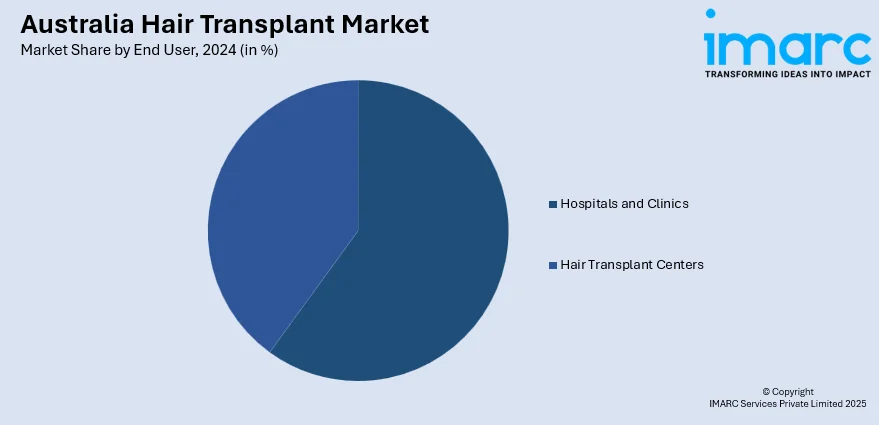

End User Insights:

- Hospitals and Clinics

- Hair Transplant Centers

The report has provided a detailed breakup and analysis of the market based on end user. This includes hospitals and clinics and hair transplant centers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hair Transplant Market News:

- In July 2024, Gro Clinics, a leading provider of hair transplant and restoration services in Australia and New Zealand, introduced free consultations at all its branches. The initiative is designed to make professional guidance more accessible for those exploring hair restoration options, helping individuals take informed steps toward treatment.

Australia Hair Transplant Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Surgical, Non-Surgical |

| Genders Covered | Male, Female |

| End Users Covered | Hospital and Clinics, Hair Transplant Centers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hair transplant market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hair transplant market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hair transplant industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The hair transplant market in Australia was valued at USD 154.20 Million in 2024.

The Australia hair transplant market is projected to exhibit a CAGR of 22.19% during 2025-2033.

The Australia hair transplant market is projected to reach a value of USD 936.28 Million by 2033.

The Australia hair transplant market is characterized by a strong demand for minimally invasive techniques like FUE (Follicular Unit Extraction) due to less scarring and faster recovery. The growing interest in advanced technologies, such as robotic hair transplantation for enhanced precision, and the use of adjunctive therapies like PRP (Platelet-Rich Plasma) to improve graft survival and hair growth are also propelling market growth.

The Australia hair transplant market is primarily driven by increasing beauty consciousness and the desire for improved self-esteem. Advancements in minimally invasive techniques (like FUE) offering natural results and quicker recovery, alongside the growing use of robotic systems and adjunctive therapies, are fueling demand. Additionally, the normalization of procedures via social media is attracting a broader demographic.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)