Australia HDPE Pipes Market Size, Share, Trends and Forecast by Type, Application and Region, 2025-2033

Australia HDPE Pipes Market Overview:

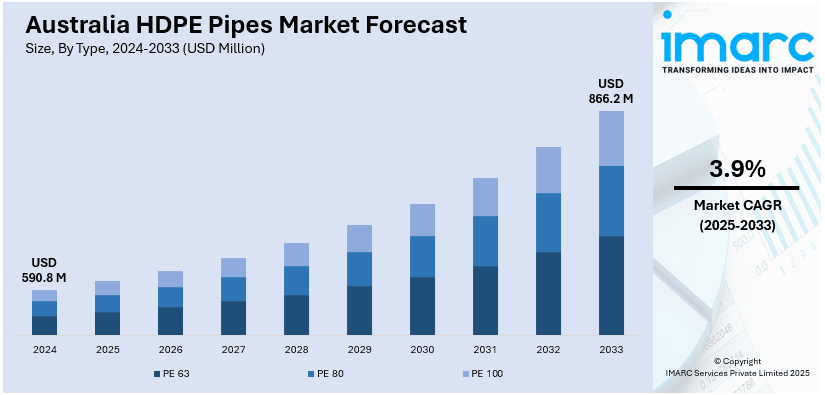

The Australia HDPE pipes market size reached USD 590.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 866.2 Million by 2033, exhibiting a growth rate (CAGR) of 3.9% during 2025-2033. The market is experiencing consistent growth fueled by increasing infrastructure development, agricultural irrigation requirements, and industrial uses, aided by the material's resistance to corrosion, durability, and adaptability to varied environmental and operating conditions in the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 590.8 Million |

| Market Forecast in 2033 | USD 866.2 Million |

| Market Growth Rate 2025-2033 | 3.9% |

Australia HDPE Pipes Market Trends:

Rising Preference for Durable Piping Systems in Infrastructure Development

The use of high-density polyethylene (HDPE) pipes in Australia is on the rise with infrastructure projects emphasizing longevity, efficiency, and cost-effectiveness. The pipes are being used on a large scale in municipal water distribution, sewage networks, and stormwater management because they have high corrosion resistance, abrasion, and chemical degradation resistance. With urban growth spreading over large cities and regional areas, the demand for piping systems with low maintenance and long life is impacting procurement. Furthermore, HDPE's flexibility and simplicity of installation in trenchless as well as conventional means make it a popular option among civil contractors. These benefits are going hand in hand with government-initiated investments in water infrastructure renewal, particularly in drought-affected areas. Australia HDPE pipes market outlook indicates steady growth, driven by national plans to upgrade key utilities with a view to minimizing operational downtime and long-term maintenance needs in both public and private infrastructure sectors.

To get more information on this market, Request Sample

Expanding Use in Agricultural Irrigation and Water Management

Australia's farm industry is progressively using HDPE pipes for effective water management and irrigation systems. With the nation's fluctuating rainfall patterns and recurring drought periods, there is a growing focus on the implementation of water-saving technologies in agriculture. HDPE pipes are gaining popularity due to their leak-proof connections, resistance to high pressure, and versatility to varied landscapes, which makes them ideal for drip and sprinkler irrigation systems. Their function in conserving water loss and enhancing delivery reliability is important within major-scale farming activities, especially in groundwater- or distant-water-sourced areas. Farmers and agricultural businesses are spending in long-lasting piping networks to enhance crop output and reliability throughout planting cycles. The systems are also effective in conveying recycled water for agricultural reuse. Australia HDPE pipes market share in the irrigation sector is growing steadily, fueled by policies, growing awareness of sustainable agriculture, and increased demand for durable rural infrastructure solutions.

Increased Deployment in Mining and Industrial Applications

The application of HDPE pipes in the industrial and mining sectors of Australia is increasing their usage in harsh operating conditions. HDPE pipes withstand abrasive slurries and corrosive chemicals, as well as rough operating conditions are expected in these applications. These pipes provide light yet durable means compared to typical metal and concrete piping systems by minimizing handling fees and enabling more rapid installations for distant locations. They are being increasingly used in mine dewatering, chemical treatment, and tailings haulage, where system integrity is crucial to operational efficiency and environmental regulatory compliance. The material's ultraviolet (UV) resistance and cracking resistance further increase its applicability to outdoor industrial uses. With continued resource exploitation and industrial area expansion, HDPE piping systems are becoming a part of infrastructure planning in such regions. Australia HDPE pipes market growth is being complemented by accelerating demand from industrial consumers for low-maintenance solutions that are designed to meet specific, long-term operational needs.

Australia HDPE Pipes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- PE 63

- PE 80

- PE 100

The report has provided a detailed breakup and analysis of the market based on the type. This includes PE 63, PE 80, and PE 100.

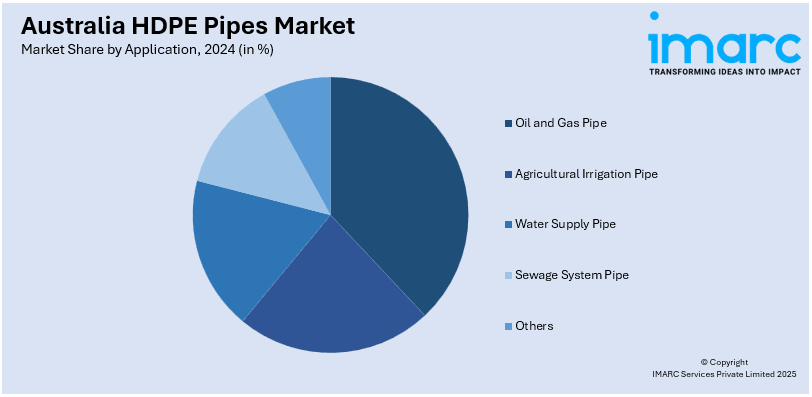

Application Insights:

- Oil and Gas Pipe

- Agricultural Irrigation Pipe

- Water Supply Pipe

- Sewage System Pipe

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. oil and gas pipe, agricultural irrigation pipe, water supply pipe, sewage system pipe, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia HDPE Pipes Market News:

- In November 2024, Acu-Tech Piping Systems spotlighted in Australian Mining Magazine for its innovative HDPE co-extruded pipe solutions. Acu-Therm PE100 pipes by the company facilitate mining waste transportation with improved durability, abrasion resistance, and recyclability. A new plant in Brisbane enhances large-diameter pipe manufacturing and delivery efficiency throughout eastern Australia.

- In April 2024, Acu-Tech Pty Ltd officially announced the acquisition of JAG Poly, a long-standing HDPE piping producer. The strategic acquisition is intended to improve the product range of Acu-Tech, broaden its national coverage, and improve its competence in supplying major industries such as mining, infrastructure, agriculture, and water utilities throughout Australia.

Australia HDPE Pipes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | PE 63, PE 80, PE 100 |

| Applications Covered | Oil and Gas Pipe, Agricultural Irrigation Pipe, Water Supply Pipe, Sewage System Pipe, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia HDPE pipes market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia HDPE pipes market on the basis of type?

- What is the breakup of the Australia HDPE pipes market on the basis of application?

- What is the breakup of the Australia HDPE pipes market on the basis of region?

- What are the various stages in the value chain of the Australia HDPE pipes market?

- What are the key driving factors and challenges in the Australia HDPE pipes?

- What is the structure of the Australia HDPE pipes market and who are the key players?

- What is the degree of competition in the Australia HDPE pipes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia HDPE pipes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia HDPE pipes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia HDPE pipes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)