Australia Health Drinks Market Size, Share, Trends and Forecast by Product Type, Distribution Channel, and Region, 2025-2033

Australia Health Drinks Market Overview:

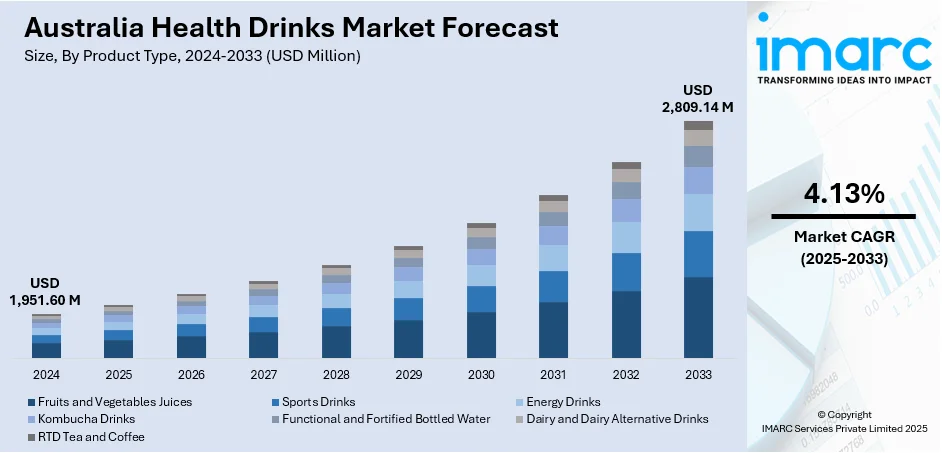

The Australia health drinks market size reached USD 1,951.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,809.14 Million by 2033, exhibiting a growth rate (CAGR) of 4.13% during 2025-2033. The market is driven by growing consumer health and wellness awareness, resulting in a shift towards low-sugar drinks with functional values such as high nutritional content and supplemented vitamins. The growth of the fitness and well-being industry, along with a preference for easy, on-the-go wellness solutions, continues to propel the trend. Additionally, the increased demand for organic and plant-based beverages and personalized nutrition further augments Australia health drinks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,951.60 Million |

| Market Forecast in 2033 | USD 2,809.14 Million |

| Market Growth Rate 2025-2033 | 4.13% |

Australia Health Drinks Market Trends:

Rising Demand for Functional Beverages

The market is experiencing a significant increase in demand for functional beverages that provide additional health benefits beyond basic hydration. People are looking for beverages that offer immune-boosting, digestive health, and increased energy, as well as improved mental acuity. According to the Australian Institute of Health and Welfare 2023, approximately 75% of men and 60% of women in Australia are suffering from being overweight. This has resulted in increased consumer interest in preventative care and wellness, and many are opting for drinks that promote overall health and well-being. Aside from this, ingredients like probiotics, antioxidants, adaptogens, and vitamins are becoming selling points for health beverages, and companies are taking advantage of this demand. Additionally, the growth of personalized nutrition also spurs the trend, with consumers seeking beverages that cater to their individual health requirements, including low-calorie beverages for weight control or electrolyte-enriched beverages for recovery after workouts. This change in consumer behavior is pushing innovation in new formulations and flavors, and brands are focusing on transparency in ingredient supply and health statements. As value-conscious consumers increasingly prioritize performance, they are seeking beverages that provide hydration while offering a tangible health benefit, which is positively contributing to the market.

To get more information on this market, Request Sample

Innovation in Low-Sugar and Sugar-Free Health Drinks

The rising awareness of the negative health impacts of excessive sugar consumption is a driving force behind the increasing demand for low-sugar and sugar-free health drinks in Australia. According to Food Standards Australia New Zealand's (FSANZ) 2024 study, approximately 63% of consumers check the sugar content when buying a product for the first time. Consumers are growing more health-conscious, especially with respect to managing weight and lowering the risk of lifestyle diseases like diabetes. As a result, demand for lower-sugar beverages is growing at a fast pace. Brands are responding by developing sugar alternatives, including stevia, monk fruit, and erythritol, to deliver health-oriented products that don't sacrifice taste. This, in turn, is giving a boost to Australia health drinks market growth. This trend is most notably observed among young Australians and health enthusiasts who are interested in maintaining a balanced diet. In addition, the enforcement of government programs that cut sugar intake and enhance labeling transparency has led manufacturers to product reformulations, thus creating an increased variety of healthier drink options. This change in consumer taste is not just affecting the creation of soft drinks but also influences energy drinks, juices, and functional beverages, with many brands emphasizing their low-sugar nature as a selling point to appeal to consumers concerned with health.

Australia Health Drinks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Fruits and Vegetables Juices

- Sports Drinks

- Energy Drinks

- Kombucha Drinks

- Functional and Fortified Bottled Water

- Dairy and Dairy Alternative Drinks

- RTD Tea and Coffee

The report has provided a detailed breakup and analysis of the market based on the product type. This includes fruits and vegetables juices, sports drinks, energy drinks, kombucha drinks, functional and fortified bottled water, dairy and dairy alternative drinks, and RTD tea and coffee.

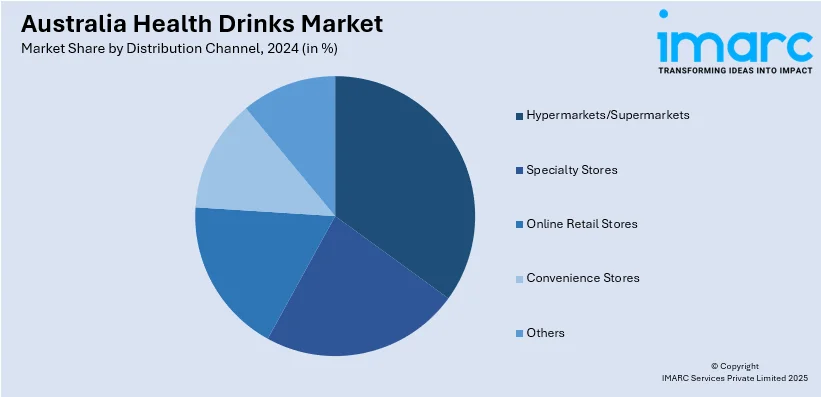

Distribution Channel Insights:

- Hypermarkets/Supermarkets

- Specialty Stores

- Online Retail Stores

- Convenience Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes hypermarkets/supermarkets, specialty stores, online retail stores, convenience stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Health Drinks Market News:

- On February 6, 2024, Australian kombucha producer Kommunity Brew announced its strategic expansion into the hydration and probiotic beverage sector, aiming to introduce a zero-sugar iced tea and a probiotic drink within the year. The company emphasizes strong partnerships with independent, family-run grocers. CEO Mason Bagios highlighted a market trend where traditionally brewed kombucha is gaining popularity in independent outlets, even as the broader kombucha category contracts.

- On October 30, 2024, Australian media personality Merrick Watts and co-founder Ed Stening launched Posca Hydrate, a modern adaptation of an ancient Roman beverage, introducing Australia's first sugar-free sparkling hypertonic sports drink. Infused with red wine vinegar, Posca Hydrate offers antioxidant benefits and supports gut health, blood sugar regulation, and immune function, while enhancing hydration and electrolyte retention through its unique formulation. Available in Grape, Yuzu, and Pineapple flavors, the drink is distributed nationwide across convenience stores, gyms, quick-service restaurants, and online platforms.

Australia Health Drinks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Fruits and Vegetables Juices, Sports Drinks, Energy Drinks, Kombucha Drinks, Functional and Fortified Bottled Water, Dairy and Dairy Alternative Drinks, RTD Tea and Coffee |

| Distribution Channels Covered | Hypermarkets/Supermarkets, Specialty Stores, Online Retail Stores, Convenience Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia health drinks market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia health drinks market on the basis of product type?

- What is the breakup of the Australia health drinks market on the basis of distribution channel?

- What is the breakup of the Australia health drinks market on the basis of region?

- What are the various stages in the value chain of the Australia health drinks market?

- What are the key driving factors and challenges in the Australia health drinks market?

- What is the structure of the Australia health drinks market and who are the key players?

- What is the degree of competition in the Australia health drinks market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia health drinks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia health drinks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia health drinks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)