Australia Healthcare IT Market Size, Share, Trends and Forecast by Product and Services, Component, Delivery Mode, End-User, and Region, 2025-2033

Australia Healthcare IT Market Overview:

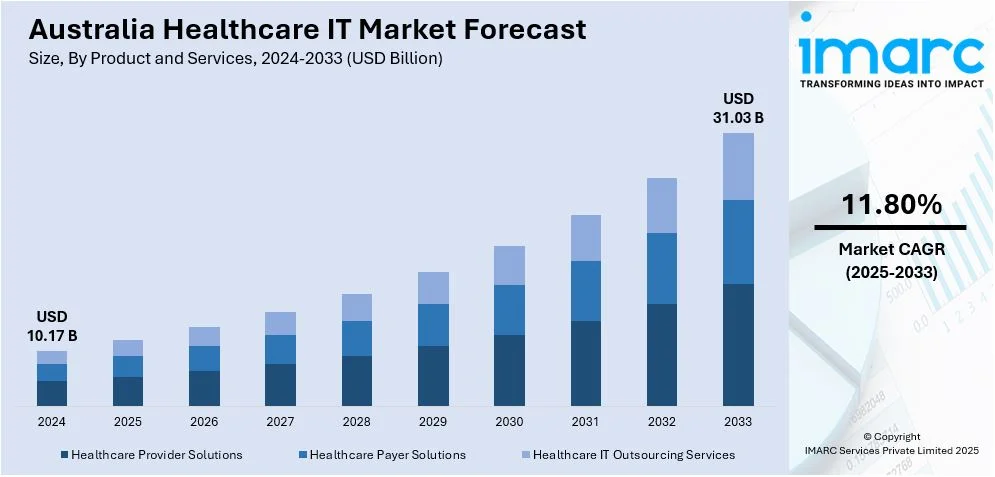

The Australia healthcare IT market size reached USD 10.17 Billion in 2024. Looking forward, the market is expected to reach USD 31.03 Billion by 2033, exhibiting a growth rate (CAGR) of 11.80% during 2025-2033. The market consists of growing demand for eHealth solutions, adoption of telehealth and artificial intelligence (AI) technologies, government efforts to advance eHealth, and demand for better patient care and operational effectiveness. These are promoting increased integration of technology, expanding healthcare access, and improving service delivery further impelling the Australia healthcare IT market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 10.17 Billion |

| Market Forecast in 2033 | USD 31.03 Billion |

| Market Growth Rate 2025-2033 | 11.80% |

Key Trends of Australia Healthcare IT Market:

Integration of Artificial Intelligence and Machine Learning

AI and machine learning (ML) are revolutionizing Australia healthcare through optimized diagnostics, patient care, and operational effectiveness. For instance, In June 2024, Queensland's Gold Coast University Hospital launched AI technology for medical imaging, an Australian first. AI will help radiologists with X-rays, MRI scans, and CT scans, increasing productivity. Moreover, medical data such as imaging and lab tests are processed by AI technologies for better and timelier decision-making. AI system-based systems, for instance, support early detection of diseases, such as cancer or cardiovascular disorders, to support timely interventions. ML codes also help anticipate patient needs and distribute healthcare resources effectively. Such innovations, though promising much potential to enhance the outcomes of health care, privacy, security, and ethical problems are still in concern. With machine learning and AI advancing more and more, it will be necessary to work on these problems to be able to use them properly and safely in medicine.

To get more information on this market, Request Sample

Expansion of Telehealth Services

Telehealth usage has been rising in Australia, particularly since the COVID-19 pandemic, as it provides more convenient healthcare opportunities for patients, including those located in remote or underserved regions. According to a survey, 69.3% of Australians who had a healthcare consult within the last year utilized telehealth, with most patients choosing general practitioner (GP) consultations. This growth enables patients to be provided with guidance and follow-up care in the convenience of their own homes, with increased flexibility. Telehealth is integrated with electronic health records (EHRs), ensuring communication between providers and enhancing coordination of care. Integration enables enhanced continuity of care, decreases waiting times, and enhances management of healthcare needs in a more proactive way. Telehealth care not only increases access but also encompasses a patient-focused method of delivering healthcare that empowers individuals to play a more active role in managing their health.

Adoption of Wearable Health Technologies

Wearable health technologies, including smartwatches and fitness trackers, are gaining popularity in Australia, enabling individuals to track their health parameters in real time. Smartwatches and fitness trackers monitor significant health parameters such as heart rate, sleeping patterns, and exercise, giving insightful information about one's well-being. The information gathered can be forwarded to healthcare professionals to facilitate ongoing monitoring and early intervention, especially for chronically ill patients. As wearables integrate more into healthcare information technology (IT) systems, they make it possible for a more proactive, individualized model of managing health. However, preserving data accuracy and handling privacy issues regarding personal health information are issues to consider going forward thus strengthening the Australia healthcare IT market growth.

Growth Drivers of Australia Healthcare IT Market:

Regional Health Digitization Drives Healthcare IT Demand

Australia's healthcare IT sector continues to gain from the nation's aggressive drive to integrate digital health. Such national initiatives as the My Health Record system have developed a centralized platform for managing patient information, with improved coordination of general practitioners, specialists, and hospitals. This framework is particularly impactful in a country with large rural populations and widespread geography, where access to consistent healthcare is a challenge. With digital records now more widely accepted, healthcare providers can streamline patient care, reduce administrative errors, and improve the speed of diagnosis and treatment. Additionally, the federal and state governments of Australia have set up targeted programs for the digitization of rural clinics and indigenous healthcare centers so that digital health systems are not limited to urban areas. Consequently, the need for healthcare solutions that ensure interoperability, cloud-based storage, and secure data exchange is growing further, ensuring the long-term position of digital platforms in providing accessible, efficient, and patient-centric healthcare.

Integration of Mental Health and Digital Wellbeing Services

One of the new drivers on the Australia healthcare IT market demand is the increasing need for digital mental health and wellbeing platforms. Mental wellbeing is now a national priority, and the government has increased support for virtual psychological services to a great extent. Virtual tools like mental health apps, cognitive behavioral therapy (CBT) platforms, and virtual counseling services are being integrated into primary healthcare services throughout the country. These sites commonly incorporate real-time tracking, anonymous use, and AI-driven mood monitoring that fit with discreet and responsive mental health care. In rural and remote areas, where there is limited access to psychologists and psychiatrists, digital mental health care plays a vital role. Healthcare IT vendors are creating scalable products meeting clinical requirements that provide user-friendly interfaces for varying populations. With institutional support and rising public acceptance, digital mental health technology is now a central part of Australia's developing health ecosystem, supporting expansion of the overall healthcare IT market.

Policy-Driven Investment in Interoperable Health Systems

A key driver of growth according to the Australia healthcare IT market analysis, is the region's policy drive for system-wide interoperability. The disconnected character of previous healthcare information systems gave rise to inefficiencies and communication silos among providers. The Australian government has therefore moved to unite the digital health infrastructure by investing in platforms that enable seamless data sharing between general practitioners, hospitals, pharmacies, and aged care homes. In industries such as chronic disease management and aged care, in which there are several providers, there is a need to share updated patient records securely and in real-time. This has created more demand for software that enhances standard data formats, health information exchanges, and real-time updates. Recent regulations have also meant that health systems must achieve minimum interoperability standards, further stimulating investment. The move toward integrated digital health systems is enhancing patient care while spearheading long-term growth in the overall Australian healthcare IT market.

Opportunities of Australia Healthcare IT Market:

Electronic Integration Over Broad Geographies

Australia offers a distinctly spread-out population, with high-density urban concentrations as well as remote and rural settlements located over a continent-scale landmass. This geographic setting presents an attractive prospect for healthcare IT solutions emphasizing integration over distance, most notably telehealth systems linking metropolitan medical hubs with regional clinics and indigenous populations. These solutions need to be adapted to manage long‑distance network variability, harsh infrastructure, and the requirement for culturally suitable care interfaces, making Australia an ideal proving ground for resilient, inclusive digital health technologies. Healthcare professionals, particularly those engaged in community and Aboriginal health services, need systems that interoperate with large hospital networks, and are also responsive and usable under low bandwidth. Therefore, innovators and suppliers who are able to provide strong, offline‑enabled, culture‑sensitive platforms that facilitate remote diagnostics, care coordination, health education, and patient engagement will make real inroads. The focus is hence on remote consults, along with interoperable integration with current digital health programs, state-level electronic medical records, and aged-care systems. In this environment, start‑ups or incumbent companies that can provide modular, scalable, and locally supported applications specific to Australia's geographic patchwork of healthcare delivery will have rich soil.

National Digital Health Record Evolution and Local Provider Synergy

Australia's national digital health record plan focusing on a singular, consumer‑driven health record platform, is an uncommon opportunity for IT companies to integrate, extend, and add value to that system. With the law allowing patients to view and control their own health record, IT vendors can create citizen‑facing applications to augment the usefulness of those records, like dynamic reminders for medications, cross‑provider health summaries, or tailored wellness trackers drawn from one single record. In addition, there is an extensive network of local primary care providers, pharmacies, physiotherapists, and allied health professionals who all engage in this single record system. IT solutions that allow efficient data flow, automated workflows, appointment scheduling, and care pathway management, while honoring models of patient consent, are bound to succeed. Moreover, the local organizational form of general practice in Australia, being typically small to medium independent clinics, creates a demand for lightweight, cloud‑based practice management systems that conveniently interface with the national record. Vendors focusing on user‑friendly design, secure integration, and clinical workflow support for variation will emerge as leaders. Notably, customizing these tools to be in concert with local professional standards, Medicare billing practices, and privacy expectations will provide providers with the assurance of implementing digital enhancements, creating a synergistic relationship between local clinicians and the overall national digital health infrastructure.

Leading‑Edge Innovation in Aged Care and Chronic Disease Management

Australia is experiencing continued demographic change, where an increasing proportion of ageing adults receives care in a diverse set of environments ranging from their home to community centers and residential aged-care facilities. This ground can be used as a soil for health IT innovations that target chronic disease monitoring, fall detection, medication adherence, and coordination of caregivers, including those involving wearable sensors, mobile apps, and secure communication. There is a huge potential for technology providers to work with local aged‑care providers in co‑designing solutions that meet the Australian model of elderly care, which tends to combine government‑funded in‑home support with private nursing service and outreach. Furthermore, culturally and linguistically diverse older communities, with many from migrant communities, mean that digital tools need to accommodate multilingual interfaces and culturally sensitive content. They have outstanding potential: innovations such as natural dashboards for family carers, mobile notice for in‑home care coordinators, and AI‑driven trend identification for chronic diseases, built with local regulatory and caregiving standards in mind. The Australian regulatory framework promotes safe, supervised innovation, and local health tech accelerators and government procurement frequently place value on smart, evidence‑based solutions that reduce pressure on hospitals and improve quality of life. Therefore, health IT firms that develop empathetic, trusted, locally tailored chronic‑care platforms, thoroughly in touch with the distinctive Australian society and care delivery patterns, are particularly well‑placed.

Government Support for Australia Healthcare IT Market:

Government-Led Digital Health Strategy

The Australian state and federal governments have traditionally remained steadfast in their support for the development of digital health innovation as an integral part of the national healthcare continuum. This support is based on the nation's National Digital Health Strategy, which focuses on a linked framework to enhance patient outcomes, simplify provider workflows, and strengthen system-wide interoperability. What is particularly unique about Australia's strategy is the roll-out of a national My Health Record system, which is a personally controlled electronic health record platform accessible to all citizens and permanent residents. The platform is a core component of Australia's digital health ecosystem, allowing clinicians, pharmacists, and allied health professionals to safely and efficiently access and share critical patient information, with patient consent. In rural and remote communities, where the delivery of healthcare must overcome distinctive geographic and demographic impediments, the government has encouraged telehealth and remote consultation services, subsidized by target programs that aim to provide equity of access. These actions represent a cohesive policy direction in which healthcare IT is presented as a tool for streamlining operations and as a mechanism for providing genuinely universal and accessible care over extensive and dissimilar territories.

State-Level Innovations and Collaborative Ecosystems

Upon the foundation of the national framework, state and territory governments throughout Australia have introduced their own state-specific healthcare IT programs to address region-specific requirements. For example, certain states have introduced customized e-prescribing systems and statewide electronic medication management solutions that integrate hospitals, outpatient clinics, and community pharmacies. The systems are meant to avoid medication mistakes and match prescriptions in the care transitions, which is a vital advantage in the states where the long commutes and rural health clinics are the norm. The state governments tend to collaborate with the local health districts, university research teams, and private-enterprise startups via innovation hubs and public–private partnership models. These multidisciplinary ecosystems enable experimentation with higher-level technologies like AI-driven decision support systems, predictive triage, and virtual care models. Especially, new digital health incubators located in capital cities and regional hubs have gained government support, promoting solution-building focused on the local disease burden, Indigenous health requirements, and remote community complexities. The outcome is a cohesive but decentralized mosaic of digital innovations informed by state-level policymaking, aligned to a uniform federal digital health policy direction, yet sufficiently versatile to respond to the diverse social, cultural, and logistical contexts of Australia.

Indigenous Health, Workforce Capacity, and Future Outlook

In recognition of the ongoing disparities in Indigenous health outcomes, the federal and state governments of Australia have made a deliberate focus on healthcare IT interventions to assist First Nations people. Among these IT programs are culturally appropriate telehealth services, translated mobile health apps into local languages, and secure community-held digital records that affirm the choice and tradition of distant Aboriginal and Torres Strait Islander people. Additionally, government-funded capacity-building programs are assisting in the training of Indigenous health workers to use digital health technologies so that these solutions are sustainable and community-led. At the same time, the government is investing in workforce development in the wider health sector, enabling clinicians and IT professionals to reskill in digital workflows, cybersecurity procedures, and data governance policies. As the healthcare IT marketplace continues to mature, policymakers continue to look for ways to shape it that are inclusive and resilient: promoting resilient infrastructure appropriate for high-demand rural environments, investing in platforms that value patient agency over their health information, and actively extending invitations to stakeholder voices, ranging from clinical associations to representatives of remote communities, into strategic planning rooms. This places Australia's healthcare IT market as a future-looking environment, characterized by enabling governance, local relevance, and a steadfast dedication to equitable care throughout one of the globe's most geographically diverse countries.

Challenges of Australia Healthcare IT Market:

Geographic Disparities and Infrastructure Shortfalls

Australia's vast and mostly sparsely inhabited territory raises one of the most compelling challenges for the implementation of healthcare IT. From the Outback to remote Indigenous settlements in the Northern Territory or Western Australia, the sheer distances and low levels of connectivity infrastructure tend to render reliable broadband and digital communication challenging. There, clinics often depend on old telecommunications networks or satellite connections that are not capable of hosting heavy bandwidth use such as real-time telemedicine, digital imaging, or large uploads to the national electronic record system. This inequality hinders equal access to sophisticated digital technology, where urban-based clinicians are able to access common patient records instantly or conduct virtual case reviews, while remote-based practitioners experience delays or full disruptions. The digital infrastructure fragmentation not only undermines clinical continuity but also makes it more complicated to roll out standardized healthcare IT systems: vendors must engineer flexible solutions that can work across both new city hospitals and remote bush clinics. These conditions provide a chronic tension between the vision of an integrated digital health ecosystem and the hard realities of Australia's geographic and infrastructural heterogeneity.

Interoperability and Multiple Legacy Systems

Across Australia's federated healthcare, there are many legacy record systems, proprietary systems, and state-specific IT implementations, all influenced locally by commissioning choice, past procurement, or different standards. For example, there are various states and territories that have implemented their own hospital information platforms, e-prescribing systems, and community care documentation tools, some of which are still highly customized and locked tightly into vendor ecosystems. Such heterogeneity brings significant interoperability hurdles: clinicians crossing state lines or patients receiving care across jurisdictions could face incompatible format, lag in accessing longitudinal clinical records, or manual reconciliations. Even with the existence of a national digital health record system as a unifying framework, plugging those localized legacy systems into uniform workflows continues to be a logistical and technical challenge. The issue goes beyond just data formats, as it also involves varying governance models, security systems, and user authentication processes adopted by each jurisdiction. It is this patchwork that is expensive and time-consuming to update or harmonize systems across the country, hindering the progress towards one, seamless digital health record accessible everywhere and by any authorized carer throughout Australia.

Workforce Capacity, Digital Literacy, and Change Adoption

Another notable challenge in Australia's healthcare IT sector is caused by inconsistent workforce ability and information literacy among the providers of care. While metropolitan city hospitals might employ full-time health informaticians, IT support staff, and digitally competent clinicians, a great many rural health services, even those with large populations in mining centers, regional towns, or Indigenous communities, lack sufficient skilled staff. Clinicians might not receive formal training on new digital workflows, find advanced clinical systems difficult to use, or become intimidated by the requirements of cybersecurity protocols, privacy legislation, and consent management. Without adequate investment in change management, training, and customized training programs, staff will become resistant or disconnected to new tools, seeing them as administrative burdens instead of as enablers of care. This is exacerbated in environments where healthcare provision is already under strain, as doctors and allied health professionals tend to give patient-facing responsibilities precedence over training in IT. Exacerbating this issue, system implementation timelines and platform updates might be out of sync between jurisdictions, inducing disruption, exhaustion, and confusion, particularly for locum workers, visiting specialists, or multi-site practitioners. Ultimately, healthcare IT's full potential is limited unless concerted effort is invested in building human capacity, promoting digital literacy, and guiding smooth adoption throughout the diverse and disparate workforce that defines Australia's healthcare environment.

Australia Healthcare IT Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and services, component, delivery mode, and end-user.

Product and Services Insights:

- Healthcare Provider Solutions

- Clinical Solutions

- Nonclinical Healthcare IT Solutions

- Healthcare Payer Solutions

- Pharmacy Audit and Analysis Systems

- Claims Management Solutions

- Analytics and Fraud Management Solutions

- Member Eligibility Management Solutions

- Provider Network Management Solutions

- Billing and Accounts (Payment) Management Solutions

- Customer Relationship Management Solutions

- Population Health Management Solutions

- Others

- Healthcare IT Outsourcing Services

- Provider HCIT Outsourcing Services

- Payer IT Outsourcing Services

- Operational IT Outsourcing Services

The report has provided a detailed breakup and analysis of the market based on the product and services. This includes healthcare provider solutions (clinical solutions and nonclinical healthcare IT solutions), healthcare payer solutions (pharmacy audit and analysis systems, claims management solutions, analytics and fraud management solutions, member eligibility management solutions, provider network management solutions, billing and accounts (payment) management solutions, customer relationship management solutions, population health management solutions, and others), and healthcare IT outsourcing services (provider HCIT outsourcing services, payer it outsourcing services, and operational it outsourcing services).

Component Insights:

- Software

- Hardware

- Services

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes software, hardware, and services.

Delivery Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the delivery mode. This includes on-premises and cloud-based.

End-User Insights:

.webp)

- Healthcare Providers

-

- Hospitals

- Ambulatory Care Centers

- Home Healthcare Agencies, Nursing Homes and Assisted Living Facilities

- Diagnostic and Imaging Centers

- Pharmacies

- Healthcare Payers

-

- Private Payers

- Public Payers

- Others

A detailed breakup and analysis of the market based on the end-user have also been provided in the report. This includes healthcare providers (hospitals, ambulatory care centers, home healthcare agencies, nursing homes and assisted living facilities, diagnostic and imaging centers, and pharmacies), healthcare payers (private payersand public payers), and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Healthcare IT Market News:

- In September 2024, Australia’s Department of Health and Aged Care is launching a telehealth service for aged care residents, seeking telehealth providers to deliver virtual nursing to 30 residential aged care homes. The chosen suppliers will offer person-centered care through video consultations, provide staff training, and assess or enhance existing technologies. They’ll also develop clinical governance and provide easy-to-understand resources on residents' rights regarding virtual nursing care.

- In May 2024, Ovum AI launched Australia’s first-ever longitudinal dataset focused on women’s health, aiming to bridge the gender health gap. Developed by Dr. Ariella Heffernan-Marks, the app offers a holistic health assistant for women at all stages of life. The AI-powered app helps track chronic health issues, manage personal health data, and provides resources for empowerment, addressing systemic healthcare disparities. Privacy and security are prioritized, ensuring users' data is protected.

Australia Healthcare IT Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product and Services Covered |

|

| Components Covered | Software, Hardware, Services |

| Delivery Modes Covered | On-Premises, Cloud-Based |

| End-Users Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia healthcare IT market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia healthcare IT market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia healthcare IT industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia healthcare IT market was valued at USD 10.17 Billion in 2024.

The Australia healthcare IT market is projected to exhibit a CAGR of 11.80% during 2025-2033.

The Australia healthcare IT market is expected to reach a value of USD 31.03 Billion by 2033.

The Australia healthcare IT market trends include growing use of AI in diagnostics, expansion of mobile health apps, integration of cloud-based electronic health records, and rising investment in cybersecurity. There is also increased focus on interoperability, patient-centered digital platforms, and tech solutions supporting aged care, mental health, and rural healthcare delivery.

Key drivers of Australia healthcare IT market include widespread adoption of telehealth, government support for digital health initiatives, demand for integrated electronic medical records, and the need to improve access in rural and remote areas. Aging populations and chronic disease management further accelerate innovation and investment in smart health technologies.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)