Australia Healthy Instant Meals Market Size, Share, Trends and Forecast by Product Type, Ingredient Type, Packaging Type, Distribution Channel, End User, and Region, 2026-2034

Australia Healthy Instant Meals Market Summary:

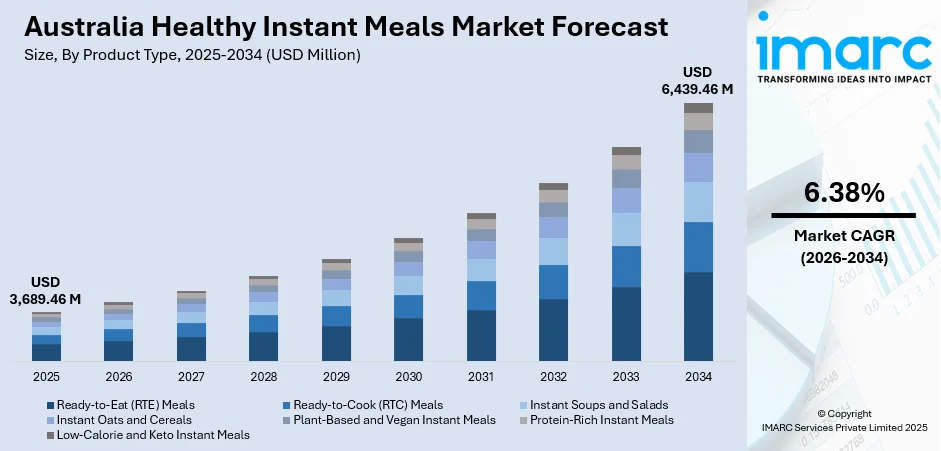

The Australia healthy instant meals market size was valued at USD 3,689.46 Million in 2025 and is projected to reach USD 6,439.46 Million by 2034, growing at a compound annual growth rate of 6.38% from 2026-2034.

The growth of the Australia healthy instant meals market is rapid as more and more consumers look for convenience yet value health. The rise in dual-income households and working professionals will drive market growth due to the need for time-efficient meal solutions without much sacrifice on health benefits. Also, the bigger awareness about balanced nutrition, clean-label ingredients, and adoption of plant-based diets has impacted purchase decisions in the country. In fact, easy access to the online market and direct-to-consumer delivery platforms has resulted in better market penetration, too, allowing brands to cater to the needs of health-conscious consumers across urban and regional areas alike.

Key Takeaways and Insights:

-

By Product Type: Ready-to-Eat (RTE) Meals dominates the market with a share of 38.9% in 2025, driven by consumer demand for convenient meal solutions requiring minimal preparation time, appealing particularly to time-constrained urban households.

-

By Ingredient Type: Organic and natural ingredients leads the market with a share of 32.8% in 2025, reflecting heightened consumer awareness regarding clean-label products and preference for meals free from artificial preservatives and additives.

-

By Packaging Type: Pouches holds the largest share of 40.7% in 2025, owing to their lightweight nature, extended shelf life, portability, and growing sustainability credentials through recyclable materials.

-

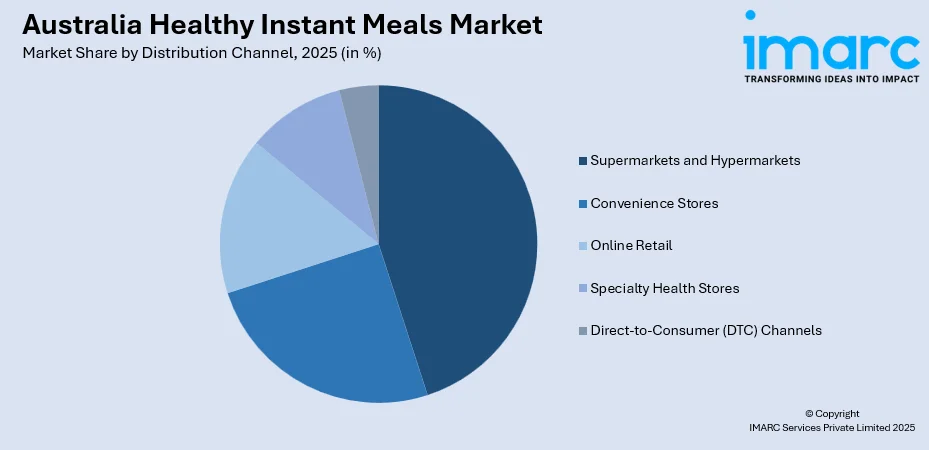

By Distribution Channel: Supermarkets and hypermarkets represents the largest segment with a market share of 45.9% in 2025, attributed to wide product assortments, competitive pricing strategies, and strategic shelf placements in major retail chains.

-

By End User: Working Professionals accounts for 38.7% of the market share in 2025, driven by demanding work schedules, limited cooking time, and preference for nutritionally balanced meal options.

-

By Region: Australia Capital Territory & New South Wales dominates with 34.7% share in 2025, supported by high urbanization rates, substantial working population concentration, and robust retail infrastructure.

-

Key Players: The Australia healthy instant meals market exhibits a moderately competitive landscape, with established meal delivery providers competing alongside major supermarket private labels and emerging plant-based specialists for market dominance.

To get more information on this market Request Sample

The Australia healthy instant meals market continues to evolve as consumers increasingly prioritize convenience without sacrificing nutritional value. The growing prevalence of flexitarian and plant-based dietary preferences has prompted manufacturers to expand their product portfolios with innovative offerings featuring organic ingredients, high-protein formulations, and functional health benefits. For instance, in March 2024, v2food, one of Australia’s leading plantbased food companies, acquired readymeals brand Soulara, signalling a strategic push to merge plantbased proteins with readymade meal convenience in the mainstream market. Major supermarket chains have significantly expanded their ready-to-eat sections, while specialized meal delivery services have witnessed substantial growth through direct-to-consumer models and subscription-based platforms. The integration of sustainable packaging solutions and transparent nutritional labeling has emerged as a key differentiator among brands seeking to capture the health-conscious consumer segment in Australia's dynamic food landscape.

Australia Healthy Instant Meals Market Trends:

Rising Adoption of Plant-Based and Flexitarian Meal Options

Australian consumers are increasingly embracing plant-based and flexitarian dietary patterns, driving substantial demand for healthy instant meals incorporating vegetable-forward ingredients and meat alternatives. According to the 2024 Food Frontier national consumer survey, about 7% of Australians identified as flexitarian, a further 15% as vegetarian or vegan, and 21% described themselves as “meat reducers” (i.e., consciously reducing meat intake). The shift toward reduced meat consumption is motivated by health consciousness, environmental sustainability concerns, and ethical considerations. Manufacturers are responding by developing innovative product lines featuring plant proteins, legumes, and whole grains that deliver satisfying taste profiles while meeting nutritional requirements for busy consumers.

Expansion of Clean-Label and Functional Food Offerings

The demand for transparency in ingredient sourcing and product formulation has accelerated the clean-label movement within the healthy instant meals segment. Consumers are actively seeking products free from artificial additives, preservatives, and genetically modified organisms while prioritizing recognizable whole food ingredients. For example, in late 2023, plantbased brand Thoughtful Food launched a range of cleanerlabel readytoeat meals targeting healthconscious and timepressed consumers, signalling that producers are acting on this demand. Additionally, functional food formulations enriched with probiotics, superfoods, adaptogens, and essential vitamins are gaining prominence as consumers pursue holistic wellness through their dietary choices.

Digital Transformation and Direct-to-Consumer Delivery Models

The proliferation of e-commerce platforms and mobile applications has revolutionized distribution channels for healthy instant meals in Australia. Subscription-based meal delivery services and direct-to-consumer brands have experienced remarkable growth by offering personalized nutrition plans, convenient doorstep delivery, and flexible ordering options. According to reports, Lite n' Easy, once primarily a weightloss readymeal provider, has repositioned itself successfully as a leading healthymeals delivery subscription service: in 2023, they were rated the best healthy meal delivery service in Australia by Canstar Blue for the fourth year in a row. The integration of artificial intelligence and data analytics enables companies to provide tailored meal recommendations based on individual dietary preferences, health goals, and consumption patterns.

Market Outlook 2026-2034:

The Australia healthy instant meals market is poised for sustained expansion throughout the forecast period, supported by evolving consumer lifestyles, increasing health awareness, and continuous product innovation. The growing emphasis on convenience-driven nutrition solutions among working professionals, students, and fitness enthusiasts is expected to fuel market demand. Furthermore, advancements in food processing technologies, sustainable packaging innovations, and cold-chain logistics capabilities will enable manufacturers to deliver premium-quality products with extended shelf life. The market generated a revenue of USD 3,689.46 Million in 2025 and is projected to reach a revenue of USD 6,439.46 Million by 2034, growing at a compound annual growth rate of 6.38% from 2026-2034.

Australia Healthy Instant Meals Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Product Type | Ready-to-Eat (RTE) Meals | 38.9% |

| Ingredient Type | Organic and Natural Ingredients | 32.8% |

| Packaging Type | Pouches | 40.7% |

| Distribution Channel | Supermarkets and Hypermarkets | 45.9% |

| End User | Working Professionals | 38.7% |

| Region | Australia Capital Territory & New South Wales | 34.7% |

Product Type Insights:

- Ready-to-Eat (RTE) Meals

- Ready-to-Cook (RTC) Meals

- Instant Soups and Salads

- Instant Oats and Cereals

- Plant-Based and Vegan Instant Meals

- Protein-Rich Instant Meals

- Low-Calorie and Keto Instant Meals

The ready-to-eat (RTE) meals dominates with a market share of 38.9% of the total Australia healthy instant meals market in 2025.

Ready-to-eat meals have witnessed remarkable growth in Australia as consumers increasingly prioritize convenience without compromising nutritional quality. The segment's dominance is attributed to the minimal preparation requirements, typically requiring only microwave heating or direct consumption, making them ideal for time-constrained individuals. The proliferation of chilled and frozen RTE options across supermarket chains and online platforms has enhanced product accessibility. For example, in April 2024, Woolworths launched a new “Dine In” range of 35 readymeal offerings (roasts, pasta bakes, family dinners) in a trial across 100 stores in New South Wales and Victoria.

The growing diversity within the RTE category encompasses global cuisines, dietary-specific formulations, and portion-controlled offerings catering to various consumer segments. Health-focused RTE meals featuring balanced macronutrients, reduced sodium content, and clean-label ingredients have gained substantial traction among wellness-conscious Australians. The segment continues benefiting from advancements in food preservation technologies that maintain nutritional integrity while extending shelf life without artificial preservatives.

Ingredient Type Insights:

- Organic and Natural Ingredients

- Plant-Based Ingredients

- Gluten-Free Ingredients

- Protein-Fortified Ingredients

The organic and natural ingredients lead with a share of 32.8% of the total Australia healthy instant meals market in 2025.

The organic and natural ingredients segment has experienced sustained growth as Australian consumers demonstrate heightened awareness regarding food quality and sourcing practices. The preference for products free from synthetic pesticides, artificial flavors, and chemical preservatives reflects a broader shift toward mindful consumption patterns. The Australia organic food market size reached USD 1.1 Billion in 2024, highlighting the sector’s robust consumer demand. Certified organic instant meals command premium positioning, attracting health-conscious consumers willing to pay higher prices for perceived quality and environmental benefits associated with sustainable farming practices.

Manufacturers are increasingly reformulating products to incorporate organic whole food ingredients, ancient grains, and locally sourced produce to meet evolving consumer expectations. The clean-label movement has prompted transparency in ingredient declarations, with brands highlighting recognizable components and eliminating artificial additives. This trend aligns with Australia's broader food regulatory framework emphasizing accurate labeling and consumer protection standards.

Packaging Type Insights:

- Pouches

- Cups and Bowls

- Trays and Boxes

- Cans and Bottles

The pouches dominate with a market share of 40.7% of the total Australia healthy instant meals market in 2025.

Flexible pouch packaging has emerged as the preferred format within the healthy instant meals category due to its numerous functional and sustainability advantages. The lightweight nature of pouches reduces transportation costs and environmental footprint while offering superior portability for on-the-go consumption. Modern pouch designs incorporate resealable features, microwave-safe materials, and innovative dispensing mechanisms that enhance consumer convenience and product versatility. Importantly, this shift toward eco-conscious pouch packaging aligns with Australia’s 2025 regulatory push, as APCO reinforces its National Packaging Targets requiring all packaging to be reusable, recyclable or compostable.

The Australian packaging industry's commitment to sustainability has driven innovation in recyclable and compostable pouch materials aligned with national packaging targets. Manufacturers are transitioning toward mono-material structures that facilitate recycling while maintaining product freshness and shelf stability. The visual appeal of stand-up pouches also provides branding opportunities and improved shelf presence in competitive retail environments.

Distribution Channel Insights:

Access the comprehensive market breakdown Request Sample

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Retail

- Specialty Health Stores

- Direct-to-Consumer (DTC) Channels

The supermarkets and hypermarkets lead with a share of 45.9% of the total Australia healthy instant meals market in 2025.

Supermarkets and hypermarkets maintain their dominant position in healthy instant meals distribution through extensive store networks, competitive pricing strategies, and comprehensive product assortments. Major retailers including Woolworths, Coles, and independent chains have significantly expanded their health-focused meal sections, offering both private-label and branded options to cater to diverse consumer preferences. The in-store shopping experience allows consumers to compare nutritional information, assess packaging quality, and make informed purchasing decisions.

The retail giants have invested substantially in refrigerated and frozen meal infrastructure, enabling broader product ranges and improved freshness standards. Strategic placement of healthy instant meals in high-traffic store sections and promotional activities have enhanced category visibility and consumer awareness.

End User Insights:

- Working Professionals

- Students

- Fitness Enthusiasts

- Travelers and Outdoor Consumers

The working professionals dominates with a market share of 38.7% of the total Australia healthy instant meals market in 2025.

Working professionals constitute the primary consumer demographic for healthy instant meals in Australia, driven by demanding work schedules, extended commuting times, and the desire for nutritious meal options that fit busy lifestyles. The segment encompasses both office-based employees seeking convenient lunch solutions and remote workers requiring quick meal options during home-based work hours. The rise of dual-income households has further amplified demand for time-efficient meal solutions that deliver balanced nutrition without extensive preparation. In line with this, Australia recorded 14.2 million employed individuals in 2024, including 9.85 million full-time workers, highlighting the large working-age population increasingly reliant on convenient meal formats.

Manufacturers have developed specialized product lines targeting professional consumers with portion-controlled offerings, calorie-transparent labeling, and premium ingredient profiles. The emphasis on high-protein formulations, sustained energy release, and cognitive function support resonates with career-focused individuals seeking to optimize their dietary intake. Subscription-based delivery services have gained particular traction among this segment, offering meal planning convenience and consistent nutritional quality.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory & New South Wales exhibits a clear dominance with a 34.7% share of the total Australia healthy instant meals market in 2025.

The Australia Capital Territory and New South Wales region commands the largest market share, supported by Australia's highest population density and concentration of major metropolitan centers including Sydney and Canberra. The region's substantial working population, higher disposable income levels, and sophisticated retail infrastructure create favorable conditions for healthy instant meals adoption. Urban consumers in this region demonstrate pronounced preferences for premium, health-focused food products and readily embrace innovative meal solutions.

The presence of major food manufacturers, distribution centers, and cold-chain logistics networks in New South Wales facilitates efficient product availability and freshness maintenance. The region also serves as a hub for food innovation, with numerous startups and established companies developing next-generation healthy meal products. Consumer exposure to global food trends through Sydney's multicultural dining scene has fostered demand for diverse cuisine options within the instant meals category.

Market Dynamics:

Growth Drivers:

Why is the Australia Healthy Instant Meals Market Growing?

Increasing Urbanization and Time-Constrained Lifestyles

Australia's accelerating urbanization has fundamentally transformed consumer eating habits, with metropolitan populations increasingly seeking convenient meal solutions compatible with demanding modern lifestyles. As of June 2024, the combined population of Australia’s capital cities rose by 427,800 people, a 2.4% increase in just one year, signalling growing concentration in major urban centers such as Sydney, Melbourne and Brisbane. The growing prevalence of longer working hours, extended commuting distances, and dual-income households has significantly reduced time available for traditional meal preparation. Urban consumers prioritize efficiency and convenience without willingness to compromise on nutritional quality, creating substantial demand for healthy instant meals that deliver balanced nutrition with minimal preparation time. The concentration of population in major cities including Sydney, Melbourne, and Brisbane provides manufacturers with accessible consumer markets and established distribution networks to efficiently serve health-conscious urban dwellers seeking premium convenience food options.

Rising Health Consciousness and Wellness-Focused Consumer Preferences

Australian consumers have demonstrated increasingly sophisticated understanding of nutrition and its impact on overall wellbeing, driving demand for instant meals that support health objectives beyond basic sustenance. A recent national survey reflects this shift, revealing that 74% of Australians now rank “nutrition” as their top priority when choosing food, ahead of taste and price, highlighting the country’s growing focus on health-oriented eating. The heightened awareness regarding balanced macronutrients, micronutrient density, and functional food benefits has elevated consumer expectations for healthy instant meal formulations. Growing concerns about lifestyle-related health conditions including obesity, diabetes, and cardiovascular disease have motivated dietary modifications favoring lower sodium, reduced sugar, and portion-controlled meal options. The wellness movement has expanded beyond weight management to encompass holistic health considerations including gut health, energy optimization, and cognitive performance, prompting manufacturers to develop innovative products addressing diverse health priorities.

Expansion of E-commerce and Direct-to-Consumer Distribution Channels

The proliferation of digital commerce platforms and sophisticated last-mile delivery infrastructure has revolutionized healthy instant meals accessibility across Australia. Online retail channels and subscription-based meal delivery services have enabled consumers to conveniently access diverse product ranges from their homes, overcoming geographic limitations of traditional brick-and-mortar retail. In 2025, My Muscle Chef opened a new A$55 million manufacturing and logistics facility in Western Sydney, expanding its capacity from about 500,000 meals a week to over 1.2 million. The direct-to-consumer model has empowered specialized brands to build loyal customer relationships through personalized experiences, flexible subscription options, and responsive customer service. Enhanced cold-chain logistics capabilities have enabled nationwide delivery of chilled and frozen meal products while maintaining quality standards, significantly expanding market reach beyond metropolitan centers to regional and rural consumers seeking healthy convenience options.

Market Restraints:

What Challenges the Australia Healthy Instant Meals Market is Facing?

Premium Pricing Constraints and Value Perception Challenges

Healthy instant meals typically command higher price points compared to conventional processed food alternatives, creating affordability barriers for cost-sensitive consumer segments. The premium pricing associated with organic ingredients, specialized formulations, and quality packaging limits market penetration among budget-conscious households. Economic pressures and cost-of-living concerns have heightened consumer price sensitivity, potentially constraining demand growth despite strong underlying interest in healthy convenience options.

Intense Competition from Traditional Home-Cooked Meals and Food Service Options

The healthy instant meals segment faces competitive pressure from multiple food consumption alternatives including traditional home cooking, restaurant dining, and food delivery services. Consumer perceptions regarding freshness superiority and customization flexibility of home-prepared meals present ongoing challenges for instant meal products. The proliferation of restaurant and takeaway delivery platforms through mobile applications has intensified competition for share of stomach among time-constrained consumers seeking convenient meal solutions.

Supply Chain Complexity and Cold-Chain Logistics Requirements

Maintaining product quality and freshness throughout distribution networks presents operational challenges, particularly for chilled and frozen healthy instant meals requiring uninterrupted temperature control. The geographic vastness of Australia creates logistical complexities in serving regional and remote consumers while maintaining cold-chain integrity. Rising energy costs, transportation expenses, and sustainability requirements associated with refrigerated distribution infrastructure impact overall supply chain economics and market accessibility.

Competitive Landscape:

The Australia healthy instant meals market exhibits a moderately fragmented competitive landscape characterized by the presence of multinational food corporations, established domestic meal delivery specialists, and emerging plant-based innovators. Major supermarket chains have strengthened their market positions through private-label product development and strategic acquisitions of ready meal producers. Specialized direct-to-consumer brands have carved distinct market niches by focusing on specific dietary requirements, fitness goals, and premium ingredient sourcing. The competitive intensity has driven continuous product innovation, with companies differentiating through recipe creativity, nutritional optimization, sustainable packaging, and enhanced convenience features. Strategic partnerships, vertical integration, and digital marketing capabilities have emerged as key competitive determinants shaping market dynamics.

Recent Developments:

-

In November 2025, Youfoodz partnered with Diabetes Australia to launch the “Healthy Balanced Range”, offering 25 fresh, nutritionistdesigned meals for people with or at risk of diabetes. Meals are ready-to-eat, convenient, and support healthy eating. A portion of sales is donated to Diabetes Australia, combining nutrition with social impact.

Australia Healthy Instant Meals Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Ready-to-Eat (RTE) Meals, Ready-to-Cook (RTC) Meals, Instant Soups and Salads, Instant Oats and Cereals, Plant-Based and Vegan Instant Meals, Protein-Rich Instant Meals, Low-Calorie and Keto Instant Meals |

| Ingredient Types Covered | Organic and Natural Ingredients, Plant- Based Ingredients, Gluten- Free Ingredients, Protein-Fortified Ingredients |

| Packaging Types Covered | Pouches, Cups and Bowls, Trays and Boxes, Cans and Bottles |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Online Retail, Specialty Health Stores, Direct-to-Consumer (DTC) Channels |

| End Users Covered | Working Professionals, Students, Fitness Enthusiasts, Travelers and Outdoor Consumers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia healthy instant meals market size was valued at USD 3,689.46 Million in 2025.

The Australia healthy instant meals market is expected to grow at a compound annual growth rate of 6.38% from 2026-2034 to reach USD 6,439.46 Million by 2034.

Ready-to-Eat (RTE) meals dominated the product type segment with 38.9% market share, driven by consumer demand for convenient meal solutions requiring minimal preparation time and appealing to time-constrained urban households.

Key factors driving the Australia healthy instant meals market include increasing urbanization and time-constrained lifestyles, rising health consciousness among consumers, expansion of e-commerce and direct-to-consumer distribution channels, and growing demand for plant-based and clean-label food options.

Major challenges include premium pricing constraints limiting affordability for cost-sensitive consumers, intense competition from traditional home-cooked meals and food service options, supply chain complexity requiring cold-chain logistics, and consumer perceptions regarding freshness compared to home-prepared alternatives.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)