Australia Healthy Snacks Market Size, Share, Trends and Forecast by Product, Application, and Region, 2025-2033

Australia Healthy Snacks Market Overview:

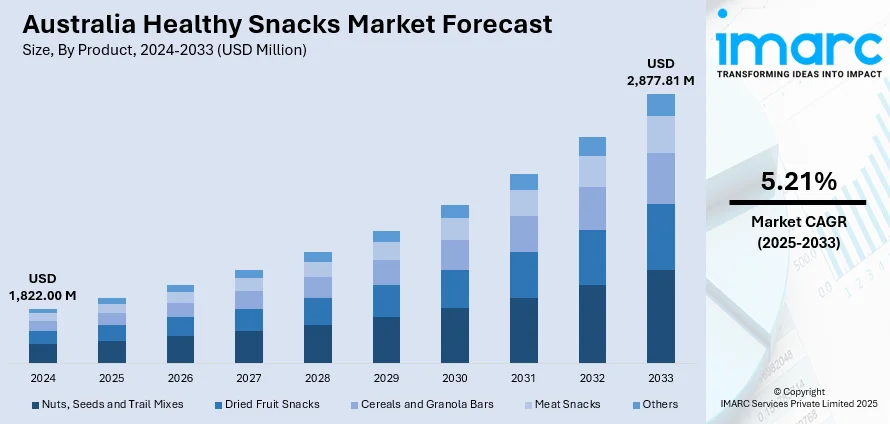

The Australia healthy snacks market size reached USD 1,822.00 Million in 2024. Looking forward, the market is projected to reach USD 2,877.81 Million by 2033, exhibiting a growth rate (CAGR) of 5.21% during 2025-2033. The market is driven by shifting dietary habits aligned with preventive health, elevating demand for natural, high-functionality snack options. Product innovation is central, with brands adopting nutrient-rich ingredients and wellness claims that cater to evolving consumer expectations, thereby fueling the market. Widespread access through e-commerce and retail expansion is deepening reach and visibility, further augmenting the Australia healthy snacks market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,822.00 Million |

| Market Forecast in 2033 | USD 2,877.81 Million |

| Market Growth Rate 2025-2033 | 5.21% |

Key Trends of Australia Healthy Snacks Market:

Rising Health Consciousness and Lifestyle Shifts

The shift toward health-centric living in Australia has reshaped consumer preferences across food categories, particularly in snacking. Consumers are actively seeking out high-protein, nutrient-dense, and low-sugar snack options that align with their fitness goals, dietary plans, and wellness routines. Public health campaigns, increasing gym memberships, and a growing emphasis on weight management have made healthy snacks a viable part of everyday consumption. A recent industry report reveals a significant shift in Australian consumer habits over the past decade, with snacking increasing by more than 400% in frequency, penetration, and monetary value. The research highlights a growing demand for healthy, convenient snack options, with many Australians now turning to vegetables such as celery, cucumber, and carrots as go-to snacks. Brands are responding by incorporating natural ingredients, superfoods, and functional additives such as probiotics, fiber, and plant-based proteins. Additionally, the reduced social stigma around dietary restrictions, gluten-free, keto, vegan, has widened market accessibility. Consumers are now reading labels more closely, favoring snacks with clean, traceable ingredients. The expansion of health-oriented product lines in both traditional retail and online channels is further influencing purchase decisions, especially among millennials and Gen Z. Moreover, media coverage linking poor diet to chronic illness is reinforcing consumer behavior in favor of smarter snacking habits. As eating patterns move from three daily meals to frequent smaller portions, healthy snacks have become integral to daily nutrition. This widespread alignment of diet with preventive health principles is directly contributing to Australia healthy snacks market growth.

To get more information on this market, Request Sample

Retail Expansion and E-commerce Penetration

The growing availability of healthy snack options across mainstream retail chains, specialty stores, and digital platforms has significantly enhanced consumer access in Australia. The consumption of snack foods per person has increased by 10% from 2018-19 to 2022-23. Supermarket giants are dedicating more shelf space to organic and wellness-oriented snack products, often accompanied by prominent in-store health labels and promotional campaigns. Simultaneously, independent health food retailers are offering curated selections that appeal to niche dietary needs, such as paleo, vegan, or low-FODMAP. The rise of e-commerce and direct-to-consumer platforms has played a key role in expanding visibility for emerging brands, allowing them to scale without traditional distribution constraints. Subscription boxes and influencer-backed product reviews are helping build brand loyalty and trial among health-conscious audiences. Additionally, food delivery aggregators and convenience platforms have begun integrating healthy snack categories into their offerings, making such products more accessible during everyday routines. COVID-19 further accelerated digital food purchases, and this behavior has persisted post-pandemic, driving repeat purchases through personalized recommendation algorithms. Together, these omnichannel developments are creating a seamless path from discovery to purchase, ensuring consistent product availability regardless of region or time. This enhanced distribution landscape is vital in sustaining consumer engagement and growing long-term demand.

Clean Label Preferences Driving Health-Conscious Choices

Consumers in Australia are increasingly gravitating towards clean label products, most notably in healthy snacks. Consumers are becoming more aware of ingredients and checking labels to ensure they align with their wellness goals and dietary needs. There is a growing trend of consumers looking for snacks made from simple, easily identified ingredients that do not contain synthetic additives, artificial preservatives, and typical allergens like gluten, soy, and dairy. This trend is highlighted with an increased need for transparency and trust in food brands that has led to manufacturers reformulating their foods using natural alternatives. As awareness about food sensitivities and holistic health expands, clean label offerings are anticipated to play a pivotal role in influencing future snack innovations, thereby further stimulating Australia healthy snacks market demand.

Growth Drivers of Australia Healthy Snacks Market:

Busy Lifestyles and Snacking Habits

Modern Australian consumers are navigating busy lives that often blend work, travel, and personal commitments. Consequently, snacking has increasingly become a central component of daily meals, sometimes replacing traditional eating occasions. This trend has intensified the demand for portable, ready-to-consume nutritious snacks such as protein bars, trail mixes, roasted chickpeas, and dried fruit packs. Brands are concentrating on resealable packaging and portion control to cater to these emerging preferences. Today's consumers expect snacks that provide a quick energy boost while still supporting their health objectives. According to Australia healthy snacks market analysis, the expanding selection of these products available in retail and e-commerce channels underscores this transformation.

Dietary Shifts and Food Intolerances

Shifting dietary trends in Australia are having a notable effect on snack creation, particularly with the increase in gluten sensitivity, lactose intolerance, and plant-based diets. Consumers are actively pursuing snacks that fit vegan, gluten-free, and allergen-friendly criteria. This evolution has inspired brands to broaden their offerings with alternative ingredients such as almond flour, coconut milk, and pea protein. The push for clean and inclusive snacks is driven by health considerations and ethical concerns related to sustainability and animal welfare. Companies are developing innovative products to satisfy these varied demands without sacrificing taste or texture. This growing inclination toward personalized nutrition is a significant factor in shaping the evolving landscape of healthy snacks in Australia.

Rising Disposable Incomes

The increase in disposable income in Australia is influencing consumer priorities, particularly in the food and beverage industry. Shoppers are more willing to invest in high-quality, health-focused snacks made from organic ingredients, superfoods, or those offering functional benefits like immune support or gut health. Instead of opting for budget-friendly traditional snacks, consumers are leaning toward options that resonate with their wellness aspirations even if they are priced higher. This shift represents a broader lifestyle enhancement, emphasizing food quality, ethical sourcing, and ingredient transparency more than ever before. As household incomes climb, the readiness to spend on healthier snacking choices continues to fuel innovation within Australia’s healthy snacks market.

Opportunities of Australia Healthy Snacks Market:

Expansion into Functional Snacks

The healthy snacks market in Australia is witnessing significant opportunities in the creation of functional snacks products that offer more than just basic nutrition by providing additional wellness advantages. Shoppers are increasingly interested in snacks enriched with probiotics to promote gut health, collagen for skin and joint benefits, and adaptogens such as ashwagandha to assist in stress management and enhance focus. These enriched ingredients enable brands to market their offerings as integral to a comprehensive health regimen, appealing to both general wellness enthusiasts and specific health-focused demographics. Functional snacks, including protein bites, bars, and fortified drinks, are becoming popular as convenient options for supporting immunity, digestion, and cognitive abilities, thereby expanding a premium segment within the evolving Australian healthy snacks market.

Innovation in Indigenous Ingredients

The incorporation of native Australian ingredients represents a significant innovation opportunity within the healthy snacks sector. Superfoods such as Kakadu plum, Davidson’s plum, finger lime, and wattleseed are rich in antioxidants and essential nutrients, providing both health benefits and cultural relevance. These native ingredients are increasingly featured in energy bars, nut blends, and snack bites, contributing unique flavor experiences that resonate with local pride and sustainability interests. By highlighting indigenous botanicals, brands can also promote ethical sourcing and collaborate with Aboriginal producers. This trend allows companies to distinguish their products in a competitive landscape while appealing to consumers' desires for authenticity, origin, and functional nutrition.

Personalized Nutrition and Custom Packs Cater to Individual Needs

Personalization is emerging as a key growth area in the Australian healthy snacks marketplace, with consumers looking for products that match their individual dietary requirements and lifestyle objectives. Custom snack packs enable customers to choose items based on criteria such as calorie content, macronutrient proportions, dietary restrictions (gluten-free, vegan, keto), or functional aims (energy, focus, recovery). This customization enhances the consumer experience, fosters brand loyalty, and allows for better portion management. Brands are taking advantage of digital platforms and subscription services to provide easily accessible tailored snack boxes. As health consciousness rises, personalization is transitioning from a niche offering to a mainstream expectation, creating a notable opportunity for brands to present focused, value-driven solutions in a convenient and engaging manner.

Challenges of Australia Healthy Snacks Market:

High Production and Ingredient Costs

One of the significant challenges in the Australian healthy snacks market is the elevated expenses related to crafting premium-quality products. Incorporating organic, non-GMO, or specialty components such as superfoods, plant-based proteins, or functional additives can notably drive-up manufacturing costs. Furthermore, adhering to clean-label standards often necessitates advanced processing techniques and stringent quality control measures, which further escalates production expenditures. Typically, these costs are transferred to consumers in the form of higher retail prices, making it tough to compete with standard snacks. Smaller brands may particularly find it challenging to maintain profitability while scaling their operations. As cost-efficiency becomes increasingly critical, manufacturers face pressure to discover innovative sourcing, production, and packaging strategies that keep prices manageable without sacrificing quality.

Price Sensitivity Among Consumers

Despite the rising awareness of health and wellness, price sensitivity continues to be a significant hurdle to the widespread uptake of healthy snacks in Australia. While a segment of consumers is prepared to pay extra for clean, natural, and functional products, a larger demographic still emphasizes affordability, especially during economic uncertainty. This creates a pricing dilemma for brands seeking to provide high-quality ingredients while remaining accessible to the mass market. Discount-driven buying behavior and comparisons with lower-priced conventional options can hinder healthier snacks from securing shelf space and building consumer loyalty. Effectively addressing this challenge calls for strategic pricing, value-oriented messaging, and possibly smaller packaging to promote trial and encourage repeat purchases among budget-minded shoppers.

Limited Shelf Life of Natural Products

Natural and minimally processed healthy snacks generally do not contain synthetic preservatives, leading to a shorter shelf life than typical snack foods. This presents a considerable logistical and financial challenge for producers and retailers. Products must swiftly move through the supply chain to prevent spoilage, which places additional pressure on storage, distribution, and retail turnover. It also restricts the viability of long-distance exports or online sales without advanced cold chain logistics. Smaller companies may confront increased risks of product wastage and returns, directly impacting profitability. Moreover, consumers might be hesitant to purchase in bulk or try new items if freshness and shelf stability are questionable. To overcome this challenge, investment in natural preservation methods, smart packaging solutions, and more efficient inventory management systems is essential.

Australia Healthy Snacks Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and application.

Product Insights:

- Nuts, Seeds and Trail Mixes

- Dried Fruit Snacks

- Cereals and Granola Bars

- Meat Snacks

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes nuts, seeds and trail mixes, dried fruit snacks, cereals and granola bars, meat snacks, and others.

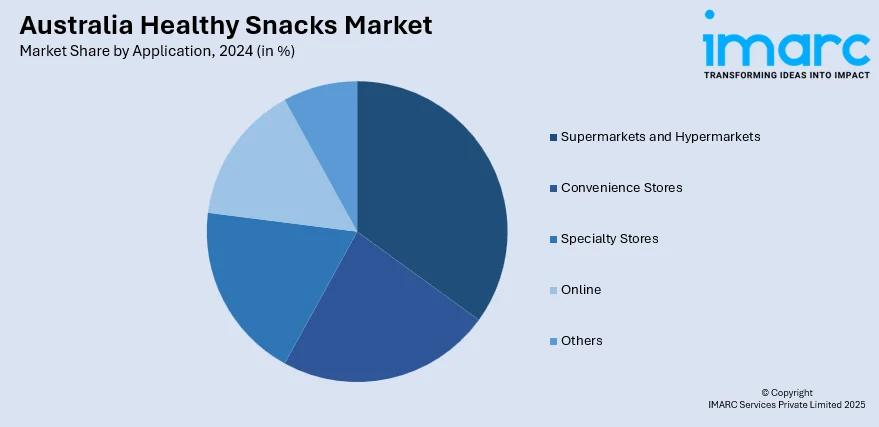

Application Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialty Stores

- Online

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes supermarkets and hypermarkets, convenience stores, specialty stores, online, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Healthy Snacks Market News:

- On 15 September 2023, Arnott's announced the launch of a new Snack Right range of snacks, designed to meet consumers' daily snack cravings without compromising on taste or health. The campaign, created by Saatchi & Saatchi, showcases a fun and lively office environment where workers discover the new snacks. Each product in the range features a Health Star Rating of 3.5 stars or higher, appealing to health-conscious Australians.

- On June 19, 2023, BC Snacks partnered with Surfing Australia for the "Seas the Day" event, celebrating women in surfing, and launched new multi-pack healthy snacks in Coles and Woolworths. With an average Health Star Rating over four, the brand's products, endorsed by ambassador Isabella Nichols, support active lifestyles and fitness.

Australia Healthy Snacks Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Nuts, Seeds and Trail Mixes, Dried Fruit Snacks, Cereals and Granola Bars, Meat Snacks, Others |

| Applications Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialty Stores, Online, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia healthy snacks market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia healthy snacks market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia healthy snacks industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The healthy snacks market in Australia was valued at USD 1,822.00 Million in 2024.

The Australia healthy snacks market is projected to exhibit a compound annual growth rate (CAGR) of 5.21% during 2025-2033.

The Australia healthy snacks market is expected to reach a value of USD 2,877.81 Million by 2033.

Australia’s healthy snacks market is seeing rising interest in functional foods, clean-label ingredients, and plant-based offerings. Consumers are also favoring indigenous superfoods, eco-friendly packaging, and personalized nutrition. These trends reflect a broader shift toward wellness, sustainability, and transparent product sourcing.

Increasing health awareness, changing dietary habits, and demand for convenient, nutrient-rich food options are key drivers of Australia healthy snacks market. Higher disposable incomes and a growing preference for premium, allergen-free, and diet-specific products are also fueling market expansion across both retail and online channels.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)