Australia Heat Exchanger Market Size, Share, Trends and Forecast by Product, Material, End User Industry, and Region, 2025-2033

Australia Heat Exchanger Market Overview:

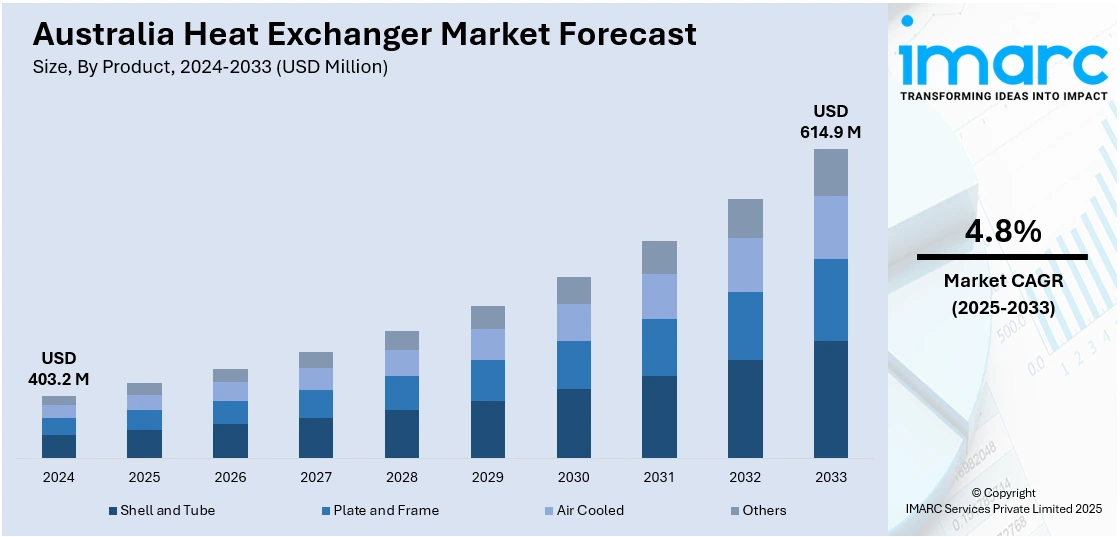

The Australia heat exchanger market size reached USD 403.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 614.9 Million by 2033, exhibiting a growth rate (CAGR) of 4.8% during 2025-2033. The market is boosted by growing applications in energy-hungry sectors, focus on sustainability, and innovation in thermal technologies to promote operational efficiency and address the changing needs of industrial, commercial, and renewable energy applications.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 403.2 Million |

| Market Forecast in 2033 | USD 614.9 Million |

| Market Growth Rate 2025-2033 | 4.8% |

Australia heat exchanger Market Trends:

Increasing Demand Due to Renewable Energy Integration

Australia's increasing investment in renewable energy installations is impacting the heat exchanger industry significantly. With solar thermal power plants, bioenergy, and geothermal power systems picking up, there is a need for efficient thermal management systems. Heat exchangers are of vital importance to ensure operational efficiency by exchanging heat during power generation and storage processes. Their use in solar water heating and energy recovery on an industrial scale is growing consistently. Moreover, in line with the focus on low-carbon energy solutions, more efficient heat exchangers that have higher energy efficiency and lowest possible environmental impact are gaining favor. For example, in November 2024, CSIRO solar research touched new levels of achievement breakthroughs in printable solar cells and tandem technology, on the path towards lowering costs and improving efficiency to make solar the leading energy option. Furthermore, this development is also accelerated by government patronage of green infrastructure and the transition towards decarbonization. The growing integration of heat exchangers into various clean energy technologies indicates a positive Australia heat exchanger market outlook, pointing to opportunities for long-term growth and boosting market share in alignment with national sustainability objectives.

To get more information on this market, Request Sample

Industrial Upgrades Driving Technology Adoption

Australia's industrial base is undergoing a process of modernization, leading to a transition towards more sophisticated thermal systems. Businesses like chemicals, mining, food processing, and pulp and paper need high-duty heat exchangers to successfully control temperatures, conserve energy, and optimize the process. In the face of increasing operational expenditures and stringent regulations on energy efficiency, companies replace aging systems with compact, corrosion-proof, and high-performance heat exchangers. Such upgrades enable minimized downtime and maintenance coupled with enhanced thermal efficiency. For instance, in March 2024, APV introduced the Automated FastFrame™ Plate Heat Exchanger, allowing operators to open and close units in minutes at the touch of a button, improving food and beverage processing efficiency. Additionally, customized and modular designs are highly in demand for their flexibility to suit diverse operating conditions. The encouragement for operational excellence in large-scale and niche manufacturing sectors drives more deployment of cutting-edge exchanger technologies. The trend indicates robust Australia heat exchanger market growth, which is indicative of the sector's development toward high-efficiency systems that address both performance and sustainability standards.

Growth in HVAC and Building Infrastructure

The demand for efficient heating, ventilation, and air conditioning (HVAC) systems in Australia's residential and commercial markets is driving the heat exchanger market. Urbanization, growth in construction activity, and green building certifications are encouraging the application of sophisticated HVAC components. Heat exchangers play a crucial role in air conditioning, heat recovery, and water heating systems, enhancing the quality of indoor air and minimizing energy consumption. With increasing climate variability and energy issues, the need for systems that synergize comfort and efficiency is becoming more rapid. The move towards smart building technology also promotes the use of automated heat exchanger solutions with the ability to monitor performance. This growing footprint in real estate and infrastructure indicates a rising Australia heat exchanger market share, as HVAC applications continue to drive adoption and underpin long-term demand for trusted thermal solutions throughout the nation.

Australia heat exchanger Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, material, and end user industry.

Product Insights:

- Shell and Tube

- Plate and Frame

- Air Cooled

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes shell and tube, plate and frame, air cooled, and others.

Material Insights:

- Carbon Steel

- Stainless Steel

- Nickel

- Others

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes carbon steel, stainless steel, nickel, and others.

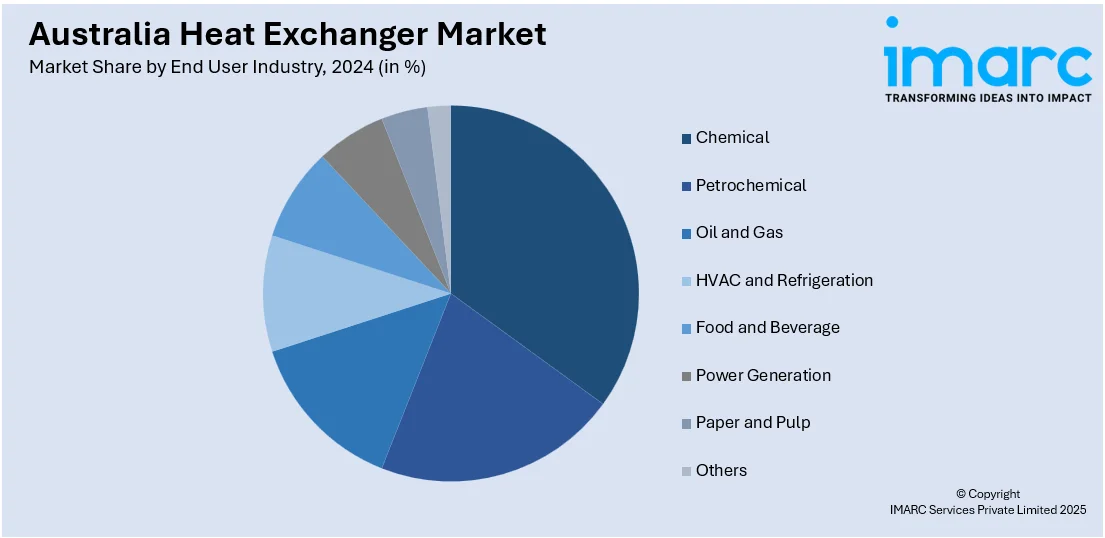

End User Industry Insights:

- Chemical

- Petrochemical

- Oil and Gas

- HVAC and Refrigeration

- Food and Beverage

- Power Generation

- Paper and Pulp

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes chemical, petrochemical, oil and gas, HVAC and refrigeration, food and beverage, power generation, paper and pulp, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia heat exchanger Market News:

- In April 2025, Conflux Technology partners with AMSL Aero to improve hydrogen fuel cell cooling for the Vertiia VTOL aircraft. The collaboration progresses to phase two, with an emphasis on improving heat exchanger design to minimize weight, manage heat loads, and enable long-range, sustainable aviation for the hydrogen-powered plane.

- In November 2024, Conflux Technology, which is headquartered in Geelong, Australia, has raised $11 million in Series B funding to drive its additive manufacturing systems for heat exchangers. The investment will fund international customer growth, product development at a faster pace, and more partnerships, such as with Odys Aviation to develop sustainable aviation technologies.

Australia Heat Exchanger Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Shell and Tube, Plate and Frame, Air Cooled, Others |

| Materials Covered | Carbon Steel, Stainless Steel, Nickel, Others |

| End User Industries Covered | Chemical, Petrochemical, Oil and Gas, HVAC and Refrigeration, Food and Beverage, Power Generation, Paper and Pulp, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia heat exchanger market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia heat exchanger market on the basis of product?

- What is the breakup of the Australia heat exchanger market on the basis of material?

- What is the breakup of the Australia heat exchanger market on the basis of end user industry?

- What is the breakup of the Australia heat exchanger market on the basis of region?

- What are the various stages in the value chain of the Australia heat exchanger market?

- What are the key driving factors and challenges in the Australia heat exchanger?

- What is the structure of the Australia heat exchanger market and who are the key players?

- What is the degree of competition in the Australia heat exchanger market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heat exchanger market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heat exchanger market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heat exchanger industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)