Australia Heat Recovery Systems Market Size, Share, Trends and Forecast by Type, Technology, Industry, and Region, 2026-2034

Australia Heat Recovery Systems Market Summary:

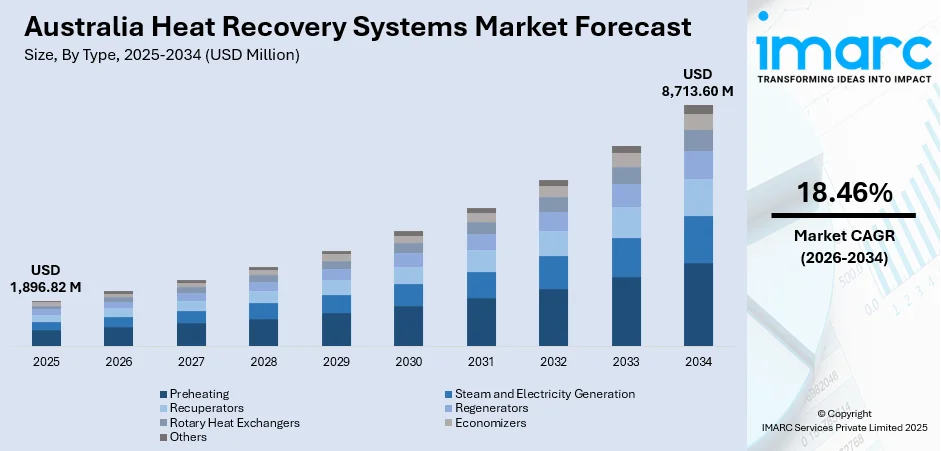

The Australia heat recovery systems market size was valued at USD 1,896.82 Million in 2025 and is projected to reach USD 8,713.60 Million by 2034, growing at a compound annual growth rate of 18.46% from 2026-2034.

The Australia heat recovery systems market is gaining momentum as industries and commercial facilities prioritise energy efficiency and operating cost reduction. Growing focus on sustainable practices, rising energy prices, and stricter environmental expectations are encouraging adoption of systems that capture and reuse waste heat. Expanding industrial activity, particularly in manufacturing, food processing, and HVAC applications, supports steady demand. Technological improvements and increased awareness of long-term savings further strengthen the market’s positive outlook.

Key Takeaways and Insights:

- By Type: Steam and electricity generation dominates the market with a share of 30% in 2025, driven by industrial facilities leveraging exhaust gas turbines and combined cycle systems to convert waste thermal energy into power for operational self-sufficiency and grid export.

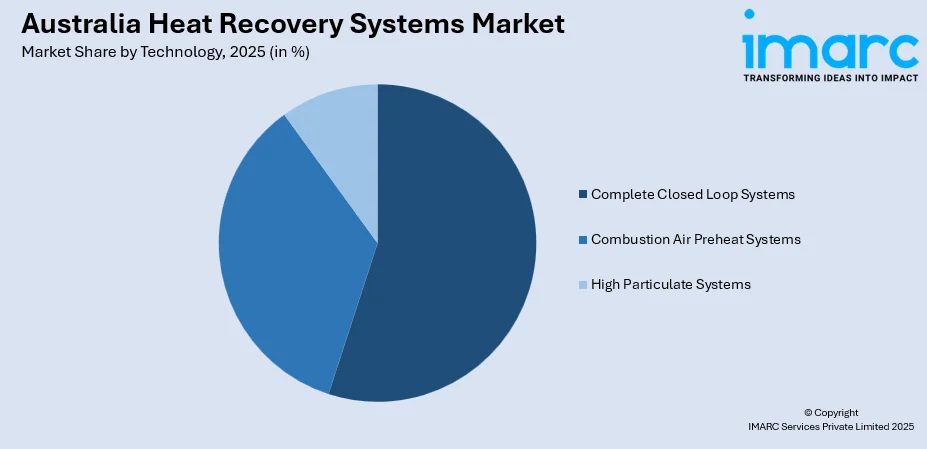

- By Technology: Complete closed loop systems leads the market with a share of 50% in 2025, owing to their superior thermal efficiency, minimal environmental impact, and ability to integrate seamlessly with existing industrial infrastructure for continuous heat recovery operations.

- By Industry: Petroleum refining represents the largest segment with a market share of 25% in 2025, attributed to the sector's high energy intensity, significant waste heat generation from distillation and cracking processes, and regulatory mandates for emissions reduction.

- Key Players: The Australia heat recovery systems market exhibits a moderately competitive landscape characterized by established global thermal technology providers competing alongside specialized regional manufacturers. Companies are focusing on technological innovation, strategic partnerships, and customized solutions to strengthen market positioning and expand industrial clientele across energy-intensive sectors.

To get more information on this market, Request Sample

The Australia heat recovery systems market is experiencing steady growth as industries, commercial buildings, and residential developers adopt technologies that improve energy efficiency and reduce operational costs. In August 2025, a pioneering three-step heat recovery system was trialed at a processing plant in New South Wales, funded by the Australian Meat Processor Corporation. This system aims to reduce reliance on natural gas, potentially saving $600,000 annually and cutting emissions. Results from the first stage of research are expected in 2026. Rising energy prices and increasing environmental expectations are prompting businesses to integrate systems that capture waste heat from industrial processes, HVAC equipment, and power generation units. These solutions support sustainability goals by lowering emissions and optimising resource utilisation. Adoption is further encouraged by the shift toward green building standards and corporate commitments to carbon reduction. Manufacturing, food processing, and chemical industries remain key users, while the commercial sector is expanding its uptake through smart HVAC and ventilation upgrades. Ongoing advancements in heat exchangers, compact designs, and automation are enhancing performance and affordability, strengthening market penetration. Overall, the market outlook remains favourable as Australia advances toward more energy-efficient infrastructure.

Australia Heat Recovery Systems Market Trends:

Growing Integration in Industrial Operations

Industries such as manufacturing, food processing, and chemicals are increasingly adopting heat recovery systems to capture waste heat and reduce overall energy consumption. In May 2025, a groundbreaking solar thermal demonstrator in Australia aims to revolutionize industrial heat by utilizing lightweight plastic mirrors. This project, backed by the Federal Government’s AEA Ignite program, targets a 25% reduction in global energy use and 20% of CO2 emissions, offering a 40% cost reduction for renewable process heat. These solutions improve process efficiency, lower operating costs, and support sustainability goals. As high-heat industrial operations seek long-term savings, adoption continues to rise across both modernized and traditionally energy-intensive facilities.

Rising Adoption in Commercial HVAC Systems

Commercial buildings are integrating heat recovery technologies into HVAC and ventilation systems to achieve greater energy efficiency and meet sustainability objectives. In July 2025, Panasonic launched a hydronic heating solution in Australia, featuring an Air to Water Heat Pump available in J Series (9kW, 16kW) and T-CAP (12kW, 16kW) models. This energy-efficient system offers heating, cooling, and hot water, suitable for new builds and retrofits. These systems improve indoor climate control, reduce heating and cooling loads, and lower utility costs. Growing emphasis on green building standards and operational efficiency is driving wider adoption across offices, retail spaces, and institutional buildings.

Expansion of Energy-Efficient Building Practices

Sustainability-focused construction trends are encouraging the incorporation of heat recovery solutions in new residential and commercial projects. Green building frameworks prioritise systems that reduce energy usage and enhance overall performance. In October 2025, the federal government invested USD 20 Million to expand the Commercial Building Disclosure (CBD) program, targeting hotels and large offices. The initiative aims to double energy savings and nearly triple emissions savings, with average annual savings of USD 280,000 from improving energy ratings from 4 to 6 stars.

Market Outlook 2026-2034:

The Australia heat recovery systems market outlook remains positive as industries and commercial facilities prioritise energy efficiency, cost reduction, and sustainable operations. Rising energy prices and growing environmental expectations are encouraging wider adoption of systems that capture and reuse waste heat. Expanding use across manufacturing, HVAC, and green building projects further supports demand. Technological advancements in compact, modular, and automated designs are improving system performance and affordability, reinforcing the market’s long-term growth potential across both new installations and retrofits. The market generated a revenue of USD 1,896.82 Million in 2025 and is projected to reach a revenue of USD 8,713.60 Million by 2034, growing at a compound annual growth rate of 18.46% from 2026-2034.

Australia Heat Recovery Systems Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Steam and Electricity Generation | 30% |

| Technology | Complete Closed Loop Systems | 50% |

| Industry | Petroleum Refining | 25% |

Type Insights:

- Preheating

- Steam and Electricity Generation

- Recuperators

- Regenerators

- Rotary Heat Exchangers

- Economizers

- Others

The steam and electricity generation dominates with a market share of 30% of the total Australia heat recovery systems market in 2025.

Steam and electricity generation is the leading segment, driven by its essential role in industrial energy optimisation. Facilities across sectors rely on heat recovery to convert waste heat into usable steam or power, reducing fuel consumption and improving overall operational efficiency. In April 2025, Australian startup MGA Thermal launched the world’s first industrial steam heat energy storage demonstrator, successfully storing 5MWh of energy with a 500kW output. Located in Tomago, New South Wales, the project features innovative 'Thermal Blocks' using a unique miscibility gap alloy for efficient thermal energy storage. This segment benefits from strong adoption in heavy industries where high-temperature processes create significant recovery potential.

Growing focus on sustainability and cost reduction continues to support the expansion of steam and electricity generation systems. Industries are increasingly integrating advanced heat recovery boilers and turbines to achieve stable energy output, lower emissions, and enhance process reliability. The segment’s ability to deliver measurable financial and environmental benefits strengthens its dominant position across the market.

Technology Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Complete Closed Loop Systems

- Combustion Air Preheat Systems

- High Particulate Systems

The complete closed loop systems leads with a share of 50% of the total Australia heat recovery systems market in 2025.

Complete closed loop systems hold the leading share due to their superior efficiency, reduced losses, and strong compatibility with continuous industrial operations. These systems capture waste heat and reintroduce it directly into the process, enabling manufacturers to maintain stable temperatures and improve resource utilisation. Their closed design also supports safer and cleaner heat transfer.

Demand for complete closed loop systems is rising as facilities prioritise automation, precision control, and high-performance thermal management. The ability to integrate with advanced monitoring tools enhances reliability and operational visibility, making them suitable for energy-intensive industries. Their strong return on investment and reduced maintenance requirements reinforce their leadership in the market.

Industry Insights:

- Petroleum Refining

- Metal Production

- Cement

- Chemical

- Paper and Pulp

- Others

The petroleum refining segment holds the largest share at 25% of the total Australia heat recovery systems market in 2025.

The petroleum refining sector leads the market due to its high energy intensity and continuous processing needs. Refineries generate substantial waste heat during distillation, cracking, and treatment operations, making heat recovery systems essential for lowering fuel consumption and improving thermal efficiency. This segment increasingly adopts advanced exchangers and recovery boilers to enhance process performance.

Growing emphasis on sustainability, emissions reduction, and cost optimisation continues to drive adoption in petroleum refining. Heat recovery supports regulatory compliance while improving overall plant reliability and operational stability. With strong demand for energy-efficient refinery infrastructure and ongoing modernisation activities, the segment maintains a dominant position within the Australia heat recovery systems market.

Regional Insights:

- Australian Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & South Australia

- Western Australia

Australian Capital Territory and New South Wales benefit from strong industrial activity, modern commercial infrastructure, and rising adoption of energy-efficient technologies. Growing investments in construction, advanced manufacturing, and sustainability-focused upgrades continue to support demand for heat recovery systems that help reduce operating costs and improve energy performance.

Victoria and Tasmania show increasing uptake of heat recovery solutions due to expanding commercial buildings, food processing units, and industrial modernisation. The region’s focus on greener operations encourages widespread integration of energy-saving systems that reduce waste heat and support long-term efficiency gains across key sectors.

Queensland demonstrates strong demand for heat recovery systems driven by its large mining, metals, and chemical industries. High energy usage and the need for cost optimisation motivate businesses to adopt heat recovery technologies that enhance process efficiency and reduce fuel consumption in energy-intensive operations.

Northern Territory and South Australia are witnessing steady growth in heat recovery adoption across mining, manufacturing, and emerging renewable projects. Industries in this region prioritise energy optimisation to manage operating costs, supporting wider installation of systems that maximise waste heat utilisation.

Western Australia continues to show robust demand due to its extensive mining and resource extraction activities. High process heat loads and a strong focus on operational efficiency encourage industries to deploy heat recovery solutions that improve performance and reduce long-term energy expenses.

Market Dynamics:

Growth Drivers:

Why is the Australia Heat Recovery Systems Market Growing?

Government Support for Energy-Efficient Technologies

Government policies focused on sustainability and energy conservation are encouraging wider adoption of heat recovery systems across Australia. Incentives such as energy-efficiency grants, green building certifications, and stricter emission guidelines motivate industries and commercial facilities to upgrade their infrastructure with advanced heat recovery solutions. In September 2025, ARENA is funding McCain Foods (USD 7.38 million) and Sugar Australia (USD 4.1 million) to implement heat recovery systems, aiming to reduce emissions and natural gas reliance. Blackmores will receive USD 723,900 for a high-efficiency heat pump project. These measures help businesses reduce energy waste, comply with environmental standards, and improve long-term operational performance, creating a favourable environment for market expansion.

Advancements in Heat Exchanger and Automation Technologies

Technological progress in compact heat exchangers, smart sensors, and automated control systems is significantly improving the efficiency, reliability, and adaptability of heat recovery solutions. Modern systems offer better heat transfer capability, real-time performance monitoring, and predictive maintenance features, reducing downtime and operational risks. These advancements make heat recovery more cost-effective and suitable for diverse applications in commercial, industrial, and residential settings, accelerating market adoption across Australia.

Rising Energy Costs Encouraging Efficiency Improvements

Escalating electricity and fuel prices are prompting industries and commercial establishments to adopt heat recovery systems as a strategic cost-saving measure. Electricity prices in Australia soared by 27% above inflation between June 2023 and June 2025, with a total increase of 206% since 2000. The Australian Energy Regulator approved price hikes for 2025-2026 of up to 9.7%, impacting households by AUD 280 and small businesses by AUD 489. These technologies enable organizations to capture and reuse waste heat, lowering dependence on conventional energy sources and reducing long-term utility expenses. As operating costs rise, businesses increasingly prioritize energy-efficient infrastructure that enhances productivity while supporting sustainability goals, making heat recovery systems an essential component of their efficiency improvement strategies.

Market Restraints:

What Challenges the Australia Heat Recovery Systems Market is Facing?

Limited Awareness Among Small and Medium Enterprises

Small and medium enterprises often lack clarity on the long-term financial and energy-saving benefits of heat recovery systems. Limited technical expertise, budget constraints, and insufficient access to skilled professionals reduce confidence in adopting these solutions. As a result, many SMEs continue relying on conventional systems, slowing market penetration in non-specialised sectors.

Maintenance and Operational Challenges

Heat recovery systems require consistent upkeep, including cleaning, component checks, and performance monitoring, to operate at peak efficiency. When maintenance is delayed or inadequately performed, system effectiveness declines, increasing downtime and overall operating costs. These challenges discourage some businesses from investing in advanced solutions, particularly if they lack dedicated technical teams.

Variability in Waste Heat Availability

Industries with inconsistent production levels often generate fluctuating waste heat, which limits the steady performance of heat recovery systems. This unpredictability affects system efficiency, makes energy savings harder to forecast, and can extend payback periods. As a result, businesses may hesitate to invest when heat output does not guarantee reliable returns.

Competitive Landscape:

The competitive landscape of the Australia heat recovery systems market is characterised by a mix of established manufacturers, energy service providers, and technology specialists offering customised efficiency solutions. Competition is shaped by continuous innovation in heat exchangers, automation, and smart monitoring tools that enhance system performance and reliability. Companies focus heavily on delivering tailored designs for industrial, commercial, and building applications, strengthening their position through technical expertise and strong after-sales support. Growing demand for sustainable infrastructure encourages providers to expand product portfolios, improve integration capabilities, and offer cost-efficient solutions that meet evolving regulatory and energy-efficiency expectations.

Recent Developments:

- In July 2025, Manildra Group announced its plans to invest USD 110 Million in heat recovery projects at Shoalhaven Starches to support Australia’s net-zero emissions target by 2050. Funded by a USD 44.5 Million grant, the initiative will reduce CO₂ emissions by over 95,000 tonnes annually, equivalent to removing 47,000 cars from the roads, and create 80 jobs.

- In October 2024, Conflux Technology secured USD 11 million in Series B funding, led by Breakthrough Victoria, to enhance global heat exchanger production. The investment will boost their Conflux Production Systems (CPS) development. The firm targets a $6 billion market, focusing on sustainable solutions in various industries, including aviation.

Australia Heat Recovery Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Preheating, Steam and Electricity Generation, Recuperators, Regenerators, Rotary Heat Exchangers, Economizers, Others |

| Technologies Covered | Complete Closed Loop Systems, Combustion Air Preheat Systems, High Particulate Systems |

| Industries Covered | Petroleum Refining, Metal Production, Cement, Chemical, Paper and Pulp, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia heat recovery systems market size was valued at USD 1,896.82 Million in 2025.

The Australia heat recovery systems market is expected to grow at a compound annual growth rate of 18.46% from 2026-2034 to reach USD 8,713.60 Million by 2034.

The steam and electricity generation segment held the largest share, driven by its extensive use in energy-intensive industries. Its ability to maximise waste heat recovery and support overall energy efficiency makes it the most widely adopted type in the market.

Key factors driving the Australia heat recovery systems market include rising energy costs, stronger sustainability commitments, growing industrial modernisation, and increasing adoption of energy-efficient technologies across commercial and industrial facilities seeking long-term operational savings.

Major challenges include high initial installation costs, inconsistent waste heat availability across industries, limited awareness among smaller enterprises, and the need for regular maintenance to ensure optimal system performance and long-term efficiency.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)