Australia Heavy-Duty Automotive Aftermarket Market Size, Share, Trends and Forecast by Replacement Parts, Vehicle Type, Service Channel, and Region, 2025-2033

Australia Heavy-Duty Automotive Aftermarket Market Size and Share:

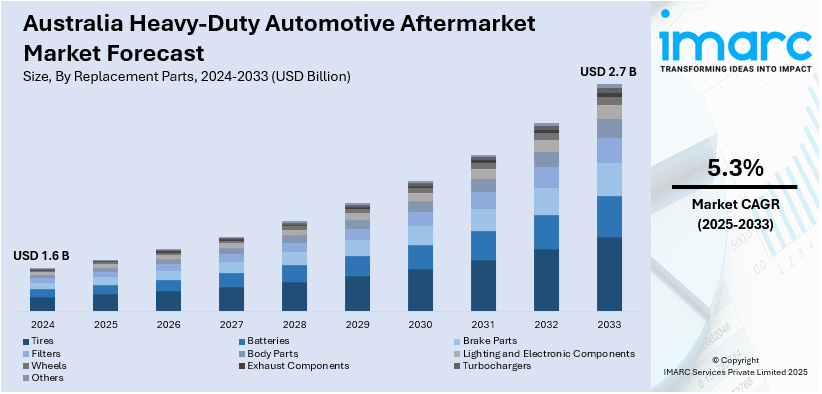

The Australia heavy-duty automotive aftermarket market size reached USD 1.6 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.7 Billion by 2033, exhibiting a growth rate (CAGR) of 5.3% during 2025-2033. The market is witnessing substantial growth, driven by technological advancements and favorable trade agreements. Engine innovation necessitates specialized aftermarket solutions, while eased trade barriers expand export potential. This dual dynamic fosters growth and innovation within the sector.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.6 Billion |

| Market Forecast in 2033 | USD 2.7 Billion |

| Market Growth Rate 2025-2033 | 5.3% |

Australia Heavy-Duty Automotive Aftermarket Market Trends:

Engine Innovation Spurs Aftermarket Needs

The Australian heavy-duty automotive aftermarket is in the process of undergoing a deep revolution, driven by the unstoppable pace of technological advancement in the manufacturing of vehicles. Moreover, this transformation is compelling the rapid adjustment of conventional vehicle service providers. The introduction of the Volvo FH Aero range in October 2024, featuring advanced fuel-saving technologies, including new Euro 6 engines and electric drivetrains, stands as a pivotal development. This development represents a significant change in what kinds of services and products are needed in the market. As such, this innovation should drive demand for specialized aftermarket products, service offerings, and maintenance upgrades specifically designed for these new technologies significantly. In particular, the demand for advanced diagnostic equipment that can deal with intricate electronic systems, customized software patches for engine management, and technical expertise in servicing electric and hybrid transmissions will escalate. Further, the increasing focus on sustainability will see the advent of aftermarket parts that are fuel-efficient and environmentally friendly move faster, compelling the manufacturers to innovate beyond the conventional. In effect, the integration of advanced engine technology is revolutionizing the aftermarket market, compelling companies to spend on equipment and training to address the changing demands of the heavy-duty truck industry.

To get more information on this market, Request Sample

International Trade Agreements Fuel Export Growth

The Australian heavy-duty automotive aftermarket is experiencing a notable surge in export opportunities, primarily fueled by the strategic implementation of favorable international trade agreements. This expansion is opening new horizons for Australian manufacturers for instance, in September 2024, the Australian Automotive Aftermarket Association (AAAA) welcomed the Australia-UAE trade agreement, a critical development that eliminated tariffs on Australian products, including heavy-duty 4WD and vehicle upgrades. This agreement has unlocked significant avenues for Australian manufacturers to expand their market reach into the UAE, a region with a growing demand for high-quality automotive products. The removal of trade barriers has substantially enhanced the competitiveness of Australian aftermarket products in the region, leading to increased demand for specialized parts and services that meet the unique demands of the UAE market. This trade agreement is expected to stimulate a considerable growth in the production and export of high-quality aftermarket components, creating new jobs and investment opportunities within the Australian automotive sector. The resultant growth will place pressure on supply chains and logistics, demanding efficient delivery and support infrastructure to handle the increased volume of trade.

Australia Heavy-Duty Automotive Aftermarket Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on replacement parts, vehicle type, and service channel.

Replacement Parts Insights:

- Tires

- Batteries

- Brake Parts

- Filters

- Body Parts

- Lighting and Electronic Components

- Wheels

- Exhaust Components

- Turbochargers

- Others

The report has provided a detailed breakup and analysis of the market based on the replacement parts. This includes tires, batteries, brake parts, filters, body parts, lighting and electronic components, wheels, exhaust components, turbochargers, and others.

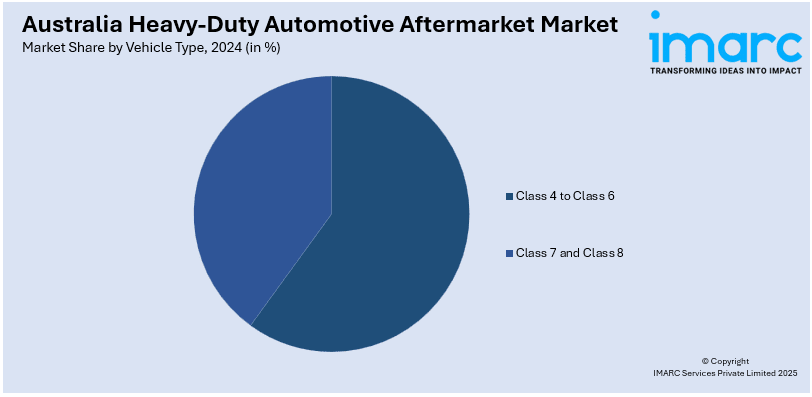

Vehicle Type Insights:

- Class 4 to Class 6

- Class 7 and Class 8

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes class 4 to class 6 and class 7 and class 8.

Service Channel Insights:

- DIY

- OE Seller

- DIFM

A detailed breakup and analysis of the market based on the service channel have also been provided in the report. This includes DIY, OE seller, and DIFM.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heavy-Duty Automotive Aftermarket Market News:

- March 2025: Isuzu launched its all-new 2025 truck range in Melbourne, highlighting significant upgrades in safety, emissions, and productivity. This launch is set to impact the heavy-duty automotive aftermarket by driving demand for new parts, systems, and aftersales services, promoting innovation and market growth.

- November 2024: Western Australia introduced its first heavy-duty electric truck, the Volvo FM Electric, marking a key shift in the heavy-duty automotive aftermarket sector. This move, driven by sustainability goals, is expected to impact parts, maintenance, and service demands, emphasizing electric vehicle integration and innovation.

Australia Heavy-Duty Automotive Aftermarket Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Replacements Parts Covered | Tires, Batteries, Brake Parts, Filters, Body Parts, Lighting and Electronic Components, Wheels, Exhaust Components, Turbochargers, Others |

| Vehicle Types Covered | Class 4 to Class 6, Class 7 and Class 8 |

| Services Covered | DIY, OE Seller, DIFM |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia heavy-duty automotive aftermarket market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia heavy-duty automotive aftermarket market on the basis of replacement parts?

- What is the breakup of the Australia heavy-duty automotive aftermarket market on the basis of vehicle type?

- What is the breakup of the Australia heavy-duty automotive aftermarket market on the basis of service channels?

- What are the various stages in the value chain of the Australia heavy-duty automotive aftermarket market?

- What are the key driving factors and challenges in the Australia heavy-duty automotive aftermarket market?

- What is the structure of the Australia heavy-duty automotive aftermarket market and who are the key players?

- What is the degree of competition in the Australia heavy-duty automotive aftermarket market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heavy-duty automotive aftermarket market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heavy-duty automotive aftermarket market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heavy-duty automotive aftermarket industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)