Australia Heavy Machinery Components Market Size, Share, Trends and Forecast by Component Type, Material Type, Machinery Type, Sales Channel, End Use Industry, and Region, 2025-2033

Australia Heavy Machinery Components Market Overview:

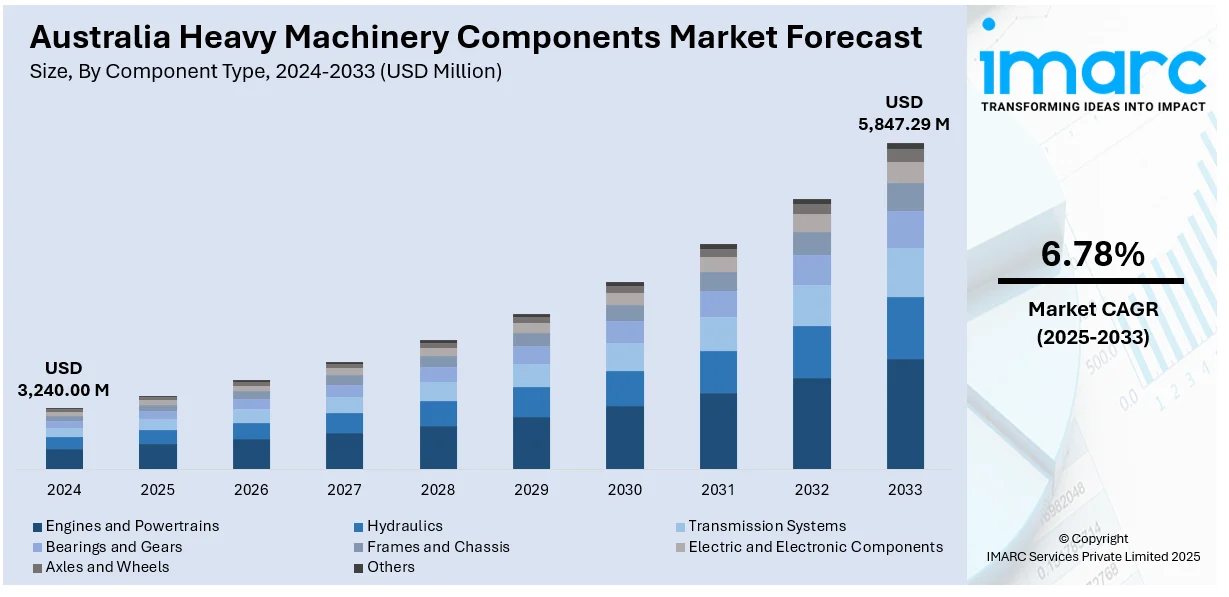

The Australia heavy machinery components market size reached USD 3,240.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 5,847.29 Million by 2033, exhibiting a growth rate (CAGR) of 6.78% during 2025-2033. Strong demand from the mining sector, expansion of public and private infrastructure projects, increased agricultural mechanization, and the rise of equipment rental services are fueling the market growth. Other contributors include high replacement rates of wear parts, adoption of automation in machinery, original equipment manufacturer (OEM) investments in local production and distribution, and government-backed transport and construction programs. Additional, renewable energy infrastructure upgrades, international trade collaborations, and the use of predictive maintenance technologies to reduce downtime and enhance equipment life cycles are factors stimulating the Australia heavy machinery components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 3,240.00 Million |

| Market Forecast in 2033 | USD 5,847.29 Million |

| Market Growth Rate 2025-2033 | 6.78% |

Australia Heavy Machinery Components Market Trends:

Rising Demand in Mining Operations

Australia's reputation as a global leader in mineral export maintains the heavy machinery parts demand in top gear. For instance, in 2024, Evolution Mining invested approximately USD 285 million (A$430 million) in developing its New South Wales-based Cowal Gold Operations. The growth will contribute an additional 2 million ounces of gold and extend the life of the mine by 10 years, bringing its horizon to 2042. The mining industry, especially in Queensland and Western Australia, relies greatly on heavy machinery like dump trucks, excavators, and loaders. The equipment works under tough conditions and must be replaced frequently with components such as engine parts, braking systems, and hydraulic cylinders. As commodity prices firm up and more mining occurs, the mining operators are spending on new machinery as well as maintenance cycles. This is directly leading to a continued level of demand for both OEM as well as after-market components. The shift to deeper and complex mining operations also increases the strain on the equipment, leading to increased wear and tear. For optimal performance without interference, companies are more interested in predictive maintenance that raises the replacement rate of critical components.

To get more information on this market, Request Sample

Expansion of Infrastructure Projects

Australia’s ongoing infrastructure expansion is another key factor boosting the heavy machinery components market. Government-led initiatives such as the Inland Rail project, major road upgrades, and public transport enhancements are creating consistent demand for earthmoving and construction equipment. These projects require reliable machinery components to keep operations running efficiently, particularly in high-usage machines like bulldozers, cranes, and graders. Contractors working on time-sensitive infrastructure developments prioritize equipment uptime, pushing up the frequency of component replacements and maintenance. Additionally, public-private partnerships and long-term investment plans ensure a continuous pipeline of projects, offering long-term growth potential for component manufacturers and distributors. Urban development and population growth in cities like Sydney and Melbourne also support rising construction activity, further reinforcing the demand. Suppliers who can offer fast delivery, inventory availability, and durable parts are well-positioned to benefit from this trend.

Growth in Agricultural Mechanization

Agriculture remains a vital part of Australia’s economy, and the sector is undergoing a gradual shift toward greater mechanization. Farms are increasingly using advanced equipment such as harvesters, balers, and tractors to improve productivity and reduce labor dependency. This transition is directly increasing the demand for reliable heavy machinery components, particularly in remote and regional areas where downtime can result in significant yield losses. Key components such as clutches, hydraulic pumps, and powertrain parts see frequent use and replacement due to constant exposure to dust, weather, and uneven terrain. With changing climate patterns and a push toward sustainable practices, farmers are also investing in newer, more efficient machines, which in turn creates demand for compatible components and upgrades. Government grants and agricultural support programs further incentivize farmers to adopt modern equipment, driving the Australia heavy machinery components market growth.

Australia Heavy Machinery Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, material type, machinery type, sales channel, and end use industry.

Component Type Insights:

- Engines and Powertrains

- Hydraulics

- Pumps

- Valves

- Cylinders

- Transmission Systems

- Bearings and Gears

- Frames and Chassis

- Electric and Electronic Components

- Axles and Wheels

- Others

The report has provided a detailed breakup and analysis of the market based on the component type. This includes engines and powertrains, hydraulics (pumps, valves, and cylinders), transmission systems, bearings and gears, frames and chassis, electric and electronic components, axles and wheels, and others.

Material Type Insights:

- Steel

- Aluminum

- Cast Iron

- Composites

- Others

A detailed breakup and analysis of the market based on the material type have also been provided in the report. This includes steel, aluminum, cast iron, composites, and others.

Machinery Type Insights:

- Construction Equipment

- Mining Equipment

- Agriculture Equipment

- Industrial Machinery

- Oil and Gas Equipment

- Others

The report has provided a detailed breakup and analysis of the market based on the machinery type. This includes construction equipment, mining equipment, agriculture equipment, industrial machinery, oil and gas equipment, and others.

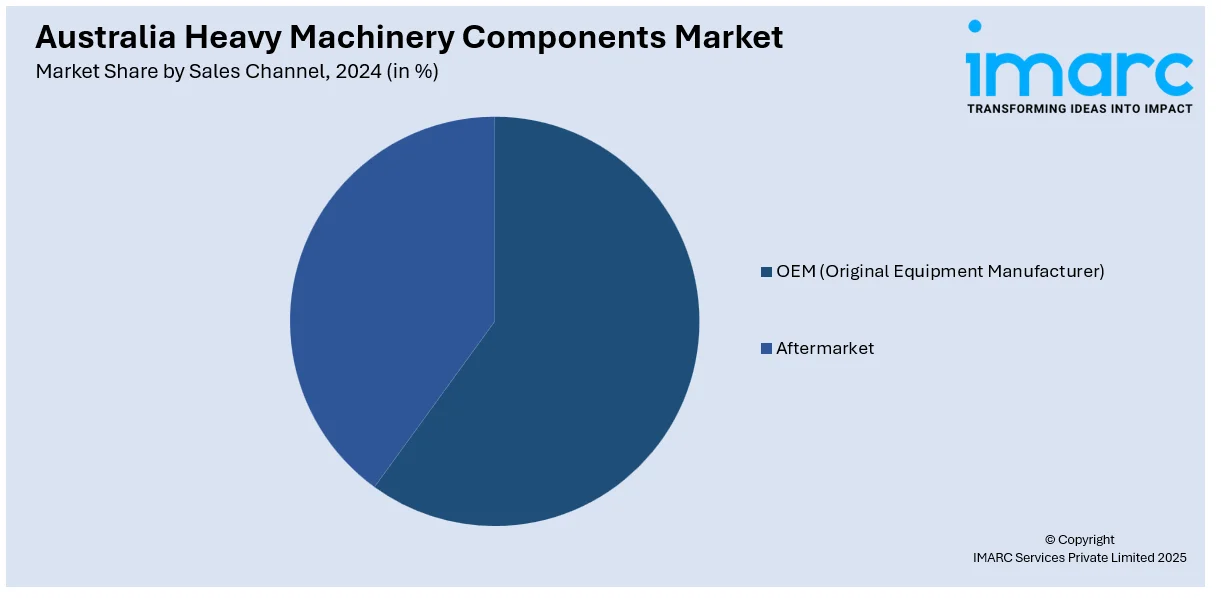

Sales Channel Insights:

- OEM (Original Equipment Manufacturer)

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes OEM (original equipment manufacturer) and aftermarket.

End Use Industry Insights:

- Construction and Infrastructure

- Mining and Metallurgy

- Agriculture

- Manufacturing

- Oil and Gas

- Energy and Power

- Others

The report has provided a detailed breakup and analysis of the market based on the end use industry. This includes construction and infrastructure, mining and metallurgy, agriculture, manufacturing, oil and gas, energy and power, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Heavy Machinery Components Market News:

- In 2024, At MINExpo Liebherr and Fortescue announced an expansion of their partnership, committing to the delivery of 475 zero-emission mining machines, including 360 autonomous battery-electric T 264 trucks. These trucks are equipped with Fortescue Zero's battery power systems and are part of a broader initiative to establish a large-scale zero-emission mining ecosystem by 2030. Additionally, the collaboration includes the development of 60 electric PR 776 dozers and 55 R 9400 E electric excavators, marking a significant step towards decarbonizing mining operations in Australia .

- In 2024, Mechatronix and Thiess have deepened their collaboration to retrofit mining trucks with carbon-fibre reinforcements, enhancing durability and payload capacity. Following successful trials, Thiess increased its stake in Mechatronix to 50%, with plans to apply this technology across its global fleet.

Australia Heavy Machinery Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Steel, Aluminum, Cast Iron, Composites, Others |

| Machinery Types Covered | Construction Equipment, Mining Equipment, Agriculture Equipment, Industrial Machinery, Oil and Gas Equipment, Others |

| Sales Channels Covered | OEM (Original Equipment Manufacturer), Aftermarket |

| End Use Industries Covered | Construction and Infrastructure, Mining and Metallurgy, Agriculture, Manufacturing, Oil and Gas, Energy and Power, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia heavy machinery components market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia heavy machinery components market on the basis of component type?

- What is the breakup of the Australia heavy machinery components market on the basis of material type?

- What is the breakup of the Australia heavy machinery components market on the basis of machinery type?

- What is the breakup of the Australia heavy machinery components market on the basis of sales channel?

- What is the breakup of the Australia heavy machinery components market on the basis of end use industry?

- What is the breakup of the Australia heavy machinery components market on the basis of region?

- What are the various stages in the value chain of the Australia heavy machinery components market?

- What are the key driving factors and challenges in the Australia heavy machinery components market?

- What is the structure of the Australia heavy machinery components market and who are the key players?

- What is the degree of competition in the Australia heavy machinery components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia heavy machinery components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia heavy machinery components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia heavy machinery components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)