Australia High-Brightness LED Market Size, Share, Trends and Forecast by Application, Distribution Channel, Indoor and Outdoor Application, End-Use Sector, and Region, 2025-2033

Australia High-Brightness LED Market Overview:

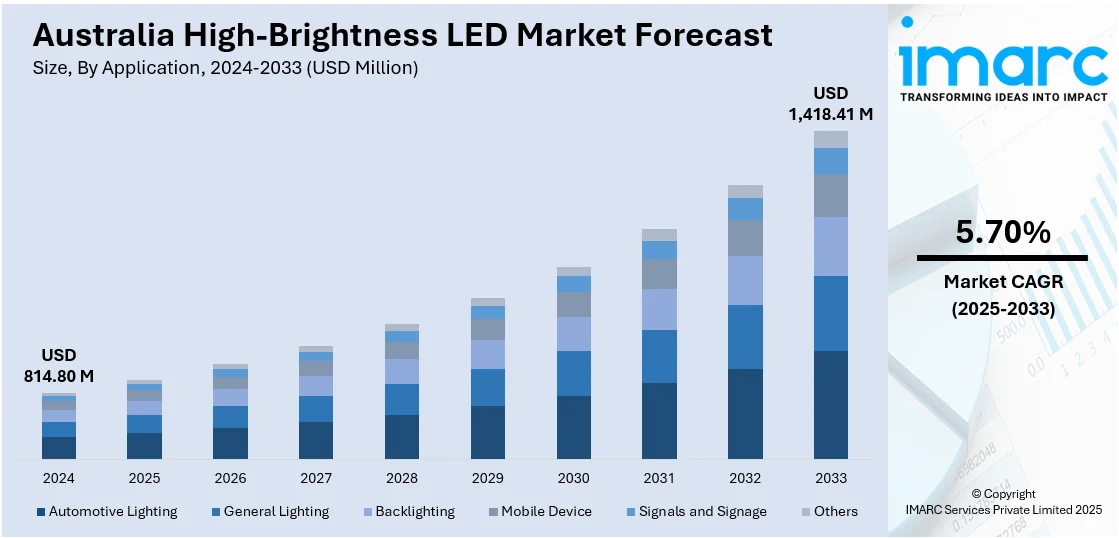

The Australia high-brightness LED market size reached USD 814.80 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,418.41 Million by 2033, exhibiting a growth rate (CAGR) of 5.70% during 2025-2033. Heightening energy prices, favorable policies, and increasing urbanization are strongly accelerating market growth. Smart city programs, coupled with developments in automotive headlamps and industrial lighting, are driving amplified demand. In addition, government efficiency standards, mass retrofitting of office buildings, and increasing usage in signage and display systems are supporting market growth. Apart from this, decreasing light-emitting diode (LED) prices and design, heat management and color performance technical improvements, and the drive for sustainability and reliable, low-maintenance lighting are propelling the Australia high-brightness LED market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 814.80 Million |

| Market Forecast in 2033 | USD 1,418.41 Million |

| Market Growth Rate 2025-2033 | 5.70% |

Australia High-Brightness LED Market Trends:

Government Energy-Efficiency Policies

The market is significantly contributed by strict government policies aimed at energy efficiency. Policy measures, such as the National Construction Code (NCC) necessitate low-energy lighting in new buildings, contributing directly to increasing high-brightness light-emitting diode (HB LED) usage. According to the reports, in December 2023, Haneco Lighting Australia Pvt. Ltd. released the Stax G4 outdoor floodlights with selectable color temperature, double power, and optional PIR motion sensors, which can be used in domestic, commercial, and industrial segments. Moreover, government programs at both federal and state levels, including rebates and incentives for domestic and commercial upgrades to LEDs, have also driven market growth. These efforts are part of Australia's overall carbon-reduction plans, calling on businesses and residences to install new, energy-efficient lighting systems in place of older, energy-wasteful ones. Public education campaigns and collaboration with utilities have also promoted end-user awareness of long-term savings from LED usage. As the government implements progressively stringent sustainability plans, especially for public property and business buildings, demand for high-brightness LEDs should remain unrelenting, which is further boosting the Australia high-brightness LED market growth.

To get more information on this market, Request Sample

Smart City and Urban Infrastructure Projects

The rise of smart city projects across Australia has become a major catalyst for the high-brightness LED market. Cities like Sydney, Melbourne, and Brisbane are investing heavily in smart infrastructure, covering street lighting, public transportation systems, and digital signage, where HB-LEDs offer clear advantages. These LEDs provide high luminosity, long service life, and lower energy costs, aligning with the core objectives of smart city frameworks focused on efficiency and automation. HB-LEDs are being widely deployed in smart streetlights that use sensors and connectivity to adjust brightness based on real-time activity, improving safety while reducing power consumption. In transport networks, they are used in platform lighting, station signage, and vehicle indicators. The scalability and performance of HB-LEDs make them ideal for such integrated systems. As urban areas increasingly prioritize smart upgrades and data-driven infrastructure, the adoption of HB-LED technology is expected to rise in tandem.

Growth in Automotive LED Usage

The automotive sector in Australia is playing a significant role in boosting demand for high-brightness LEDs. Automakers are increasingly using HB-LEDs in headlamps, taillights, daytime running lights, and interior lighting systems due to their low energy usage, compact size, and aesthetic flexibility. Furthermore, these lights not only improve vehicle visibility and safety but also allow car manufacturers to offer more modern and distinctive designs. With rising consumer preference for electric and hybrid vehicles, where battery efficiency is paramount, HB-LEDs are becoming a preferred choice because they reduce power draw compared to traditional lighting. Furthermore, local demand for premium vehicles and aftermarket customization is supporting this trend. As vehicle safety standards become more rigorous, and design innovation remains a competitive factor, the role of high-brightness LEDs in the automotive lighting segment is set to grow.

Australia High-Brightness LED Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on application, distribution channel, indoor and outdoor application, and end-use sector.

Application Insights:

- Automotive Lighting

- General Lighting

- Backlighting

- Mobile Device

- Signals and Signage

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes automotive lighting, general lighting, backlighting, mobile device usage, signals and signage, and others.

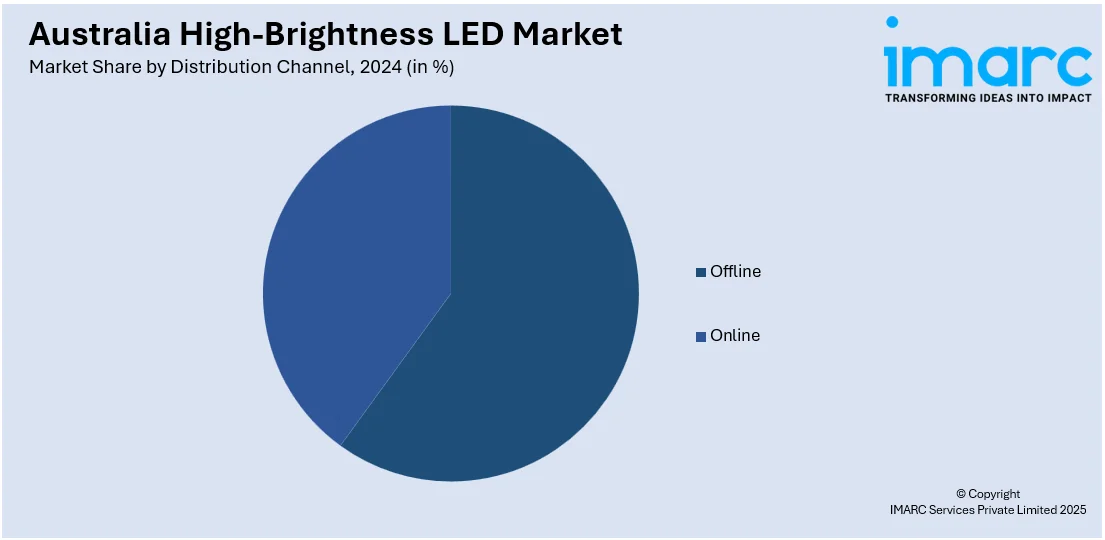

Distribution Channel Insights:

- Offline

- Online

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes offline and online.

Indoor and Outdoor Application Insights:

- Indoor

- Outdoor

The report has also provided a detailed breakup and analysis of the market based on indoor and outdoor application. This includes indoor and outdoor.

End-Use Sector Insights:

- Commercial

- Residential

- Industrial

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use sector. This includes commercial, residential, industrial, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia High-Brightness LED Market News:

- In May 2025, VAILO has launched the PC amber version of its Zenith Gen-V luminaire, which is created to tackle problems white LEDs pose in wildlife-friendly situations. This top-performing floodlight, well-suited for use in sports stadiums, highways, and airports, suppresses blue light and maintains essential features such as UV protection and cockatoo interference resistance.

- In January 2025, Hisense introduced its 116-inch TriChroma RGB LED TV, At CES 2025, featuring individual red, green, and blue LEDs. This technology achieves 10,000 nits peak brightness and 97% of the BT.2020 color space, offering enhanced brightness and color accuracy. The TV is set to launch in Australia later this year.

Australia High-Brightness LED Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Automotive Lighting, General Lighting, Backlighting, Mobile Device, Signals and Signage, Others |

| Distribution Channels Covered | Offline, Online |

| Indoor and Outdoor Applications Covered | Indoor, Outdoor |

| End-Use Sectors Covered | Commercial, Residential, Industrial, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia high-brightness LED market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia high-brightness LED market on the basis of application?

- What is the breakup of the Australia high-brightness LED market on the basis of distribution channel?

- What is the breakup of the Australia high-brightness LED market on the basis of indoor and outdoor application?

- What is the breakup of the Australia high-brightness LED market on the basis of end-use sector?

- What is the breakup of the Australia high-brightness LED market on the basis of region?

- What are the various stages in the value chain of the Australia high-brightness LED market?

- What are the key driving factors and challenges in the Australia high-brightness LED market?

- What is the structure of the Australia high-brightness LED market and who are the key players?

- What is the degree of competition in the Australia high-brightness LED market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia high-brightness LED market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia high-brightness LED market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia high-brightness LED industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)