Australia High-Pressure Pumps Market Size, Share, Trends and Forecast by Type, Pressure, End User Industry, and Region, 2025-2033

Australia High-Pressure Pumps Market Overview:

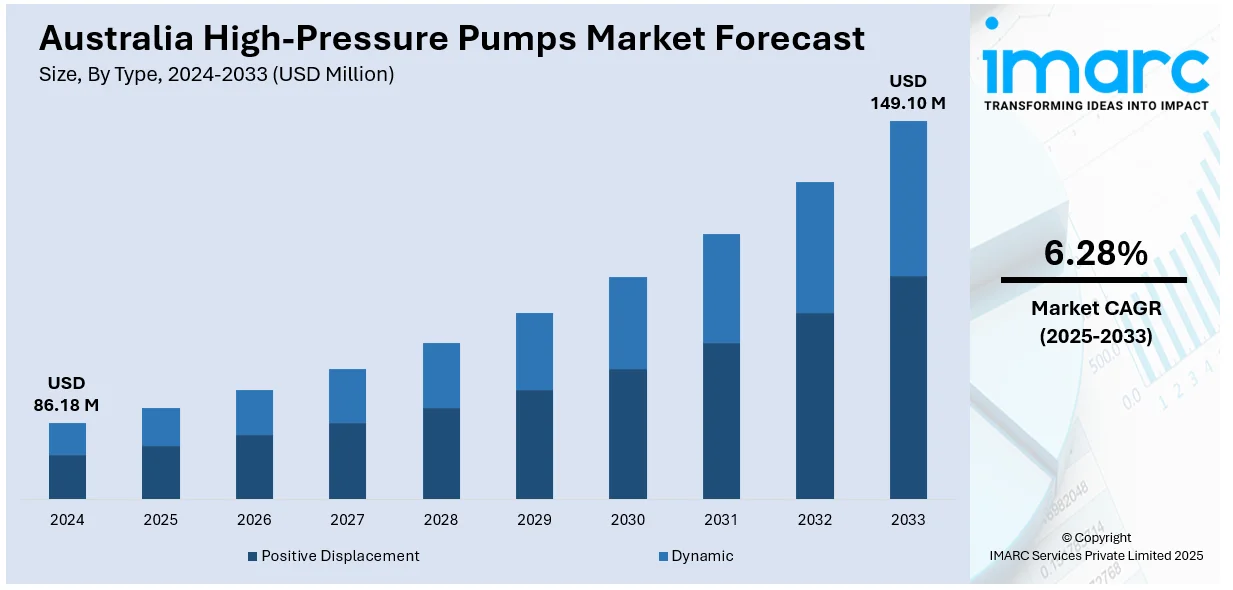

The Australia high-pressure pumps market size reached USD 86.18 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 149.10 Million by 2033, exhibiting a growth rate (CAGR) of 6.28% during 2025-2033. Expanding mining activities, burgeoning investments in water and wastewater treatment, rising industrial manufacturing, and ongoing oil and gas operations. Moreover, higher adoption in agricultural irrigation, growing preference for automation, stricter fire safety regulations, and booming construction projects are supporting the market growth. Furthermore, rising desalination plant installations, demand for high-pressure cleaning systems, upgrades in power generation infrastructure, and sustained government spending on public utilities and infrastructure are boosting the Australia high-pressure pumps market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 86.18 Million |

| Market Forecast in 2033 | USD 149.10 Million |

| Market Growth Rate 2025-2033 | 6.28% |

Australia High-Pressure Pumps Market Trends:

Expansion of Mining Operations Across Western Australia

Western Australia remains a key mining hub, with growing activity across commodities like iron ore, lithium, and gold. This expansion has directly increased the demand for high-pressure pumps. These pumps are essential in handling heavy-duty tasks such as dewatering pits, moving slurry, and supporting mineral processing systems. As companies scale up operations to meet export demand, there is a clear need for more reliable and efficient pumping solutions. High-pressure pumps are also preferred due to their ability to perform under tough conditions, including high temperatures and corrosive materials. With several new projects under development and existing ones expanding, pump manufacturers are seeing strong business from the mining sector. There’s also growing attention on using pumps that reduce downtime and energy usage. This means companies are not only looking for heavy-duty performance but also expecting smarter and longer-lasting equipment suited to Australia’s rugged mining environments.

To get more information on this market, Request Sample

Increasing Investments in Water and Wastewater Treatment Infrastructure

Australia is investing more in water and wastewater treatment systems due to rising urban populations and water scarcity concerns. High-pressure pumps are a core part of these treatment plants, especially in processes like reverse osmosis and membrane filtration, where strong pressure is needed to push water through filters. As cities grow, so does the volume of wastewater, pushing the need for plant upgrades and new facilities. Governments and private companies are responding by expanding treatment capacity and improving efficiency. For example, in 2024, the New South Wales government announced a $1.5 billion investment in water infrastructure, which includes upgrading existing wastewater treatment plants and constructing new desalination facilities to address water scarcity in coastal regions. This move aims to enhance the state's resilience to climate variability and population growth, and it will rely heavily on high-pressure pumps for desalination and filtration processes. There's also more focus on reusing water and investing in desalination plants, both of which require reliable high-pressure pumps. With stricter environmental regulations in place, treatment facilities are adopting newer, energy-efficient pump models that offer consistent output. This has led to steady demand for pumps that are durable, low-maintenance, and capable of handling large volumes under pressure without performance drops, especially in municipal and industrial setups.

Growth in Industrial Manufacturing and Chemical Processing Sectors

Australia’s industrial and chemical sectors are seeing gradual growth, which is adding to the demand for high-pressure pumps. These pumps are used in a range of operations—moving fluids through production lines, mixing chemicals, and cleaning equipment. In chemical processing, high-pressure pumps are important because they help handle hazardous or corrosive materials safely. In manufacturing, they’re often used in cooling systems or automated machinery. As industries aim to boost efficiency and reduce energy costs, they’re switching to pumps that are both powerful and smart, with features like flow control and condition monitoring. The push toward local manufacturing in sectors such as food, pharma, and specialty chemicals is also creating more need for reliable pumping equipment. Companies want pumps that are not only high-performing but also meet safety standards and are easy to maintain. This steady industrial activity is keeping demand strong across both new installations and equipment replacements, which is further driving the Australia high-pressure pumps market growth.

Australia High-Pressure Pumps Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, pressure, and end user industry.

Type Insights:

- Positive Displacement

- Dynamic

The report has provided a detailed breakup and analysis of the market based on the type. This includes positive displacement and dynamic.

Pressure Insights:

- 30 bar to 100 bar

- 100 bar to 500 bar

- Above 500 bar

A detailed breakup and analysis of the market based on the pressure have also been provided in the report. This includes 30 bar to 100 bar, 100 bar to 500 bar, and above 500 bar.

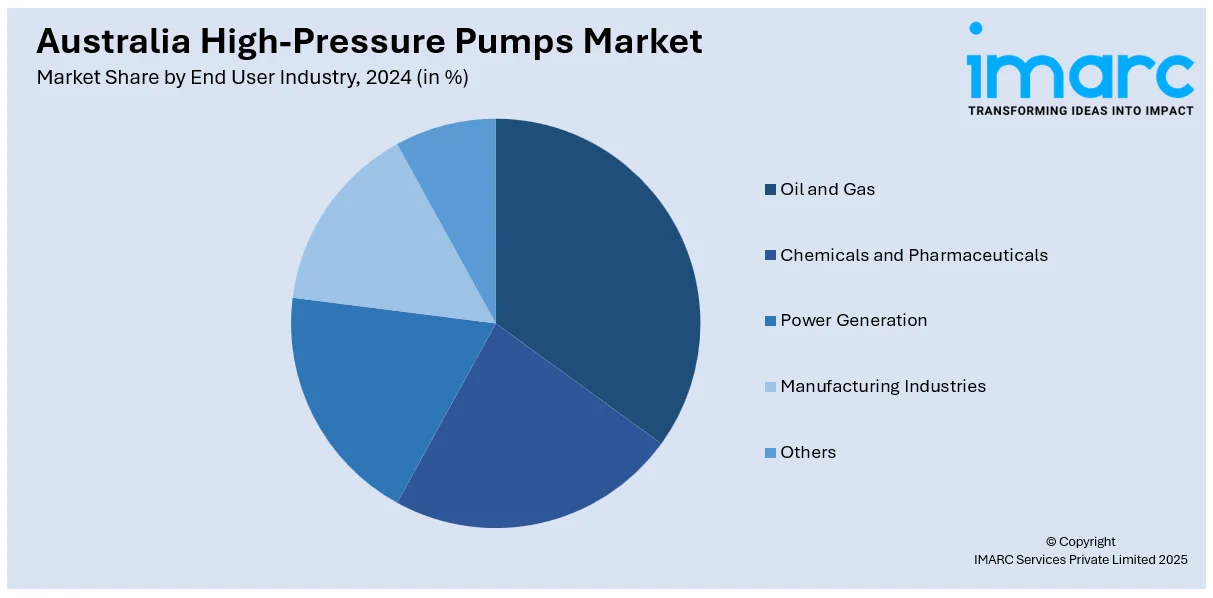

End User Industry Insights:

- Oil and Gas

- Chemicals and Pharmaceuticals

- Power Generation

- Manufacturing Industries

- Others

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes oil and gas, chemicals and pharmaceuticals, power generation, manufacturing industries, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia High-Pressure Pumps Market News:

- In 2025, Pumps Australia unveiled a new Stainless Steel Grade 316 Impeller for its Nitro Series Pumps. This innovation enhances durability and performance, catering to demanding applications in the high-pressure water industry.

- In 2025, Franklin Electric Co Inc has acquired Australia-based PumpEng Pty Ltd, a worldwide OEM of submersible pumps for the mining industry. The acquisition further solidifies Franklin Electric's dedication to the mining industry and complements current operations in Australia under the Pioneer Pump and Minetuff brands.

- In 2024, Waterco Limited announced the acquisition of Davey Water Products, a subsidiary of GUD Holdings Limited, for approximately USD 64.9 million. This strategic move aims to expand Waterco's reach and solidify its position as a leading Australian-owned entity in the water industry.

Australia High-Pressure Pumps Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Positive Displacement, Dynamic |

| Pressures Covered | 30 bar to 100 bar, 100 bar to 500 bar, Above 500 bar |

| End User Industries Covered | Oil and Gas, Chemicals and Pharmaceuticals, Power Generation, Manufacturing Industries, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia high-pressure pumps market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia high-pressure pumps market on the basis of type?

- What is the breakup of the Australia high-pressure pumps market on the basis of pressure?

- What is the breakup of the Australia high-pressure pumps market on the basis of end user industry?

- What is the breakup of the Australia high-pressure pumps market on the basis of region?

- What are the various stages in the value chain of the Australia high-pressure pumps market?

- What are the key driving factors and challenges in the Australia high-pressure pumps market?

- What is the structure of the Australia high-pressure pumps market and who are the key players?

- What is the degree of competition in the Australia high-pressure pumps market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia high-pressure pumps market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia high-pressure pumps market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia high-pressure pumps industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)