Australia Home Automation Market Size, Share, Trends and Forecast by Type, Technology, End User, and Region, 2025-2033

Australia Home Automation Market Overview:

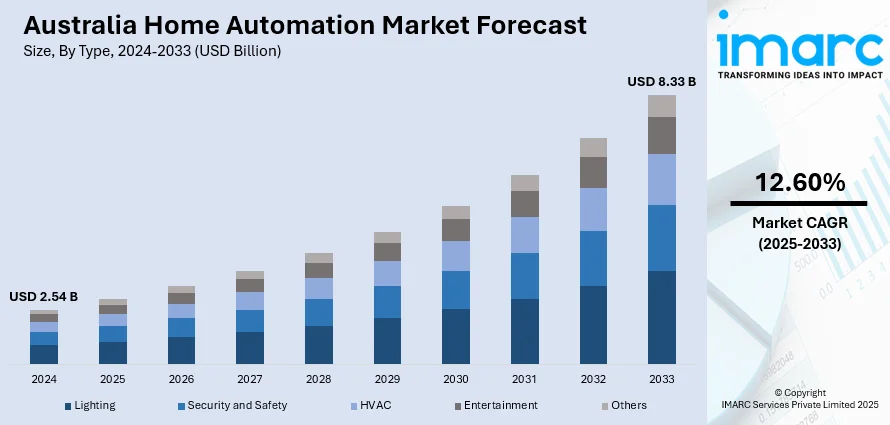

The Australia home automation market size reached USD 2.54 Billion in 2024. Looking forward, the market is expected to reach USD 8.33 Billion by 2033, exhibiting a growth rate (CAGR) of 12.60% during 2025-2033. The market is driven by rising electricity costs and homeowner interest in energy efficiency. Also, widespread smart device adoption and broadband access are fueling the product adoption. Additionally, sustainability regulations in new housing developments are accelerating market entry. Smart infrastructure mandates, improved connectivity, and changing consumer behavior are some of the other factors positively impacting the Australia home automation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.54 Billion |

| Market Forecast in 2033 | USD 8.33 Billion |

| Market Growth Rate 2025-2033 | 12.60% |

Key Trends of Australia Home Automation Market:

Rising Energy Costs and Demand for Efficiency in Residential Living

Australia has experienced sustained increases in residential electricity prices over the past decade, prompting homeowners to seek ways to manage and reduce consumption. Home automation systems have gained popularity as effective tools for controlling lighting, heating, cooling, and appliance use. These systems provide real-time energy data, enabling users to make informed decisions about power usage and avoid peak-rate periods. The integration of smart thermostats, lighting controls, and appliance scheduling into daily household routines is becoming more common, especially in metro regions such as Sydney, Melbourne, and Brisbane. Consumers are also showing a preference for devices that work seamlessly across ecosystems—such as those compatible with Google Home, Amazon Alexa, or Apple HomeKit—allowing broader and more intuitive control. On February 18, 2025, Schneider Electric released the third edition of its Home & Distribution Consumer Survey, revealing that while 87% of Australian homeowners rank energy efficiency as their top home improvement priority, 60% remain hesitant to adopt smart home technologies due to high upfront costs. The survey highlighted a gap between environmental intent and actual action, with only 28% planning to switch to renewable energy sources and 53% expressing reluctance to use AI for household tasks. Despite this, younger Australians are showing more willingness to invest, spending 30% above the national average on energy-efficient upgrades. As energy efficiency becomes a higher priority, particularly with the shift toward time-of-use tariffs and solar integration, automation offers both convenience and cost mitigation. This is a major factor driving Australia home automation market growth, particularly among homeowners investing in solar-plus-storage systems and smart metering. As energy retailers and hardware providers collaborate to deliver bundled services, more Australians are adopting home automation as a standard feature of modern living.

To get more information on this market, Request Sample

Increased Penetration of Smart Devices and Broadband Connectivity

The widespread availability of high-speed internet and falling prices for connected devices have accelerated smart technology adoption across Australian households. With over 90% of homes now connected to broadband, and growing 5G network coverage, consumers are better positioned to install and operate connected home systems. The average Australian household owns multiple smart devices—from TVs and voice assistants to connected security cameras and lighting systems. As digital literacy improves and integration becomes easier through app-based platforms, even older demographics are embracing smart home products. On February 29, 2024, Samsung Electronics Australia released its Australians@Home in 2029 report, revealing that nearly 50% of Australians are open to AI transforming their homes in the next five years. The report, developed with futurist Steve Sammartino, outlined five trends set to reshape Australian living: Ambient AI ecosystems, Rolling Lounge Rooms, Soft Robotics, AI-powered Energy Management, and Transparent TVs. It also highlighted that 63% of Australians plan to buy smart home devices in 2024, with Gen Z and Millennials leading adoption. Retailers are responding by expanding product ranges and offering flexible installation services, including do-it-yourself kits and professional smart home packages. In addition, cloud storage, remote monitoring, and mobile alerts have made home security automation more appealing, particularly in suburban and semi-rural areas. The ability to monitor homes remotely, automate lights or locks, and control appliances from smartphones adds a level of convenience and safety that is increasingly considered essential. Growing consumer awareness, combined with affordable device pricing, is contributing to greater product penetration across both new constructions and retrofitted homes.

Growth Factors of Australia Home Automation Market:

Growing Consumer Awareness and Digital Literacy

Australia’s increasingly connected society is contributing to rising consumer awareness about the benefits of smart home technologies. A significant part of the population is adequately skilled and versed in the developments of the digital world, such as smart devices, voice devices, and application-controlled systems. Such awareness has created a cultural shift such that the integration of smart homes is no longer a luxury but a convenient lifestyle improvement. The extra comfort, control, and customization that these technologies bring attract consumers, including urban households, especially. Technologically inclined people will be interested in automating their settings in terms of switching on lights, temperature control, appliance scheduling, and so on. This shift in perception and lifestyle is directly influencing the rising adoption rates of home automation across Australia.

Government Support for Smart Infrastructure

Government initiatives at both federal and state levels are playing a vital role in driving the Australia home automation market demand. Strategic plans aimed at building smart cities and sustainable urban environments have led to increased funding for infrastructure projects that integrate automation technologies. Regulatory bodies are also updating building codes to encourage energy-efficient construction and smart grid readiness, further enabling widespread adoption of connected home systems. These policy frameworks support innovation by incentivizing developers and builders to incorporate automation features in new residential projects. Additionally, smart energy management and sustainability goals are aligning with national climate targets, making automation not just a convenience but a necessity. This regulatory backing significantly boosts market confidence and accelerates technological adoption across the country.

Aging Population and Assisted Living Needs

Australia’s aging population is emerging as a key driver of home automation growth, particularly in the context of assisted living and independent aging. As the number of elderly residents increases, there is growing demand for in-home technologies that enhance comfort, safety, and autonomy. Features such as voice-controlled lighting, fall detection systems, smart locks, and emergency response integration provide critical support for older adults who wish to live independently. These technologies reduce the reliance on caregivers and create a safer living environment. Additionally, families and healthcare providers recognize the role of smart homes in remote monitoring and medical alerts. This growing reliance on home automation for elderly care is encouraging broader adoption, especially among senior households and healthcare-focused housing developments.

Opportunities of Australia Home Automation Market:

Expansion into Rental and Multi-Unit Housing

The home automation market in Australia is witnessing growing adoption beyond single-family residences, particularly in rental and multi-unit dwellings. Developers and property managers are now equipping apartments and high-rise buildings with smart technologies like digital door locks, automated lighting, and centralized energy monitoring systems. According to the Australia home automation market analysis, these features not only boost operational efficiency for building management but also attract tech-savvy tenants who prioritize convenience, security, and sustainability. Smart intercom systems, app-based access control, and shared amenity bookings are enhancing the appeal of such properties in competitive urban rental markets. Additionally, automated energy usage tracking aligns with eco-conscious living preferences. As housing density increases in Australia’s major cities, the integration of home automation into rental and multi-occupancy settings represents a significant growth opportunity.

Integration with Renewable Energy Systems

Australia’s widespread adoption of rooftop solar and emphasis on sustainable living creates a natural alignment with home automation systems. Smart homes are increasingly integrating with renewable energy technologies, enabling real-time energy monitoring, intelligent load balancing, and predictive energy usage. Systems like smart inverters and connected battery storage optimize the consumption of solar-generated power, allowing homeowners to shift toward self-sufficiency and lower electricity bills. Automation tools can prioritize appliance use during peak solar production hours or manage storage discharges during high-demand periods. Moreover, linking home automation with energy dashboards and apps gives users greater control and visibility over their energy behaviors. This integration not only supports environmental goals but also reinforces the financial value of smart homes among sustainability-minded consumers.

Demand for Comprehensive Home Security Solutions

Security remains one of the strongest motivators behind home automation adoption in Australia, particularly in urban and suburban areas. Homeowners are increasingly investing in comprehensive smart security systems that offer real-time monitoring, motion detection, and instant alerts. Devices such as smart doorbells, surveillance cameras, glass break sensors, and connected alarms are becoming standard components of modern homes. These systems can be remotely controlled via smartphones and are often integrated with law enforcement or security agencies for faster response in emergencies. In addition to physical safety, features like automated lighting schedules and presence simulation add layers of deterrence. The emphasis on safety and peace of mind continues to drive interest in robust, easy-to-use, and scalable home security automation solutions.

Challenges of Australia Home Automation Market:

High Initial Installation and Maintenance Costs

While consumer interest in smart home automation is steadily rising, the high initial investment required remains a significant barrier to widespread adoption. Purchasing smart devices such as lighting systems, thermostats, home hubs, and security equipment involves considerable upfront costs. In addition to hardware expenses, installation charges—particularly for complex systems that require professional setup—add to the financial burden. Middle-income households often perceive these technologies as non-essential due to budget constraints. Furthermore, ongoing costs related to software subscriptions, updates, and occasional device repairs increase the long-term financial commitment. This cost sensitivity limits market penetration outside affluent segments. Until manufacturers and service providers offer more affordable, scalable solutions, adoption will likely remain concentrated among high-income consumers or early tech adopters.

Data Privacy and Cybersecurity Concerns

As smart home ecosystems grow increasingly interconnected, concerns around data privacy and cybersecurity have become more prominent among Australian consumers. Devices such as smart cameras, voice assistants, and connected appliances continuously gather personal data that could be vulnerable to breaches, hacking, or unauthorized surveillance. Many users hesitate to adopt these systems fully due to fears about how their data is stored, used, and shared by third-party providers. Additionally, inconsistent privacy policies and lack of transparency further erode consumer trust. Ensuring end-to-end encryption, secure user authentication, and compliance with Australian data protection laws is crucial for the home automation industry. Gaining consumer confidence will depend heavily on the industry’s ability to prioritize robust security protocols and transparent data handling practices.

Interoperability and Compatibility Issues

The fragmented nature of the smart home technology market poses a serious challenge for homeowners looking to build fully integrated systems. With a wide array of brands and platforms offering different standards, achieving seamless interoperability remains difficult. Consumers frequently encounter compatibility issues when attempting to connect devices from various manufacturers, leading to frustrating user experiences and additional expenses for bridging technologies or separate apps. These limitations discourage widespread adoption, especially among users seeking simplicity and convenience. The absence of universal protocols or industry-wide standards restricts the scalability of home automation systems. Overcoming this challenge will require stronger collaboration between tech providers and adherence to open standards that allow smooth, cross-platform functionality and user-friendly integration across all smart devices.

Australia Home Automation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, technology, and end user.

Type Insights:

- Lighting

- Relay

- Dimmers

- Switches

- Others

- Security and Safety

- Bells

- Locks

- Security Cameras

- Others

- HVAC

- Thermostats

- Sensors

- Control Valves

- Others

- Entertainment

- Home Theater System

- Audio, Volume, and Multimedia Controls

- Others

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes lighting (relay, dimmers, switches, and others), security and safety (bells, locks, security cameras, and others), HVAC (thermostats, sensors, control valves, and others), entertainment (home theater system, audio, volume, and multimedia controls, and others), and others.

Technology Insights:

- Wired

- Wireless

The report has provided a detailed breakup and analysis of the market based on the technology. This includes wired and wireless.

End User Insights:

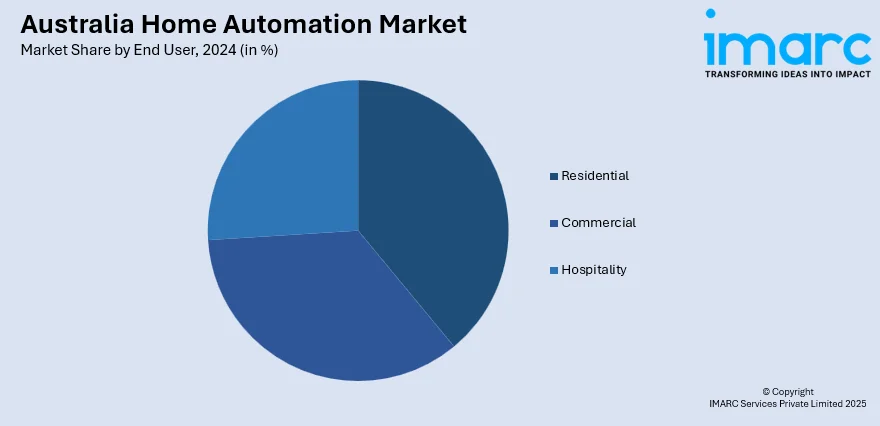

- Residential

- Commercial

- Hospitality

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and hospitality.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Automation Market News:

- On December 4, 2024, Honeywell announced it will provide building automation solutions for Victoria’s new all-electric Melton Hospital under a 25-year contract, integrating its Honeywell Forge software to enhance energy efficiency and operational performance. As the first fully electric hospital in the state, the facility will use AI-driven systems for real-time monitoring, condition-based maintenance, and automatic energy optimization—supporting Victoria’s goal of net-zero emissions by 2050.

Australia Home Automation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Technologies Covered | Wired, Wireless |

| End Users Covered | Residential, Commercial, Hospitality |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home automation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home automation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home automation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home automation market in Australia was valued at USD 2.54 Billion in 2024.

The Australia home automation market is projected to exhibit a CAGR of 12.60% during 2025-2033.

The Australia home automation market is projected to reach a value of USD 8.33 Billion by 2033.

The Australia home automation market is witnessing increased adoption of AI-driven systems, voice-controlled devices, and IoT-based integrated platforms. Growth in retrofitting solutions and modular automation products allows wider market reach, particularly in rental properties and older homes across urban and regional areas, which is further accelerating market growth.

Key growth drivers include government initiatives promoting smart infrastructure, rising demand for enhanced home security, and increasing integration with renewable energy systems. An aging population also fuels the adoption of assisted living. These factors, combined with growing digital literacy and affordability of connected devices, are accelerating smart home technology adoption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)