Australia Home Automation Systems Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Home Automation Systems Market Overview:

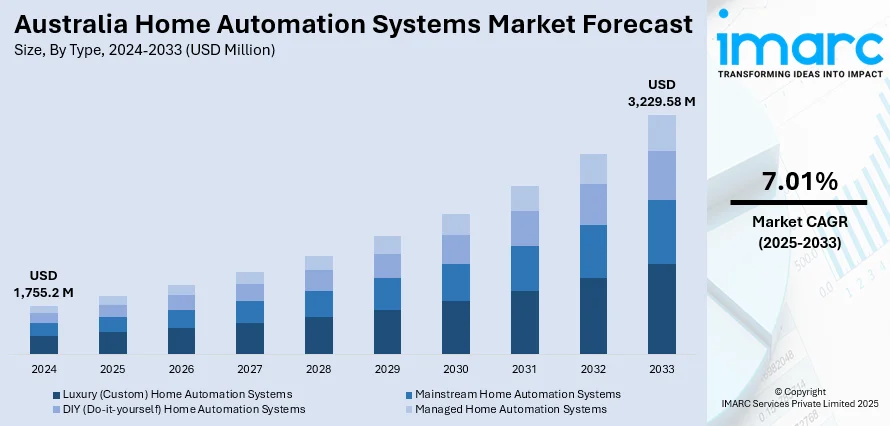

The Australia home automation systems market size reached USD 1,755.2 Million in 2024. Looking forward, the market is expected to reach USD 3,229.58 Million by 2033, exhibiting a growth rate (CAGR) of 7.01% during 2025-2033. Growing demand for energy-efficient solutions, rising adoption of smart appliances, and government initiatives promoting sustainable housing are some of the factors contributing to Australia home automation systems market share. Increased smartphone penetration and improved internet infrastructure further support the integration of connected devices across residential applications, boosting market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,755.2 Million |

| Market Forecast in 2033 | USD 3,229.58 Million |

| Market Growth Rate 2025-2033 | 7.01% |

Key Trends of Australia Home Automation Systems Market:

Rising Focus on Smart Energy Solutions

Energy-efficient living is becoming a key priority for Australian households, especially among younger homeowners who are investing significantly more in smart energy upgrades. Despite inflationary concerns, consumers are increasingly aligning their choices with long-term sustainability goals. A major shift is underway as smart technologies become more accessible and desirable, driven by growing environmental awareness. Energy-conscious buyers are reshaping expectations around home infrastructure, leading to wider adoption of automation systems. As digital innovation meets consumer demand for efficiency and control, the market is witnessing expanding interest in solutions that optimize electricity use and reduce carbon impact. This direction signals strong momentum for intelligent, sustainable home environments across Australia’s residential sector. These factors are intensifying the Australia home automation systems market growth. For example, a Schneider Electric survey conducted in February 2025 showed strong interest in home automation among Australians, with 87% prioritizing energy efficiency. Young homeowners lead the trend, investing 30% more than average in smart energy upgrades. Despite cost pressures, households are keen on long-term sustainability and plan to adopt smart technologies. Growing awareness and evolving preferences indicate a positive outlook for Australia’s home automation systems market, driven by innovation and energy-conscious consumer behavior.

To get more information on this market, Request Sample

Smart Construction Boosts Automation Potential

Australia’s adoption of 3D-printed housing is reshaping residential development, offering faster construction and lower costs while creating a natural fit for automation integration. With institutions working to standardize the technology, these digitally fabricated homes are emerging as ideal platforms for embedding smart systems from the ground up. The current build in Dubbo highlights how this approach can expand access to energy-efficient living, particularly in underserved regions. As 3D printing gains momentum, it complements the shift toward intelligent housing by enabling more streamlined design, embedded controls, and scalable automation. This convergence of construction innovation and digital home systems signals broader accessibility and deeper penetration of smart living solutions across Australia’s residential landscape. For instance, as per industry reports, Australia’s push toward sustainable housing is accelerating with the rise of 3D-printed homes, opening new opportunities for home automation integration. Swinburne University, alongside SmartCrete CRC and Standards Australia, is leading efforts to standardize the technology. In Dubbo, NSW’s first 3D-printed social housing project is underway, promising faster builds and lower costs. These smart construction advances pave the way for automated, energy-efficient living in regional and remote communities.

Growth Drivers of Australia Home Automation Systems Market:

Rising Focus on Smart Energy Solutions

Australian households are increasingly adopting home automation systems to optimize energy consumption and reduce costs. Escalating electricity bills and increased environmental concern have compelled consumers to look for energy-saving solutions like automated lighting, climate control, and smart thermostats. Not only do these technologies reduce energy wastage, but they also contribute to fulfilling national sustainability objectives. Government stimulus in encouraging the incorporation of renewable energy, such as solar and smart grids, motivates individuals toward adoption. The real-time monitoring and control of energy consumption through mobile applications or voice assistants strongly appeals to environmentally aware consumers, which is driving the Australia home automation systems market demand. As sustainability turns into a lifestyle, energy-centric automation solutions continue to gain traction in both suburban and urban households.

Smart Construction Boosts Automation Potential

The increasing adoption of smart construction practices in Australia is expanding opportunities for home automation systems. Modern residential projects are being designed with pre-installed smart infrastructure, including IoT-enabled wiring, centralized control hubs, and energy management frameworks. Developers are integrating these solutions to attract buyers seeking technologically advanced living spaces. Growing investment in green and smart building projects also creates demand for automation in lighting, HVAC, and security systems. Homebuyers are more inclined to invest in properties that offer long-term convenience, safety, and efficiency. According to the Australia home automation systems market analysis, this trend is particularly prominent in urban development where sustainability and technology-driven lifestyles are marketed as key differentiators. Such construction practices significantly accelerate the penetration of automation systems in new homes.

Security and Lifestyle Enhancement Driving Adoption

Beyond energy savings, home automation in Australia is increasingly valued for enhancing security and lifestyle convenience. Automated surveillance cameras, motion detectors, and smart locks provide homeowners with peace of mind, particularly in urban centers where safety concerns are growing. Integration with mobile devices allows remote monitoring and control, adding layers of convenience. Additionally, lifestyle-focused features like voice-controlled entertainment systems, smart appliances, and mood-based lighting create a modern living experience tailored to consumer preferences. Rising disposable incomes and changing lifestyle aspirations encourage families to invest in these advanced solutions. As demand for safer, more comfortable, and connected living spaces rises, home automation systems are becoming a mainstream choice for Australian households.

Australia Home Automation Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Luxury (Custom) Home Automation Systems

- Mainstream Home Automation Systems

- DIY (Do-it-yourself) Home Automation Systems

- Managed Home Automation Systems

The report has provided a detailed breakup and analysis of the market based on the type. This includes luxury (custom) home automation systems, mainstream home automation systems, DIY (do-it-yourself) home automation systems, and managed home automation systems.

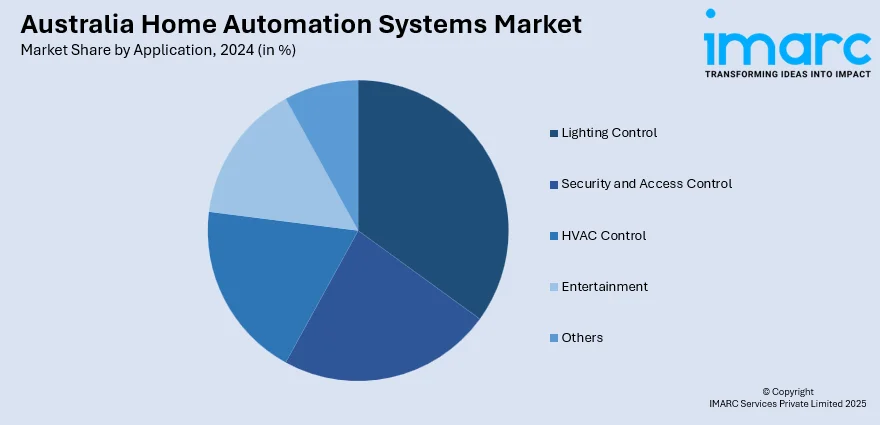

Application Insights:

- Lighting Control

- Security and Access Control

- HVAC Control

- Entertainment

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes lighting control, security and access control, HVAC control, entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Automation Systems Market News:

- In January 2024, OliverIQ, introduced at the 2024 Consumer Electronics Show (CES), has emerged as the industry’s first fully integrated Smart Home-as-a-Service (SHaaS) provider. Its subscription-based platform unifies leading smart home devices within a single, user-friendly application, supported by 24/7 unlimited technical assistance to ensure seamless connectivity and enhanced customer experience.

- In October 2023, Synnex Australia announced a new strategic alliance with EZVIZ, a globally recognized leader in smart home security technologies. Through this collaboration, Synnex significantly broadens its product portfolio by incorporating EZVIZ’s advanced and diverse range of innovative home security solutions, further strengthening its presence in the connected living space.

Australia Home Automation Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Luxury (Custom) Home Automation Systems, Mainstream Home Automation Systems, DIY (Do-it-yourself) Home Automation Systems, Managed Home Automation Systems |

| Applications Covered | Lighting Control, Security and Access Control, HVAC Control, Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home automation systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home automation systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home automation systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The home automation systems market in Australia was valued at USD 1,755.2 Million in 2024.

The Australia home automation systems market is projected to exhibit a CAGR of 7.01% during 2025-2033.

The Australia home automation systems market is projected to reach a value of USD 3,229.58 Million by 2033.

The Australia home automation systems market is driven by increasing adoption of smart devices, growing preference for energy-efficient solutions, and integration of IoT and AI technologies. Rising demand for enhanced security, voice-controlled assistants, and seamless connectivity is further shaping consumer interest, fueling innovation, and expanding the market landscape.

The Australia home automation systems market is fueled by rising smart home adoption, increasing consumer focus on convenience and security, and growing energy efficiency awareness. Expanding IoT ecosystem, affordability of connected devices, and government initiatives supporting sustainable living further accelerate market penetration and long-term growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)