Australia Home Decor Market Report by Product Type (Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, and Others), Distribution Channel (Home Decor Stores, Supermarkets and Hypermarkets, Online Stores, Gift Shops, and Others), and Region 2025-2033

Australia Home Decor Market Size and Share:

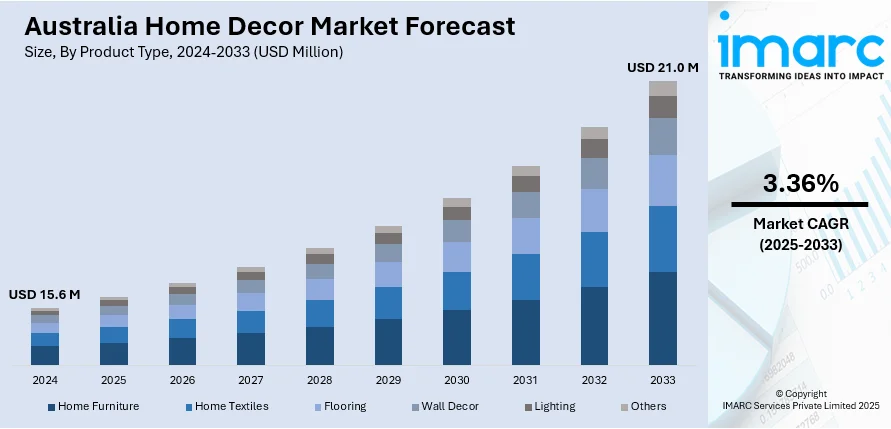

Australia home decor market size reached USD 15.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 21.0 Million by 2033, exhibiting a growth rate (CAGR) of 3.36% during 2025-2033. The inflating need among individuals for creating personalized and visually appealing living spaces is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 15.6 Million |

|

Market Forecast in 2033

|

USD 21.0 Million |

| Market Growth Rate 2025-2033 | 3.36% |

Australia Home Decor Market Analysis:

- Major Market Drivers: The elevating levels of lifestyle and the growing focus on creating aesthetically pleasing living spaces on account of the inflating disposable income of consumers living in the country are primarily driving the growth of the market. Moreover, as individuals across the country are increasingly prioritizing decorating their homes, the demand for diverse elements, including furniture, lighting, textiles, etc., witnesses a notable surge.

- Key Market Trends: The proliferation of online platforms and e-commerce channels plays a pivotal role in market expansion. Additionally, with rising awareness towards environmental impact, consumers seek eco-friendly and ethically sourced home decor products, thereby positively influencing the market growth in Australia. This trend encourages innovation and the widespread adoption of sustainable materials, reflecting a broader shift towards responsible consumerism.

- Challenges and Opportunities: Changing trends in interior design, long lead times, minimum delivery requirements dictated by suppliers, high competition in the market, and rising customer expectations are a few challenges in the market. However, the expanding construction in the country, along with the rising spending power of consumers, is anticipated to offer lucrative growth opportunities to the market in the coming years.

To get more information of this market, Request Sample

Australia Home Decor Market Trends:

Increasing Rate of Home Ownership

Due to fast-changing lifestyles and a rise in the number of house possessions, the Australia home decor market is experiencing a significant growth. In 2022, Australia’s construction industry reported a gross value added (GVA) of around AUD$ 156 billion, with the industry’s GVA standing at about AUD$120 billion as of September 2023. The increasing population in the country is bolstering the need for more housing, commercial buildings, social spaces, and infrastructure. This, in turn, is leading to an increase in the house ownership rates in the country. In the December quarter of 2023, the number of residential dwellings in Australia reached a peak of 11.13 Million, rising by around 52,500 dwellings from the previous quarter. Such a massive rise in home ownership is creating a positive outlook for the home decor market. Home decor products like furniture, textiles, and floor coverings are increasingly being used to enhance the living space.

Growing Focus on Health and Wellness

Health-conscious consumers are increasingly opting for home decor items made from natural and sustainable materials. In addition, people are preferring materials like bamboo, reclaimed wood, organic cotton, and eco-friendly paints as they reduce exposure to harmful chemicals and promote a healthier indoor environment. Additionally, numerous organizations are offering eco-friendly home decor items to cater to this consumer demand. For instance, the co-owners of The Render Shed, a paint-selling enterprise in Australia, sell environmentally friendly paints and are the main ACT distributor of EcoStyle Paints by Rockcote. These premium-quality paints are known for their durability as well as being non-toxic and extremely low-volatile organic compounds (VOCs). Apart from this, the rising popularity of the biophilic design approach, which incorporates natural elements like plants, natural light, and natural textures into interior spaces, is also contributing to the market growth. Moreover, the easy availability of energy efficient LED lights and ergonomic furniture across online retail channels is also contributing to the growth of the Australia home decor market.

Increasing Integration of Smart Technology

Integration of smart technology in decor products assists in providing enhanced experiences to individuals. In addition, it offers improved convenience and control. Furthermore, the rising popularity of voice-activated assistants, such as Amazon's Alexa, Google Assistant, and Apple's Siri, since they provide personalized assistance and information, is creating a positive outlook for the overall market. Smart decor products often include security features like connected cameras, doorbell cameras, and smart locks. Additionally, various companies are continuously investing in new product designs. For example, Google's Nest smart-home division recently introduced a new smart thermostat. The new Nest Thermostat is a simpler model than the Nest Learning Thermostat or Nest Thermostat E and is offered at a lower price of US$ 129.99, accounting for a difference of US$ 40 less than the Nest E and US$ 120 less than the top-of-the-line third-generation Nest Learning Thermostat. It was made available to pre-order immediately.

Apart from this, the escalating demand for smart lighting solutions that allow users to monitor and optimize energy consumption is offering significant growth opportunities to the overall market. Smart lighting systems can automatically adjust brightness based on natural light levels, reducing electricity usage and lowering energy bills.

Australia Home Decor Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Breakup by Product Type:

- Home Furniture

- Home Textiles

- Flooring

- Wall Decor

- Lighting

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes home furniture, home textiles, flooring, wall decor, lighting, and others.

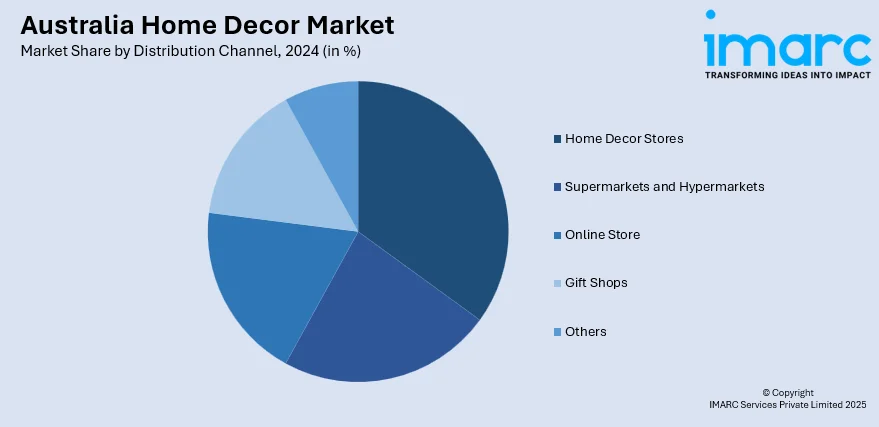

Breakup by Distribution Channel:

- Home Decor Stores

- Supermarkets and Hypermarkets

- Online Store

- Gift Shops

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes home decor stores, supermarkets and hypermarkets, online stores, gift shops, and others.

Breakup by Region:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Decor Market Latest News:

- October 2023: Ikea announced the location of its latest shopfront in Australia and is expected to open the door of its new stores in 2024. Ikea Australia market area manager Johanna Gbenplay said the new stores were part of the brand’s focus on making their products more accessible to customers.

- November 2022: Brilliant Lighting, a leader in smart light solutions, in Australia, introduced DIY light kits. These lights are easy to install and can be installed easily without the help of an electrician.

Australia Home Decor Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Home Furniture, Home Textiles, Flooring, Wall Decor, Lighting, Others |

| Distribution Channels Covered | Home Decor Stores, Supermarkets and Hypermarkets, Online Stores, Gift Shops, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home decor market performed so far and how will it perform in the coming years?

- What has been the impact of COVID-19 on the Australia home decor market?

- What is the breakup of the Australia home decor market on the basis of product type?

- What is the breakup of the Australia home decor market on the basis of distribution channel?

- What are the various stages in the value chain of the Australia home decor market?

- What are the key driving factors and challenges in the Australia home decor?

- What is the structure of the Australia home decor market and who are the key players?

- What is the degree of competition in the Australia home decor market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home decor market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home decor market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home decor industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)