Australia Home Safe Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia Home Safe Market Size and Share:

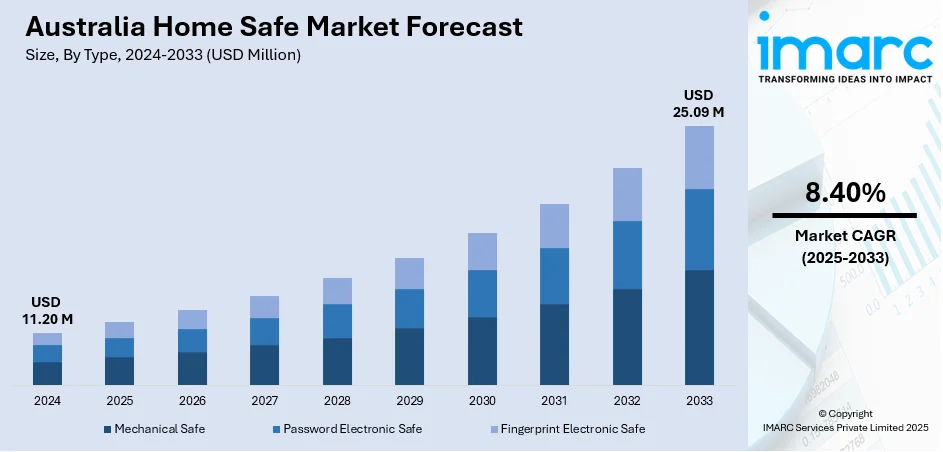

The Australia home safe market size reached USD 11.20 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 25.09 Million by 2033, exhibiting a growth rate (CAGR) of 8.40% during 2025-2033. The market is driven by the increase in awareness among Australian homeowners about home safety and security issues. Furthermore, growing demand for smart home technology and advanced security systems are propelling market growth. Additionally, increasing crime rates and enhanced emphasis on protecting families are creating more investments for home safety solutions in urban and rural regions, further augmenting the Australia home safe market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 11.20 Million |

| Market Forecast in 2033 | USD 25.09 Million |

| Market Growth Rate 2025-2033 | 8.40% |

Australia Home Safe Market Trends:

Growing Awareness About Home Safety

Australian homeowners in recent years have shown an increased concern for home safety, fueled by increasing crime levels within major cities as well as heightened media reporting of home invasions and burglaries. According to an industry report, 2.1% of households in Australia (217,600) experienced a break-in during the 2023-24 period. This data represents an increasingly anxious sense of vulnerability among occupants, which has led to a shift in consumer behavior toward taking precautionary measures within their properties. This, in turn, is positively impacting the Australia home safe market growth. Consequently, the demand for home safes is increasing, with Australians increasingly perceiving them as part of an overall home security plan. The awareness is also promoted by insurance firms, which, in many cases, provide premium incentives for homes with certified safes and security systems. Besides this, awareness campaigns conducted by law enforcement and private security companies emphasize the necessity of secure storage. The COVID-19 pandemic also influenced this trend with an increase in people working from home and storing sensitive work documents in-house. Therefore, the market is witnessing high growth as customers prioritize safety, privacy, and peace of mind when making purchases.

To get more information on this market, Request Sample

Integration of Smart Home Security Systems

The integration of home safes into broader smart home security ecosystems is a defining trend in the Australian market. According to industry reports, the country’s national digital inclusion index has shown consistent improvement, rising from an average score of 67.5 in 2020 to 73.2 in 2023. This upward trajectory highlights a population that is increasingly comfortable with digital technologies and more inclined to adopt interconnected, tech-driven solutions for everyday needs, including home security. Consumers are increasingly seeking interconnected solutions that allow centralized control of various security components, including safes, surveillance cameras, motion detectors, and alarm systems. This is driven by the growth of IoT devices and increased access to inexpensive, easy-to-use smart home platforms. Apart from this, the introduction of home safes with features such as Wi-Fi or Bluetooth connectivity that provide real-time notifications, remote locking/unlocking, and status checks through smartphones or voice assistants is enhancing the market appeal. This degree of integration enhances situational awareness, allowing homeowners to respond promptly to any threat. Cloud storage of access logs and video recordings also provides an added layer of accountability and evidence in the event of a security breach. The need for such integrated systems is strongest among young homebuyers and technology users who appreciate convenience, automation, and full coverage. As smart home adoption increases, the role of connected safes in these systems is likely to expand significantly.

Australia Home Safe Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- Mechanical Safe

- Password Electronic Safe

- Fingerprint Electronic Safe

The report has provided a detailed breakup and analysis of the market based on the type. This includes mechanical safe, password electronic safe, and fingerprint electronic safe.

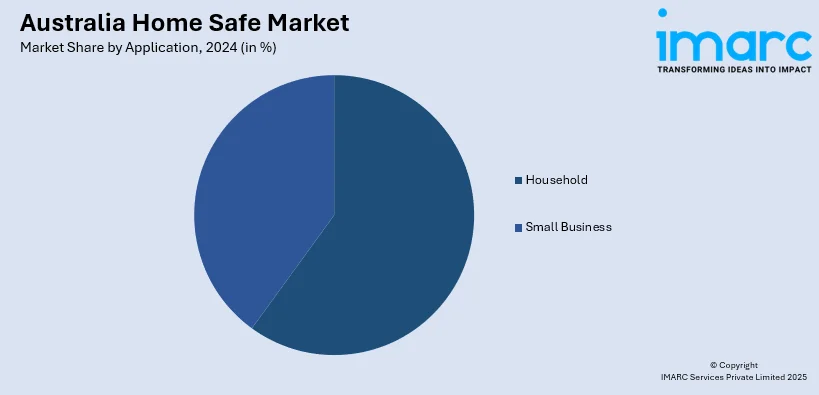

Application Insights:

- Household

- Small Business

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes household and small business.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Safe Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mechanical Safe, Password Electronic Safe, Fingerprint Electronic Safe |

| Applications Covered | Household, Small Business |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home safe market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home safe market on the basis of type?

- What is the breakup of the Australia home safe market on the basis of application?

- What is the breakup of the Australia home safe market on the basis of region?

- What are the various stages in the value chain of the Australia home safe market?

- What are the key driving factors and challenges in the Australia home safe market?

- What is the structure of the Australia home safe market and who are the key players?

- What is the degree of competition in the Australia home safe market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home safe market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home safe market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home safe industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)