Australia Home Security Systems Market Size, Share, Trends and Forecast by Product, Residence Type, and Region, 2025-2033

Australia Home Security Systems Market Overview:

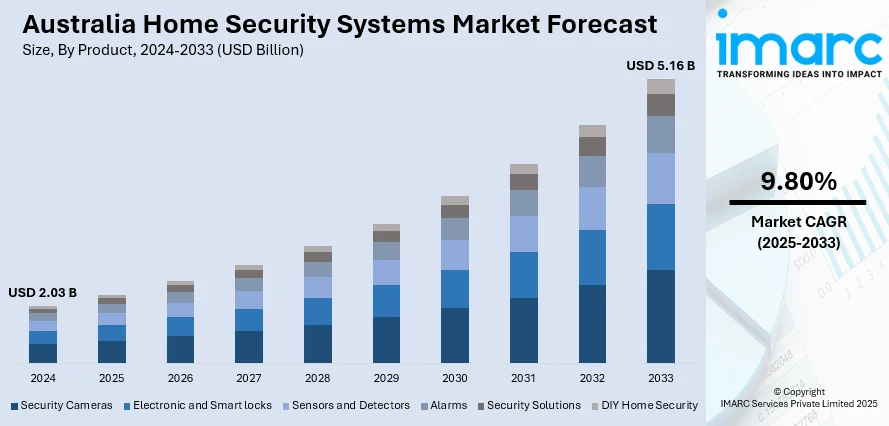

The Australia home security systems market size reached USD 2.03 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.16 Billion by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The growth of e-commerce and the increasing demand for surveillance cameras and video doorbells are driving the home security systems market. E-commerce makes security products more accessible and convenient, while surveillance technologies enhance safety by offering real-time monitoring and control, especially in high-crime areas, contributing to the expansion of the Australia home security systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.03 Billion |

| Market Forecast in 2033 | USD 5.16 Billion |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Home Security Systems Market Trends:

Growth of E-Commerce and Online Shopping Trends

As online shopping grows in popularity, more individuals are using digital platforms to buy security items since they are convenient and have affordable prices. A wider range of people can now access home security systems thanks to the increasing trend toward e-commerce, especially those living in rural or isolated areas where traditional retail options may be limited. The demand for a range of security devices, including as alarm systems, video doorbells, and surveillance cameras, is being fueled by the expansion of e-commerce platforms. These products are now readily available for online ordering and may be delivered right to customers' homes. As a result, producers and sellers are making significant investments in e-commerce platforms to access a wider customer base, driving market expansion. A clear illustration of this trend is evident in the Australian e-commerce sector, which was assessed at USD 536.0 Billion in 2024. As per IMARC Group, the market is projected to reach USD 1,568.60 Billion by 2033, experiencing a CAGR of 12.70% between 2025 and 2033. This increase in online shopping offers substantial opportunities for home security firms to meet the growing need for smart security solutions via online channels, boosting both recognition and sales nationwide.

To get more information on this market, Request Sample

Rising Demand for Surveillance Cameras and Video Doorbells

The increasing demand for surveillance cameras and video doorbells is a major factor propelling the Australia home security systems market growth, as individual desire improved visibility and control of their homes. Video monitoring is emerging as an essential part of home security systems, with video doorbells becoming more favored for their capability to deliver live video feeds, enabling homeowners to evaluate who is at their door prior to responding. This function is crucial for improving safety by keeping out unauthorized guests and offering useful proof if incidents occur. Furthermore, surveillance cameras, furnished with cutting-edge capabilities like motion sensing and night vision, are sought after for their capacity to oversee properties around the clock, providing reassurance. The rising fascination with these technologies corresponds to the growing need for greater safety and security, especially in regions with elevated crime levels. In 2024, Lorex officially launched in Australia, bringing a range of smart home security products to local clients via Officeworks. Their offerings included 2K and 4K video doorbells, Wi-Fi cameras, and floodlight systems with local storage, addressing the increasing need for sophisticated, dependable security solutions. As homeowners emphasize their safety and seek improved control, such options are ideally suited to fulfill the growing demand for advanced home security solutions.

Australia Home Security Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product and residence type.

Product Insights:

- Security Cameras

- Electronic and Smart locks

- Sensors and Detectors

- Alarms

- Security Solutions

- DIY Home Security

The report has provided a detailed breakup and analysis of the market based on the product. This includes security cameras, electronic and smart locks, sensors and detectors, alarms, security solutions, and DIY home security.

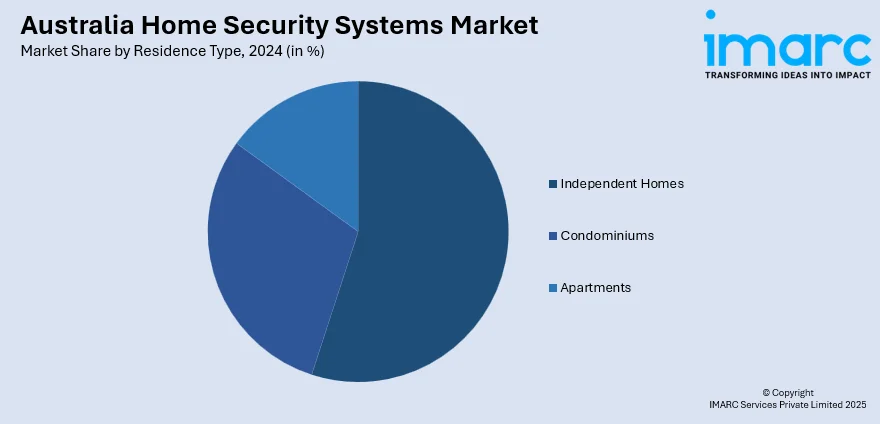

Residence Type Insights:

- Independent Homes

- Condominiums

- Apartments

A detailed breakup and analysis of the market based on the residence type have also been provided in the report. This includes independent homes, condominiums, and apartments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Home Security Systems Market News:

- In May 2025, Reolink launched the Altas 2K battery-powered security camera in Australia, featuring smart pre-recording that captures footage up to 10 seconds before motion is detected. It includes a 20,000mAh battery, optional solar panel, and ColorX night vision for vivid low-light recording. The camera offers AI detection and local storage with no subscription fees.

- In October 2024, Amazon Australia launched Blink, its affordable smart home security brand, featuring the Outdoor 4 and Mini 2 cameras with up to two years of battery life. Available at Bunnings and Amazon.com.au, Blink offered local storage and smart features like motion and person detection.

Australia Home Security Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Security Cameras, Electronic and Smart locks, Sensors and Detectors, Alarms, Security Solutions, DIY Home Security |

| Residence Types Covered | Independent Homes, Condominiums, Apartments |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia home security systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia home security systems market on the basis of product?

- What is the breakup of the Australia home security systems market on the basis of residence type?

- What is the breakup of the Australia home security systems market on the basis of region?

- What are the various stages in the value chain of the Australia home security systems market?

- What are the key driving factors and challenges in the Australia home security systems market?

- What is the structure of the Australia home security systems market and who are the key players?

- What is the degree of competition in the Australia home security systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia home security systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia home security systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia home security systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)