Australia Human Resources Services Market Report by Service Type (Recruitment and Staffing Services, HR Consulting, Payroll and Benefits Administration, Learning and Development (L&D), Outsourcing HR Functions, and Others), Enterprise Size (Large Enterprises, Small and Medium Enterprises (SMEs)), Industry Segmentation (Healthcare and Medical, Information Technology, Retail and Consumer Goods, Construction and Real Estate, Financial Services, Manufacturing and Industrial, Public Sector and Government, and Others), and Region 2025-2033

Australia Human Resources Services Market Overview:

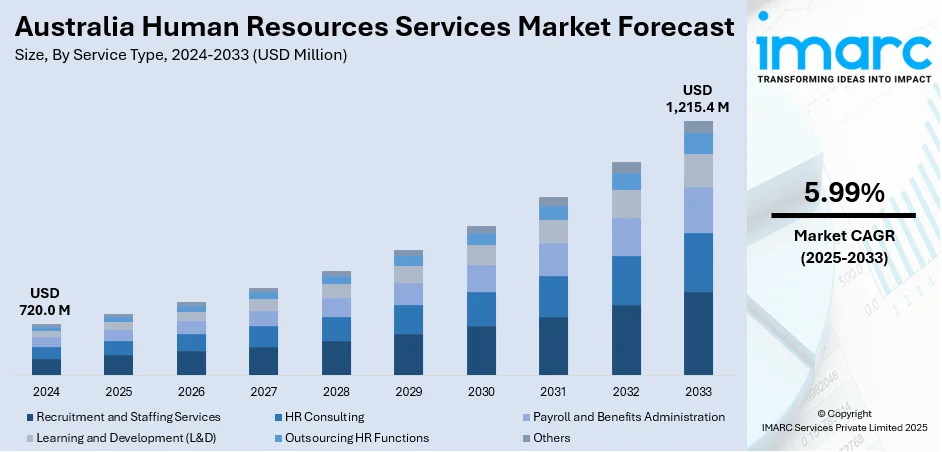

The Australia human resources services market size reached USD 720.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,215.4 Million by 2033, exhibiting a growth rate (CAGR) of 5.99% during 2025-2033. The market is primarily driven by the growing adoption of HR technology solutions, the increasing emphasis on employee physical and mental health, the increased need for workforce planning and recruitment services, and the adaptation to shifting workplace dynamics and the rising competition for hiring skilled professionals.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 720.0 Million |

|

Market Forecast in 2033

|

USD 1,215.4 Million |

| Market Growth Rate 2025-2033 | 5.99% |

Australia Human Resources Services Market Trends:

Increased Adoption of HR Technology

The market for human resources services in Australia is witnessing an increase in the use of HR technology solutions. Advanced HR management solutions, such as cloud-based software, artificial intelligence, and data analytics, are being integrated by businesses more frequently to expedite payroll, employee engagement, hiring, and performance management procedures. The need to strengthen decision-making, increase operational efficiency, and provide individualized employee experiences is essentially driving this shift. HR services that are automated, scalable, and flexible are in greater demand, particularly from large and mid-sized businesses. Additionally, the adoption of digital HR technologies is being enhanced by remote work practices and hybrid work models, which allow businesses to successfully manage a distributed staff.

To get more information on this market, Request Sample

Growing Focus on Employee Well-being and Mental Health

There is an increasing emphasis on employee well-being and mental health within the Australian market. Companies are recognizing the importance of implementing comprehensive support systems to enhance productivity, retention, and overall employee satisfaction. The challenges brought on by the COVID-19 pandemic have accelerated this trend, highlighting the necessity of programs focused on mental health, stress management, and work-life balance. As a result, businesses are prioritizing holistic approaches to foster healthier, more resilient work environments. In response, HR service providers are providing specialized services such as mental health resources, wellness programs, and employee assistance programs (EAPs). In order to create a healthy work environment, organizations are also introducing flexible work schedules and promoting an open and supportive culture.

Rise in Demand for Talent Acquisition and Workforce Planning

The Australian market for human resources services is witnessing an increase in demand for workforce planning and talent acquisition services. Companies are competing more and more for qualified workers, especially in high-demand sectors such as technology, healthcare, and finance. As a result, there is an increasing need for strategic recruitment solutions. To assist businesses in attracting and keeping top talent, HR service providers are providing customized talent acquisition initiatives, such as employer branding, recruitment process outsourcing (RPO), and data-driven hiring techniques. Consequently, workforce planning has become essential for companies seeking to adapt to the evolving market conditions, particularly with the growing prevalence of remote work and heightened employee expectations.

Australia Human Resources Services Market News:

- October 18, 2023: Employment Hero, an Australian firm, raised $167 million in a Series F round of funding, valuing the company at $1.37 billion. The company has released a "super app" called Swag in addition to its plans for worldwide expansion. This software seeks to transform the way people discover and get paid for work by fusing banking services with job-seeking tools. In addition, Employment Hero intends to upend the world financial system and is concentrated on real-time payment solutions.

Australia Human Resources Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service type, enterprise size, and industry segmentation.

Service Type Insights:

- Recruitment and Staffing Services

- HR Consulting

- Payroll and Benefits Administration

- Learning and Development (L&D)

- Outsourcing HR Functions

- Others

The report has provided a detailed breakup and analysis of the market based on the service type. This includes recruitment and staffing services, HR consulting, payroll and benefits administration, learning and development (L&D), outsourcing HR functions, and others.

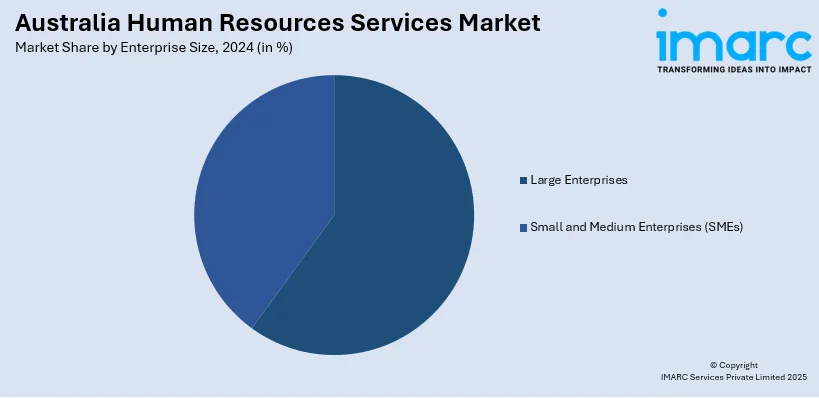

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises (SMEs)

The report has provided a detailed breakup and analysis of the market based on the enterprise size. This includes large enterprises and small and medium enterprises (SMEs).

Industry Segmentation Insights:

- Healthcare and Medical

- Information Technology

- Retail and Consumer Goods

- Construction and Real Estate

- Financial Services

- Manufacturing and Industrial

- Public Sector and Government

- Others

The report has provided a detailed breakup and analysis of the market based on the industry segmentation. This includes healthcare and medical, information technology, retail and consumer goods, construction and real estate, financial services, manufacturing and industrial, public sector and government, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Human Resources Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered |

Recruitment and Staffing Services, HR Consulting, Payroll and Benefits Administration, Learning and Development (L&D), Outsourcing HR Functions, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises (SMEs) |

| Industry Segmentations Covered | Healthcare and Medical, Information Technology, Retail and Consumer Goods, Construction and Real Estate, Financial Services, Manufacturing and Industrial, Public Sector and Government, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia human resources services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia human resources services market on the basis of service type?

- What is the breakup of the Australia human resources services market on the basis of enterprise size?

- What is the breakup of the Australia human resources services market on the basis of industry segmentation?

- What are the various stages in the value chain of the Australia human resources services market?

- What are the key driving factors and challenges in the Australia human resources services?

- What is the structure of the Australia human resources services market and who are the key players?

- What is the degree of competition in the Australia human resources services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia human resources services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia human resources services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia human resources services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)