Australia HVAC Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia HVAC Market Size and Share:

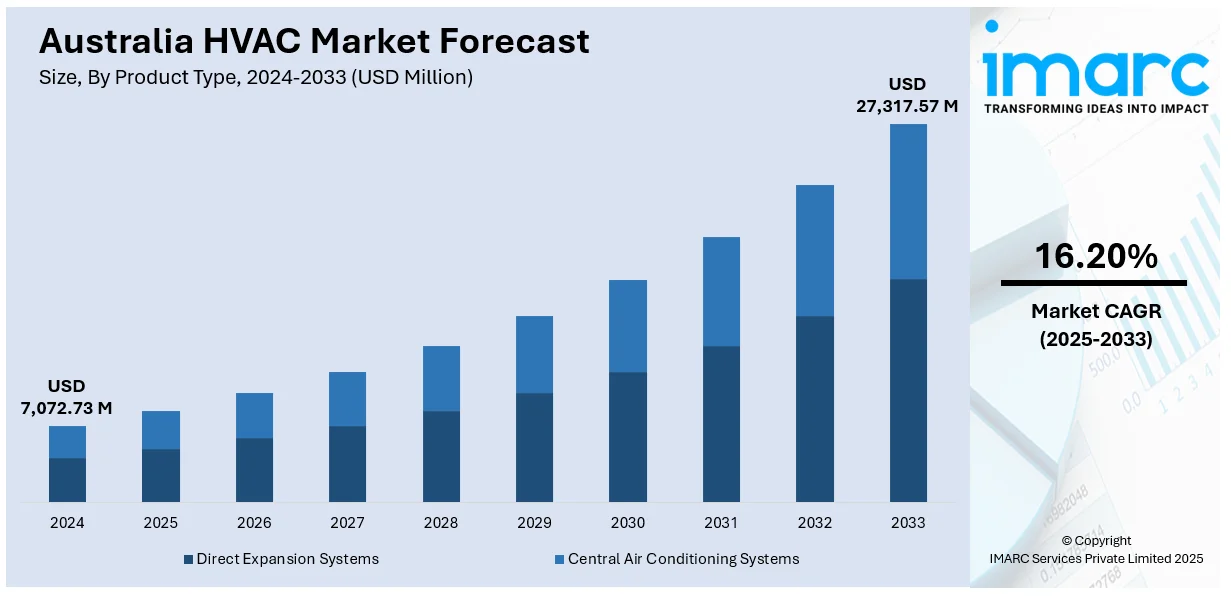

The Australia HVAC market size reached USD 7,072.73 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 27,317.57 Million by 2033, exhibiting a growth rate (CAGR) of 16.20% during 2025-2033. The market is driven by region-specific climate control needs, rising urban infrastructure investments, and rapid adoption of energy-efficient technologies. New construction and retrofit projects increasingly demand integrated, regulation-compliant systems across both residential and commercial sectors. Continued investment in smart, automated solutions is expected to reshape demand patterns, further augmenting the Australia HVAC market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7,072.73 Million |

| Market Forecast in 2033 | USD 27,317.57 Million |

| Market Growth Rate 2025-2033 | 16.20% |

Key Trends in Australia HVAC Market:

Climate Variability and Regional Weather Demands

Australia's vast geography creates sharp climatic contrasts between regions, requiring tailored heating, ventilation, and air conditioning solutions. Northern states contend with tropical and subtropical climates, where cooling requirements dominate, while southern areas face temperate to cool conditions that demand efficient heating systems. These regional temperature fluctuations have driven consistent demand across both residential and commercial sectors, prompting manufacturers and service providers to diversify their offerings. Government-mandated energy standards and comfort expectations have further influenced product development, making adaptability a key consideration in system design and installation. Urban density in coastal cities has also played a role. Residential high-rises and commercial complexes now require centralized systems that perform under varying load conditions, especially during seasonal peaks. This has led to increased investment in smart climate control and energy-efficient infrastructure. Developers prioritize integrated systems to comply with building regulations and sustainability benchmarks, especially in cities such as Sydney and Melbourne. Over time, demand patterns reflect not only ambient temperature shifts but also the long-term trend toward climate-conscious consumption. Regulatory changes in emission standards and energy consumption have introduced new technical requirements. On September 19, 2022, Beijer Ref signed an agreement to acquire 51% of Australian HVAC firms AAD and HVAC Consolidated for approximately SEK 480 million (USD 43.6 million), with an option to purchase the remaining shares. Together, the Melbourne-based companies reported turnover of about SEK 800 million (USD 72.7 million) in the 2021–2022 financial year and have a workforce of around 125 employees. The deal expands Beijer Ref’s footprint in the Australian HVAC distribution market, strengthens its product portfolio, and is expected to improve purchasing scale and profitability across the group. These shifts, combined with increased awareness about environmental impact, have contributed directly to Australia HVAC market growth through the adoption of newer, compliant technologies that meet both local and national guidelines.

To get more information on this market, Request Sample

Urban Infrastructure Expansion and Real Estate Activity

According to the Australia HVAC market analysis, construction activity in Australia’s urban centers has expanded steadily due to population growth, interstate migration, and rising demand for mixed-use developments. This has increased demand for HVAC installations across various segments, including commercial offices, retail spaces, hospitals, and educational facilities. The integration of advanced climate systems into new buildings has become standard practice, especially as developers seek to meet higher sustainability ratings under initiatives like NABERS and Green Star. Large-scale projects, including airport redevelopments, transport interchanges, and inner-city apartment complexes, have created consistent demand for sophisticated, centralized HVAC solutions. On June 26, 2024, Johnson Controls-Hitachi Air Conditioning launched a new range of high-efficiency HVAC products in Australia and New Zealand, including the air365 Max Pro, SideSmart, and airCore 700 systems, at ARBS 2024. The air365 Max Pro can reduce energy use by up to 39% at part load, while the SideSmart VRF system offers a maximum cooling capacity of 152 kW in a slim, modular format suited for retrofits. These releases align with Australia’s plan to cut HFC emissions to 15% of baseline levels by 2036 and support growing demand for low-carbon HVAC technologies across residential and commercial sectors. These systems are no longer seen as optional add-ons but core components of initial building design. The sector has responded with scalable systems capable of adjusting to different occupancy levels and load demands. As a result, contractors and developers engage HVAC consultants early in the planning process, driving innovation in system architecture and control integration. Retrofitting efforts in older buildings further add to the upward momentum. In metropolitan areas, heritage-listed properties and legacy infrastructure are being modernized with discrete, high-performance systems to improve energy ratings. These retrofits often require custom configurations, which have opened opportunities for manufacturers and specialists alike to provide tailored solutions that comply with modern codes without compromising architectural integrity.

Energy Efficiency

Energy efficiency has become a key consideration in the Australian HVAC market as consumers and businesses face rising electricity costs and increasing pressure to reduce carbon emissions. Buyers are actively seeking systems with high star ratings, inverter technology, and smart controls that help manage energy consumption more effectively. Regulatory standards and green building codes are reinforcing this shift, with many new developments requiring HVAC systems that meet strict efficiency criteria. Manufacturers are responding by launching products with improved performance and lower operating costs. This demand is particularly strong in both residential retrofits and commercial developments aiming for sustainability certifications. The emphasis on energy efficiency is significantly influencing purchasing decisions and contributing to the expansion of Australia HVAC market share.

Growth Drivers in Australia HVAC Market:

Population Growth

Australia’s growing population, particularly in urban centers like Sydney, Melbourne, and Brisbane, is driving strong demand for HVAC systems. As cities expand and housing density increases, there is greater need for reliable climate control in residential apartments, office buildings, schools, and healthcare facilities. New developments must include modern heating, ventilation, and cooling systems to meet comfort and energy efficiency expectations. Additionally, population growth leads to increased infrastructure projects—shopping centers, public buildings, and transport hubs—all requiring efficient HVAC installations. Developers and facility managers are prioritizing HVAC integration early in planning to ensure performance and compliance. This ongoing urban growth is a consistent driver in the Australia HVAC market, contributing to rising system sales, service contracts, and retrofit activity across multiple sectors.

Smart Technology Adoption

The rising interest in smart homes and commercial automation is boosting demand for connected HVAC systems in Australia. Consumers and building managers increasingly prefer units that integrate with mobile apps, voice control, and centralized energy management platforms. Features like remote temperature control, predictive maintenance alerts, and usage analytics are driving this shift. In commercial settings, building management systems (BMS) now often include HVAC automation to optimize efficiency and reduce energy costs. The appeal of convenience, better air quality control, and real-time system monitoring is accelerating adoption across residential and commercial segments. As smart technology becomes more affordable and mainstream, HVAC systems with advanced connectivity and automation are expected to drive the Australia HVAC market demand.

Workplace Air Quality Concerns

The COVID-19 pandemic brought workplace air quality into sharp focus, prompting employers and building owners across Australia to reevaluate their HVAC systems. Improved ventilation, air purification, and humidity control have become priorities to reduce the risk of airborne illness and create healthier indoor environments. Businesses are investing in upgraded filtration systems (like HEPA filters), increased outdoor air exchange, and air quality monitoring technologies. In commercial offices, schools, healthcare facilities, and retail spaces, these changes are now considered part of essential infrastructure. Compliance with updated health guidelines and the desire to attract employees back to physical workspaces are also driving upgrades. This renewed focus on indoor air health is a long-term driver contributing to demand growth in the Australia HVAC market.

Australia HVAC Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Direct Expansion Systems

- Central Air Conditioning Systems

The report has provided a detailed breakup and analysis of the market based on the product type. This includes direct expansion systems and central air conditioning systems.

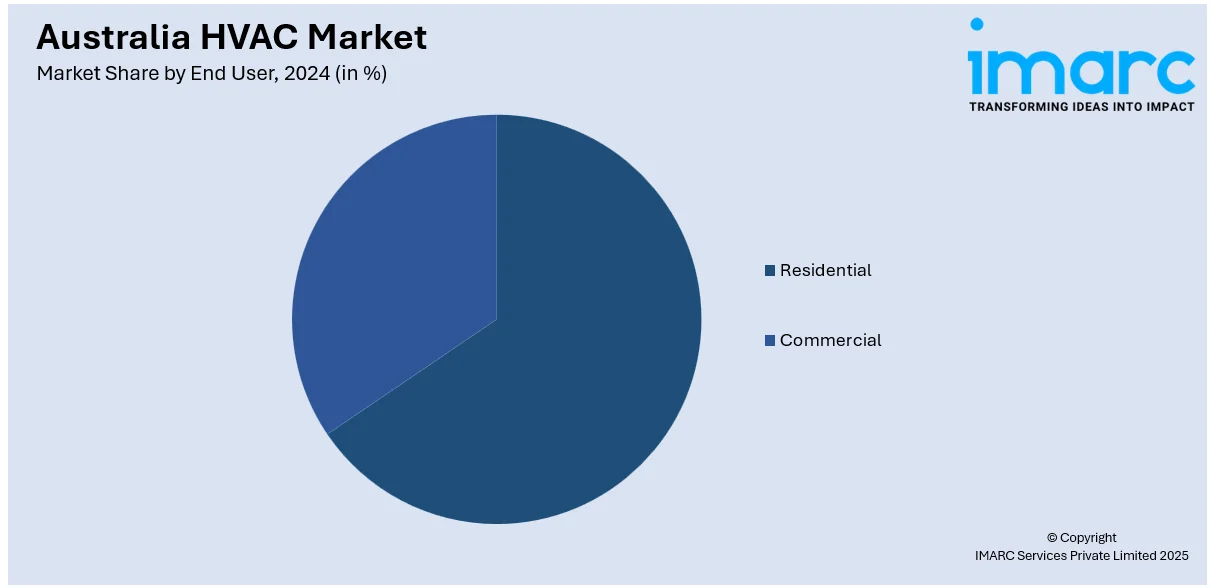

End User Insights:

- Residential

- Commercial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Daikin Australia Pty., Ltd.

- Haier Australia Pty Ltd

- Hitachi, Ltd.

- Johnson Controls

- Kirby HVAC&R Pty Ltd.

- LG Electronics

- Mitsubishi Electric Corporation

- Samsung Australia

- Trane Technologies International Limited

Australia HVAC Market News:

- On November 12, 2024, Fieldpiece Instruments Inc. acquired its long-time Australian master distributor, Fieldpiece Australia, establishing a direct corporate presence in the country and setting the groundwork for broader expansion in the Asia-Pacific HVACR market.

- On January 30, 2025, Sojitz Corporation acquired a 70% stake in New South Wales-based HVAC and mechanical services firm Climatech Group Holdings via its Australian subsidiary Ellis Air, consolidating total annual sales of JPY 45 billion (AUS$450 million / USD 295 million) across both companies. This move positions Sojitz as a top HVAC contractor in Australia.

Australia HVAC Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Direct Expansion Systems, Central Air Conditioning Systems |

| End Users Covered | Residential, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Daikin Australia Pty., Ltd., Haier Australia Pty Ltd, Hitachi, Ltd., Johnson Controls, Kirby HVAC&R Pty Ltd., LG Electronics, Mitsubishi Electric Corporation, Samsung Australia, Trane Technologies International Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia HVAC market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia HVAC market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia HVAC industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The HVAC market in the Australia was valued at USD 7,072.73 Million in 2024.

The Australia HVAC market is projected to exhibit a compound annual growth rate (CAGR) of 16.20% during 2025-2033.

The Australia HVAC market is expected to reach a value of USD 27,317.57 Million by 2033.

The market is seeing increased demand for energy-efficient systems, smart HVAC technology, and heat pumps. Post-pandemic air quality concerns and green building standards are influencing product design and installation. Retrofitting in aging buildings and rising interest in sustainable solutions are also shaping market direction.

Urban development, population growth, and climate variability are key drivers of HVAC demand. Government incentives and stricter energy efficiency regulations are encouraging system upgrades. Additionally, the adoption of smart technologies and growing awareness around indoor air quality in homes and workplaces are contributing to consistent market expansion.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)