Australia Hybrid Electric Vehicle Market Size, Share, Trends and Forecast by Propulsion Type, Configuration Type, Vehicle Type, Power Source, and Region, 2025-2033

Australia Hybrid Electric Vehicle Market Overview:

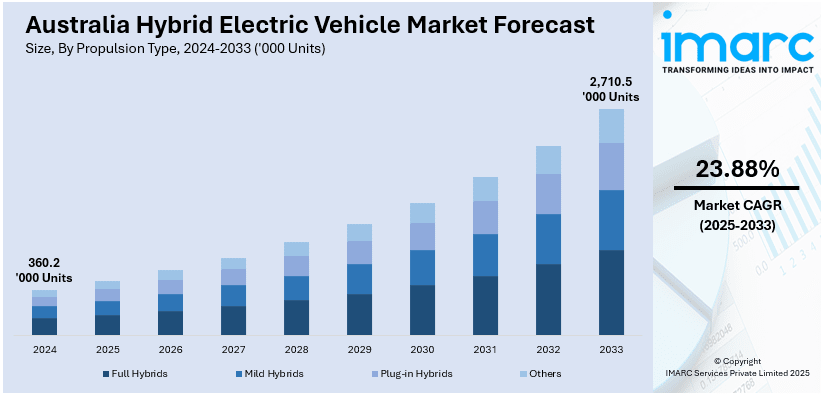

The Australia hybrid electric vehicle market size reached 360.2 Thousand Units in 2024. Looking forward, the market is expected to reach a volume of 2,710.5 Thousand Units by 2033, exhibiting a growth rate (CAGR) of 23.88% during 2025-2033. The market is fueled by government incentives, rising fuel prices, growing environmental awareness, and advancements in battery technology. Increasing consumer demand for fuel-efficient vehicles and expanding charging infrastructure further boost the Australia hybrid electric vehicle market share, supporting country’s transition toward sustainable transportation solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 360.2 Thousand Units |

| Market Forecast in 2033 | 2,710.5 Thousand Units |

| Market Growth Rate 2025-2033 | 23.88% |

Key Trends of Australia Hybrid Electric Vehicle Market:

Government Incentives and Policies

The Australian government is promoting the adoption of hybrid and electric vehicles through financial incentives, rebates, and tax reductions. Several states offer subsidies on hybrid vehicle purchases, reduced registration fees, and exemptions from certain road taxes. Additionally, stricter emission regulations and fuel efficiency standards encourage automakers to introduce more HEV models, which is driving the Australia hybrid electric vehicle market growth. For instance, in December 2024, National Australia Bank (NAB) collaborated with a top EV distributor and providers of charging infrastructure to provide advantages to current business clients. These perks include a one-time charging credit with JOLT or a one-year discount on the list price of new BYD electric or plug-in hybrid cars, as well as lower expenses for EV fleet charging with Evie Networks. The collaboration will help companies lower their transportation-related emissions sooner while also making EV ownership more accessible and reasonably priced. Government-led initiatives supporting green transportation and investments in sustainable mobility solutions further contribute to the increasing Australia hybrid electric vehicle market demand. These policies make hybrid cars more affordable and attractive to both individual buyers and corporate fleet owners.

To get more information on this market, Request Sample

Growing Environmental Awareness

As concerns over climate change and carbon emissions grow, Australian consumers are shifting towards eco-friendly vehicle options. Hybrid electric vehicles emit less pollution than conventional gasoline cars, helping to lessen environmental effects. Many buyers are now prioritizing sustainability, leading to increased demand for hybrid models. Automakers are also investing in greener technologies to meet consumer expectations and regulatory requirements, which is creating a positive impact on the Australia hybrid electric vehicle market outlook. The push for reducing greenhouse gas emissions and promoting clean energy solutions has positioned HEVs as a crucial step toward a more sustainable transportation system in Australia. This growing consumer shift is influencing mainstream car choices and also expanding into niche segments like off-road and utility vehicles. For instance, in June 2024, GWM announced the launch of the POER Sahar in Australia, marking the first HEV-powered off-road pickup in the market. With a powerful hybrid and diesel engine option, it boasts a 3.5-ton towing capacity. The vehicle has received praise from the media for its performance, comfort, and advanced intelligent features.

Growth Drivers of Australia Hybrid Electric Vehicle Market:

Clean Mobility Transition and Infrastructure Growth

According to the Australia hybrid electric vehicle market analysis, the transition to clean mobility is a prominent growth driver for the market. The transition is policy-initiated and based on national and regional transport planning that focuses on sustainability. Large cities like Sydney, Melbourne, and Brisbane are on the way to creating infrastructure for low-emission transport, including the extension of green vehicle lanes, hybrid-specific parking spaces, and connection with renewable fuels. Public transport authorities and public transport fleet operators also look into HEVs for municipal and government use, pushing their justification further. Moreover, investment in rural infrastructure—such as highway rest stops with future-proof charging stations—is making hybrid vehicles more viable for Australia's large, low-density areas. This expanding urban-planning-to-highway-development ecosystem accommodates hybrid vehicle use across the country's diverse landscapes. As the infrastructure becomes more inclusive and ubiquitous, Australians are increasingly viewing HEVs as alternatives and as rational, future-proof mobility options.

Fuel Cost Sensitivity and Long-Distance Driving Habits

Australia's reliance on personal cars for work travel and leisure travel, particularly over extended distances, has a tremendous impact on the popularity of hybrid electric vehicles. Since Australia is a vast country with limited public transport in rural areas outside metropolitan cities, Australians frequently drive over long distances to work, entertainment, and for everyday shopping. Therefore, fuel economy plays a foremost concern for car purchasers. With increasing international fuel costs and Australia's import-based fuel supply, HEVs present a convenient alternative by providing higher mileage and fewer refueling intervals. Regional and semi-rural area consumers, whose charging infrastructure for electric vehicles may still be emerging, appreciate HEVs most, as they pair fuel economy with the familiarity of an engine-driven vehicle. Moreover, most consumers living in these regions value durability and range in vehicles above other aspects, and thus hybrid SUVs and crossovers are in high demand. This combination of hybrid technology and Australian driving habits is fueling consumer uptake across varied parts of the nation.

Technological Advancements and Market Diversification

Technological advances in hybrid electric vehicles have contributed significantly to market reach throughout Australia. Improvements in battery tech, powertrain efficiency, and vehicle design have come together to provide improved performance, greater driving ranges, and lower costs, making the HEV more affordable for a larger population. The Australian market is also seeing diversification in the form of hybrid vehicles offered, such as SUVs, sedans, and even ute vehicles with rural and off-road capabilities. This range appeals to Australian consumers' diverse requirements, ranging from urbanites to people living in outlying or farming areas. Local manufacturers and dealerships also improve after-sales service and advocate hybrid technology using education and test drives, dispelling concerns of unknown technology. Overall, these technological changes are consistent with Australian lifestyle and environmental objectives, supporting continued growth within the hybrid vehicle category.

Government Initiatives of Australia Hybrid Electric Vehicle Market:

Federal Initiative toward Low-Emission Transport Policies

The Australian federal government has been increasingly taking the lead in directing national policy to facilitate the expansion of hybrid electric vehicles (HEVs). In contrast with previous years when attention continued to be centered mainly on traditional transport infrastructure, today's federal initiatives now incorporate the need for low-emission mobility. The National Electric Vehicle Strategy, while its core target is electric vehicles, also involves policies that indirectly assist hybrid adoption—like more stringent fuel efficiency standards and industry cooperation to expand low-emission vehicle choices. The federal government is also collaborating with automakers, fleet operators, and states to promote consistency in vehicle standards and incentives, to build a more unified national strategy. There are also indirect stimulants to the hybrid market through overall programs of sustainability, such as emission offset policies and purchasing policies that prefer cleaner fleet vehicles. These top-down initiatives are assisting in getting industry participants to assist with climate objectives and telegraphing long-term federal support for hybrid technology as a steppingstone to full electrification.

State-Level Incentives and Registration Benefits

Individual Australian states have encouraged hybrid cars through specially designed financial as well as regulatory incentives. For example, some states deduct stamp duty or the price of registration especially for hybrid electric cars, thus making them cheaper at the point of acquisition. In places such as the Australian Capital Territory and Victoria, state governments have established formal programs with rebates or incentives for the purchase of low-emission vehicles that cover hybrids as well as electric vehicles. These are especially useful in suburban and rural areas, where hybrids tend to be more useful than full EVs because of charging constraints. In addition, some states implement hybrid-friendly infrastructure like priority lanes or special parking areas, promoting adoption through routine convenience. Localized policies enable states to respond to their specific transportation and environmental needs and contribute to a wider national sustainability objective. Decentralized practices also spur states to compete favorably to innovate and pioneer clean transport adoption.

Public Sector Fleet Transition and Procurement Policies

Another special program within Australia's hybrid vehicle market is the environment friendly public sector fleet vehicles. State and territory governments have installed mandates that demand a share of new fleet acquisition to be low-emission vehicles, oftentimes involving hybrids because of their operational dependability and fuel efficiency. These three policies matter as, government fleets usually range over three-fourths of the country's terrain, and hence exhibiting hybrid cars to a broad constituency and spur greater acceptance. Public sector buying policies are also being updated to prefer eco-friendly cars on tenders and contracts, which indirectly incentivizes hybrid technology by requiring suppliers to include them. Municipal councils are also getting involved by including hybrids in their garbage collection, transport, and administrative services. These government-initiated transitions lower public sector emissions and are also demonstrations of hybrid vehicle feasibility in various use cases. Publicity of hybrids in public service applications normalizes their usage and instills consumer trust among various groups.

Opportunities of Australia Hybrid Electric Vehicle Market:

Developing Rural and Regional Market Potential

Australia's wide geography offers a special chance for hybrid electric vehicles (HEVs) to fill the gap between conventional combustion engines and pure electric cars, particularly for the rural and regional communities. Most of these areas continue to experience the shortages in electric charging facilities, and hybrids provide a more realistic option to consumers who need longer travel distances and the convenience of refilling fuel. HEVs provide the fuel efficiency and lower emissions of electric vehicles without range anxiety. While rural communities are only starting to explore alternative forms of transportation, hybrid offerings—SUVs and utility vehicles—can satisfy the needs of farm communities, mining industries, and long-distance travelers. Furthermore, Australia's established road freight and regional transport networks stand to gain from hybrid technology as businesses start incorporating cleaner fleet modes. By meeting both environmental and operational requirements, hybrids stand ready to become the default choice in markets where total electrification remains years off.

Corporate and Commercial Sector Adoption

The Australian market for hybrid electric vehicles presents significant opportunity in the corporate and commercial space, where businesses are increasingly embedding sustainability objectives into their business model. Major organizations within finance, logistics, and real estate sectors are taking onboard internal environmental objectives and attempting to shift their motor vehicle fleets towards greener options. HEVs present a natural place to begin, with a balance of fuel efficiency, dependability, and lower emissions without the complete infrastructure requirements of EVs. Furthermore, most companies travel on different terrains and distances, which makes hybrid technology particularly applicable for mixed-use driving conditions. There is also increasing popularity of Australian companies employing hybrid cars as part of their brand image—demonstrating their sustainability commitment to clients, investors, and employees. As demand increases for fleet vehicles with lower emissions in metro and regional offices, manufacturers and leasing organizations have the chance to develop packages, finance models, and service contracts that suit the changing transportation demands of the commercial sector.

Tourism and Environmental-Friendly Transport Services

Australia's successful tourist sector provides another promising area for hybrid electric vehicle market expansion, particularly as tourists increasingly demand environmentally friendly travel experiences. Tour areas like the Great Ocean Road, the Blue Mountains, and Tasmania's driving routes provide excellent applications for hybrid vehicles, with the need for fuel efficiency matched by the ability for long-distance driving. Car rental companies, tour operators, and eco-resorts are starting to consider hybrid models as a component of their green transportation options. This is in line with the larger tourism sustainability movement, where hybrids can be sold as functional and moral substitutes. Furthermore, hybrid guided tour buses and shuttle buses would lower emissions in environmentally rich locations like coastal reserves and national parks. The potential is in drawing on both local and overseas tourism demand while helping to fund conservation activities. With government assistance for regional tourism and increasing eco-tourism popularity, hybrid vehicles are in a favorable position to be at the forefront of changing sustainable Australian travel.

Australia Hybrid Electric Vehicle Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on propulsion type, configuration type, vehicle type, and power source.

Propulsion Type Insights:

- Full Hybrids

- Mild Hybrids

- Plug-in Hybrids

- Others

The report has provided a detailed breakup and analysis of the market based on the propulsion type. This includes full hybrids, mild hybrids, plug-in hybrids, and others.

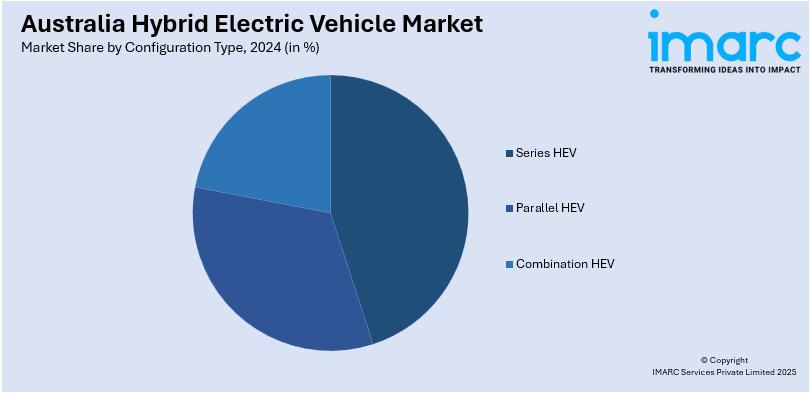

Configuration Type Insights:

- Series HEV

- Parallel HEV

- Combination HEV

A detailed breakup and analysis of the market based on the configuration type have also been provided in the report. This includes series HEV, parallel HEV, and combination HEV.

Vehicle Type Insights:

- Passenger Cars

- Commercial Vehicles

- Two-Wheelers

- Others

A detailed breakup and analysis of the market based on vehicle type have also been provided in the report. This includes passenger cars, commercial vehicles, two-wheelers, and others.

Power Source Insights:

- Stored Electricity

- On Board Electric Generator

A detailed breakup and analysis of the market based on the power source have also been provided in the report. This includes stored electricity and on board electric generator.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hybrid Electric Vehicle Market News:

- In March 2025, Skoda announced its plans to launch plug-in hybrid and mild hybrid vehicles in Australia by the end of 2025. The Kodiaq and Superb will feature PHEVs with up to 135km electric range, while the Octavia is expected to introduce mild-hybrid technology. These moves aim to boost local sales amid growing demand.

- In October 2024, the new plug-in hybrid electric utility vehicle that might compete with Australia’s best-selling models, the Toyota Hilux and Ford Ranger, garnered nearly 1,000 pre-orders just hours after its launch. The BYD Shark 6, offering an electric range of approximately 80km before using petrol, signifies China's entry into a market traditionally led by diesel cars.

- In June 2025, new information from AFIA revealed that the demand for low-emission vehicles is skyrocketing, with financing for electric and hybrid vehicles exceeding $6.17 Billion in 2024—a 50% increase compared to the previous year. This surge in financing facilitated the acquisition of 104,835 electric and hybrid cars, a rise from merely 64,288 in 2023—an remarkable growth that highlights a distinct change in Australian transportation preferences. AFIA's recent Electric Vehicle & Hybrid Finance Report reveals that both consumers and businesses are adopting lower emissions vehicles, even with persistent infrastructure and policy hurdles. Hybrid cars maintain their dominance in adoption, with 60,083 hybrids financed in 2024, while fully electric vehicles total 44,752.

Australia Hybrid Electric Vehicle Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Units |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Propulsion Types Covered | Full Hybrids, Mild Hybrids, Plug-in Hybrids, Others |

| Configuration Types Covered | Series HEV, Parallel HEV, Combination HEV |

| Vehicle Types Covered | Passenger Cars, Commercial Vehicles, Two-Wheelers, Others |

| Power Sources Covered | Stored Electricity, On Board Electric Generator |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hybrid electric vehicle market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hybrid electric vehicle market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hybrid electric vehicle industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia hybrid electric vehicle market reached a volume of 360.2 Thousand Units in 2024.

The Australia hybrid electric vehicle market is projected to exhibit a CAGR of 23.88% during 2025-2033.

The Australia hybrid electric vehicle market is expected to reach a volume of 2,710.5 Thousand Units by 2033.

The Australia hybrid-electric vehicle market is propelled by growing fuel cost sensitivity, expanding environmental awareness, and practicality for long-distance travel. Broader infrastructure, customer demand for low-emission transportation, and robust take-up in private and commercial markets also facilitate hybrid adoption across the country's different geographic and economic regions.

The major trend of the Australia hybrid electric car market is increased consumer demand for fuel-efficient and environment-friendly models, particularly in urban and regional markets. Increasing environmental awareness, changing corporate fleet options, and increasing model availability by global manufacturers are also building momentum toward a trend for hybrids as a viable stepping-stone between traditional and full electric vehicles.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)