Australia Hydraulics Pneumatics and Actuator Market Size, Share, Trends and Forecast by Type, Functionality, Component, End Use Industry, and Region, 2025-2033

Australia Hydraulics Pneumatics and Actuator Market Size and Share:

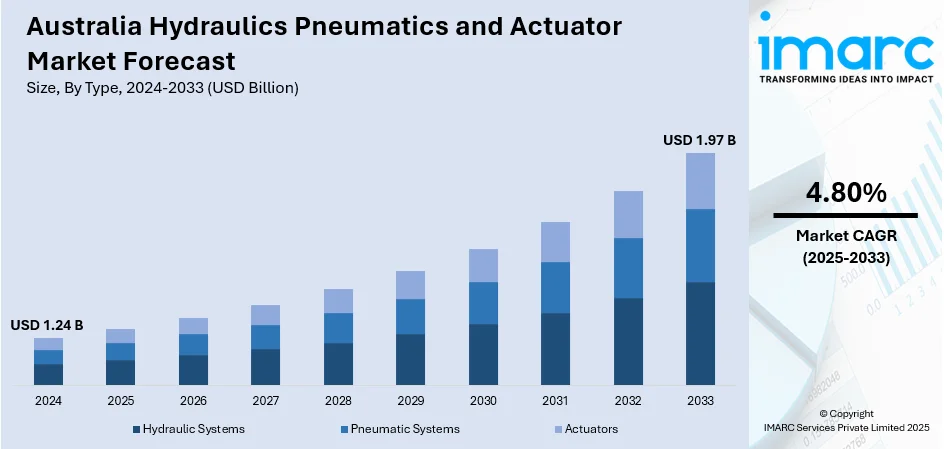

The Australia hydraulics pneumatics and actuator market size reached USD 1.24 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 1.97 Billion by 2033, exhibiting a growth rate (CAGR) of 4.80% during 2025-2033. The market is dominated by the growing demand for automation in different industries, energy-saving solutions, and technological advancements. All these factors drive the growth of the market and are evident in the increasing utilization of smart systems as well as the creation of new products. Consequently, the Australia hydraulics pneumatics and actuator market share is expanding.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.24 Billion |

| Market Forecast in 2033 | USD 1.97 Billion |

| Market Growth Rate 2025-2033 | 4.80% |

Australia Hydraulics Pneumatics and Actuator Market Trends:

Integration of Smart Pneumatic Systems

The growing integration of smart pneumatic systems is reshaping operational strategies across key Australian industries, including automotive, food processing, and advanced manufacturing. These systems are embedded with sensors, actuators, and connectivity tools that allow for real-time monitoring and performance diagnostics. By enabling predictive maintenance, reducing energy consumption, and improving process efficiency, smart pneumatics significantly contribute to enhanced productivity. Their ability to be easily integrated into existing industrial networks aligns well with the rising demand for Industry 4.0-compliant technologies. As manufacturers continue to adopt automated systems to maintain competitiveness, the shift towards smart pneumatic solutions is becoming increasingly prevalent. This advancement is expected to play a critical role in accelerating Australia hydraulics pneumatics and actuator market growth over the coming years. For instance, in May 2025, Emerson, which provides hydraulics, pneumatics, and actuators as part of its industrial automation and control solutions, released AspenTech v15, enhancing industrial AI, sustainability tools, and user experience. The software includes generative AI, multiple sustainability models, and features like AspenTech Subsurface Intelligence™ and Cimphony Network Model Management™. These updates aim to boost operational excellence, decarbonization, and user productivity across industries.

To get more information on this market, Request Sample

Shift Towards Electric and Hybrid Actuators

Australia is witnessing a transition from traditional hydraulic and pneumatic actuators to electric and hybrid alternatives, driven by the need for higher energy efficiency and precise control. Electric actuators provide several advantages including lower operational noise, ease of integration into automated systems, and reduced maintenance requirements. Their adaptability in compact industrial applications makes them ideal for sectors such as robotics, automotive manufacturing, and renewable energy systems. For instance, in June 2024, MasterMac2000, a leading Australian pneumatic parts supplier, launched a wide range of pneumatic cylinders suited for automation applications. Known for their power, versatility, and efficiency, these cylinders are ideal for manufacturing, food processing, and construction. Hybrid actuators, combining the strengths of different actuation technologies, offer versatility for customized performance demands. This shift reflects a broader global trend toward environmentally conscious industrial practices. As a result, demand for innovative actuator technologies is rising, which is poised to contribute significantly to Australia hydraulics pneumatics and actuator market growth in the near future.

Australia Hydraulics Pneumatics and Actuator Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, functionality, component, and end use industry.

Type Insights:

- Hydraulic Systems

- Pneumatic Systems

- Actuators

The report has provided a detailed breakup and analysis of the market based on the type. This includes hydraulic systems, pneumatic systems, and actuators.

Functionality Insights:

- Power Transmission

- Motion Control

- Force Generations

A detailed breakup and analysis of the market based on the functionality have also been provided in the report. This includes power transmission, motion control, and force generations.

Component Insights:

- Pumps

- Valves

- Cylinders

- Compressors

- Actuator Control Systems

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes pumps, valves, cylinders, compressors, and actuator control systems.

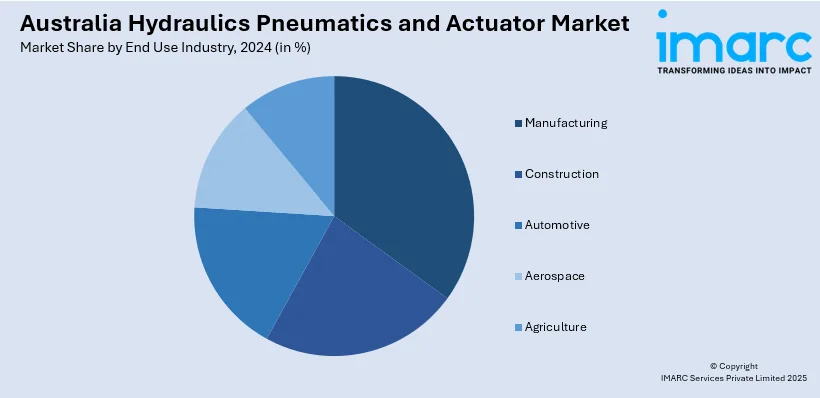

End Use Industry Insights:

- Manufacturing

- Construction

- Automotive

- Aerospace

- Agriculture

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes manufacturing, construction, automotive, aerospace, and agriculture.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hydraulics Pneumatics and Actuator Market News:

- In June 2025, Acrodyne Pty Ltd announced the in-house production of Australian-built Limitorque actuators and HMA Group gate valves. The full scope, actuators, AcroGears bevel gearboxes, engineered adaptors, protective coatings, mounting, setting, and pre-commissioning, was completed using stock from their facility. This highlights Acrodyne's local manufacturing capabilities and end-to-end actuator solutions.

- In June 2024, SMC introduced the EQ series electric actuators with fully integrated controllers, simplifying setup and reducing wiring, space, and energy use. These slide- and rod-type actuators improve precision and control in automation, reduce CO2 emissions by up to 60%, and are easy to retrofit due to standard mounting dimensions.

Australia Hydraulics Pneumatics and Actuator Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Hydraulic Systems, Pneumatic Systems, Actuators |

| Functionalities Covered | Power Transmission, Motion Control, Force Generations |

| Components Covered | Pumps, Valves, Cylinders, Compressors, Actuator Control Systems |

| End Use Industries Covered | Manufacturing, Construction, Automotive, Aerospace, Agriculture |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hydraulics pneumatics and actuator market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hydraulics pneumatics and actuator market on the basis of type?

- What is the breakup of the Australia hydraulics pneumatics and actuator market on the basis of functionality?

- What is the breakup of the Australia hydraulics pneumatics and actuator market on the basis of component?

- What is the breakup of the Australia hydraulics pneumatics and actuator market on the basis of end-use industry?

- What is the breakup of the Australia hydraulics pneumatics and actuator market on the basis of region?

- What are the various stages in the value chain of the Australia hydraulics pneumatics and actuator market?

- What are the key driving factors and challenges in the Australia hydraulics pneumatics and actuator?

- What is the structure of the Australia hydraulics pneumatics and actuator market and who are the key players?

- What is the degree of competition in the Australia hydraulics pneumatics and actuator market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hydraulics pneumatics and actuator market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hydraulics pneumatics and actuator market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hydraulics pneumatics and actuator industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)