Australia Hydroponics Market Size, Share, Trends and Forecast by Type, Crop Type, Equipment, and Region, 2025-2033

Australia Hydroponics Market Overview:

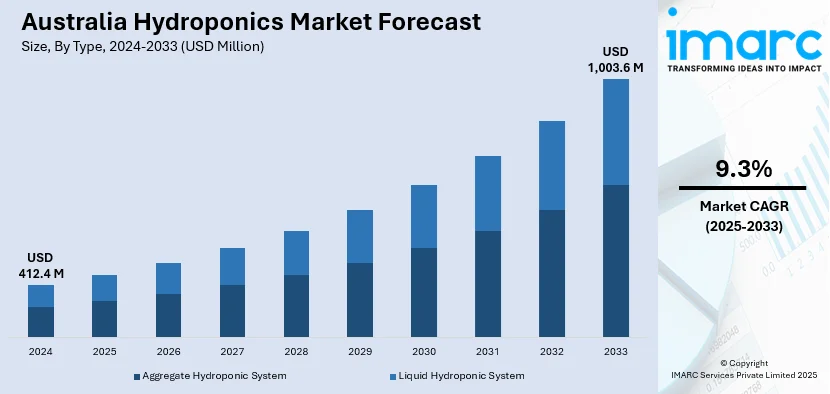

The Australia hydroponics market size reached USD 412.4 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,003.6 Million by 2033, exhibiting a growth rate (CAGR) of 9.3% during 2025-2033. The rising demand for locally grown, pesticide-free produce, continual advancements in controlled environment agriculture technologies, increasing urbanization, water scarcity concerns, and growing adoption of sustainable farming practices are driving market expansion and encouraging commercial growers and startups to invest in soil-less cultivation systems across urban and semi-urban regions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 412.4 Million |

| Market Forecast in 2033 | USD 1,003.6 Million |

| Market Growth Rate 2025-2033 | 9.3% |

Australia Hydroponics Market Trends:

Expansion of Commercial Hydroponic Facilities

The rise in the establishment of commercial hydroponic facilities, driven by the need to ensure consistent crop yield regardless of climatic variability, is propelling Australia hydroponics market growth. Traditional agriculture in many Australian regions faces challenges such as water scarcity, poor soil quality, and seasonal fluctuations. In contrast, hydroponic greenhouses offer a controlled environment where temperature, humidity, and nutrient levels can be precisely managed, resulting in higher productivity per square meter. These facilities are becoming popular for high-value crops like tomatoes, cucumbers, and leafy greens. For example, Christmas Island's the Green Space Tech hydroponic initiative currently yields approximately 100 kilograms of fruits and vegetables each week. Major horticulture businesses and agritech startups are investing in large-scale operations, some integrating vertical farming and artificial lighting systems to maximize space usage and crop cycles. Additionally, commercial operators are adopting automation tools, including nutrient delivery systems and AI-based technologies, to reduce labor costs and improve crop quality. Notably, greenhouse operator in Queensland using traditional irrigation controllers replaced them with Nuravine's AI-driven system, thereby reducing water usage by 30% while improving crop uniformity and quality. Government incentives and research support for sustainable agriculture are further encouraging commercial scale-ups, especially near urban centers to reduce transportation costs and food miles.

To get more information on this market, Request Sample

Adoption of Hydroponics in Urban and Vertical Farming

Urban centers in Australia, such as Melbourne, Sydney, and Brisbane, are becoming hubs for innovative hydroponic farming methods, particularly vertical farms integrated within city infrastructure. According to an industry report, the urban population in Australia stood at 86.62% of the total population in 2023, representing an annual growth of 2.62%. With growing urban population and a rise in demand for fresh, locally sourced produce, hydroponics provides a viable alternative to traditional peri-urban agriculture. These systems are increasingly integrated into warehouses, rooftops, and even underground spaces, which is creating a positive Australia hydroponics market outlook. Apart from this, urban hydroponics appeals to consumers prioritizing sustainability, reduced carbon footprints, and minimal pesticide use. Many small businesses and community cooperatives have adopted compact hydroponic setups for microgreens, herbs, and specialty vegetables. Besides this, the vertical farming model, supported by LED lighting and IoT-based environmental controls, allows year-round cultivation with minimal water use. In high-density areas where arable land is limited, hydroponics supports localized food production and contributes to urban food security. This trend is also reinforced by consumer preferences shifting toward transparency in food sourcing. These factors are collectively augmenting Australia hydroponics market share.

Australia Hydroponics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, crop type, and equipment.

Type Insights:

- Aggregate Hydroponic System

- Closed System

- Opened System

- Liquid Hydroponic System

The report has provided a detailed breakup and analysis of the market based on the type. This includes aggregate hydroponic system (closed system and opened system) and liquid hydroponic system.

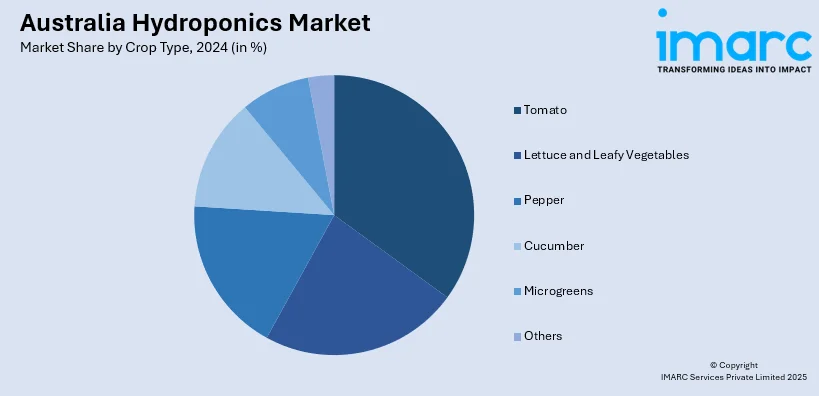

Crop Type Insights:

- Tomato

- Lettuce and Leafy Vegetables

- Pepper

- Cucumber

- Microgreens

- Others

A detailed breakup and analysis of the market based on the crop type have also been provided in the report. This includes tomato, lettuce and leafy vegetables, pepper, cucumber, microgreens, and others.

Equipment Insights:

- HVAC

- LED Grow Light

- Irrigation Systems

- Material Handling

- Control Systems

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment. This includes HVAC, LED grow light, irrigation systems, material handling, control systems, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Hydroponics Market News:

- April 2024: Melbourne developer Beulah International partnered with Sydney-based vertical farming company Greenspace to establish a 200-square-meter hydroponic urban farm at the future site of the STH BNK By Beulah project in Southbank. This initiative aims to explore sustainable urban agriculture by cultivating micro herbs, salads, and flowers and supplying fresh produce to local businesses. Beulah plans to integrate community vertical farming into the completed development to provide low-carbon food options and educational opportunities for residents and workers.

Australia Hydroponics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered |

|

| Crop Types Covered | Tomato, Lettuce and Leafy Vegetables, Pepper, Cucumber, Microgreens, Others |

| Equipments Covered | HVAC, LED Grow Light, Irrigation Systems, Material Handling, Control Systems, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia hydroponics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia hydroponics market on the basis of type?

- What is the breakup of the Australia hydroponics market on the basis of crop type?

- What is the breakup of the Australia hydroponics market on the basis of equipment?

- What is the breakup of the Australia hydroponics market on the basis of region?

- What are the various stages in the value chain of the Australia hydroponics market?

- What are the key driving factors and challenges in the Australia hydroponics market?

- What is the structure of the Australia hydroponics market and who are the key players?

- What is the degree of competition in the Australia hydroponics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia hydroponics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia hydroponics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia hydroponics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)