Australia In Vitro Diagnostics Market Size, Share, Trends and Forecast by Test Type, Product, Usability, Application, End User, and Region, 2025-2033

Australia In Vitro Diagnostics Market Overview:

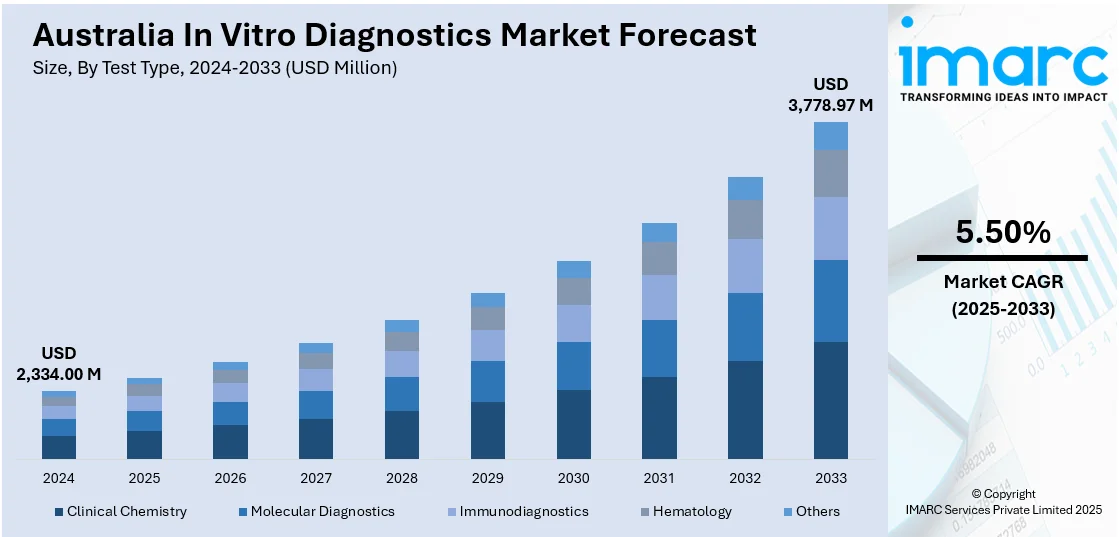

The Australia in vitro diagnostics market size reached USD 2,334.00 Million in 2024. Looking forward, the market is expected to reach USD 3,778.97 Million by 2033, exhibiting a growth rate (CAGR) of 5.50% during 2025-2033. The market is driven by the rising demand for early disease detection, increased adoption of personalized medicine, and advancements in in-vitro diagnostic technologies. Public and private healthcare investments, growing elderly population, regulatory support and strong laboratory infrastructure further contribute to the Australia in vitro diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,334.00 Million |

| Market Forecast in 2033 | USD 3,778.97 Million |

| Market Growth Rate 2025-2033 | 5.50% |

Key Trends of Australia In Vitro Diagnostics Market:

Rising Prevalence of Chronic and Infectious Diseases

Australia faces a significant health burden from chronic diseases such as diabetes, cardiovascular conditions, and cancer, which necessitate regular monitoring and early detection. The diagnosis of these conditions depends heavily upon in vitro diagnostic systems, which provide correct and timely testing results. The growing need for dependable diagnostic tools intensified because of the ongoing emergence and survival of infectious diseases and sexually transmitted infections, as well as respiratory illnesses. The COVID-19 pandemic demonstrated how vital rapid and precise diagnostic tools are for healthcare, thus driving increased investments as well as innovation within the IVD sector. As the population continues to age and the incidence of chronic and infectious diseases rises, the reliance on IVD technologies is expected to grow, driving the Australia in vitro diagnostics market growth.

To get more information on this market, Request Sample

Technological Advancements and Innovation

The Australian IVD market is benefiting from rapid technological progress, including developments in molecular diagnostics, next-generation sequencing, and point-of-care testing. The recent innovations have brought superior accuracy along with faster results and easier implementation of diagnostic tests, thus creating more accessible and efficient systems. The implementation of artificial intelligence with machine learning technology enables more precise disease identification and disease tracking in medical practice. New technological developments improve patient results and enhance both laboratory efficiency and minimize healthcare expenses. The IVD market expansion in Australia will gain momentum as technology advances, and more opportunities emerge for customized medicine alongside early disease identification. For instance, in June 2024, Abacus DX announced that it had partnered with Roche on a new business venture. Our product offerings in the Life Sciences industry alone have significantly expanded because of our relationship. By combining Roche's cutting-edge solutions for the Life Science industry with Abacus dx's vast distribution network, this partnership strengthens our dedication to developing research, academic, and biotechnology capacities throughout Australia.

Growing Demand for Personalized Medicine

There is an increasing emphasis on personalized medicine in Australia, where treatments are tailored to individual genetic profiles and specific health conditions. In vitro diagnostics are integral to this approach, providing critical information for the customization of therapeutic strategies. Advancements in genomic testing and biomarker identification have enabled more precise disease diagnosis and treatment planning. This shift towards individualized care is driving the demand for sophisticated diagnostic tools that can deliver detailed insights into a patient's health status. As personalized medicine becomes more prevalent, the role of IVDs in facilitating targeted therapies and improving patient outcomes is expected to expand, thereby boosting market growth.

Growth Drivers of Australia In Vitro Diagnostics Market:

Aging Population

The growing elderly population in Australia plays a major role in the growth of the in vitro diagnostics (IVD) market. As the population ages, there is an increased occurrence of chronic conditions like diabetes, cardiovascular diseases, and cancer, which require ongoing monitoring and early detection. This has led to an increased need for diagnostic tests as older individuals frequently require routine screenings and assessments for effective disease management and prevention. Additionally, the rising demand for personalized healthcare solutions and early detection techniques further drives this trend. Consequently, the aging demographic is a crucial factor influencing Australia in vitro diagnostics market demand which in turn fosters innovation in diagnostic tools and testing technologies to address these healthcare challenges.

Integration of Artificial Intelligence (AI)

The convergence of artificial intelligence into in vitro diagnostics (IVD) is transforming the accuracy and productivity of diagnostic testing. AI technologies such as machine learning and deep learning are used to process complex data patterns from diagnostic tests leading to faster and more precise results. This improves earlier disease detection, patient outcomes, and reduces human error in diagnoses. In addition, AI simplifies lab processes accelerating testing time and labor costs while boosting productivity. Since AI has the ability to learn and modify continuously from data it can provide more customized and accurate diagnostic solutions. The increasing potential of AI is creating vast opportunities for the in vitro diagnostics market in Australia which drives new product innovations and expands the range of diagnostic solutions for healthcare professionals and patients.

Rising Healthcare Awareness

The growing awareness among Australian consumers regarding the significance of preventive healthcare and early disease detection is a major factor driving growth in the in vitro diagnostics (IVD) market. As individuals gain a better understanding of their health, they are increasingly searching for ways to track their wellness and identify conditions before they escalate. This heightened health consciousness is propelling demand for various diagnostic tests including home testing kits, screenings, and specialized laboratory analyses. Preventive health practices such as routine cancer screenings and diabetes management tests are becoming more prevalent as people acknowledge the advantages of early intervention. The increase in healthcare awareness has also resulted in greater governmental support for public health initiatives further boosting the demand for IVD products in Australia’s healthcare landscape.

Opportunities of Australia In Vitro Diagnostics Market:

Point-of-Care Testing

Point-of-care (POC) testing is becoming increasingly popular in Australia driven by the rising demand for on-site diagnostic solutions that yield quick and accurate results. These tests are especially beneficial for managing chronic diseases like diabetes and cardiovascular issues enabling patients and healthcare professionals to monitor health conditions in real-time. The surge in infectious diseases such as COVID-19 has further boosted the need for POC tests which provide immediate results and support faster decision-making thus alleviating pressure on hospitals and laboratories. Moreover, the convenience and accessibility of POC testing make it a favorable choice in remote and underserved regions with limited access to comprehensive lab services. As the focus on patient-centered healthcare grows POC testing presents a considerable growth potential in the Australian in vitro diagnostics (IVD) market.

Home-based Diagnostics

The increasing interest in home-based diagnostic testing signifies a major opportunity within the Australian IVD market. Consumers are progressively looking for convenient, private, and cost-effective testing options for various health issues, including diabetes, pregnancy, and infectious diseases such as COVID-19. Home testing kits allow for self-monitoring, minimizing the need for visits to healthcare facilities. This trend reflects a wider shift towards consumer-driven healthcare, enabling individuals to take greater control of their health management. With the rise in chronic conditions and the push for early detection, home-based diagnostics create a growing segment for companies providing user-friendly, accurate, and trustworthy testing kits. The appeal and privacy of home diagnostics continue to stimulate consumer interest in Australia.

Expansion of Screening Programs

Government initiatives aimed at early disease detection and routine health screenings are significant factors driving growth in the Australian in vitro diagnostics (IVD) market. National screening programs for various conditions, including cancers (like breast, cervical, and colorectal) and genetic disorders, are expanding, leading to a higher demand for diagnostic tests throughout the country. These programs focus on identifying diseases in their early stages, allowing for timely treatment and improved patient outcomes. As Australia’s population ages, the government is prioritizing the expansion of screening services for conditions associated with aging. This commitment to preventive healthcare helps cut long-term healthcare costs and fosters the ongoing development and adoption of innovative diagnostic tests, creating substantial market opportunities for IVD providers.

Challenges of Australia In Vitro Diagnostics Market:

Regulatory Compliance

Navigating the regulatory environment for in vitro diagnostics (IVD) in Australia can be quite complex due to the stringent approval processes established by the Therapeutic Goods Administration (TGA). The TGA ensures that all IVD products comply with rigorous safety, quality, and performance standards before they enter the market. Manufacturers are required to provide extensive clinical evidence, adhere to quality management system standards, and undergo thorough evaluations, leading to lengthy approval timelines and considerable costs. Furthermore, ongoing adherence to TGA regulations necessitates continuous monitoring and documentation to maintain compliance, which adds to the operational complexities. These regulatory challenges can delay market entry and elevate costs, particularly impacting small and medium-sized enterprises attempting to bring innovative diagnostic solutions to the forefront.

High Cost of Innovation

The journey of developing and commercializing new in vitro diagnostic technologies in Australia is often marked by high expenses, presenting a substantial barrier to market access and growth. The creation of advanced diagnostic tools demands significant investment in research and development, including costly clinical trials necessary for validating accuracy, efficacy, and safety. The requirements for regulatory approvals, such as those from the TGA, further complicate the process and contribute to elevated costs, as adherence to strict guidelines is essential. The adoption of cutting-edge technologies, such as artificial intelligence and genomics, usually entails substantial capital expenditure. This financial strain can be particularly daunting for smaller companies or startups in the IVD landscape, as they may not have the resources to navigate these extensive and expensive processes. Nevertheless, overcoming these obstacles can result in innovations that enhance patient care and market viability.

Competition from Global Players

The influx of international in vitro diagnostics (IVD) companies into the Australian market poses significant challenges for local businesses. These global firms often introduce established products with proven effectiveness, competitive pricing, and economies of scale, which can undermine smaller domestic manufacturers. Additionally, international companies typically enjoy strong brand recognition and well-developed distribution networks, making it challenging for local enterprises to compete. As these foreign players increase their market presence, they compel local companies to innovate rapidly and adopt more competitive pricing strategies. Despite these pressures, there remain opportunities for growth, particularly in segments like personalized medicine and point-of-care testing, where Australia in vitro diagnostics market demand is on the rise. Local businesses that can present unique, high-quality offerings and meet specific market needs will likely maintain a competitive advantage.

Australia In Vitro Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on test type, product, usability, application, and end user.

Test Type Insights:

- Clinical Chemistry

- Molecular Diagnostics

- Immunodiagnostics

- Hematology

- Others

The report has provided a detailed breakup and analysis of the market based on the test type. This includes clinical chemistry, molecular diagnostics, immunodiagnostics, hematology, and others.

Product Insights:

- Reagents and Kits

- Instruments

A detailed breakup and analysis of the market based on the product have also been provided in the report. This includes reagents and kits and instruments.

Usability Insights:

- Disposable IVD Devices

- Reusable IVD Devices

A detailed breakup and analysis of the market based on usability have also been provided in the report. This includes disposable IVD devices and reusable IVD devices.

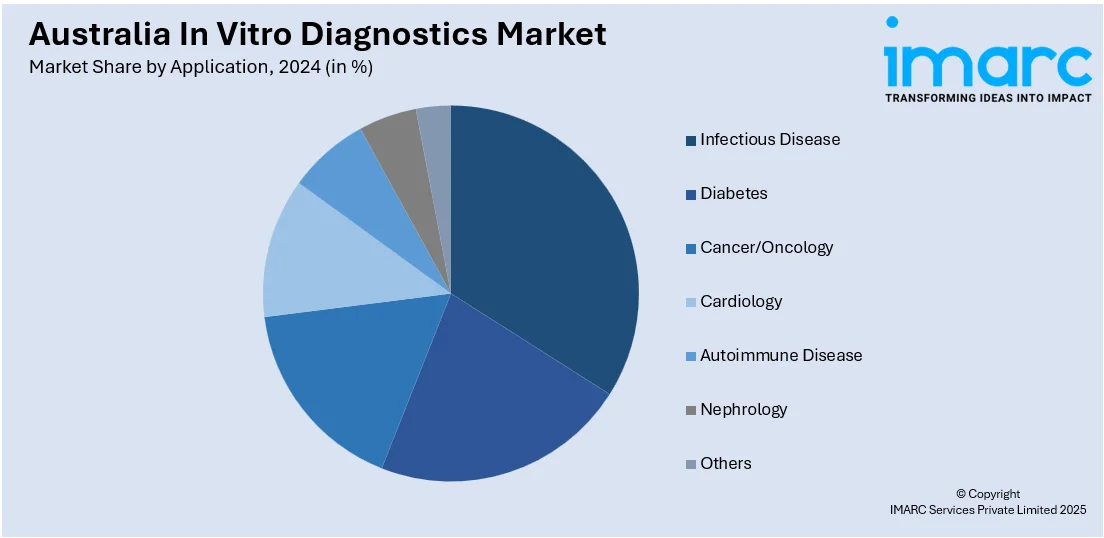

Application Insights:

- Infectious Disease

- Diabetes

- Cancer/Oncology

- Cardiology

- Autoimmune Disease

- Nephrology

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes infectious disease, diabetes, cancer/oncology, cardiology, autoimmune disease, nephrology, and others.

End User Insights:

- Hospitals Laboratories

- Clinical Laboratories

- Point-of-care Testing Centers

- Academic Institutes

- Patients

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals laboratories, clinical laboratories, point-of-care testing centers, academic institutes, patients, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- AusDiagnostics

- Biosynth

- Burkert Australia Pty Ltd

- ELITechGroup (Bruker Corporation)

- Fujirebio

- Immulab

- Roche Australia

- Sysmex Australia Pty Ltd

Latest News and Developments:

- In June 2025, researchers at Western Sydney University developed a groundbreaking AI-powered tool that predicts the risk of Type 1 Diabetes (T1D) using microRNA markers. This Dynamic Risk Score (DRS4C) can differentiate T1D from T2D, forecast treatment responses, and improve early diagnosis, potentially transforming diabetes management worldwide.

- In August 2024, Abacus dx partnered with Mindray to introduce advanced haematology analysers in Australia, enhancing in-vitro diagnostics. The BC-700 series offers quick CBC and ESR results in 1.5 minutes, improving reliability and efficiency while providing better cell differentiation and alarm messages for abnormal results.

- In June 2024, Abacus dx announced a commercial partnership with Roche to enhance its offerings in Australia's Life Science sector. Abacus dx will distribute Roche’s advanced Molecular Diagnostics hardware and reagents, as well as Tissue Diagnostics solutions, supporting research and biotechnology advancements across Australia.

Australia In Vitro Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Test Types Covered | Clinical Chemistry, Molecular Diagnostics, Immunodiagnostics, Hematology, Others |

| Products Covered | Reagents and Kits, Instruments |

| Usabilities Covered | Disposable IVD Devices, Reusable IVD Devices |

| Applications Covered | Infectious Disease, Diabetes, Cancer/Oncology, Cardiology, Autoimmune Disease, Nephrology, Others |

| End Users Covered | Hospitals Laboratories, Clinical Laboratories, Point-of-care Testing Centers, Academic Institutes, Patients, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | AusDiagnostics, Biosynth, Burkert Australia Pty Ltd, ELITechGroup (Bruker Corporation), Fujirebio, Immulab, Roche Australia, Sysmex Australia Pty Ltd, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia in vitro diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia in vitro diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia in vitro diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The in vitro diagnostics market in the Australia was valued at USD 2,334.00 Million in 2024.

The Australia in vitro diagnostics market is projected to exhibit a compound annual growth rate (CAGR) of 5.50% during 2025-2033.

The Australia in vitro diagnostics market is expected to reach a value of USD 3,778.97 Million by 2033.

Growth drivers of the Australian in vitro diagnostics market are the rising prevalence of chronic diseases like diabetes, advancements in technology, government healthcare initiatives, increasing healthcare expenditure, and the growing adoption of home-based and remote diagnostics.

Key trends in the Australia in vitro diagnostics market include the increasing demand for point-of-care testing, the integration of AI and machine learning in diagnostic tools, a rise in personalized medicine, and advancements in molecular diagnostics for early disease detection.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)