Australia Industrial Air Compressors Market Size, Share, Trends and Forecast by Product, Lubrication, Operation, Capacity, End User, and Region, 2025-2033

Australia Industrial Air Compressors Market Overview:

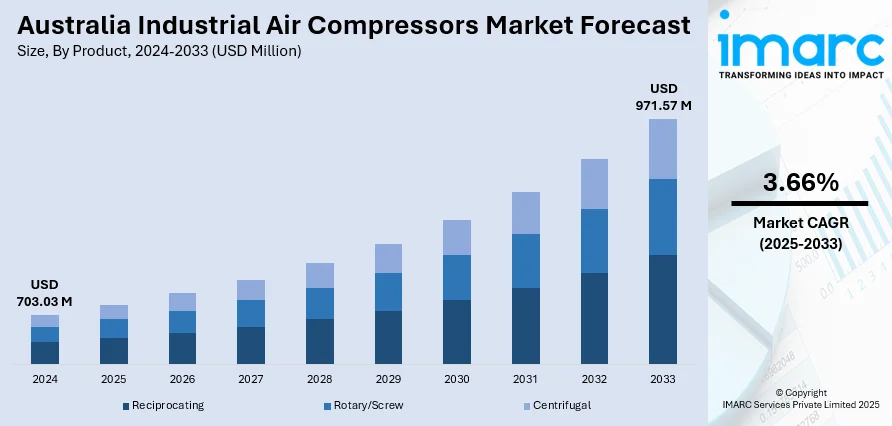

The Australia industrial air compressors market size reached USD 703.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 971.57 Million by 2033, exhibiting a growth rate (CAGR) of 3.66% during 2025-2033. Strong demand from mining, expanding manufacturing activity, and rising construction projects are supporting the market growth. Moreover, strict energy efficiency norms, surging automation in factories, and renewable energy developments are fueling the market growth. Apart from this, rising oil and gas exploration, increasing use in food and beverage (F&B) processing, adoption of the Internet of Things (IoT) enabled compressors, investment in infrastructure upgrades, and the shift toward oil-free and low-maintenance systems are propelling the Australia industrial air compressors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 703.03 Million |

| Market Forecast in 2033 | USD 971.57 Million |

| Market Growth Rate 2025-2033 | 3.66% |

Australia Industrial Air Compressors Market Trends:

Expanding Mining Sector

Australia’s mining industry is one of the country’s largest economic contributors, especially in Western Australia and Queensland. Industrial air compressors are essential in this sector for powering pneumatic tools used in drilling, extraction, and ore processing. Compressed air systems also operate ventilation units and cleaning equipment in underground mines, where electric alternatives may be unsafe due to the risk of sparks. The Australian government reported that mining contributed around USD 273 billion in exports in FY 2022–23, showing the scale and activity level of the sector. As mining operations expand deeper and into more remote locations, the demand for reliable and high-capacity air compressors increases. Many operators are shifting toward energy-efficient compressors to reduce operating costs in high-volume applications. The rugged environmental conditions also drive demand for durable and weather-resistant models that can function without frequent servicing or breakdowns.

To get more information on this market, Request Sample

Growth in Manufacturing

Australia’s manufacturing industry is evolving toward high-value, specialized production such as food processing, pharmaceuticals, and machinery. Industrial air compressors support this transformation by providing the necessary compressed air for various tasks, operating packaging equipment, actuators, and conveyors. In the food and beverage sector, demand is particularly strong for oil-free air compressors that avoid product contamination. Compressed air is also used in cleaning, drying, and bottling operations. With automation becoming more common in modern factories, compressors must run efficiently, continuously, and quietly to meet production line requirements. There is also a shift toward centralized air systems to serve multiple units simultaneously, which improves energy use and reduces maintenance. Manufacturers are investing in smart air systems to monitor air pressure, leaks, and performance in real time, which is driving the Australia industrial air compressors market growth.

Rise in Infrastructure Projects

Australia’s rising investment in large-scale infrastructure, including roads, bridges, airports, and metro rail systems, is increasing the need for industrial air compressors. These machines are vital in construction, especially for operating jackhammers, compactors, and pneumatic drills. In 2024, the OECD projected that infrastructure investment needs would rise to over USD 6.9 trillion by 2030 to support population growth and urban expansion. Air compressors are preferred in many construction tasks because of their mobility, ease of operation, and compatibility with a wide range of tools. Portable and trailer-mounted compressors are in demand for remote and temporary worksites. Moreover, contractors are seeking low-maintenance and fuel-efficient models to reduce downtime and emissions during continuous operation which is further driving the Australia industrial air compressors market growth. Infrastructure projects in regional and rural areas also rely on compressed air due to limited grid power access, making diesel-powered units a common choice.

Australia Industrial Air Compressors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, lubrication, operation, capacity, and end user.

Product Insights:

- Reciprocating

- Rotary/Screw

- Centrifugal

The report has provided a detailed breakup and analysis of the market based on the product. This includes reciprocating, rotary/screw, and centrifugal.

Lubrication Insights:

- Oil-free

- Oil-Filled

A detailed breakup and analysis of the market based on the lubrication have also been provided in the report. This includes oil-free and oil-filled.

Operation Insights:

- ICE

- Electric

The report has provided a detailed breakup and analysis of the market based on the operation. This includes ICE and electric.

Capacity Insights:

- Up to 100 kW

- 101–200 kW

- 201–300 kW

- 301–500 kW

- 501 kW and Above

A detailed breakup and analysis of the market based on the capacity have also been provided in the report. This includes up to 100 kW, 101–200 kW, 201–300 kW, 301–500 kW, and 501 kW and above.

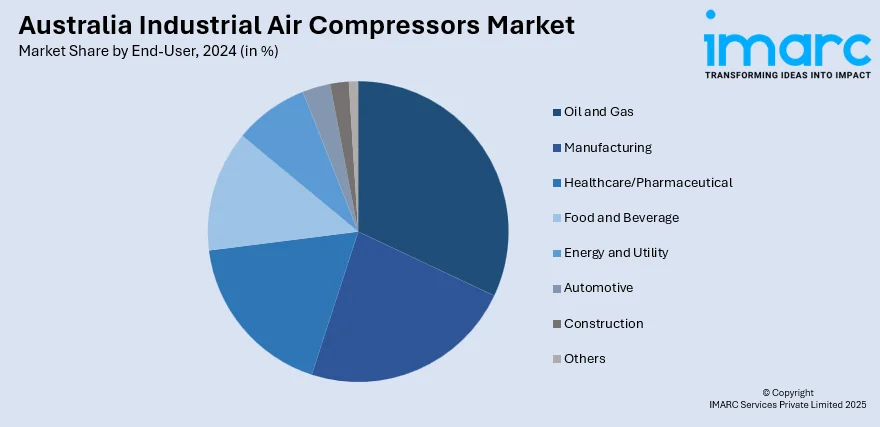

End-User Insights:

- Oil and Gas

- Manufacturing

- Healthcare/Pharmaceutical

- Food and Beverage

- Energy and Utility

- Automotive

- Construction

- Others

The report has provided a detailed breakup and analysis of the market based on the end-user. This includes oil and gas, manufacturing, healthcare/pharmaceutical, food and beverage, energy and utility, automotive, construction, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Air Compressors Market News:

- In 2024, Ingersoll Rand acquired CAPS Australia, a leading air compressor and power generation solutions provider. The acquisition strengthens Ingersoll Rand’s presence in the Australian market by integrating CAPS’s national service network and expanding product offerings across industrial air, power, and vacuum solutions.

- In 2024, Atlas Copco opened a new service center in Perth, Western Australia, to enhance support for local industries including mining, manufacturing, and construction. The facility offers advanced compressor servicing, spare parts, and technical expertise, strengthening the company’s footprint in Western Australia's industrial sector

Australia Industrial Air Compressors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Reciprocating, Rotary/Screw, Centrifugal |

| Lubrications Covered | Oil-Free, Oil-Filled |

| Operations Covered | ICE, Electric |

| Capacities Covered | Up to 100 kW, 101–200 kW, 201–300 kW, 301–500 kW, 501 kW and Above |

| End Users Covered | Oil and Gas, Manufacturing, Healthcare/Pharmaceutical, Food and Beverage, Energy and Utility, Automotive, Construction, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial air compressors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial air compressors market on the basis of product?

- What is the breakup of the Australia industrial air compressors market on the basis of lubrication?

- What is the breakup of the Australia industrial air compressors market on the basis of operation?

- What is the breakup of the Australia industrial air compressors market on the basis of capacity?

- What is the breakup of the Australia industrial air compressors market on the basis of end user?

- What is the breakup of the Australia industrial air compressors market on the basis of region?

- What are the various stages in the value chain of the Australia industrial air compressors market?

- What are the key driving factors and challenges in the Australia industrial air compressors market?

- What is the structure of the Australia industrial air compressors market and who are the key players?

- What is the degree of competition in the Australia industrial air compressors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial air compressors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial air compressors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial air compressors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)