Australia Industrial Automation Components Market Size, Share, Trends and Forecast by Component, Application, End Use Industry, and Region, 2025-2033

Australia Industrial Automation Components Market Overview:

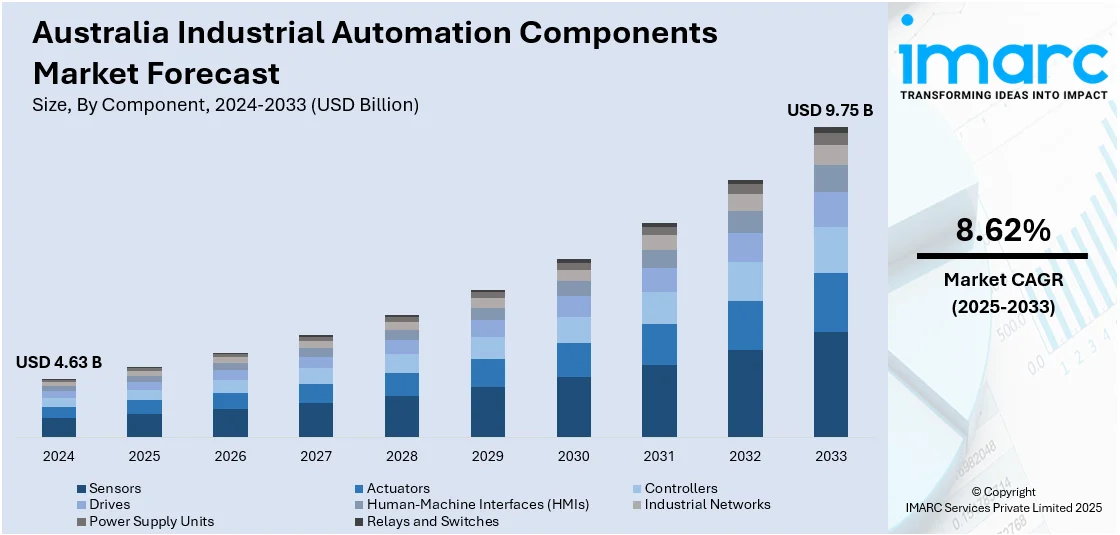

The Australia industrial automation components market size reached USD 4.63 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 9.75 Billion by 2033, exhibiting a growth rate (CAGR) of 8.62% during 2025-2033. Drivers such as the increasing requirement for energy-saving technology, the shift towards intelligent manufacturing, and technology development in automation are driving demand. The focus on reducing operating costs and enhancing productivity is further augmenting the Australia industrial automation components market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.63 Billion |

| Market Forecast in 2033 | USD 9.75 Billion |

| Market Growth Rate 2025-2033 | 8.62% |

Australia Industrial Automation Components Market Trends:

Adoption of Smart Manufacturing Technologies

Smart manufacturing, which incorporates advanced automation technologies such as AI, IoT, and robotics, is transforming Australia’s industrial sector. For instance, in May 2025, Comau developed an advanced automation solution for Li Auto's next-generation EV range extender, enabling an annual capacity of 400,000 units. This end-to-end solution includes assembly lines, collaborative robots, and Comau’s SmartCell technology, achieving over 99% production pass rate and enhancing flexibility, reliability, and efficiency in EV manufacturing. Growing necessity for monitoring, capturing, and analyzing real-time data is fueling the use of smart industrial automation equipment like PLCs, sensors, and HMIs. The equipment helps manufacturers attain predictive maintenance, better decision-making, and optimized manufacturing processes. Deployment of smart manufacturing technology also supports greater flexibility and customization in manufacturing, lessening downtime and enhancing overall productivity. This trend will be important in driving the growth of the Australia industrial automation components market.

To get more information on this market, Request Sample

Shift Towards Automation in the Food and Beverage Sector

The Australian food and drinks sector is more reliant on automation to handle product consistency, quality control, and manufacturing efficiency. Automation elements such as sensors, actuators, and controllers are being integrated onto manufacturing lines to automate packaging, sorting, and processing procedures. These kinds of systems help improve accuracy, reduce human mistakes, and meet food safety regulations. Automation also promotes higher production rates and reduced labor expenses, which is vital in the highly competitive food and beverage sector. With continuing automation adoption, the Australia industrial automation components market growth will probably expand in this industry. For instance, in May 2024, Konica Minolta Australia partnered with Kinrise Snackfoods to improve manufacturing efficiency using Autonomous Mobile Robots (AMRs). The deployment of four AMRs automates pallet handling, enhancing productivity, safety, and operational efficiency at Kinrise's facility. The solution includes MiRcharge and MiR Fleet, offering autonomous charging and fleet management.

Australia Industrial Automation Components Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component, application, and end use industry.

Component Insights:

- Sensors

- Actuators

- Controllers

- PLC

- DCS

- Drives

- Servo Drives

- VFDs

- Human-Machine Interfaces (HMIs)

- Industrial Networks

- Power Supply Units

- Relays and Switches

The report has provided a detailed breakup and analysis of the market based on the component. This includes sensors, actuators, controllers (PLC and DCS), drives (servo drives and VFDs), human-machine interfaces (HMIs), industrial networks, power supply units, and relays and switches.

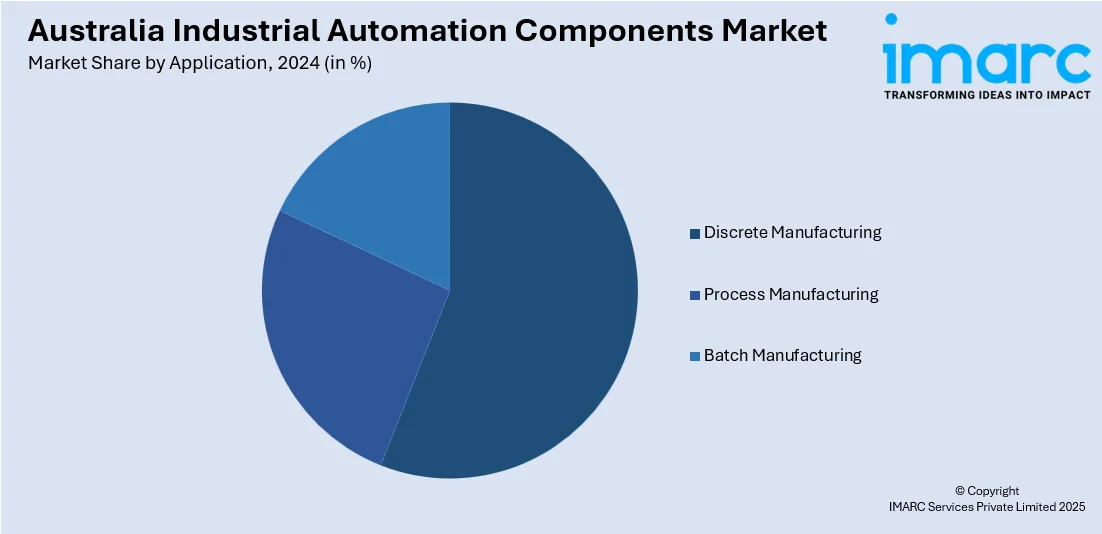

Application Insights:

- Discrete Manufacturing

- Process Manufacturing

- Batch Manufacturing

The report has provided a detailed breakup and analysis of the market based on the application. This includes discrete manufacturing, process manufacturing, and batch manufacturing.

End Use Industry Insights:

- Automotive

- Food and Beverage

- Pharmaceuticals

- Oil and Gas

- Chemicals

- Electronics and Semiconductors

- Metals and Mining

- Water and Wastewater

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes automotive, food and beverage, pharmaceuticals, oil and gas, chemicals, electronics and semiconductors, metals and mining, water and wastewater, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Automation Components Market News:

- In May 2025, Legrand Australia partnered with Applied Robotics to implement intelligent automation at their Sydney facility, doubling light switch production output. By automating the assembly process with robotic vision systems and automated component feeding, the solution reduced labor costs, enhanced product quality, and preserved local manufacturing competitiveness against international markets.

- In May 2025, OMRON opened its first Proof of Concept (PoC) Centre in Sydney to support advanced manufacturing in Australia and New Zealand. The centre aims to boost sovereign manufacturing capabilities, enhance innovation, and provide workforce training. This initiative, which is expected to generate $150 Million for the local economy, focuses on automation and robotics solutions.

- In April 2025, Honeywell announced that they will provide automation and safety controls for Iluka Resources’ Eneabba rare earths refinery in Western Australia, marking Australia’s first fully integrated rare earths refinery. The partnership will enhance operational efficiency, improve worker safety, and help produce vital rare earth oxides for electric vehicles, defense systems, and sustainable technologies.

- In February 2025, Schneider Electric partnered with Motion Solutions Australia and New Zealand to distribute its cobot robotics in the Pacific. The collaboration aims to help industries like manufacturing and packaging adopt Schneider Electric’s robotics to enhance operational efficiency. Motion Solutions will manage demand creation, delivery, and support for robotics projects.

- In June 2024, Bystronic and Lowa Lighting unveiled Australia's first Bystronic Smart Factory in Sydney, aimed at supporting a large-scale LED lighting project for New South Wales schools. This launch showcases the use of advanced automation technology in the manufacturing of LED lighting, emphasizing the integration of cutting-edge industrial automation solutions into production processes.

- In May 2024, Comau partnered with Airtac International Group to develop a range of industrial automation components, including clamps, cylinders, and linear guides. This collaboration allows Comau to offer comprehensive turnkey solutions with seamless integration and after-sales support, enhancing its competitive position in the market.

Australia Industrial Automation Components Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Discrete Manufacturing, Process Manufacturing, Batch Manufacturing |

| End Use Industries Covered | Automotive, Food and Beverage, Pharmaceuticals, Oil and Gas, Chemicals, Electronics and Semiconductors, Metals and Mining, Water and Wastewater, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial automation components market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial automation components market on the basis of component?

- What is the breakup of the Australia industrial automation components market on the basis of application?

- What is the breakup of the Australia industrial automation components market on the basis of end use industry?

- What is the breakup of the Australia industrial automation components market on the basis of region?

- What are the various stages in the value chain of the Australia industrial automation components market?

- What are the key driving factors and challenges in the Australia industrial automation components market?

- What is the structure of the Australia industrial automation components market and who are the key players?

- What is the degree of competition in the Australia industrial automation components market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial automation components market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial automation components market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial automation components industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)