Australia Industrial Automation Sensors Market Size, Share, Trends and Forecast by Sensor Type, Type, Mode of Automation, End User, and Region, 2025-2033

Australia Industrial Automation Sensors Market Overview:

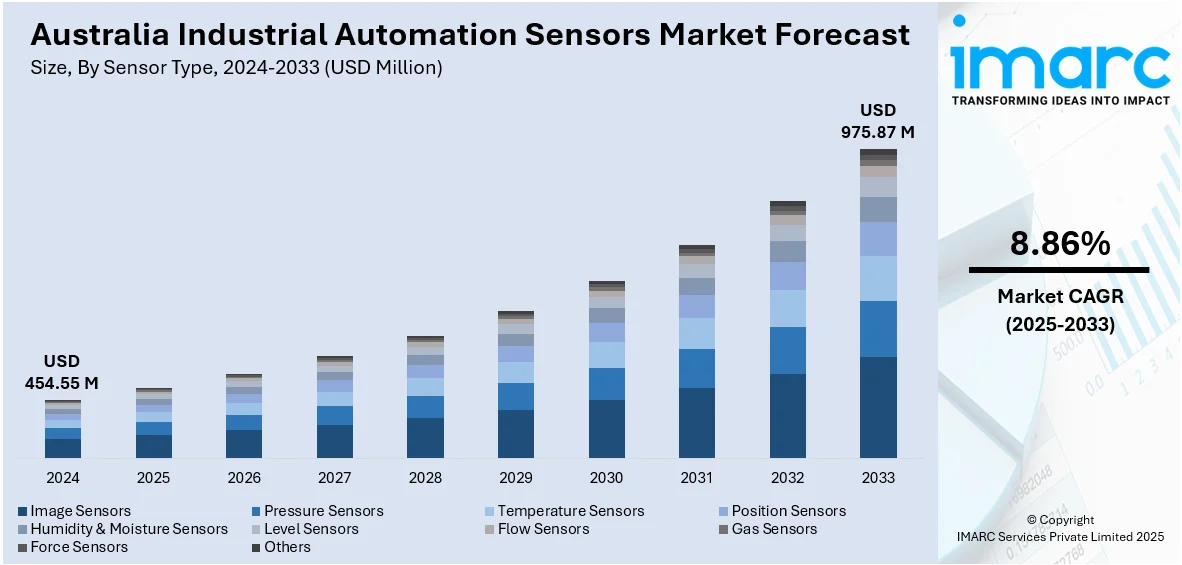

The Australia industrial automation sensors market size reached USD 454.55 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 975.87 Million by 2033, exhibiting a growth rate (CAGR) of 8.86% during 2025-2033. The market is driven by advancements in manufacturing technologies, growing adoption of Industry 4.0, and increased focus on operational efficiency. Applications spanning across the automotive, food processing, and mining industries due to government initiatives promoting smart industry practices, along with innovation and strategic partnerships are influencing the Australia industrial automation sensors market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 454.55 Million |

| Market Forecast in 2033 | USD 975.87 Million |

| Market Growth Rate 2025-2033 | 8.86% |

Australia Industrial Automation Sensors Market Trends:

Advancements in Manufacturing Technologies

The rapid evolution of manufacturing technologies is a key driver of the industrial automation sensors market in Australia. Modern factories increasingly rely on automated systems to streamline operations, minimize human error, and enhance productivity. This shift from traditional manufacturing to smart manufacturing requires accurate sensing that will enable data gathering and automation of processes. Sensors are important in increasing accuracy, measuring the environment, and enhancing the functionality of the equipment. In Australia, industries are adopting innovations such as predictive maintenance, robotics, and digital twins, all of which rely heavily on sensor integration. As manufacturing continues to evolve with emerging technologies, the demand for high-performance, durable, and adaptable sensors grows, solidifying their role in industrial automation, thereby driving the Australia industrial automation sensors market growth. For instance, Aeva, a pioneer in advanced sensing and perception technologies, has been chosen by Sensys Gatso Australia as the sole provider of LiDAR systems for secondary speed measurement. These LiDAR units will be integrated into Sensys Gatso’s latest mobile speed detection solutions, which are deployed for traffic enforcement on public roads across Australia.

To get more information on this market, Request Sample

Growing Adoption of Industry 4.0

Australian industry is transforming because of Industry 4.0, which is defined by the integration of cyber-physical systems and the Internet of Things (IoT). As companies embrace this digital transformation, there is a growing need for sensors that enable machine-to-machine communication and real-time analytics. These sensors are used for feeding data into intelligent systems, onboard for predictive maintenance, quality control, and improvement of operation. The adoption of Industry 4.0 across the Australian industries, including mining and manufacturing, and logistics, is bolstered by government support and increased industry sensitivity. With an increasing focus on smart factories and data-driven decision-making, the role of industrial automation sensors becomes even more vital in supporting seamless connectivity and automation. For instance, in May 2023, a new end-to-end industrial automation capability was introduced by Telstra to help restructure some of Australia's largest industries, making them more intelligent, secure, safe, and clean. To help businesses navigate the complexity of Industry 4.0, Telstra Purple's extensive suite of services combines its high-quality networks, including Fibre, 5G, and IoT, with its recent industrial solutions acquisitions of Aqura Technologies and Alliance Automation, as well as its joint venture with data science and AI leader Quantium.

Australia Industrial Automation Sensors Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on sensor type, type, mode of automation, and end user.

Sensor Type Insights:

- Image Sensors

- Pressure Sensors

- Temperature Sensors

- Position Sensors

- Humidity & Moisture Sensors

- Level Sensors

- Flow Sensors

- Gas Sensors

- Force Sensors

- Others

The report has provided a detailed breakup and analysis of the market based on the sensor type. This includes image sensors, pressure sensors, temperature sensors, position sensors, humidity & moisture sensors, level sensors, flow sensors, gas sensors, force sensors, and others.

Type Insights:

- Contact Sensors

- Non-contact Sensors

- Photonic Sensor

- Hall Effect Sensor

- Capacitive Sensor

- Ultrasonic Sensor

- Inductive Sensor

- Laser Displacement Sensor

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes contact sensors and non-contact sensors (photonic sensor, hall effect sensor, capacitive sensor, ultrasonic sensor, inductive sensor, and laser displacement sensor).

Mode of Automation Insights:

- Semi-Automatic Systems

- Fully-Automatic Systems

A detailed breakup and analysis of the market based on the mode of automation have also been provided in the report. This includes semi-automatic systems and fully-automatic systems.

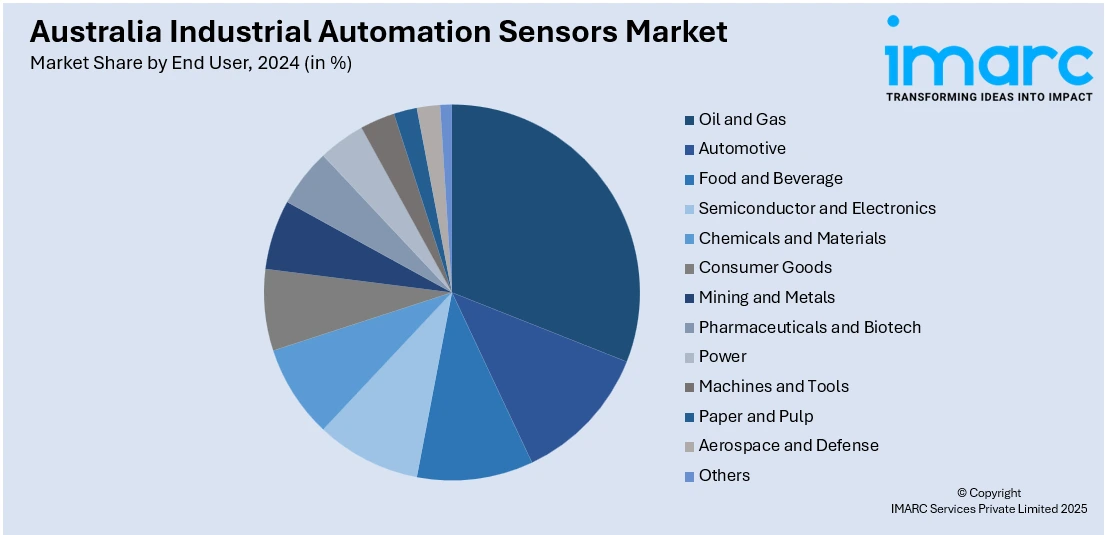

End User Insights:

- Oil and Gas

- Automotive

- Food and Beverage

- Semiconductor and Electronics

- Chemicals and Materials

- Consumer Goods

- Mining and Metals

- Pharmaceuticals and Biotech

- Power

- Machines and Tools

- Paper and Pulp

- Aerospace and Defense

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes oil & gas, automotive, food & beverage, semiconductor & electronics, chemicals & materials, consumer goods, mining & metals, pharmaceuticals & biotech, power, machines & tools, paper & pulp, aerospace & defense, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Automation Sensors Market News:

- In February 2025, leading energy management and automation digital transformation company Schneider Electric partnered with Motion Solutions Australia and Motion Solutions New Zealand to distribute cobot robotics for its Industrial Automation division in the Pacific.

- In March 2024, Pacific Automation, one of Australia's top brands in industrial automation, announced its most recent collaboration with Microsonic, a leader in specialized automation systems. This collaboration is a major turning point for Pacific Automation since it elevates Microsonic's cutting-edge product line to the top of the Australian market.

Australia Industrial Automation Sensors Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sensor Types Covered | Image Sensors, Pressure Sensors, Temperature Sensors, Position Sensors, Humidity & Moisture Sensors, Level Sensors, Flow Sensors, Gas Sensors, Force Sensors, Others |

| Types Covered |

|

| Modes of Automation Covered | Semi-Automatic Systems, Fully-Automatic Systems |

| End Users Covered | Oil & Gas, Automotive, Food and Beverage, Semiconductor and Electronics, Chemicals and Materials, Consumer Goods, Mining and Metals, Pharmaceuticals and Biotech, Power, Machines and Tools, Paper and Pulp, Aerospace and Defense, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial automation sensors market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial automation sensors market on the basis of sensor type?

- What is the breakup of the Australia industrial automation sensors market on the basis of type?

- What is the breakup of the Australia industrial automation sensors market on the basis of mode of automation?

- What is the breakup of the Australia industrial automation sensors market on the basis of end user?

- What is the breakup of the Australia industrial automation sensors market on the basis of region?

- What are the various stages in the value chain of the Australia industrial automation sensors market?

- What are the key driving factors and challenges in the Australia industrial automation sensors market?

- What is the structure of the Australia industrial automation sensors market and who are the key players?

- What is the degree of competition in the Australia industrial automation sensors market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial automation sensors market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial automation sensors market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial automation sensors industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)