Australia Industrial Conveyor Systems Market Size, Share, Trends and Forecast by Type, Load Capacity, Operation Type, End Use Industry, and Region, 2025-2033

Australia Industrial Conveyor Systems Market Overview:

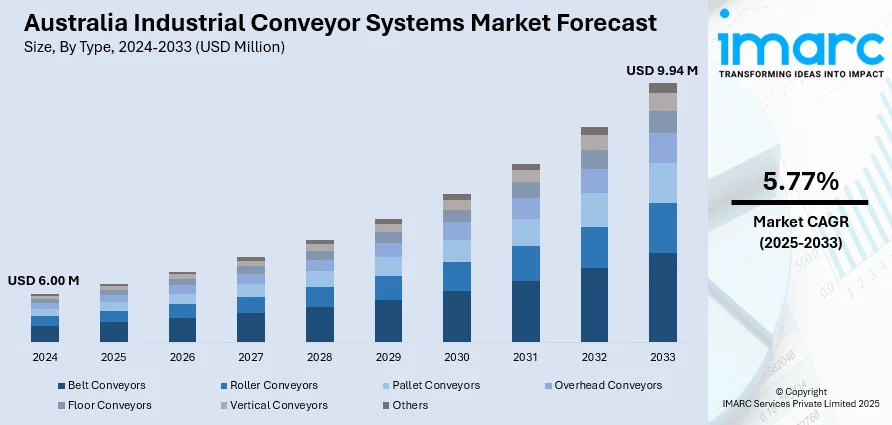

The Australia industrial conveyor systems market size reached USD 6.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9.94 Million by 2033, exhibiting a growth rate (CAGR) of 5.77% during 2025-2033. Rising mining sector expansion, e-commerce growth, and logistics automation are factors supporting the market growth. Moreover, surging labor costs, stringent food processing hygiene standards, and advanced manufacturing adoption are other growth-inducing factors. Apart from this, infrastructure projects, warehouse modernization, growing energy efficiency needs, development of waste management systems, and increased government support for industrial innovation are factors boosting the Australia industrial conveyor systems market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 6.00 Million |

| Market Forecast in 2033 | USD 9.94 Million |

| Market Growth Rate 2025-2033 | 5.77% |

Australia Industrial Conveyor Systems Market Trends:

Significant growth in the Mining Sector

Australia’s mining industry plays a vital role in driving demand for industrial conveyor systems, particularly due to its scale and reliance on continuous bulk material handling. Conveyor belts are indispensable in transporting minerals such as iron ore, coal, bauxite, and copper from remote extraction sites to processing facilities and ports. Major mining companies like BHP and Rio Tinto operate some of the world’s largest conveyor systems, integrated into autonomous and semi-autonomous mining operations. Conveyor systems are key to maintaining operational efficiency and safety in these large-scale operations. In line with this, a 2024 report from the Minerals Council of Australia highlighted that over AUD 20 billion in new mining projects are underway, with a significant portion incorporating advanced bulk handling infrastructure, including next-generation conveyor systems. Additionally, there is a growing push toward reducing greenhouse gas emissions, leading to investment in energy-efficient conveyor technology and electrified transport. As resource extraction intensifies to meet global demand, especially for critical minerals, the role of conveyors continues to grow, which is driving the Australia industrial conveyor systems market growth.

To get more information on this market, Request Sample

Rapid Logistics Automation

The Australian logistics sector is experiencing a rapid transformation through automation, and conveyor systems are central to this shift. As the volume of e-commerce surges, projected to reach USD 91.5 billion by 2025, warehousing and fulfillment centers are under pressure to speed up order processing while minimizing errors. Automated conveyor systems enable high-throughput movement, sorting, and routing of packages, significantly reducing manual labor and improving accuracy. Companies such as Australia Post, Toll Group, and Woolworths have upgraded their distribution centers with advanced conveyor networks integrated with barcode scanners, sensors, and robotic arms. In 2024, Australia Post announced a $400 million investment to expand and automate its parcel processing facilities nationwide, including the installation of high-speed conveyor systems capable of handling over 500,000 parcels per day. These upgrades allow for 24/7 operations with minimal downtime. The demand for faster delivery times and streamlined last-mile logistics continues to fuel investment in automation technologies, and conveyors are among the first components upgraded during warehouse modernization.

Food Processing Hygiene Needs

Food processing facilities in Australia must comply with strict hygiene and safety regulations, making specialized conveyor systems a crucial part of operations. The food-grade conveyor systems used in meat, dairy, bakery, and beverage processing are typically made from stainless steel or food-safe plastics with designs that allow thorough and easy cleaning. These systems reduce contamination risk and ensure regulatory compliance under standards enforced by Food Standards Australia New Zealand (FSANZ). For instance, conveyors with open frames, smooth welds, and removable belts are preferred because they prevent bacteria accumulation and are easier to sanitize between production shifts. In response to increasing scrutiny on food safety, especially post-COVID-19, many manufacturers have invested in automated conveyors that minimize human handling of food products.

Australia Industrial Conveyor Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, load capacity, operation type, and end use industry.

Type Insights:

- Belt Conveyors

- Roller Conveyors

- Pallet Conveyors

- Overhead Conveyors

- Floor Conveyors

- Vertical Conveyors

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes belt conveyors, roller conveyors, pallet conveyors, overhead conveyors, floor conveyors, vertical conveyors, and others.

Load Capacity Insights:

- Light-Duty Conveyors

- Medium-Duty Conveyors

- Heavy-Duty Conveyors

A detailed breakup and analysis of the market based on the load capacity have also been provided in the report. This includes light-duty conveyors, medium-duty conveyors, and heavy-duty conveyors.

Operation Type Insights:

- Automated Conveyors

- Semi-Automated Conveyors

- Manual Conveyors

The report has provided a detailed breakup and analysis of the market based on the operation type. This includes automated conveyors, semi-automated conveyors, and manual conveyors.

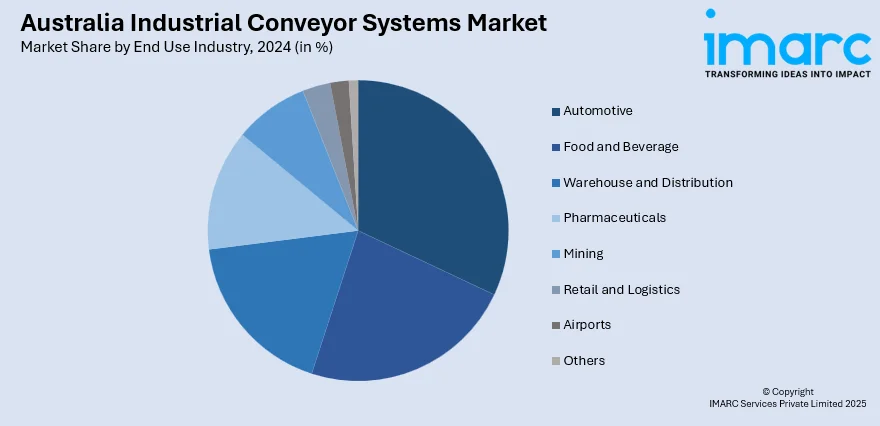

End Use Industry Insights:

- Automotive

- Food and Beverage

- Warehouse and Distribution

- Pharmaceuticals

- Mining

- Retail and Logistics

- Airports

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes automotive, food and beverage, warehouse and distribution, pharmaceuticals, mining, retail and logistics, airports, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Conveyor Systems Market News:

- In 2024, Conveyor Products & Solutions (CPS) partnered with SKF to incorporate advanced bearing technology into its conveyor systems. This collaboration aims to enhance operational efficiency, extend equipment lifespan, and reduce maintenance needs across mining and industrial applications. The partnership strengthens CPS’s focus on quality and performance.

- In 2024, TSGlobal unveiled a next-gen conveyor belt system featuring enhanced durability, energy efficiency, and intelligent monitoring capabilities. Designed for heavy-duty industrial use, the solution supports predictive maintenance and reduces operational disruptions. This innovation reflects TSGlobal’s focus on improving safety, performance, and automation in bulk material handling.

Australia Industrial Conveyor Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Belt Conveyors, Roller Conveyors, Pallet Conveyors, Overhead Conveyors, Floor Conveyors, Vertical Conveyors, Others |

| Load Capacities Covered | Light-Duty Conveyors, Medium-Duty Conveyors, Heavy-Duty Conveyors |

| Operation Types Covered | Automated Conveyors, Semi-Automated Conveyors, Manual Conveyors |

| End Use Industries Covered | Automotive, Food and Beverage, Warehouse and Distribution, Pharmaceuticals, Mining, Retail and Logistics, Airports, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial conveyor systems market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial conveyor systems market on the basis of type?

- What is the breakup of the Australia industrial conveyor systems market on the basis of load capacity?

- What is the breakup of the Australia industrial conveyor systems market on the basis of operation type?

- What is the breakup of the Australia industrial conveyor systems market on the basis of end use industry?

- What is the breakup of the Australia industrial conveyor systems market on the basis of region?

- What are the various stages in the value chain of the Australia industrial conveyor systems market?

- What are the key driving factors and challenges in the Australia industrial conveyor systems market?

- What is the structure of the Australia industrial conveyor systems market and who are the key players?

- What is the degree of competition in the Australia industrial conveyor systems market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial conveyor systems market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial conveyor systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial conveyor systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)