Australia Industrial Filtration Market Size, Share, Trends and Forecast by Type, Product, Filter Media, Application, and Region, 2025-2033

Australia Industrial Filtration Market Overview:

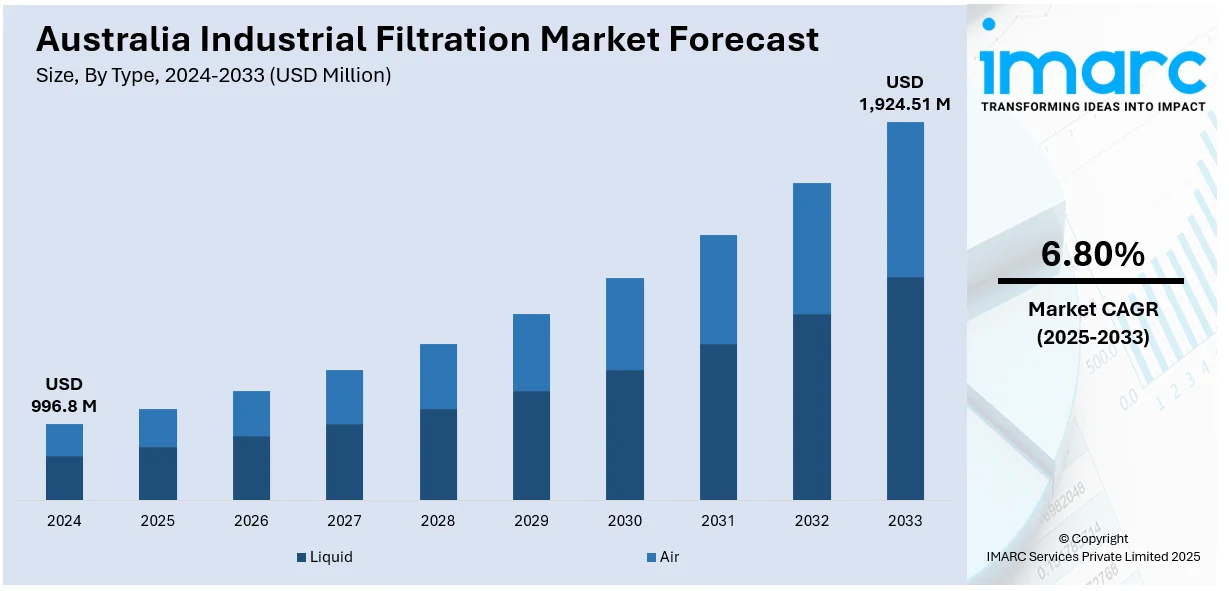

The Australia industrial filtration market size reached USD 996.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,924.51 Million by 2033, exhibiting a growth rate (CAGR) of 6.80% during 2025-2033. The increasing expansion of mining and resource extraction operations is impelling the market growth. This trend, along with the heightened adoption of stringent environmental policies to restrain industrial emissions and control wastewater discharge, is contributing to the market growth. Moreover, the ongoing adoption of advanced manufacturing technologies and automation is expanding the Australia industrial filtration market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 996.8 Million |

| Market Forecast in 2033 | USD 1,924.51 Million |

| Market Growth Rate 2025-2033 | 6.80% |

Australia Industrial Filtration Market Trends:

Strengthening Environmental Regulations and Compliance Measures

The Australian market is growing with regulatory bodies adopting stringent environmental policies to restrain industrial emissions and control wastewater discharge. Agencies like the Environmental Protection Agency (EPA) are regularly revising air and water quality standards, encouraging industries to adopt sophisticated filtration technologies. In 2024, schemes operated implemented by the government are projected to have cut emissions by at least 69.2 million tons of carbon dioxide equivalent (Mt CO2-e), an 8% increase on 2023. This is projected to increase to at least 72 Mt CO2-e in 2025. These are cautious projections as they rely on the average emissions intensity of the electricity grid instead of presuming that renewables are replacing coal and gas generation exclusively. Industrial plants, power plants, chemical plants, and mines are spending on installing filtration systems to meet legal requirements and prevent penalties or shutdowns. These market pressures lead to ongoing technology advancements in filtration devices, such as high efficiency particulate air (HEPA) filters, membrane filters, and electrostatic precipitators, which improve the efficiency of particulate capture. As industrial operators are increasingly focusing on sustainability and corporate environmental responsibility, they are incorporating high-efficiency filtration systems to minimize their ecological impact.

To get more information on this market, Request Sample

Expanding Mining and Resource Extraction Activities

The increasing expansion of mining and resource extraction operations is impelling the Australia industrial filtration market growth. These industries need strong filtration systems to control dust suppression, equipment protection, and purification of water used in mineral processing. Iron ore, coal, and lithium extraction companies are investing in industrial filters to maintain operational efficiency and minimize environmental footprint. As worldwide demand for raw materials and critical minerals keeps increasing, particularly for renewable energy technologies and electric vehicles (EVs), Australia's mining industry is expanding operations. This expansion is requiring more sophisticated air and liquid filtration systems that can operate in high-particulate, high-volume conditions. In turn, manufacturers of filtration equipment are adapting solutions to suit the challenging environment and operational conditions of Australian mines, thus driving the demand for industrial filtration technology. According to Gilbert+Tobin, the metals and mining industry contributes 14.3% of Australia’s GDP in 2024, generating 1.1 million jobs and directly employing 300,00 people.

Growing Adoption of Advanced Manufacturing and Automation

The ongoing adoption of advanced manufacturing technologies and automation across Australia is driving the demand for efficient industrial filtration systems. Sectors such as food processing, pharmaceuticals, electronics, and automotive manufacturing are integrating Industry 4.0 practices, which emphasize clean production environments, operational precision, and minimal contamination. As automated systems become more sensitive to airborne particulates, oil mists, and chemical vapors, manufacturers are implementing high-performance filtration units to safeguard machinery and ensure product quality. Cleanroom standards and hygiene compliance in industries like biotechnology and semiconductor production are further catalyzing the requirement for advanced filtration capabilities. Moreover, the integration of sensors and Internet of Things (IoT)-enabled monitoring within filtration systems is enhancing maintenance protocols and system responsiveness, fostering long-term cost efficiency. The shift toward smart manufacturing is continuously elevating the standards for air and liquid purity. The IMARC Group predicts that the Australia IoT market size is projected to reach USD 90.61 Billion by 2032.

Australia Industrial Filtration Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, product, filter media, and application.

Type Insights:

- Liquid

- Air

The report has provided a detailed breakup and analysis of the market based on the type. This includes liquid and air.

Product Insights:

- Bag Filter

- Cartridge Filter

- Depth Filter

- Filter Press

- Drum Filter

- Electrostatic Precipitator

- ULPA (Ultra-Low Penetration Air)

- HEPA (High Efficiency Particulate Air)

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes bag filter, cartridge filter, depth filter, filter press, drum filter, electrostatic precipitator, ULPA (ultra-low penetration air), HEPA (high efficiency particulate air), and others.

Filter Media Insights:

- Filter Paper

- Metal

- Activated Carbon/Charcoal

- Fiberglass

- Non-Woven Fabric

- Others

The report has provided a detailed breakup and analysis of the market based on the filter media. This includes filter paper, metal, activated carbon/charcoal, fiberglass, non-woven fabric, and others.

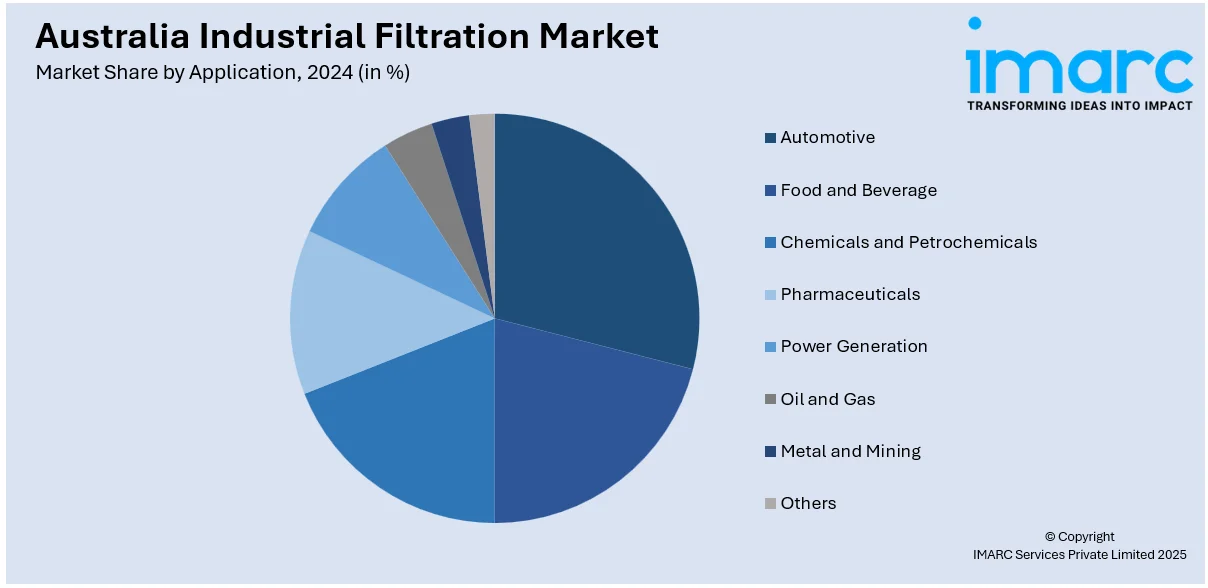

Application Insights:

- Automotive

- Food and Beverage

- Chemicals and Petrochemicals

- Pharmaceuticals

- Power Generation

- Oil and Gas

- Metal and Mining

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, food and beverage, chemicals and petrochemicals, pharmaceuticals, power generation, oil and gas, metal and mining, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Filtration Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liquid, Air |

| Products Covered | Bag Filter, Cartridge Filter, Depth Filter, Filter Press, Drum Filter, Electrostatic Precipitator, ULPA (Ultra-Low Penetration Air), HEPA (High Efficiency Particulate Air), Others |

| Filter Medias Covered | Filter Paper, Metal, Activated Carbon/Charcoal, Fiberglass, Non-Woven Fabric, Others |

| Applications Covered | Automotive, Food and Beverage, Chemicals and Petrochemicals, Pharmaceuticals, Power Generation, Oil and Gas, Metal and Mining, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial filtration market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial filtration market on the basis of type?

- What is the breakup of the Australia industrial filtration market on the basis of product?

- What is the breakup of the Australia industrial filtration market on the basis of filter media?

- What is the breakup of the Australia industrial filtration market on the basis of application?

- What is the breakup of the Australia industrial filtration market on the basis of region?

- What are the various stages in the value chain of the Australia industrial filtration market?

- What are the key driving factors and challenges in the Australia industrial filtration market?

- What is the structure of the Australia industrial filtration market and who are the key players?

- What is the degree of competition in the Australia industrial filtration market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial filtration market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial filtration market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial filtration industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)