Australia Industrial Flooring Market Size, Share, Trends and Forecast by Resin Type, Application, End-Use Industry, and Region, 2026-2034

Australia Industrial Flooring Market Summary:

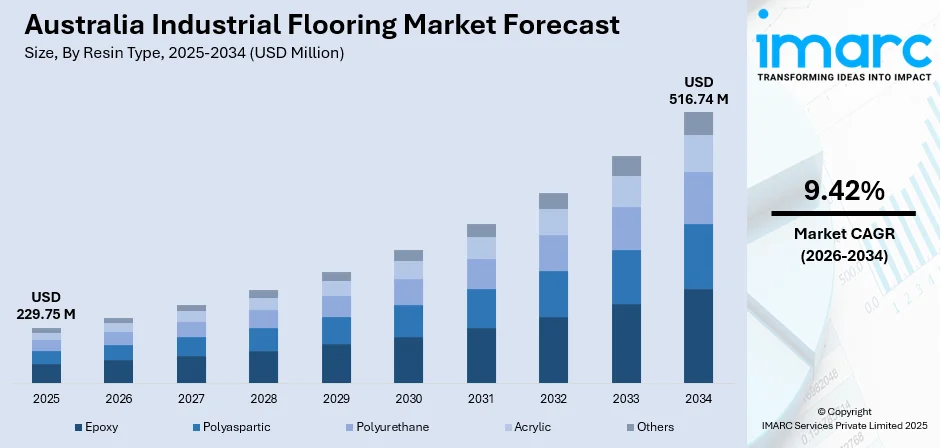

The Australia industrial flooring market size was valued at USD 229.75 Million in 2025 and is projected to reach USD 516.74 Million by 2034, growing at a compound annual growth rate of 9.42% from 2026-2034.

The Australia industrial flooring market is experiencing robust growth driven by expanding infrastructure development, rising demand for durable flooring solutions across manufacturing and logistics sectors, and increasing emphasis on workplace safety regulations. The growing food and beverage industry with stringent hygiene requirements and the surge in e-commerce fulfillment centers are catalyzing demand for high-performance flooring systems, strengthening the Australia industrial flooring market share.

Key Takeaways and Insights:

- By Resin Type: Epoxy dominates the market with a share of 46.3% in 2025, owing to its exceptional chemical resistance, durability, and cost-effectiveness for large-scale industrial applications.

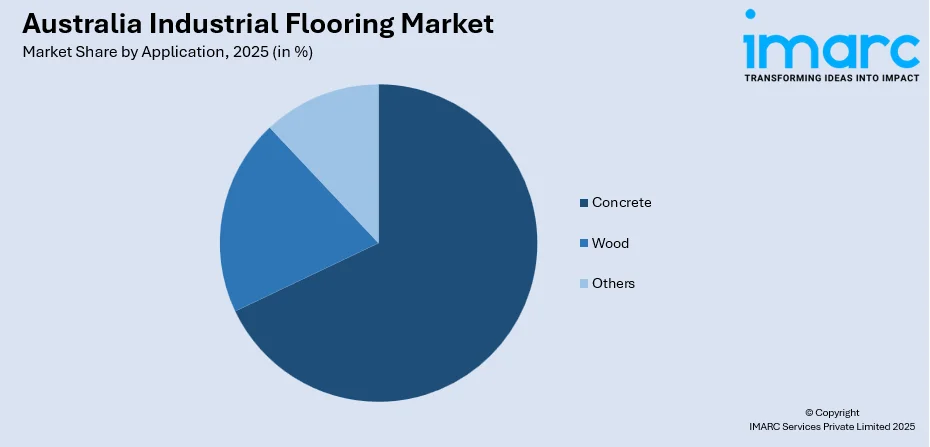

- By Application: Concrete leads the market with a share of 67.8% in 2025, driven by its superior load-bearing capacity, durability against heavy machinery, and suitability for warehousing environments.

- By End-Use Industry: Food and Beverage represents the largest segment with a market share of 30.7% in 2025, attributed to stringent hygiene regulations and HACCP compliance requirements driving demand for seamless, antimicrobial flooring.

- By Region: Australian Capital Territory and New South Wales dominates the market with a share of 35% in 2025, driven by major infrastructure projects, manufacturing and logistics growth, workplace safety, operational efficiency, and rising demand for durable, slip-resistant, and sustainable flooring solutions.

- Key Players: The Australia industrial flooring market exhibits a moderately fragmented competitive landscape, with multinational corporations and specialized regional manufacturers competing across resin types and end-use applications.

To get more information on this market Request Sample

The Australia industrial flooring market is characterized by increasing adoption of advanced resin-based flooring systems that deliver superior performance in demanding industrial environments. The market is witnessing significant investment in high-performance flooring solutions as businesses prioritize workplace safety, operational efficiency, and regulatory compliance. In parallel, in 2025, the national public infrastructure pipeline in Australia has surged: according to Infrastructure Australia, the five‑year Major Public Infrastructure Pipeline has grown by AUD 29 billion over the past year to reach AUD 242 billion, its highest level ever. The Australian government's substantial infrastructure pipeline is driving considerable demand for industrial flooring across transportation, logistics, and urban development projects. Growing emphasis on sustainability and green building certifications is encouraging manufacturers to develop eco-friendly flooring solutions with low volatile organic compound emissions and extended service life capabilities.

Australia Industrial Flooring Market Trends:

Sustainability and Green Building Certifications Driving Material Selection

The increasing emphasis on sustainability and green building certifications is reshaping material selection in the Australia industrial flooring market. Companies are prioritizing flooring solutions with low volatile organic compound emissions, high recycled content, and extended life cycles to reduce environmental impact. For instance, Forbo Flooring Systems reports that as of 2025 many of its products are certified under independent ecolabel schemes such as Global GreenTag, with some ranges containing 23 % recycled material by weight, and in certain products, individual recycled content ratios reach as high as 89 %. As more government and private sector projects adopt sustainability benchmarks, industrial flooring is being evaluated not just on cost and durability but also on carbon impact and compliance potential, encouraging manufacturers and suppliers to adopt cleaner production methods and certify materials to meet rising environmental expectations.

E-Commerce Expansion Fueling Warehouse and Fulfillment Center Development

The rapid expansion of e-commerce is catalyzing unprecedented demand for warehouse and fulfillment center construction across Australia. As more consumers shift towards online shopping, retailers and logistics providers are scaling up their operations, leading to an increase in warehouses, fulfillment centers, and large-scale retail facilities. For example, according to CBRE Australia, Australia’s e‑commerce penetration rate reached 14.3% in 2025 and is forecast to climb to 17% by 2029, requiring an additional 1.7–1.8 million sqm of logistics space over the next five years to keep pace with demand. These facilities require flooring that can withstand constant foot traffic, forklift use, and the added weight of automated robotic picking systems, driving demand for high-performance seamless flooring solutions with enhanced durability and low maintenance requirements.

Technological Advancements in Antimicrobial and Self-Healing Flooring Systems

The development of innovative flooring technologies is gaining significant traction across healthcare and food processing sectors. Antimicrobial flooring materials and self-healing flooring systems are increasingly being adopted to reduce bacterial spread and enhance floor longevity. For example, the Flowfresh antimicrobial polyurethane‐resin flooring, developed by Flowcrete, is widely used in food production, pharmaceutical, and healthcare facilities across Australia, and can reduce bacterial load on the floor surface. These technologies not only enhance the durability and performance of flooring but also offer additional benefits such as reducing the spread of bacteria in healthcare and food processing environments, making them essential for facilities with stringent hygiene requirements.

Market Outlook 2026-2034:

The Australia industrial flooring market is poised for sustained expansion over the forecast period, driven by robust infrastructure development, rising food safety standards, and growing emphasis on sustainable construction practices. The increasing adoption of seamless resin-based flooring systems offering superior chemical resistance and hygiene compliance will continue driving market growth. The construction of new warehouses, distribution centers, and manufacturing facilities across major industrial corridors will create substantial opportunities for flooring solution providers. The market generated a revenue of USD 229.75 Million in 2025 and is projected to reach a revenue of USD 516.74 Million by 2034, growing at a compound annual growth rate of 9.42% from 2026-2034.

Australia Industrial Flooring Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Resin Type | Epoxy | 46.3% |

| Application | Concrete | 67.8% |

| End-Use Industry | Food and Beverage | 30.7% |

| Region | Australia Capital Territory & New South Wales | 35% |

Resin Type Insights:

- Epoxy

- Polyaspartic

- Polyurethane

- Acrylic

- Others

The epoxy dominates with a market share of 46.3% of the total Australia industrial flooring market in 2025.

Epoxy flooring has established themselves as the dominant resin type in Australia's industrial flooring landscape, capturing the largest market share. The material's exceptional chemical resistance, durability, and ability to create seamless surfaces make it ideally suited for demanding industrial environments. Epoxy coatings create a protective layer that significantly increases surface brightness while providing excellent resistance to heat, spillage, slippage, and mechanical abrasion. For instance, in October 2025, Australian Epoxy Floors was awarded “Best Flooring Company” in the Cassowary Coast region under the 2025 Quality Business Awards, highlighting growing recognition for high-quality epoxy solutions. Water-based epoxy resin floor materials containing no harmful solvents or volatile organic compounds are gaining significant adoption across occupied industrial facilities.

The widespread adoption of epoxy flooring across manufacturing facilities, warehouses, and food processing plants is driven by its cost-effectiveness for large-scale applications and well-established technology that provides proven, reliable performance. The extended service life of epoxy coatings further enhances their appeal for industrial operators seeking long-term flooring solutions. The material's adaptability to various application techniques and compatibility with different substrate surfaces, including cement, metal, and wood, continues to drive its market leadership across diverse industrial sectors.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Concrete

- Wood

- Others

The concrete leads with a share of 67.8% of the total Australia industrial flooring market in 2025.

Concrete applications dominate the Australia industrial flooring market owing to the material's exceptional durability and capability to endure heavy machinery and high traffic volumes. Concrete floors in industrial settings offer significant advantages including low maintenance requirements, cost-effectiveness for large spaces, design versatility, and superior chemical resistance. The material's environmental sustainability credentials, with recyclable properties, align with the growing emphasis on green building practices across Australia's industrial sector. Recently, the surge in demand for warehouses and logistics sites, many of them built on large concrete slabs, has intensified. In the September 2025 quarter, buyer enquiries across Australian warehouses, factories, and industrial‑real‑estate listings rose 19% year‑on‑year.

The prevalence of concrete flooring applications is further supported by the material's compatibility with various coating systems, enabling industrial operators to enhance surface performance through epoxy, polyurethane, or polyaspartic treatments. The construction of warehouses and distribution centers across major industrial corridors is fueling demand for concrete flooring solutions capable of handling unique requirements including heavy forklift traffic, racking system loads, and automated conveyor systems. Polished concrete finishes are gaining popularity for their aesthetic appeal combined with functional durability.

End-Use Industry Insights:

- Food and Beverage

- Chemical

- Transportation and Aviation

- Healthcare

- Others

The food and beverage dominate with a market share of 30.7% of the total Australia industrial flooring market in 2025.

The food and beverage industry represents the largest end-use segment in Australia's industrial flooring market, driven by stringent hygiene regulations and food safety compliance requirements. Industrial flooring in food production facilities must be resistant to steam and hot water wash-downs, cleaning chemicals, and impervious to animal fats even under heavy-use conditions. HACCP certified flooring solutions designed specifically for food and beverage manufacturing and processing applications demonstrate the industry's commitment to meeting Australia New Zealand Food Standards Code requirements. For example, in 2025, Flowcrete Australia installed its Flowfresh antimicrobial polyurethane flooring at a major dairy processing plant in New South Wales, providing a seamless surface that resists fats, cleaning chemicals, and high-temperature wash‑downs while supporting HACCP compliance.

The growing demand for plant-based foods is creating additional opportunities for specialized flooring installations across new production facilities. The expanding Australian plant-based sector is driving construction of new food processing facilities requiring compliant flooring solutions. Seamless epoxy and polyurethane flooring systems are increasingly specified for food facilities due to their ability to eliminate joints and gaps where bacteria and pathogens can flourish, supporting effective HACCP programs and ensuring regulatory compliance across production environments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australian Capital Territory and New South Wales exhibits a clear dominance with a 35% share of the total Australia industrial flooring market in 2025.

The combined Australian Capital Territory and New South Wales region leads the Australia industrial flooring market, driven by the concentration of major infrastructure projects and industrial activity in the Sydney metropolitan area. The NSW Government's substantial infrastructure commitment is creating significant demand for industrial flooring across construction, logistics, and manufacturing sectors. Major projects including metro rail expansions, airport development, and extensive warehouse development in key industrial precincts are driving substantial flooring installations. Government initiatives to expedite residential and commercial project approvals are expected to further stimulate demand for industrial flooring solutions across supporting manufacturing and logistics facilities.

Additionally, rising awareness of workplace safety and operational efficiency is prompting businesses to adopt advanced flooring solutions with enhanced durability, slip resistance, and acoustic performance. Sustainability considerations are also influencing procurement decisions, with an increasing preference for environmentally friendly and low-maintenance materials. This trend is expected to support steady growth in the industrial flooring segment across both regions.

Market Dynamics:

Growth Drivers:

Why is the Australia Industrial Flooring Market Growing?

Expanding Infrastructure Development and Government Investment

The Australian government's substantial investment in infrastructure projects is creating significant demand for industrial flooring solutions across transportation, logistics, and urban development sectors. For example, in March 2025 the government committed A$1 billion to secure a new rail corridor connecting the southwestern suburbs of Sydney with the upcoming Western Sydney International Airport and Bradfield City Centre, a move expected to catalyze construction of new freight, logistics, and intermodal facilities in the region. The federal budget has outlined comprehensive plans supporting extensive infrastructure pipelines focusing on improved cities and suburbs. These infrastructure initiatives encompass construction of transportation hubs, logistics centers, and urban revitalization projects that directly drive demand for high-performance industrial flooring capable of withstanding heavy traffic and operational demands. Road upgrade projects and airport developments in Western Sydney are creating additional opportunities for flooring solution providers.

Rising Emphasis on Workplace Safety and Regulatory Compliance

The increasing focus on workplace safety regulations and compliance requirements is driving adoption of high-performance industrial flooring solutions across Australian industries. Industrial flooring systems must now meet stringent requirements for slip resistance, chemical resistance, and electrostatic discharge protection to comply with evolving workplace safety standards. The need for flooring that can withstand heavy machinery, chemical spills, temperature fluctuations, and high foot traffic while maintaining safety standards is compelling businesses to invest in advanced flooring technologies. For instance, the safety regulator WorkSafe Queensland notes that choosing the right floor surface (or surfacing treatment) in industrial settings is critical to preventing slips, trips, and falls, and recommends coatings such as epoxy or other rough‑profiled surfaces (with aggregates or anti-slip finishes) for areas subject to contamination or frequent cleaning. The growing awareness of long-term cost benefits associated with industrial flooring, including reduced maintenance expenses and enhanced operational efficiency, is further accelerating market expansion across manufacturing, warehousing, and logistics sectors.

Food Safety Regulations and Hygiene Standards in Processing Facilities

Strict food safety regulations and hygiene standards in food processing and manufacturing are driving demand for specialized industrial flooring solutions. Flooring must meet rigorous criteria for cleanliness, antimicrobial performance, and resistance to cleaning chemicals. Seamless systems are increasingly preferred, eliminating joints and cracks where bacteria could grow. The Australia food safety testing market size reached USD 504.00 Million in 2024, highlighting the scale and importance of compliance across the sector. Looking forward, IMARC Group expects the market to reach USD 999.13 Million by 2033, reflecting the growing emphasis on safety and hygiene in food production. Manufacturers focus on developing and certifying durable, compliant flooring solutions that support effective sanitation practices. These innovations ensure facilities maintain high hygiene standards while meeting evolving food safety requirements across Australia’s growing food and beverage processing sector.

Market Restraints:

What Challenges the Australia Industrial Flooring Market is Facing?

Fluctuating Raw Material Prices and Supply Chain Volatility

The volatility in raw material prices for epoxy resins, polyurethane, and other flooring components poses significant challenges for manufacturers and contractors in maintaining competitive pricing structures. Global supply chain disruptions and fluctuating petrochemical prices directly impact production costs and project budgets, creating uncertainty for industrial flooring providers and end-users seeking predictable cost structures for large-scale installations.

High Initial Installation Costs for Advanced Flooring Systems

The substantial upfront investment required for high-performance industrial flooring systems presents a barrier for small and medium-sized enterprises seeking to upgrade their facilities. Advanced resin-based flooring solutions, while offering superior long-term value through extended service life and reduced maintenance costs, require significant initial capital expenditure that may challenge budget-constrained operators considering facility improvements or new installations.

Skilled Labor Shortage for Specialized Flooring Installation

The construction industry's ongoing skilled labor shortage is affecting the availability of qualified technicians for specialized flooring installation, particularly for complex resin-based systems requiring precise application techniques. The shortage of experienced installers can lead to extended project timelines, quality concerns, and increased labor costs, particularly during peak construction periods when demand for industrial flooring services intensifies across multiple projects.

Competitive Landscape:

The Australia industrial flooring market exhibits a moderately fragmented competitive landscape characterized by the presence of multinational corporations, specialized regional manufacturers, and flooring contractors competing across diverse product segments and end-use applications. Major players focus on product innovation, sustainability initiatives, and strategic partnerships with construction firms to strengthen market positioning. The competitive intensity is driving continuous advancement in flooring technologies, with manufacturers investing in research and development to deliver solutions offering enhanced durability, chemical resistance, and environmental performance. Market participants are increasingly differentiating through comprehensive service offerings encompassing design consultation, installation, and ongoing maintenance support.

Recent Developments:

- In May 2025, at the Sydney Build Expo, Peikko Australia unveiled advanced flooring solutions and concrete‑connection technologies. Highlights included bolted‑connection systems, floor‑armour joints, and the proprietary DELTABEAM® Slim Floor Structure, enhancing efficiency, safety, and sustainability in construction. The showcase reflects a shift toward high-performance, modern flooring practices.

- In September 2024, Tarkett Australia introduced iD Comfort 19 — a luxury vinyl tile (LVT) engineered for the Australian climate. With a six‑layer construction, it’s built to withstand heavy traffic while offering acoustic comfort, and stands out for its resistance to indentations, scratches, stains as well as thermal and dimensional stress.

Australia Industrial Flooring Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Resin Types Covered | Epoxy, Polyaspartic, Polyurethane, Acrylic, Others |

| Applications Covered | Concrete, Wood, Others |

| End-Use Industries Covered | Food and Beverage, Chemical, Transportation and Aviation, Healthcare, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia industrial flooring market size was valued at USD 229.75 Million in 2025.

The Australia industrial flooring market is expected to grow at a compound annual growth rate of 9.42% from 2026-2034 to reach USD 516.74 Million by 2034.

Epoxy dominated the market with a 46.3% share, driven by its exceptional chemical resistance, durability, cost-effectiveness for large-scale applications, and proven performance across diverse industrial environments.

Key factors driving the Australia industrial flooring market include expanding infrastructure development supported by government investment, rising emphasis on workplace safety and regulatory compliance, stringent food safety regulations in processing facilities, and growing demand from e-commerce and logistics sectors.

Major challenges include fluctuating raw material prices and supply chain volatility, high initial installation costs for advanced flooring systems, skilled labor shortage for specialized installation, and the complexity of meeting diverse regulatory requirements across different industry sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)