Australia Industrial Gearboxes Market Size, Share, Trends and Forecast by Type, Design, Application, and Region, 2025-2033

Australia Industrial Gearboxes Market Overview:

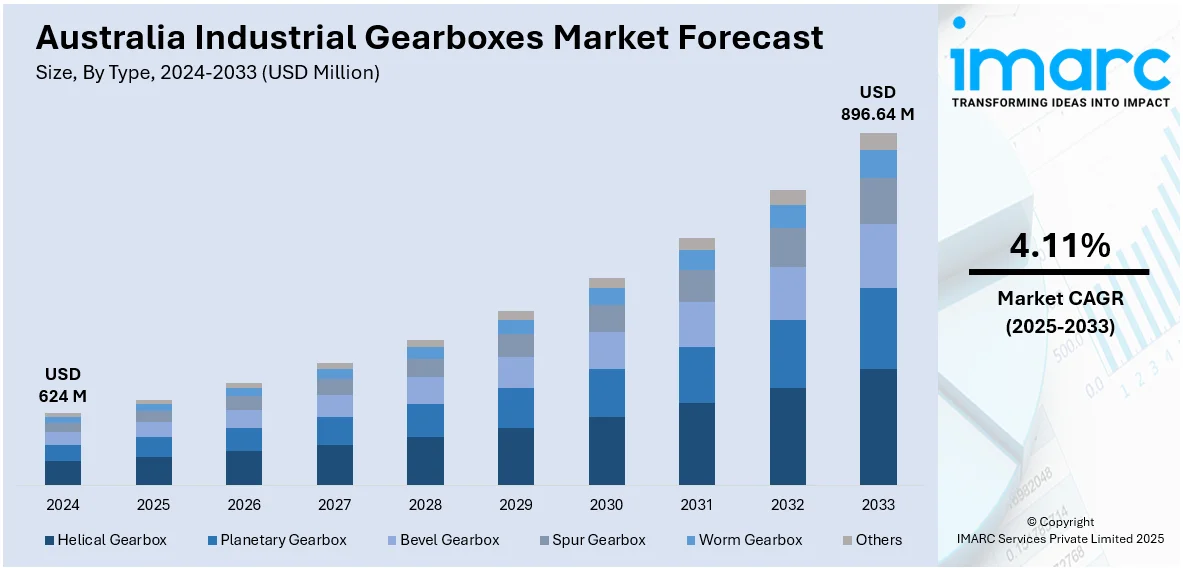

The Australia industrial gearboxes market size reached USD 624 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 896.64 Million by 2033, exhibiting a growth rate (CAGR) of 4.11% during 2025-2033. Mining and construction expansion, automation in manufacturing, renewable energy projects, and rising demand for efficient power transmission systems are some of the factors contributing to Australia industrial gearboxes market share. Upgrades in existing infrastructure and increased investment in heavy machinery also support long-term market growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 624 Million |

| Market Forecast in 2033 | USD 896.64 Million |

| Market Growth Rate 2025-2033 | 4.11% |

Australia Industrial Gearboxes Market Trends:

Rising Demand for Automatic Transmission-Compatible Gear Systems

The Australian automotive landscape is increasingly favoring vehicles equipped with automatic transmission and petrol-powered engines, moving away from manual and diesel-based configurations. This shift reflects changing consumer preferences and regulatory considerations. As a result, there is a growing requirement for specialized industrial gearboxes tailored for automatic systems. Manufacturers and service centers are expected to invest more in gearbox solutions that support efficient assembly lines, testing procedures, and long-term maintenance of such drivetrains. With more international models entering the market featuring advanced automatic gear systems, domestic infrastructure is adapting rapidly to accommodate precise, high-performance gearbox components. This evolution supports not only vehicle imports but also the broader ecosystem of parts suppliers, testing facilities, and service operations across the country. These factors are intensifying the Australia industrial gearboxes market growth. For example, in June 2023, Mahindra & Mahindra launched the XUV700 in Australia with a 2.0-litre turbo-petrol engine and a 6-speed automatic gearbox, highlighting the market’s tilt toward automatic transmission systems. The absence of manual and diesel options aligns with evolving drivetrain preferences. This development could boost demand for industrial gearboxes used in automotive assembly, testing, and service infrastructure, reinforcing Australia’s growing need for precision gearbox solutions across the vehicle manufacturing and maintenance ecosystem.

To get more information on this market, Request Sample

Focus on Compact 4WD-Compatible Gearbox Integration

The market in Australia is showing increased interest in compact utility vehicles with four-wheel drive and modern safety technologies. These vehicles typically require robust, space-efficient gearboxes capable of supporting off-road performance without compromising reliability. The growing presence of such models points to rising demand for industrial gearboxes suited for compact drivetrain assemblies and export-oriented production systems. Cross-border vehicle manufacturing is also influencing local service infrastructure, prompting investment in gear systems tailored for multi-terrain capability. Precision, durability, and adaptability are becoming key requirements for gearbox suppliers as automotive platforms evolve. Local assembly, testing, and maintenance facilities are expected to prioritize gear units that integrate seamlessly with advanced drivetrains, ensuring consistent performance in both urban and rugged conditions across Australia’s diverse landscapes. For instance, in December 2023, Suzuki introduced the India-manufactured Jimny 5-door in Australia with advanced features like ADAS and a 1.5-litre engine paired with four-wheel drive. The vehicle’s assembly and export from India highlight growing cross-border automotive integration, with transmission systems playing a central role. The model’s launch reflects rising demand in Australia for compact, rugged vehicles equipped with reliable drivetrain and gearbox technologies.

Australia Industrial Gearboxes Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, design, and application.

Type Insights:

- Helical Gearbox

- Planetary Gearbox

- Bevel Gearbox

- Spur Gearbox

- Worm Gearbox

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes helical gearbox, planetary gearbox, bevel gearbox, spur gearbox, worm gearbox, and others.

Design Insights:

- Parallel Axis

- Angled Axis

- Others

A detailed breakup and analysis of the market based on the design have also been provided in the report. This includes parallel axis, angled axis, and others.

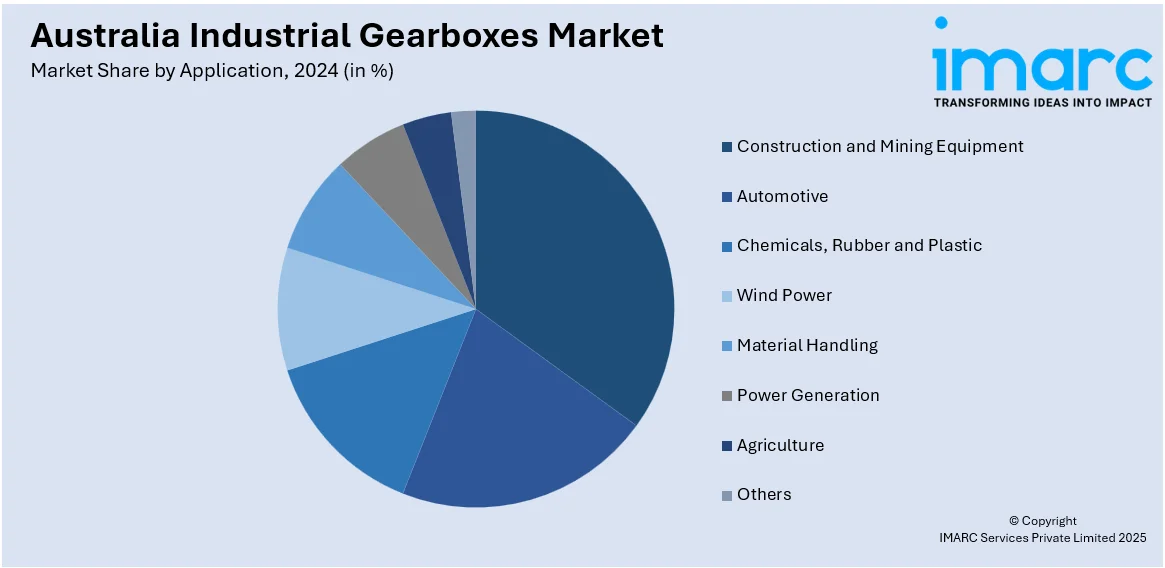

Application Insights:

- Construction and Mining Equipment

- Automotive

- Chemicals, Rubber and Plastic

- Wind Power

- Material Handling

- Power Generation

- Agriculture

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes construction and mining equipment, automotive, chemicals, rubber and plastic, wind power, material handling, power generation, agriculture, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Gearboxes Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Helical Gearbox, Planetary Gearbox, Bevel Gearbox, Spur Gearbox, Worm Gearbox, Others |

| Designs Covered | Parallel Axis, Angled Axis, Others |

| Applications Covered | Construction and Mining Equipment, Automotive, Chemicals, Rubber and Plastic, Wind Power, Material Handling, Power Generation, Agriculture, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial gearboxes market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial gearboxes market on the basis of type?

- What is the breakup of the Australia industrial gearboxes market on the basis of design?

- What is the breakup of the Australia industrial gearboxes market on the basis of application?

- What is the breakup of the Australia industrial gearboxes market on the basis of region?

- What are the various stages in the value chain of the Australia industrial gearboxes market?

- What are the key driving factors and challenges in the Australia industrial gearboxes market?

- What is the structure of the Australia industrial gearboxes market and who are the key players?

- What is the degree of competition in the Australia industrial gearboxes market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial gearboxes market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial gearboxes market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial gearboxes industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)