Australia Industrial Pumps and Valves Market Size, Share, Trends and Forecast by Product Type, Position, Driving Force, End Use, and Region, 2025-2033

Australia Industrial Pumps and Valves Market Size and Share:

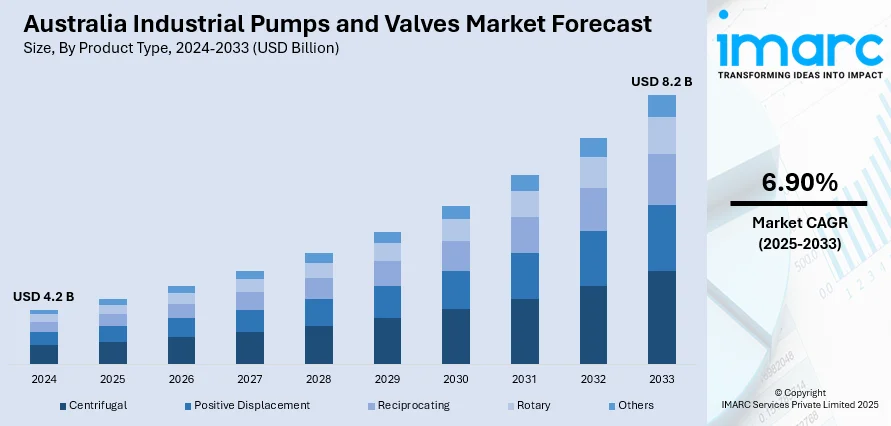

The Australia industrial pumps and valves market size reached USD 4.2 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 8.2 Billion by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. The market is fueled by increasing demand for energy-efficient fluid handling systems, increased adoption of Industrial Internet of Things (IIOT) for intelligent monitoring, and higher investment in water infrastructure and irrigation schemes. All these are boosting operational reliability, sustainability, and automation across industrial sectors. As industries keep on up-scaling and going green to meet environmental goals, these trends will go a long way in contributing to Australia industrial pumps and valves market share growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 4.2 Billion |

|

Market Forecast in 2033

|

USD 8.2 Billion |

| Market Growth Rate 2025-2033 | 6.90% |

Australia Industrial Pumps and Valves Market Trends:

Focus on Energy Efficiency and Flow Optimization

Across Australia's manufacturing industry, there is increasing focus on energy-efficient valves and pumps that enable sustainable operations. Water treatment, power generation, and mining industries are embracing variable speed drive (VSD) pumps and precision-engineered valve systems that optimize energy use while maintaining the best flow rates. These products are aligned with nation-wide goals to enhance energy productivity and minimize operational footprints. Australian manufacturers are looking more and more towards sophisticated hydraulic design and control technology that makes pumps and valves work close to their optimum efficiency levels. Real-time monitoring systems integration enables operators to monitor energy usage proactively and conduct predictive maintenance, minimizing unscheduled downtime. Australia industrial pumps and valves growth is spurred by this need for smart, energy-aware systems complying with environmental and regulatory requirements. As business pressure increases to reduce emissions and utilize resources more effectively, the trend towards energy optimization will pick up momentum in the future.

To get more information on this market, Request Sample

Convergence of Industrial IOT for Intelligent Control Systems

The convergence of Industrial Internet of Things (IIOT) technologies into pumps and valves is revolutionizing operational effectiveness in Australian industries. These intelligent systems facilitate real-time diagnostics, condition monitoring, and remote control, so that operators can monitor performance indicators like pressure, temperature, and flow with high accuracy. Unforeseen equipment failures are thus prevented, maintenance schedules become data-driven and economical, and system interoperability is improved with IIoT, facilitating easy integration of pumps and valves into larger process automation platforms. Connected valves, for example, manage water pressure dynamically in water and wastewater treatment plants according to demand as well as environmental factors. This transformation is opening doors to digital twins and AI-driven decision-making, where physical and virtual assets work together to realize better outcomes. Such digitization is transforming what is expected of conventional pump and valve systems and represents an important step towards future-proofing industrial infrastructure in Australia. According to the sources, in May 2024, Metso bought Australia's Jindex Pty Ltd, enhancing the Australian industrial pumps and valves industry by consolidating cutting-edge valve technology into its international slurry handling solutions.

Growing Demand from Irrigation and Water Infrastructure Projects

The investment by Australia in upgrading and adding water infrastructure has notably impacted the demand for valves and industrial pumps. Climate variability and threats of water scarcity have led to increasing emphasis on effective distribution and control of water with safe pumping and valve systems. For instance, In June 2023, Atlas Copco acquired National Pump & Energy, which is a dewatering, environmental, and water treatment solutions provider with 420 employees. This enhances the Atlas Copco presence in the industrial pumps and valves market in Australia, and it serves infrastructure, municipalities, and mining markets. Moreover, irrigation systems, desalination facilities, and water recycling initiatives are propelling the demand for corrosion-resistant and high-performance parts capable of withstanding rigorous environments and extended use. The agricultural industry is also becoming more dependent on automated valve systems to provide precise volumes of water based on soil conditions and crop requirements. These advancements underpin sustainable agriculture and minimize water waste, in accordance with national water management objectives. State and federal funding for modernization programs of infrastructure continues to offer opportunities for the implementation of next-generation pump and valve technologies. The demand created by these critical services guarantees that fluid handling solutions continue to be the foundation of Australia's changing industrial capabilities.

Australia Industrial Pumps and Valves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, position, driving force, end use.

Product Type Insights:

- Centrifugal

- Positive Displacement

- Reciprocating

- Rotary

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes centrifugal, positive displacement, reciprocating, rotary, others.

Position Insights:

- Submersible

- Non-Submersible

A detailed breakup and analysis of the market based on the position have also been provided in the report. This includes submersible and non-submersible.

Driving Force Insights:

- Engine Driven

- Electrical Driven

The report has provided a detailed breakup and analysis of the market based on the driving force. This includes engine driven and electrical driven.

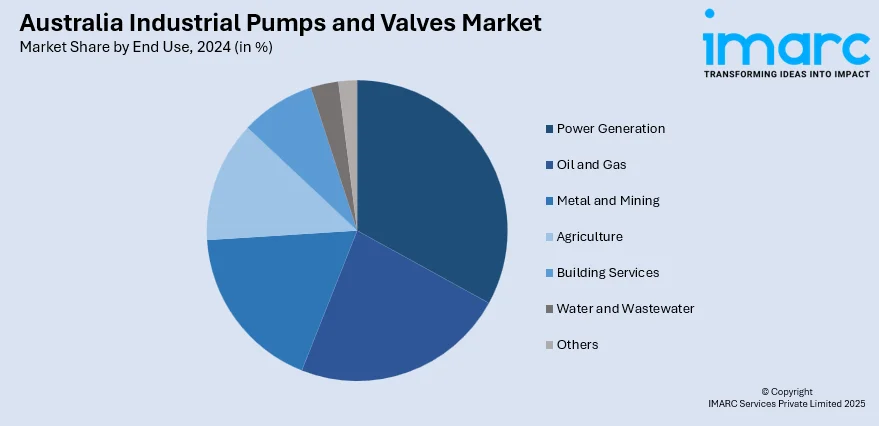

End Use Insights:

- Power Generation

- Oil and Gas

- Metal and Mining

- Agriculture

- Building Services

- Water and Wastewater

- Others

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes power generation, oil and gas, metal and mining, agriculture, building services, water and wastewater, others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard and company evaluation quadrant has been covered in the report. Also detailed profiles of all major companies have been provided.

Australia Industrial Pumps and Valves Market News:

- In August 2024, Atlas Copco Group acquired AVT Services, the Australian market leader in vacuum pump distribution. This acquisition enhances Atlas Copco's presence in Australia's industrial pumps and valves market, building local service capacity and backing superior fluid handling technologies throughout key markets such as Sydney, Melbourne, Perth and Brisbane.

Australia Industrial Pumps and Valves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Centrifugal, Positive Displacement, Reciprocating, Rotary, Others |

| Positions Covered | Submersible, Non-Submersible |

| Driving Forces Covered | Engine Driven, Electrical Driven |

| End Uses Covered | Power Generation, Oil and Gas, Metal and Mining, Agriculture, Building Services, Water and Wastewater, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial pumps and valves market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial pumps and valves market on the basis of product type?

- What is the breakup of the Australia industrial pumps and valves market on the basis of position?

- What is the breakup of the Australia industrial pumps and valves market on the basis of driving force?

- What is the breakup of the Australia industrial pumps and valves market on the basis of end use?

- What is the breakup of the Australia industrial pumps and valves market on the basis of region?

- What are the various stages in the value chain of the Australia industrial pumps and valves market?

- What are the key driving factors and challenges in the Australia industrial pumps and valves?

- What is the structure of the Australia industrial pumps and valves market and who are the key players?

- What is the degree of competition in the Australia industrial pumps and valves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial pumps and valves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges and opportunities in the Australia industrial pumps and valves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial pumps and valves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)