Australia Industrial Robotics for Assembly Lines Market Size, Share, Trends and Forecast by Robot Type, Payload Capacity, Application, End-Use, and Region, 2026-2034

Australia Industrial Robotics for Assembly Lines Market Summary:

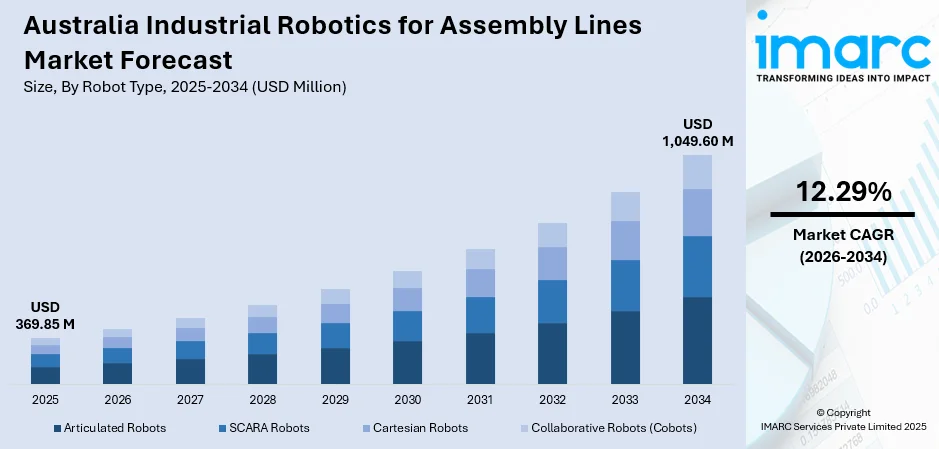

The Australia industrial robotics for assembly lines market size was valued at USD 369.85 Million in 2025 and is projected to reach USD 1,049.60 Million by 2034, growing at a compound annual growth rate of 12.29% from 2026-2034.

The market is experiencing steady growth as manufacturers accelerate automation to improve productivity and address skilled labor shortages. Rising adoption of smart manufacturing practices, supported by investments in advanced robotics, is driving demand across automotive, electronics, and metals industries. Companies are prioritizing high-precision, flexible robotic systems that enhance operational efficiency, reduce downtime, and enable continuous, high-volume production in both large and mid-sized industrial facilities.

Key Takeaways and Insights:

- By Robot Type: Articulated robots dominate the market with a share of 45% in 2025, driven by their versatile multi-axis capabilities enabling complex manufacturing tasks including welding, painting, and precision assembly operations across automotive and electronics sectors.

- By Payload Capacity: Up to 5 kg segment leads the market with a share of 30% in 2025, supported by increasing demand for lightweight, compact robotic solutions in electronics assembly, quality inspection, and precision manufacturing applications among small and medium enterprises.

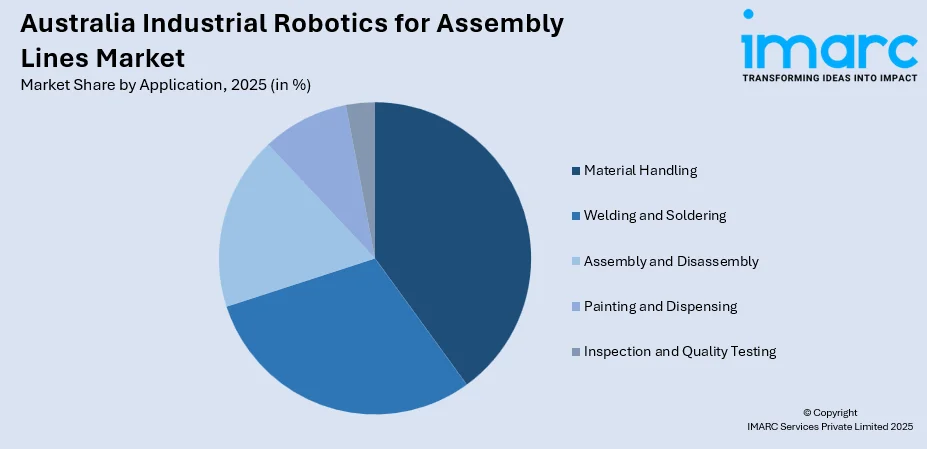

- By Application: Material handling represents the largest segment with a market share of 30% in 2025, owing to the essential role of robotic systems in streamlining logistics operations, optimizing warehouse workflows, and reducing manual handling requirements across manufacturing facilities.

- By End-Use: Automotive exhibits a clear dominance with a share of 35% in 2025, propelled by extensive automation requirements in vehicle assembly, welding operations, and quality inspection processes to meet production demands and maintain competitive manufacturing standards.

- Key Players: The Australia industrial robotics for assembly lines market exhibits a moderately consolidated competitive structure, with global automation leaders competing alongside regional integrators and specialized solution providers across diverse manufacturing segments. Competition is shaped by continuous innovation in robotic sensing, motion control, and collaborative technologies that support flexible and high precision assembly needs. Market participants focus on customized automation solutions, lifecycle service capabilities, and seamless integration with existing production environments to strengthen their position.

To get more information on this market Request Sample

The Australia industrial robotics for assembly lines market is expanding as manufacturers increase their focus on efficiency, accuracy, and long-term operational stability. The Australia automotive market size was valued at 1.22 Million Units in 2024 and is expected to reach 2.50 Million Units by 2033, which is further strengthening demand for advanced automation across assembly operations. Companies in automotive, electronics, machinery, and consumer goods production are adopting robotic systems to streamline repetitive tasks and reduce reliance on manual labor. Growth is supported by rising investment in smart factory initiatives, stronger focus on workplace safety, and the need for consistent output quality in high volume production environments. Continuous improvements in robotic sensing, motion control, and collaborative capabilities enable smoother integration with existing production setups. As industries work to improve throughput and reduce operational bottlenecks, demand for flexible, programmable, and energy efficient robotic solutions continues to accelerate across both large scale and mid sized facilities.

Australia Industrial Robotics for Assembly Lines Market Trends:

Flexible and Modular Systems

Adoption of flexible and modular solutions is growing in the Australia industrial robotics for assembly lines market as manufacturers seek faster changeovers and adaptable production layouts. These systems support quick reconfiguration, reduced downtime, and efficient handling of product variations, helping industries maintain high throughput while responding to shifting production needs without major structural adjustments.

Digital Integration Advancements

Integration of digital technologies is accelerating as industries adopt smart sensors, vision capabilities, and real time monitoring to improve accuracy and operational reliability. ICSIRO’s Continuous3D technology is revolutionizing industrial repairs by equipping robots with advanced sensors and intelligent software. This innovation addresses Australia's skilled labor shortage, enabling robots to efficiently identify and repair complex metal components in mining and aerospace, significantly reducing repair time and adapting to various challenging environments. These advancements enhance predictive maintenance, minimize unexpected stoppages, and support consistent production quality. The trend is strengthening as companies prioritize data driven insights for better decision making and long term performance stability.

Rise of Collaborative Robotics

Collaborative robotics adoption is increasing as businesses focus on safe human machine interaction and efficient workspace utilization. These robots offer easy programming, adaptable movement, and seamless integration into existing assembly setups. The Queensland Train Manufacturing Program is making significant progress with the installation of Australia's first train welding robot in Maryborough. The facility, set to begin operations in 2026, aims to create 300 local jobs, enhance manufacturing capabilities, and support the region's economy, reversing years of decline under previous management. The trend supports higher productivity and allows companies to automate complex tasks within limited floor space while maintaining strict safety and performance requirements.

Market Outlook 2026-2034:

The Australia industrial robotics for assembly lines market is expected to maintain steady growth as manufacturers expand automation to improve efficiency and address workforce constraints. Rising focus on precision, consistency, and cost control is encouraging broader adoption of advanced robotic technologies across key industries. Continued investment in smart manufacturing, improved robotic capabilities, and stronger emphasis on operational reliability will support long term market expansion while enabling companies to enhance production output, reduce errors, and streamline complex assembly operations. The market generated a revenue of USD 369.85 Million in 2025 and is projected to reach a revenue of USD 1,049.60 Million by 2034, growing at a compound annual growth rate of 12.29% from 2026-2034.

Australia Industrial Robotics for Assembly Lines Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Robot Type | Articulated Robots | 45% |

| Payload Capacity | Up to 5 Kg | 30% |

| Application | Material Handling | 30% |

| End Use | Automotive | 35% |

Robot Type Insights:

- Articulated Robots

- SCARA Robots

- Cartesian Robots

- Collaborative Robots (Cobots)

The articulated robots dominate with a market share of 45% of the total Australia industrial robotics for assembly lines market in 2025.

Articulated robots dominate the Australia industrial robotics for assembly lines market as they offer superior flexibility, multi axis movement, and compatibility with complex assembly tasks. Their ability to handle diverse operations with high precision makes them the preferred choice for manufacturers seeking efficient and reliable automation across varied production conditions.

Their dominance is further supported by strong demand from automotive, electronics, and machinery sectors that require advanced robotic capabilities for repetitive and intricate tasks. Articulated systems also integrate well with modern sensing technologies, enabling improved accuracy, faster cycle times, and seamless adaptation to evolving assembly requirements.

Payload Capacity Insights:

- Up to 5 Kg

- 5 to 10 Kg

- 10 to 20 Kg

- Above 20 Kg

The Up to 5 kg leads with a share of 30% of the total Australia industrial robotics for assembly lines market in 2025.

The up to 5 kg segment leads the Australia industrial robotics for assembly lines market due to its strong suitability for lightweight, high speed operations commonly found in electronics, consumer goods, and small component assembly. These robots offer fast movement, compact designs, and excellent precision for delicate handling needs.

Growing adoption of compact automation solutions further supports this segment as industries aim to maximize floor space efficiency while maintaining consistent quality. Their lower energy use, ease of programming, and ability to integrate with collaborative and vision systems enhance their appeal among small and mid sized manufacturers seeking cost effective automation.

Application Insights:

Access the Comprehensive Market Breakdown Request Sample

- Welding and Soldering

- Material Handling

- Assembly and Disassembly

- Painting and Dispensing

- Inspection and Quality Testing

The material handling represents the largest segment with a market share of 30% of the total Australia industrial robotics for assembly lines market in 2025.

Material handling represents the largest segment, driven by its essential role in supporting continuous movement of components, products, and materials across assembly lines. Manufacturers rely on robotic handling systems to reduce manual labor, improve safety, and maintain stable production flow in high volume environments.

The segment benefits from rising adoption of advanced gripping technologies, intelligent sensors, and high speed robotic arms that enhance accuracy and prevent damage to components. As industries prioritize efficiency and consistency in logistics and in process workflows, robotic material handling continues to gain strong momentum across diverse manufacturing settings.

End-Use Insights:

- Automotive

- Electronics and Semiconductor

- Metal and Machinery

- Plastics and Chemicals

- Food and Beverage

- Others

The automotive exhibits a clear dominance with a 35% share of the total Australia industrial robotics for assembly lines market in 2025.

The automotive segment holds the largest share as manufacturers increasingly depend on automation to support precision assembly, high throughput requirements, and complex component integration. Robotics help maintain consistent quality across welding, fastening, handling, and inspection tasks, making them essential to modern automotive production.

Rising vehicle demand and ongoing investment in production upgrades further strengthen adoption, with manufacturers integrating advanced robotic systems to reduce operational bottlenecks and labor dependency. In November 2025, Walkinshaw Group unveiled a USD 114 Million automotive manufacturing facility in Dandenong South, Victoria, creating 155 jobs. The 100,000-square-metre site consolidates operations, enhancing production capacity to over 10,000 vehicles annually. The facility features advanced engineering capabilities, positioning Victoria as a hub for high-tech manufacturing and innovation. Automotive plants also benefit from robotics that improve safety, support continuous operations, and align with long term goals for smarter and more efficient assembly environments.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory and New South Wales show steady adoption of automation as manufacturers focus on improving efficiency, maintaining consistent production quality, and strengthening operational reliability. Rising interest in digital tools and robotics supports greater optimization of assembly activities across expanding industrial facilities.

Victoria and Tasmania continue to advance automation in assembly operations as industries seek predictable output, reduced labor dependency, and streamlined workflows. Increasing focus on precision, energy efficiency, and consistent performance supports wider integration of robotic technologies across diverse manufacturing environments.

Queensland benefits from rising industrial activity, encouraging manufacturers to incorporate automation for improved productivity and long term stability. Expanding use of robotics supports faster cycle times, fewer errors, and stronger alignment with modern production requirements across both large and mid sized facilities.

Northern Territory and South Australia maintain steady automation progress as manufacturers prioritize stable throughput, safer working conditions, and reduced operational bottlenecks. Robotic integration supports enhanced reliability and helps industries achieve consistent assembly performance even in capacity constrained or specialized production settings.

Western Australia continues adopting automation to strengthen industrial output, improve quality control, and support long term production resilience. Robotics enable smoother assembly processes, minimize downtime, and assist manufacturers in meeting rising efficiency expectations across various established and emerging industrial sectors.

Market Dynamics:

Growth Drivers:

Why is the Australia Industrial Robotics for Assembly Lines Market Growing?

Smart Manufacturing Investments

Growing investment in smart manufacturing initiatives is significantly supporting the expansion of the Australia industrial robotics for assembly lines market. The Australia smart manufacturing market size reached USD 10.0 Billion in 2024 and is expected to reach USD 28.2 Billion by 2033, which is accelerating the shift toward advanced automation. Companies are prioritizing systems with real time monitoring, intelligent sensors, and precision driven controls to improve efficiency, detect issues early, optimize workflows, and ensure consistent output as they transition to connected, data centric operations.

Workplace Safety Priority

Strong emphasis on workplace safety is accelerating deployment of robotics across assembly operations in the Australia industrial robotics for assembly lines market. Industries are prioritizing automated systems to replace repetitive, strenuous, or potentially hazardous tasks that expose workers to operational risks. Robotics enhance safety standards while ensuring continuous and reliable output. This trend aligns with broader corporate objectives to improve worker wellbeing, reduce injury related downtime, and maintain high productivity levels through safer and more controlled assembly processes.

Productivity Enhancement Focus

Rising focus on productivity improvement continues to drive demand in the Australia industrial robotics for assembly lines market. Manufacturers are increasingly adopting robotic solutions to achieve consistent quality, faster cycle times, and reduced operational costs across output intensive environments. In March 2025, Vision AI, an Australian robotics innovator, become an ABB Robotics Authorized Value Provider. Their advanced automation solutions, including a world-first intelligent fruit grading and packing system powered by ABB robots, aim to address labor shortages in agriculture while enhancing efficiency and sustainability in production processes. Automated systems support stable production performance, minimize errors, and optimize resource utilization. This growing emphasis on efficiency and reliability encourages companies across various sectors to integrate robotics as a core component of their long term production strategies and modernization efforts.

Market Restraints:

What Challenges the Australia Industrial Robotics for Assembly Lines Market is Facing?

High Investment Requirements

High upfront investment requirements remain a significant restraint for the Australia industrial robotics for assembly lines market. Many mid sized manufacturers operate with limited capital, making it challenging to allocate funds for advanced automation. Costs related to installation, programming, training, and system customisation further increase financial pressure, slowing adoption and delaying long term automation planning for cost sensitive industrial facilities.

Shortage of Technical Expertise

Limited availability of specialised technical expertise is constraining market expansion as companies struggle to manage installation, integration, and maintenance of advanced robotic systems. Skill gaps make it difficult to optimise performance, troubleshoot operational issues, and ensure consistent production reliability. This shortage also increases dependence on external support, leading to higher service costs and longer adoption timelines for automation focused manufacturers.

Legacy System Integration Issues

Integration challenges with legacy machinery remain a major restraint for the Australia industrial robotics for assembly lines market. Older production setups often lack compatibility with modern automation technologies, requiring substantial modifications or complete equipment replacement. These upgrades increase costs, extend deployment time, and create operational disruptions, making manufacturers hesitant to transition fully to advanced robotic assembly solutions.

Competitive Landscape:

The competitive landscape of the Australia industrial robotics for assembly lines market is shaped by growing demand for high precision and flexible automation solutions. Competition is intensifying as global and regional automation providers focus on expanding their portfolios with advanced robotic systems, enhanced software capabilities, and integrated sensing technologies. Market players are prioritizing partnerships, localized support services, and continuous product upgrades to strengthen their presence across diverse manufacturing sectors. Increasing emphasis on reliability, customization, and easy integration is encouraging vendors to deliver tailored solutions that address efficiency, safety, and long-term operational needs in modern assembly environments.

Australia Industrial Robotics for Assembly Lines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Robot Types Covered | Articulated Robots, SCARA Robots, Cartesian Robots, Collaborative Robots (Cobots) |

| Payload Capacities Covered | Up to 5 Kg, 5 to 10Kg, 10 to 20 Kg, Above 20 Kg |

| Applications Covered | Welding and Soldering, Material Handling, Assembly and Disassembly, Painting and Dispensing, Inspection and Quality Testing |

| End-Use Covered | Automotive, Electronics and Semiconductor, Metal and Machinery, Plastics and Chemicals, Food and Beverage, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia industrial robotics for assembly lines market size was valued at USD 369.85 Million in 2025.

The Australia industrial robotics for assembly lines market is expected to grow at a compound annual growth rate of 12.29% from 2026-2034 to reach USD 1,049.60 Million by 2034.

Articulated robots held the largest share of the Australia industrial robotics for assembly lines market with a share of 45%, driven by their versatility, multi axis movement, and strong suitability for complex, high precision assembly operations across major manufacturing sectors.

Key factors driving the Australia industrial robotics for assembly lines market include rising automation adoption, growing demand for consistent output quality, increasing focus on workplace safety, expansion of smart manufacturing initiatives, and advancements in robotic sensing, motion control, and collaborative capabilities.

Major challenges include high initial investment requirements, limited availability of specialised technical expertise, integration issues with legacy systems, and concerns related to maintenance costs and downtime, which make adoption difficult for budget constrained or technologically outdated manufacturing environments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)