Australia Industrial Robotics Software Market Size, Share, Trends and Forecast by Type of Software, Deployment Model, Functionality, Application, End User Industry, and Region, 2025-2033

Australia Industrial Robotics Software Market Overview:

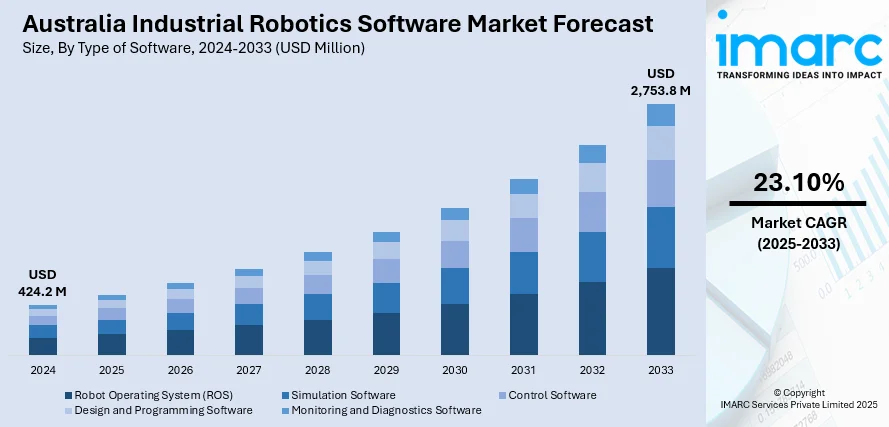

The Australia industrial robotics software market size reached USD 424.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,753.8 Million by 2033, exhibiting a growth rate (CAGR) of 23.10% during 2025-2033. The market is boosted by the increasing adoption of robotics in manufacturing and warehouses. Furthermore, government incentives and research spending on automation are driving the adoption of the product. Apart from this, substantial R&D activities and innovations from key players are driving the market growth. Advances in technology, government initiatives, and the drive for Industry 4.0 integration are also widening the Australia industrial robotics software market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 424.2 Million |

|

Market Forecast in 2033

|

USD 2,753.8 Million |

| Market Growth Rate 2025-2033 | 23.10% |

Australia Industrial Robotics Software Market Trends:

Growing Adoption of Robotics in Manufacturing and Warehousing

Growing robotics adoption in Australian manufacturing and warehousing industries is a key driving force for the market. As the nation aims to improve the efficiency of operations and competitiveness of its products in global markets, automation solutions are increasingly becoming a part of the new manufacturing practices. Notably, Sydney is set to host the IEEE/Robotics Society of Japan (RSJ) International Conference on Intelligent Robots and Systems (IROS) in 2028, as announced on March 4, 2025, marking the first time the event will be held in the Southern Hemisphere in its 30-year history. The conference is expected to attract 7,000-10,000 global delegates, generating an estimated USD 31 million in direct expenditure for the local economy. This achievement highlights Australia’s leadership in intelligent robotics research, with significant contributions from local institutions such as the University of Technology Sydney and the University of Sydney's Australian Centre for Field Robotics. The demand for automation is particularly strong in sectors like automotive, food and beverage, and consumer goods, where consistent product quality and faster production speeds are critical. Furthermore, the logistics and warehousing industries in Australia are embracing robotics for tasks such as sorting, picking, and packaging, driven by the growing need for faster and more efficient supply chains. With labor gaps, especially in the countryside, implementing automated solutions is a sustainable solution, promoting increased productivity as well as workplace safety. As companies in Australia move to digitalize and remain competitive, demand for advanced robotics software that is able to connect to various manufacturing systems is impelling the overall Australia industrial robotics software market growth.

To get more information on this market, Request Sample

Government Initiatives and Research Investment in Automation

The active promotion of advanced manufacturing and automation by the Australian government is another prime driver for the market. The government, through funding initiatives, tax breaks, and strategic investments, is inducing industries to implement automation technologies as part of its overall drive to enhance industrial productivity and innovation. The government’s focus on fostering a digital economy and enhancing its manufacturing capabilities aligns with the goals of Industry 4.0, which emphasizes automation, data exchange, and smart technologies. Australia is also investing heavily in research and development (R&D), particularly in robotics and AI, with institutions such as the Australian Robotics Academy and universities across the nation leading the charge. ANYbotics announced a partnership with Chironix Pty. Ltd. to bring its robotic inspection systems to Australia and New Zealand on 21st February, 2025. This collaboration combines Chironix’s expertise in robotic inspection, integration, and software intelligence with ANYbotics’ rugged mobile robot, ANYmal, aiming to enhance safety and reliability in heavy industries. Chironix will make the ANYmal quadruped available for direct sale or via a robotics-as-a-service (RaaS) model, with on-site support and training, and demonstrating the capability of autonomous robotic inspection through live demonstrations in Australia from March to April 2025. These initiatives not only promote the adoption of robotics in Australian industries but also help develop cutting-edge robotics software solutions that are critical for optimizing industrial processes. As the country continues to diversify its economy and reduce reliance on traditional industries, these government initiatives are strengthening the robotics ecosystem and driving the growth of industrial robotics software.

Australia Industrial Robotics Software Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of software, deployment model, functionality, application, and end user industry.

Type of Software Insights:

- Robot Operating System (ROS)

- Simulation Software

- Control Software

- Design and Programming Software

- Monitoring and Diagnostics Software

The report has provided a detailed breakup and analysis of the market based on the type of software. This includes Robot Operating System (ROS), simulation software, control software, design and programming software, and monitoring and diagnostics software.

Deployment Model Insights:

- On-Premises Solutions

- Cloud-Based Solutions

- Hybrid Solutions

The report has provided a detailed breakup and analysis of the market based on the deployment model. This includes on-premises solutions, cloud-based solutions, and hybrid solutions.

Functionality Insights:

- Robot Programming and Development

- Path Planning and Navigation

- Collaborative Robots (Cobots) Software

- Machine Learning and AI Integration

- Safety and Compliance Features

The report has provided a detailed breakup and analysis of the market based on the functionality. This includes robot programming and development, path planning and navigation, collaborative robots (cobots) software, machine learning and AI integration, and safety and compliance features.

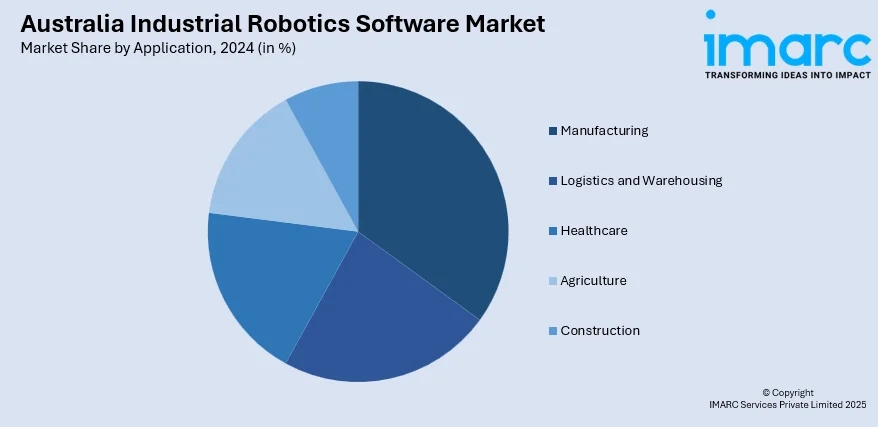

Application Insights:

- Manufacturing

- Logistics and Warehousing

- Healthcare

- Agriculture

- Construction

The report has provided a detailed breakup and analysis of the market based on the application. This includes manufacturing, logistics and warehousing, healthcare, agriculture, and construction.

End User Industry Insights:

- Aerospace and Defense

- Automotive

- Electronics

- Food and Beverage

- Pharmaceuticals

The report has provided a detailed breakup and analysis of the market based on the end user industry. This includes aerospace and defense, automotive, electronics, food and beverage, and pharmaceuticals.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, which includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Robotics Software Market News:

- On May 28, 2024, Ai Group, Cicada Innovations, and Robotics Australia Group announced the formation of the Robotics Growth Partnership (RGP) to support the development, commercialization, and scaling of robotics in Australia. The partnership aims to help Australian robotics companies expand their capabilities, foster connections with potential customers and partners, and advocate for greater adoption of robotic and automation solutions across industries.

Australia Industrial Robotics Software Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Software Covered | Robot Operating System (ROS), Simulation Software, Control Software, Design and Programming Software, Monitoring and Diagnostics Software |

| Deployment Models Covered | On-Premises Solutions, Cloud-Based Solutions, Hybrid Solutions |

| Functionalities Covered | Robot Programming and Development, Path Planning and Navigation, Collaborative Robots (Cobots) Software, Machine Learning and AI Integration, Safety and Compliance Features |

| Applications Covered | Manufacturing, Logistics and Warehousing, Healthcare, Agriculture, Construction |

| End User Industries Covered | Aerospace and Defense, Automotive, Electronics, Food and Beverage, Pharmaceuticals |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial robotics software market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial robotics software market on the basis of type of software?

- What is the breakup of the Australia industrial robotics software market on the basis of deployment model?

- What is the breakup of the Australia industrial robotics software market on the basis of functionality?

- What is the breakup of the Australia industrial robotics software market on the basis of application?

- What is the breakup of the Australia industrial robotics software market on the basis of end user industry?

- What is the breakup of the Australia industrial robotics software market on the basis of region?

- What are the various stages in the value chain of the Australia industrial robotics software market?

- What are the key driving factors and challenges in the Australia industrial robotics software market?

- What is the structure of the Australia industrial robotics software market and who are the key players?

- What is the degree of competition in the Australia industrial robotics software market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial robotics software market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial robotics software market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial robotics software industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)