Australia Industrial Safety Gloves Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia Industrial Safety Gloves Market Overview:

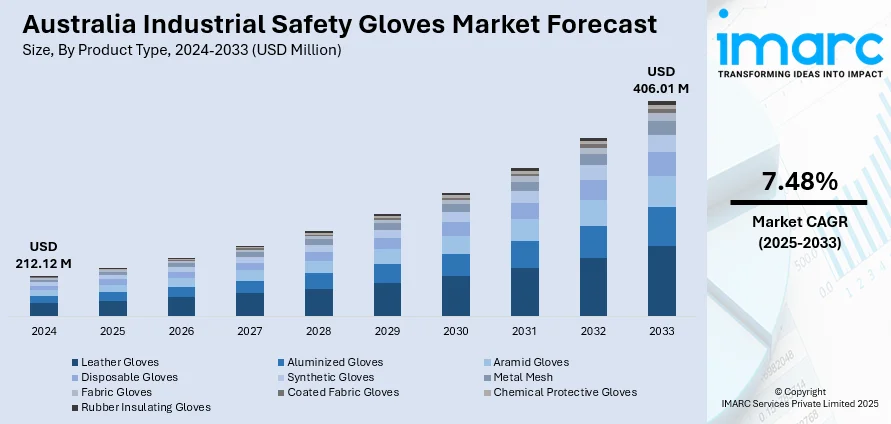

The Australia industrial safety gloves market size reached USD 212.12 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 406.01 Million by 2033, exhibiting a growth rate (CAGR) of 7.48% during 2025-2033. The market is experiencing steady growth due to rising workplace safety regulations, expansion in construction, mining, and manufacturing sectors, and increasing awareness regarding occupational hazards. The rising demand for cut-resistant, chemical-resistant, and thermal-protective gloves and technological advancements in glove materials and ergonomic design are further enhancing product adoption, contributing to the overall Australia industrial safety gloves market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 212.12 Million |

| Market Forecast in 2033 | USD 406.01 Million |

| Market Growth Rate 2025-2033 | 7.48% |

Australia Industrial Safety Gloves Market Trends:

Rising Demand in Construction and Mining

The construction and mining sectors in Australia are key drivers of demand in the industrial safety gloves market. With major infrastructure projects underway and continued investment in resource extraction, there is a growing emphasis on worker safety in high-risk environments. For instance, in March 2025, the Australian Government announced a $750 million investment in green metals, led by Prime Minister Anthony Albanese and Minister Ed Husic at Curtin University. This initiative, part of the Future Made in Australia Innovation Fund, aims to enhance mining productivity and support pilot projects for sustainable development. These industries expose workers to hazards such as sharp objects, abrasive materials, extreme temperatures, and chemical exposure, making durable, specialized gloves essential for daily operations. Gloves designed for impact resistance, cut protection, and thermal insulation are increasingly being adopted to meet industry-specific safety needs. Additionally, as automation and mechanized tools become more common on construction sites and in mines, the need for gloves that offer both dexterity and protection is rising. The increased focus on compliance with occupational safety regulations further supports the uptake of premium safety gloves across these core sectors in Australia.

To get more information on this market, Request Sample

Adoption of Sustainable and Eco-Friendly Materials

Sustainability is becoming a key focus in the Australia industrial safety gloves market as manufacturers respond to growing environmental concerns and regulatory pressures. Companies are increasingly developing gloves made from biodegradable, recycled, or sustainably sourced materials to reduce environmental impact throughout the product lifecycle. For instance, in September 2024, Mun Australia announced the launch of GloveOn COATS Biodegradable, a nitrile glove designed to enhance eco-friendliness. Featuring COATS technology for skin moisturization, these gloves biodegrade up to 90 times faster than traditional options, providing high-performance protection for healthcare and industrial use while prioritizing sustainability. These eco-conscious gloves are designed without compromising safety standards, offering durability, protection, and comfort comparable to traditional options. The shift is also driven by corporate ESG goals and customer preferences for environmentally responsible products. Packaging innovations, such as recyclable materials and reduced plastic use, further align with sustainability commitments. In sectors like construction, manufacturing, and healthcare, organizations are beginning to prioritize green procurement policies, which favor sustainable PPE options. This transition toward eco-friendly materials is expected to positively contribute to Australia industrial safety gloves market growth, reinforcing long-term industry sustainability and innovation.

Australia Industrial Safety Gloves Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Leather Gloves

- Aluminized Gloves

- Aramid Gloves

- Disposable Gloves

- Synthetic Gloves

- Metal Mesh

- Fabric Gloves

- Coated Fabric Gloves

- Chemical Protective Gloves

- Rubber Insulating Gloves

The report has provided a detailed breakup and analysis of the market based on the product type. This includes leather gloves, aluminized gloves, aramid gloves, disposable gloves, synthetic gloves, metal mesh, fabric gloves, coated fabric gloves, chemical protective gloves, and rubber insulating gloves.

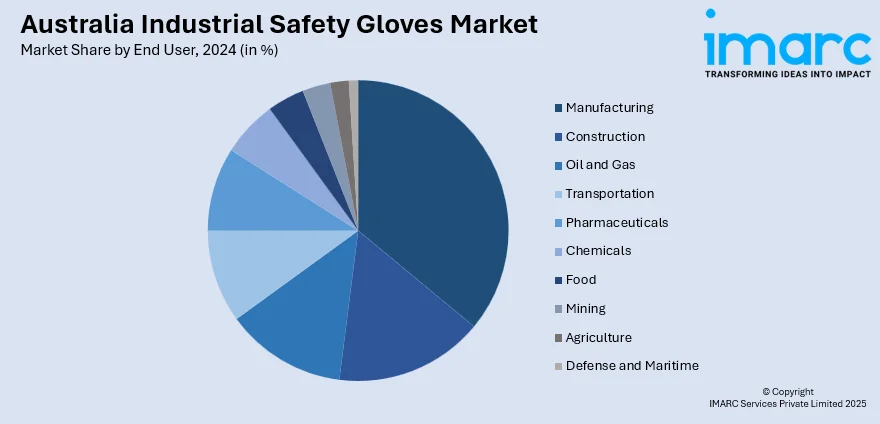

End User Insights:

- Manufacturing

- Construction

- Oil and Gas

- Transportation

- Pharmaceuticals

- Chemicals

- Food

- Mining

- Agriculture

- Defense and Maritime

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes manufacturing, construction, oil and gas, transportation, pharmaceuticals, chemicals, food, mining, agriculture, and defense and maritime.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Industrial Safety Gloves Market News:

- In April 2025, Australia’s Ansell, a leader in personal protective equipment, is increasing its presence in Japan by leveraging its acquisition of Kimberly-Clark's PPE business. With a focus on gloves and chemical protection, Ansell aims to meet the rising demand in the semiconductor and pharmaceutical industries.

- In October 2024, Ansell launched the AlphaTec® 53-002 and 53-003 gloves in Australia, utilizing innovative hybrid technology for enhanced chemical protection. These gloves meet stringent safety standards and feature a multi-layered design, offering exceptional resistance to various chemicals while ensuring mechanical protection and comfort for users.

Australia Industrial Safety Gloves Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Leather Gloves, Aluminized Gloves, Aramid Gloves, Disposable Gloves, Synthetic Gloves, Metal Mesh, Fabric Gloves, Coated Fabric Gloves, Chemical Protective Gloves, Rubber Insulating Gloves |

| End Users Covered | Manufacturing, Construction, Oil and Gas, Transportation, Pharmaceuticals, Chemicals, Food, Mining, Agriculture, Defense and Maritime |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia industrial safety gloves market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia industrial safety gloves market on the basis of product type?

- What is the breakup of the Australia industrial safety gloves market on the basis of end user?

- What is the breakup of the Australia industrial safety gloves market on the basis of region?

- What are the various stages in the value chain of the Australia industrial safety gloves market?

- What are the key driving factors and challenges in the Australia industrial safety gloves market?

- What is the structure of the Australia industrial safety gloves market and who are the key players?

- What is the degree of competition in the Australia industrial safety gloves market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia industrial safety gloves market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia industrial safety gloves market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia industrial safety gloves industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)