Australia Inland Cargo Shipping Market Size, Share, Trends and Forecast by Cargo Type, Mode of Transport, Service Type, End-Use Industry, and Region, 2025-2033

Australia Inland Cargo Shipping Market Overview:

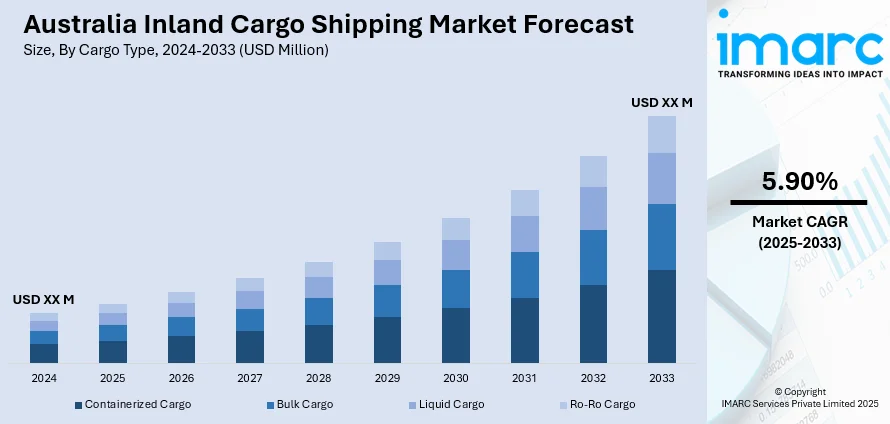

The Australia inland cargo shipping market size is projected to exhibit a growth rate (CAGR) of 5.90% during 2025-2033. The growth of the inland cargo shipping market is attributed to investments in infrastructure that enhance regional connectivity, such as upgrading rail, ports, and logistics hubs. These improvements, including automation and real-time tracking, boost cargo capacity and efficiency. Additionally, the rise of e-commerce is driving the demand for faster and more cost-effective shipping. Inland cargo shipping offers a flexible solution to meet the growing need for timely deliveries nationwide, thereby contributing to the expansion of the Australia inland cargo shipping market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Growth Rate 2025-2033 | 5.90% |

Australia Inland Cargo Shipping Market Trends:

Infrastructure Investments Enhancing Connectivity

A significant factor contributing to the growth of the inland cargo shipping market is the continuous investment in infrastructure focused on enhancing regional connectivity. The governing body in Australia is committed to enhancing the nation’s transport systems, making substantial investments to upgrade railways, ports, roads, and logistics centers, which is facilitating the movement of inland freight. Upgrading rail infrastructure, enhancing inland ports, and creating advanced freight management technologies are essential approaches to boost cargo capacity and efficiency. The implementation of automation and real-time tracking systems enhances the reliability and speed of inland shipping routes, thereby reducing delays and providing companies with real-time updates. For example, in 2025, DP World and NSW Ports revealed an A$400 million joint investment to enhance rail capacity at Port Botany in Sydney. This development, designed to increase the port’s annual capacity to 1 million TEUs, will enhance freight efficiency and reduce congestion by transferring more cargo from trucks to trains. This initiative, launching in June 2025, not only addresses the growing demand for efficient freight solutions but also aligns with sustainability objectives by reducing carbon emissions. These infrastructure improvements are enhancing the competitiveness of the inland cargo shipping sector while also attracting investments from private firms eager to capitalize on Australia’s growing freight demands.

To get more information of this market, Request Sample

Rising E-Commerce and User Expectations

The swift expansion of e-commerce is significantly influencing the Australia inland cargo shipping market growth. As online shopping continues to grow, there is a rise in the need for swift, effective, and dependable shipping options to satisfy client demands for prompt deliveries. Retailers and suppliers face pressure to complete orders within tight deadlines, particularly for buyers in regional areas distant from key distribution hubs. Inland cargo shipping, which emphasizes land transport, offers a more adaptable and scalable option compared to conventional sea freight, which is typically slower and less flexible. By enabling more efficient transportation of products along Australia's inland paths, it assists e-commerce platforms in satisfying the increased need for faster deliveries. Additionally, inland cargo shipping facilitates the cost-effective movement of substantial quantities of goods, helping companies meet the growing individuals demand for diversity, speed, and affordability in their online shopping experiences. In 2024, Australia's e-commerce industry achieved new records, as 9.8 million households spent more than $69 billion online, as reported by Australia Post. This significant rise in online purchases highlights the need for effective logistics, increasing the demand for inland cargo shipping services that can transport goods rapidly and affordably nationwide to bolster the thriving e-commerce sector.

Australia Inland Cargo Shipping Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on cargo type, mode of transport, service type, and end-use industry.

Cargo Type Insights:

- Containerized Cargo

- Bulk Cargo

- Liquid Cargo

- Ro-Ro Cargo

The report has provided a detailed breakup and analysis of the market based on the cargo type. This includes containerized cargo, bulk cargo, liquid cargo, and ro-ro cargo.

Mode of Transport Insights:

- Inland Waterways

- Coastal Shipping

- Transoceanic Shipping

A detailed breakup and analysis of the market based on the mode of transport have also been provided in the report. This includes inland waterways, coastal shipping, and transoceanic shipping.

Service Type Insights:

- Freight Forwarding

- Warehousing and Distribution

- Customs Brokerage

The report has provided a detailed breakup and analysis of the market based on the service type. This includes freight forwarding, warehousing and distribution, and customs brokerage.

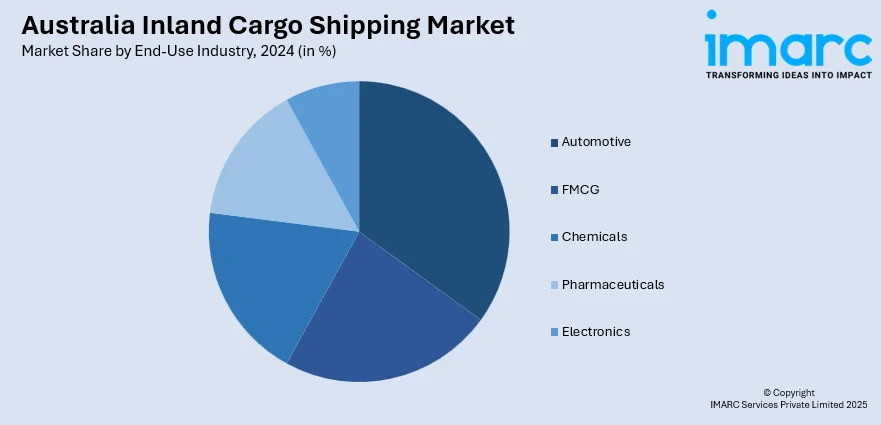

End-Use Industry Insights:

- Automotive

- FMCG

- Chemicals

- Pharmaceuticals

- Electronics

A detailed breakup and analysis of the market based on the end-use industry have also been provided in the report. This includes automotive, FMCG, chemicals, pharmaceuticals, and electronics.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Inland Cargo Shipping Market News:

- In May 2025, ANL announced the opening of four new Inland Container Depots (ICDs) in Australia, located in Kenwick, Moorebank, Enfield, and Yennora, with another planned for Somerton. These ICDs offer rail access, refrigerated storage, and streamlined documentation to enhance inland logistics. The goal is to bring the port closer to customers and reduce transit times.

Australia Inland Cargo Shipping Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Cargo Types Covered | Containerized Cargo, Bulk Cargo, Liquid Cargo, Ro-Ro Cargo |

| Mode of Transports Covered | Inland Waterways, Coastal Shipping, Transoceanic Shipping |

| Service Types Covered | Freight Forwarding, Warehousing and Distribution, Customs Brokerage |

| End-Use Industries Covered | Automotive, FMCG, Chemicals, Pharmaceuticals, Electronics |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia inland cargo shipping market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia inland cargo shipping market on the basis of cargo type?

- What is the breakup of the Australia inland cargo shipping market on the basis of mode of transport?

- What is the breakup of the Australia inland cargo shipping market on the basis of service type?

- What is the breakup of the Australia inland cargo shipping market on the basis of end-use industry?

- What is the breakup of the Australia inland cargo shipping market on the basis of region?

- What are the various stages in the value chain of the Australia inland cargo shipping market?

- What are the key driving factors and challenges in the Australia inland cargo shipping market?

- What is the structure of the Australia inland cargo shipping market and who are the key players?

- What is the degree of competition in the Australia inland cargo shipping market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia inland cargo shipping market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia inland cargo shipping market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia inland cargo shipping industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)