Australia Instant Soups Market Size, Share, Trends and Forecast by Nature, Form, Source, Distribution Channel, End Use, and Region, 2025-2033

Australia Instant Soups Market Size and Growth:

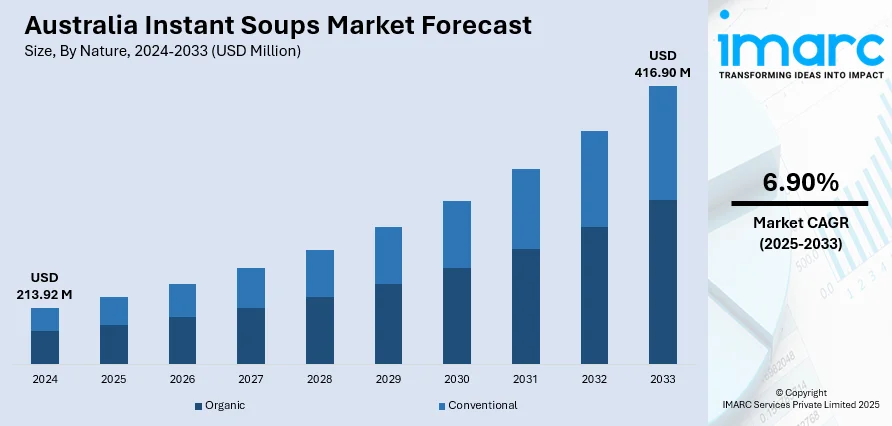

The Australia instant soups market size reached USD 213.92 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 416.90 Million by 2033, exhibiting a growth rate (CAGR) of 6.90% during 2025-2033. At present, consumers are increasingly adopting fast-paced lifestyles and constantly looking for convenient and easy meal solutions. Moreover, the heightened number of health-conscious consumers who are now seeking healthy, low-calorie, and functional food is propelling the market growth. Apart from this, the rising focus on transforming the flavor profiles and ingredients of instant soup products is expanding the Australia instant soups market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 213.92 Million |

| Market Forecast in 2033 | USD 416.90 Million |

| Market Growth Rate 2025-2033 | 6.90% |

Australia Instant Soups Market Trends:

Response to Active Lifestyles and Convenience Needs

The Australian market is experiencing growth, with consumers increasingly adopting fast-paced lifestyles and constantly looking for convenient and easy meal solutions. With hectic work routines becoming more common, Australians are shifting towards easy-to-prepare foods that have shorter cooking times. Instant soups, which often require only a couple of minutes to cook with hot water or a microwave, are fulfilling this need for convenience yet continue to provide warmth and fullness. Students, working parents, and young professionals are always opting for these products to save time without sacrificing meal satisfaction. In addition, the popularity of take-meals that can be consumed on the move is also contributing to the market growth. Supermarkets and convenience stores are now in stock with a vast variety of instant soups, making them widely accessible. Since busy individuals are focusing on convenience and speed in food options, manufacturers are launching various innovative products. For instance, in 2025, Soul Origin, a major food manufacturer in Australia, announced the launch of new flavors in its seasonal soup menu option. The flavors include chicken & corn, pumpkin, potato with smoky bacon, mushroom with truffle, Tuscan veg, and red curry chicken. The soup selection will be offered for $4.90 and can be enjoyed with slices of baguette or herb bread. Starting 24 April, Soul Origin loyalty members can receive a complimentary soup with any purchase of $6 or greater.

To get more information on this market, Request Sample

Targeting Health-Focused Consumers through Product Innovation

The increasing number of health-conscious consumers who are now seeking healthy, low-calorie, and functional food is propelling the Australia instant soups market growth. Companies are constantly innovating by introducing vitamin, mineral, and natural ingredient-fortified soups with reduced salt, artificial preservatives, and monosodium glutamate (MSG). The sector is positioning itself in aligning with the wellness revolution by providing gluten-free, organic, plant-based, and high-protein alternatives that attract consumers with dietary needs or requirements. Companies are actively promoting their products with health claims, such as "no added sugar," "low in fat," or "contains real vegetables," which is striking a chord with more educated and label-aware Australian consumers. As consumer trends continue to be defined by wellness trends and proactive health measures, instant soup brands are shifting recipes to accommodate this demand. The IMARC Group predicts that the Australia health and wellness market size is expected to show a growth rate (CAGR) of 6.75% during 2025-2033.

Cultural Diversity and Innovation in Flavor

Australia's culturally diverse society is constantly transforming the flavor profiles and ingredients of instant soup products, fueling the growth of the market. As increasingly varied cultural tastes blend into everyday food, companies are broadening their portfolios to accommodate a range of international tastes like Thai Tom Yum, Japanese Miso, Indian Lentil, and Chinese Hot & Sour. People are looking for interesting and new taste adventures, and instant soup brands are taking this cue by innovating fusion flavors and traditional ethnic cooking recipes. This trend is attractive to adventurous foodies and second-generation immigrants who want to indulge in comforting traditional tastes in an easy format. Furthermore, food tourism and exposure to global cuisines via travel and media are driving this trend. Since the Australian population is adopting flavor diversity and trying new culinary profiles, the market for instant soups is constantly evolving and diversifying, resulting in increased appeal and enhanced brand differentiation along with retail shelves.

Australia Instant Soups Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on nature, form, source, distribution channel, and end use.

Nature Insights:

- Organic

- Conventional

The report has provided a detailed breakup and analysis of the market based on the nature. This includes organic and conventional.

Form Insights:

- Dry

- Liquid

The report has provided a detailed breakup and analysis of the market based on the form. This includes dry and liquid.

Source Insights:

- Animal-based

- Plant-based

The report has provided a detailed breakup and analysis of the market based on the source. This includes animal-based and plant-based.

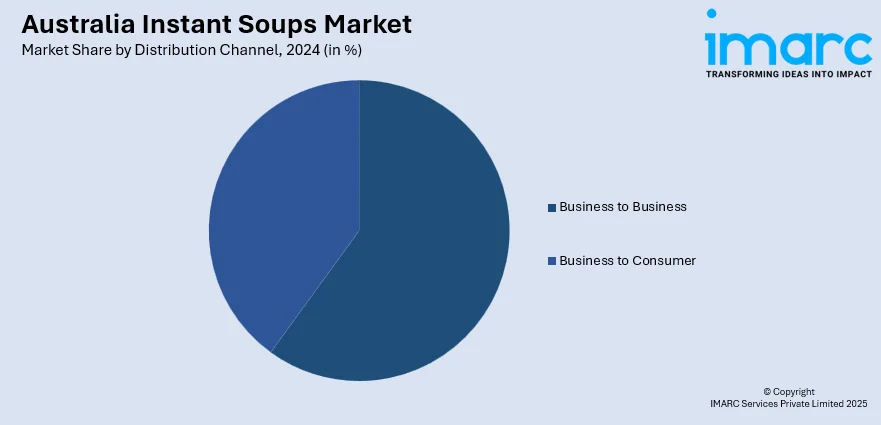

Distribution Channel Insights:

- Business to Business

- Business to Consumer

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes business to business and business to consumer.

End Use Insights:

- Foodservice

- Retail/Household

A detailed breakup and analysis of the market based on the end use have also been provided in the report. This includes foodservice and retail/household.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Instant Soups Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Natures Covered | Organic, Conventional |

| Forms Covered | Dry, Liquid |

| Sources Covered | Animal-based, Plant-based |

| Distribution Channels Covered | Business to Business, Business to Consumer |

| End Uses Covered | Foodservice, Retail/Household |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia instant soups market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia instant soups market on the basis of nature?

- What is the breakup of the Australia instant soups market on the basis of form?

- What is the breakup of the Australia instant soups market on the basis of source?

- What is the breakup of the Australia instant soups market on the basis of distribution channel?

- What is the breakup of the Australia instant soups market on the basis of end use?

- What is the breakup of the Australia instant soups market on the basis of region?

- What are the various stages in the value chain of the Australia instant soups market?

- What are the key driving factors and challenges in the Australia instant soups market?

- What is the structure of the Australia instant soups market and who are the key players?

- What is the degree of competition in the Australia instant soups market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia instant soups market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia instant soups market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia instant soups industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)