Australia Insulation Market Size, Share, Trends and Forecast by Material Type, Function, Form, End Use Industry, and Region, 2025-2033

Australia Insulation Market Overview:

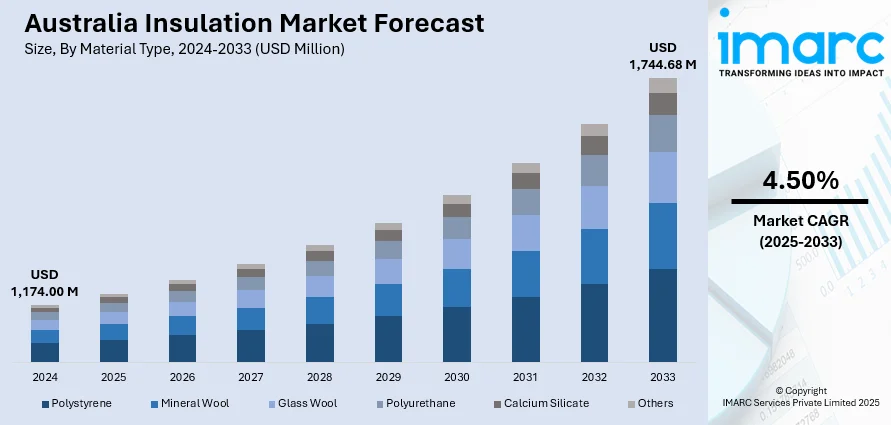

The Australia insulation market size reached USD 1,174.00 Million in 2024. Looking forward, the market is projected to reach USD 1,744.68 Million by 2033, exhibiting a growth rate (CAGR) of 4.50% during 2025-2033. The market is witnessing steady growth, driven by rising construction activity, energy efficiency regulations, and growing environmental awareness. Demand is increasing across residential, commercial, and industrial sectors, with manufacturers focusing on sustainable and high-performance insulation materials. Government initiatives promoting green buildings further support market expansion, encouraging innovation and adoption. These factors collectively contribute to the evolving landscape of the Australia insulation market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,174.00 Million |

| Market Forecast in 2033 | USD 1,744.68 Million |

| Market Growth Rate 2025-2033 | 4.50% |

Key Trends of Australia Insulation Market:

Increasing Demand for Energy-Efficient Buildings

Australia's growing emphasis on sustainability and energy efficiency is having a significant impact on the insulation industry. For example, in March 2024, Etex finalizes the acquisition of BGC's plasterboard and fibre cement businesses, adding to its sustainable product portfolio, such as insulation products, and increasing its market share in Australia and New Zealand. Furthermore, with residential, commercial, and industrial constructions highly adopting ecofriendly building principles, the need for high-performance insulation materials is gaining momentum. Policies introduced by governments to limit greenhouse gas emissions as well as meet energy efficiency standards have been key drivers in promoting the use of thermal insulation. Householders are also intensely realizing the long-term advantage of energy-efficient housing, including lower electricity costs and enhanced comfort, propelling the demand further. Improvements in insulation materials, including reflective and spray foam solutions, are increasing their application to wide-ranging applications. This change is in line with worldwide environmental regulations and promotes the shift to low-carbon infrastructure. Australia insulation market outlook shows continued growth as a result of these aspects, solidifying the role of insulation as an integral part in building energy efficiency enhancements in both urban and rural developments.

To get more information on this market, Request Sample

Increase in Retrofit and Refurbishment Works

An increasing number of aging buildings across Australia are being retrofitted and renovated to comply with modern energy efficiency standards, presenting significant growth opportunities for the insulation sector. Homeowners as well as facility managers are finding it desirable to replace insulation systems in order to enhance indoor comfort, minimize the consumption of energy, and add years to buildings that already stand. This has been a particularly strong trend in areas that experience severe weather patterns, wherein improved insulation means greater temperature control. Increased use of stricter building codes and performance requirements has also promoted insulation retrofit as a practical and cost-saving option. Furthermore, rebates offered by the government and financial incentives are now making retrofitting affordable for a larger population. Australia insulation market growth path captures this retrofitting wave, establishing the industry as a key factor in improving the sustainability and resilience of Australia's older building stock as well as its overall energy transition objectives.

Expansion of Sustainable and Recyclable Materials

Growing environmental consciousness and an increasing devotion to circular economy principles are driving a significant move toward sustainable insulation materials in Australia. For instance, in March 2024, X-Hemp introduced sustainable hempcrete in Australia, a carbon-absorbing, biodegradable building material composed of hemp, lime, and water, enhancing energy efficiency and enabling a net-zero future. Moreover, customers and constructors are preferring products that utilize renewable, recyclable, or non-toxic materials consistent with green building practices. Materials like cellulose, sheep's wool, and recycled polyester, are popular because of their minimal environmental footprint and efficient thermal properties. The building construction industry is also embracing lifecycle audits and green validations that prefer the use of lower carbon footprint-insulating materials. This change comes backed by research and development (R&D) aimed at increasing the quality of sustainable options in insulation materials. As green building practice becomes more prevalent, the Australia insulation market share of sustainable products will expand, demonstrating the industry's response to changing market demands and consolidating its leadership in sustainable development throughout the country’s-built environment.

Growth Drivers of Australia Insulation Market:

Rising Construction Activity

The growth of Australia’s residential, commercial, and infrastructure areas is a major factor influencing the insulation market. As urbanization increases, there is a rising demand for effective thermal and acoustic insulation in new housing developments, office buildings, and large infrastructure projects. Builders and developers are emphasizing energy-efficient construction approaches that align with regulatory requirements while also enhancing occupant comfort. Insulation plays a crucial role in lowering heating and cooling expenses and improving soundproofing, making it vital for both urban and suburban projects. There is also a growing trend toward retrofitting older structures with modern insulation solutions to achieve sustainability goals. These elements are significantly elevating Australia insulation market demand, as stakeholders throughout the construction sector continue to prioritize durability, performance, and adherence to energy-saving guidelines.

Industrial Demand Growth

Aside from construction, the industrial sector in Australia is emerging as a key driver for insulation adoption. Fields like manufacturing, oil and gas, and mining demand effective insulation systems to optimize operational efficiency, minimize energy losses, and ensure the safety of workers. Insulation materials are widely utilized in pipelines, machinery, furnaces, and processing facilities, where high temperatures and energy-intensive operations are standard. By maintaining ideal thermal control, industries can reduce downtime, enhance safety compliance, and lower operational costs. Furthermore, acoustic insulation is increasingly being adopted in industrial environments to mitigate noise levels and shield workers from long-term exposure. As Australia’s industrial sector continues to modernize, the pursuit of reliable, high-performance insulation solutions is anticipated to grow, further enhancing the importance of insulation in these critical industries.

Climate Considerations

Australia’s distinct climate, characterized by extremely hot summers and cold winters, significantly drives the demand for insulation. Effective insulation aids in regulating indoor temperatures, decreasing reliance on heating and cooling systems, and reducing energy bills. This aspect makes insulation critical for residential comfort and commercial efficiency. According to Australia insulation market analysis, both consumers and businesses are recognizing insulation as a long-term investment in energy savings and environmental sustainability. The severity of weather conditions also accelerates the demand for resilient materials that can endure temperature changes while continuing to perform effectively. Incentives from the government encouraging energy-efficient buildings further support this trend. As climate variability persists, the need for high-quality insulation solutions to ensure comfort, cost efficiency, and a reduced environmental footprint becomes increasingly important.

Government Support for Australia Insulation Market:

Financial Incentives and Rebates

Government-driven financial support is essential for promoting insulation adoption throughout Australia. Subsidies, tax incentives, and rebate programs aim to make energy-efficient renovations more accessible for both households and businesses. These initiatives help reduce initial costs, encouraging property owners to install or enhance insulation systems that align with energy-saving standards. For commercial properties, these financial advantages assist companies in decreasing operational costs and achieving sustainability goals without putting undue financial pressure on them. By providing these incentives, the government fosters lower energy consumption and aids in meeting national climate objectives. As more consumers and businesses become aware of the long-term savings from energy efficiency, these rebate programs are emerging as significant catalysts for growth in the insulation market.

Retrofitting Programs

Government-supported retrofitting programs are generating significant demand for insulation in Australia. Many older residential and commercial buildings lack sufficient insulation, resulting in increased energy use and operational inefficiencies. To tackle this problem, government initiatives prioritize upgrading existing buildings with modern insulation materials that meet current energy performance standards. These programs contribute to lowering household energy bills while also making a considerable impact on reducing greenhouse gas emissions on a larger scale. By promoting retrofits, authorities ensure that the advantages of insulation extend to existing structures rather than just new builds. This strategy supports sustainable urban development and enhances overall comfort and efficiency. As awareness regarding environmental responsibility expands, retrofitting programs are crucial in driving long-term insulation adoption.

Public Infrastructure Investments

Public infrastructure projects in Australia significantly enhance insulation demand through government support. Major initiatives, such as hospitals, schools, transportation facilities, and community buildings, often receive government funding and are required to meet strict energy efficiency standards. Insulation plays a vital role in these developments, contributing to improved energy performance, indoor comfort, and long-term cost advantages. By incorporating insulation requirements into public construction regulations, authorities strengthen the market and establish benchmarks for private sector initiatives. Furthermore, the emphasis on sustainable and resilient infrastructure fuels the need for advanced and durable insulation materials. As Australia continues to make substantial investments in public infrastructure, insulation suppliers and manufacturers enjoy consistent demand, which bolsters the sector’s ongoing growth.

Australia Insulation Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material type, function, form, and end use industry.

Material Type Insights:

- Polystyrene

- Mineral Wool

- Glass Wool

- Polyurethane

- Calcium Silicate

- Others

The report has provided a detailed breakup and analysis of the market based on the material type. This includes polystyrene, mineral wool, glass wool, polyurethane, calcium silicate, and others.

Function Insights:

- Thermal

- Acoustic

- Electric

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes thermal, acoustic, electric, and others.

Form Insights:

- Blanket

- Foam

- Board

- Pipe

- Others

The report has provided a detailed breakup and analysis of the market based on the form. This includes blanket, foam, board, pipe, and others.

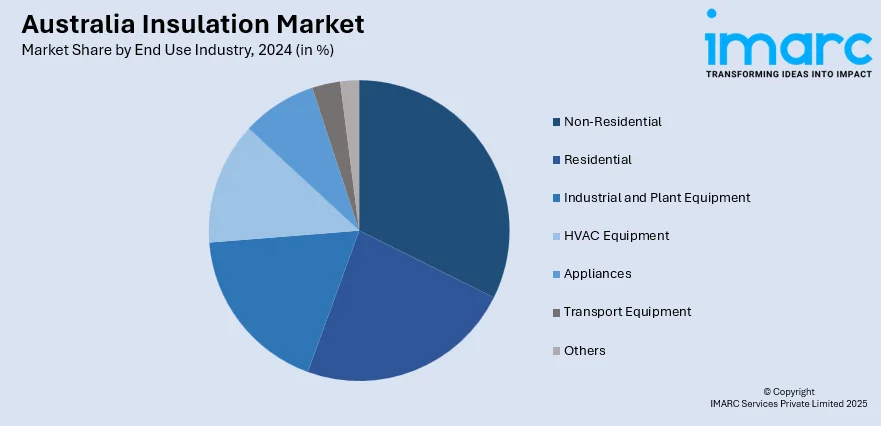

End Use Industry Insights:

- Non-Residential

- Residential

- Industrial and Plant Equipment

- HVAC Equipment

- Appliances

- Transport Equipment

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes non-residential, residential, industrial and plant equipment, HVAC equipment, appliances, transport equipment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Insulation Market News:

- In May 2024, Knauf Insulation launched its new Performance+ fiberglass insulation line, which is asthma & allergy friendly® certified and formaldehyde-free. The new line is a benchmark for HVAC insulation in reducing VOCs and exposure to allergens, enabling healthier indoor spaces and reaffirming Knauf's focus on sustainable, health-oriented building solutions.

- In January 2024, Owens Corning™ launched its EcoTouch® insulation with PureFiber® Technology, which delivers outstanding sustainability and performance. Composed of more than 99% natural components, it provides easier installation, quicker setup, and greater stiffness. Certified as having 58% recycled content, it is perfect for energy-efficient, eco-friendly homes and is thus highly recommended by homeowners and contractors.

Australia Insulation Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Material Types Covered | Polystyrene, Mineral Wool, Glass Wool, Polyurethane, Calcium Silicate, Others |

| Functions Covered | Thermal, Acoustic, Electric, Others |

| Forms Covered | Blanket, Foam, Board, Pipe, Others |

| End Use Industries Covered | Non-Residential, Residential, Industrial and Plant Equipment, HVAC Equipment, Appliances, Transport Equipment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia insulation market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia insulation market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia insulation industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The insulation market in Australia was valued at USD 1,174.00 Million in 2024.

The Australia insulation market is projected to exhibit a compound annual growth rate (CAGR) of 4.50% during 2025-2033.

The Australia insulation market is expected to reach a value of USD 1,744.68 Million by 2033.

The Australia insulation market is experiencing significant growth with rising adoption of eco-friendly materials, integration of insulation in sustainable building designs, and demand for advanced thermal and acoustic solutions. Growing use of digital tools for energy efficiency assessment further supports market innovation and long-term performance improvements.

Key drivers include rapid urbanization, expansion of industrial facilities, and government-backed energy efficiency initiatives. Rising consumer awareness about cost savings from energy-efficient homes, coupled with increased retrofitting projects for older buildings, is boosting demand. Additionally, Australia’s extreme climate conditions continue to strengthen the need for effective insulation solutions across residential, commercial, and industrial sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)