Australia Insulation Materials Market Size, Share, Trends and Forecast by Type, Application, and Region, 2026-2034

Australia Insulation Materials Market Summary:

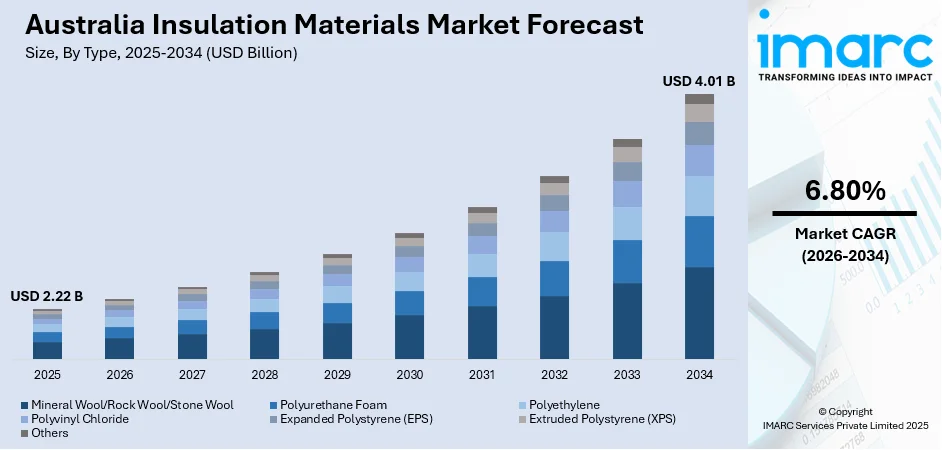

The Australia insulation materials market size was valued at USD 2.22 Billion in 2025 and is projected to reach USD 4.01 Billion by 2034, growing at a compound annual growth rate of 6.80% from 2026-2034.

The market is experiencing steady growth driven by rising construction activity and increased focus on energy efficiency. Demand is growing across residential, commercial, and industrial sectors as sustainable building practices gain prominence. Innovations in thermal and acoustic insulation materials are enhancing performance and efficiency. Government incentives and regulations supporting eco-friendly construction further encourage adoption of advanced insulation solutions nationwide.

Key Takeaways and Insights:

- By Type: Polyurethane foam dominates the market with a share of 30% in 2025, valued for superior thermal insulation, energy efficiency, and adaptability in various building applications, making it a preferred choice across residential and commercial construction projects.

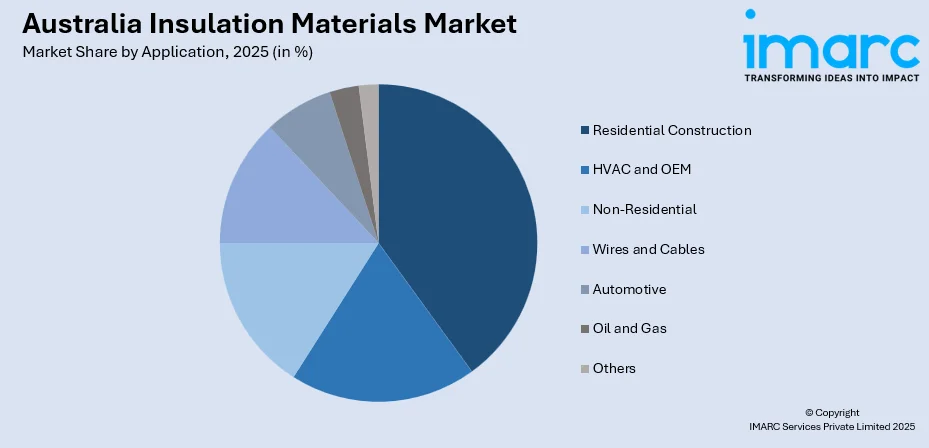

- By Application: Residential construction leads the market with a share of 40% in 2025, driven by rising demand for energy-efficient, comfortable, and sustainable homes. Increased awareness of cost savings and environmental benefits encourages widespread adoption of advanced insulation solutions in new and renovated housing projects.

- Key Players: The market is highly competitive, with key players focusing on innovative insulation technologies, eco-friendly solutions, and expanded distribution networks. Strategic collaborations, product differentiation, and sustainability initiatives help manufacturers strengthen market presence and address evolving construction sector demands.

To get more information on this market, Request Sample

The market is propelled by an increasing focus on energy-efficient building practices and sustainable construction standards. Growing consumer awareness about thermal comfort, cost savings on energy consumption, and environmental sustainability has strengthened demand for advanced insulation solutions. Technological advancements in material performance, ease of installation, and versatility across residential and commercial applications further enhance adoption. Additionally, government regulations encouraging energy-efficient construction practices are prompting builders and developers to prioritize high-quality insulation. As per sources, in July 2024, ABC News reported that under amendments to the National Construction Code, all newly constructed homes in Australia, except Tasmania, are mandated to achieve a minimum seven-star thermal efficiency rating. Moreover, urban expansion, rising residential and commercial construction projects, and integration of smart building practices are also driving growth.

Australia Insulation Materials Market Trends:

Sustainable Material Adoption

The Australia insulation materials market is increasingly shifting toward eco-friendly solutions that minimize environmental impact. In April 2025, Knauf Insulation announced its new sustainability strategy, For A Better World, setting targets for 2025, including reducing embodied carbon by 15% and using over 65% recycled material in glass‑wool products. Moreover, builders and developers are prioritizing materials that provide superior thermal insulation while supporting long-term durability. These sustainable options enable reductions in energy consumption and carbon footprint, aligning with environmental regulations and green building standards. Adoption is accelerating across residential and commercial construction, driven by rising awareness of sustainable practices and the demand for energy-efficient, high-performance insulation solutions.

Integration with Smart Homes

Insulation solutions are being integrated into smart building designs, enhancing energy management, indoor climate control, and occupant comfort. As per sources, in October 2025, Australia released a new Smart Home Guide to help households adopt automated, energy-efficient systems, supporting improved comfort, lower emissions, and enhanced integration of smart technologies across modern homes. Additionally, advanced insulation works alongside automated home systems to optimize temperature regulation and energy efficiency. This trend supports the adoption of modern construction practices that emphasize technology-driven comfort and sustainability. Builders increasingly incorporate these solutions into residential and commercial projects, aligning with evolving consumer preferences for smart, energy-conscious living and working environments.

Advanced Material Technologies

Innovations in polymer-based and composite insulation materials are transforming the Australian construction sector. In October 2025, Kingspan launched its locally manufactured K-Roc insulated wall and ceiling panels in Sydney, enhancing thermal performance, fire safety, and reducing lead times through domestic production. Further, these advanced materials improve thermal efficiency, fire resistance, and acoustic performance, providing enhanced safety and comfort in buildings. Superior durability and ease of installation make them ideal for both residential and commercial applications. Rising adoption reflects the demand for high-performance, energy-efficient solutions that meet stringent building codes and sustainability goals while supporting modern architectural designs.

Market Outlook 2026-2034:

The market is expected to experience significant growth, driven by increasing adoption across residential, commercial, and industrial sectors. Rising awareness of energy efficiency and sustainability is boosting revenue as developers favor high-performance materials. Urbanization, supportive regulations, and innovations in polyurethane foam, composite panels, and advanced insulation technologies are enhancing thermal and acoustic performance. Residential construction remains the largest contributor, with commercial and industrial applications steadily expanding, supporting a positive market outlook. The market generated a revenue of USD 2.22 Billion in 2025 and is projected to reach a revenue of USD 4.01 Billion by 2034, growing at a compound annual growth rate of 6.80% from 2026-2034.

Australia Insulation Materials Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Type | Polyurethane Foam | 30% |

| Application | Residential Construction | 40% |

Type Insights:

- Mineral Wool/Rock Wool/Stone Wool

- Polyurethane Foam

- Polyethylene

- Polyvinyl Chloride

- Expanded Polystyrene (EPS)

- Extruded Polystyrene (XPS)

- Others

The polyurethane foam dominates with a market share of 30% of the total Australia insulation materials market in 2025.

Polyurethane foam is the largest product segment in Australia’s insulation materials market, valued for its exceptional thermal resistance and lightweight properties. Its ability to conform to various surfaces makes it ideal for walls, roofs, and flooring, enhancing energy efficiency in residential and commercial buildings. Builders increasingly choose polyurethane foam for new constructions and retrofits, appreciating its cost-effectiveness, durability, and long-term performance, which help reduce energy consumption and operational costs over the building’s life. In August 2024, the Australian Government began consulting on expanding NatHERS to rate existing homes, supporting improved insulation standards and encouraging greater adoption of high-performance materials across the construction sector.

The widespread adoption of polyurethane foam is also driven by growing awareness of sustainability and energy conservation. Its versatility allows seamless integration into modern construction practices, including complex designs and retrofit solutions. Homeowners and contractors favor this material for its reliable insulation, structural benefits, and minimal maintenance requirements. As energy efficiency standards tighten, polyurethane foam continues to solidify its position as the preferred insulation solution across Australia.

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Residential Construction

- HVAC and OEM

- Non-Residential

- Wires and Cables

- Automotive

- Oil and Gas

- Others

The residential construction leads with a share of 40% of the total Australia insulation materials market in 2025.

Homeowners and builders prioritize energy-efficient solutions that reduce heating and cooling costs while meeting regulatory requirements. Insulation materials are extensively applied in walls, roofs, and floors, improving indoor comfort. The growing focus on sustainable living drives widespread adoption of residential insulation, supporting energy-conscious and environmentally responsible construction practices.

Rising awareness of environmental impact and long-term energy savings further supports the use of insulation in homes. Builders and homeowners increasingly select materials that combine durability, thermal efficiency, and ease of installation. Effective insulation solutions remain central to creating comfortable, energy-conscious residences, solidifying their leading position in Australia’s residential construction insulation market.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The Australia Capital Territory and New South Wales market is supported by urban development and extensive residential and commercial construction. Energy-efficient building practices drive the adoption of advanced insulation materials, enhancing thermal comfort, sustainability, and compliance with government regulations across major cities and metropolitan areas.

Victoria and Tasmania are witnessing growing demand for insulation materials through residential and commercial construction. In January 2024, the Australian and Tasmanian governments partnered to invest $16.6 million in energy upgrades for 1,600+ social housing homes in Tasmania, improving insulation, heating, and efficiency. Additionally, energy efficiency and sustainable building practices encourage the use of advanced insulation solutions, providing improved thermal performance and long-term durability while supporting building quality and occupant comfort across urban and suburban areas.

Queensland’s market is driven by increasing residential and commercial construction, with attention to maintaining thermal comfort in warm climates. Adoption of high-performance, energy-efficient insulation solutions is rising across urban and regional projects, supporting sustainability goals and enhancing overall building quality throughout the state.

The Northern Territory and Southern Australia market is shaped by urban development and new construction projects. Energy-efficient building practices and sustainable construction encourage adoption of high-performance insulation materials that improve thermal regulation, comfort, and energy savings in both residential and commercial buildings across these regions.

Western Australia’s market growth is influenced by residential construction, urban expansion, and mining-related infrastructure projects. Adoption of energy-efficient and durable insulation materials enhances building performance and thermal comfort, with increased uptake across urban centers and regional areas driven by sustainability awareness and efficiency considerations.

Market Dynamics:

Growth Drivers:

Why is the Australia insulation materials market growing?

Energy Efficiency Regulations

Government initiatives focused on energy-efficient construction are strongly influencing the adoption of insulation materials across Australia. As per sources, in April 2025, the Affiliated Insulation Industry Coalition welcomed the Victorian government’s reintroduction of insulation to the Victorian Energy Upgrades program, supporting energy-efficient, comfortable, and cost-effective homes across the state. Furthermore, builders and developers are increasingly selecting advanced products to meet sustainability targets, reduce energy consumption, and enhance thermal comfort for occupants. Compliance with regulatory standards has made high-performance insulation essential in residential, commercial, and industrial projects. This regulatory environment is encouraging wider use of eco-friendly, durable, and energy-saving insulation solutions, establishing a foundation for steady market growth and greater awareness of sustainable building practices.

Rising Urbanization and Residential Construction

Rapid urban expansion and an increase in residential construction are creating strong demand for insulation materials in Australia. Developers are emphasizing energy-efficient and durable solutions to improve building performance, occupant comfort, and long-term operational costs. In November 2024, demand for PGF Capital Bhd’s glass wool insulation in Australia remained strong, supported by ongoing residential construction and infrastructure projects such as light rail transit and airport expansion. Furthermore, new housing developments, apartment complexes, and commercial buildings require modern insulation solutions to meet quality expectations. Growing urban populations, coupled with government incentives for sustainable construction, are driving widespread adoption, supporting market growth and stimulating investment in advanced materials for diverse building applications.

Technological Advancements in Materials

Continuous innovation in polymer-based, composite, and foam insulation materials is enhancing performance, durability, and versatility across building projects. Advanced materials now offer superior thermal efficiency, fire resistance, and acoustic control, making them suitable for a wide range of residential and commercial applications. In November 2025, BASF unveiled Basotect® Dark EcoBalanced, the first dark melamine resin foam, combining advanced sound absorption, sustainability, and design versatility for contemporary interior, acoustic, and construction applications worldwide. Moreover, ease of installation, long service life, and improved energy efficiency are boosting adoption rates. These technological improvements support the development of modern, sustainable buildings, positioning insulation as a key contributor to high-quality construction practices and long-term market expansion.

Market Restraints:

What Challenges the Australia insulation materials market is facing?

High Initial Installation Costs

The adoption of premium insulation materials is often restrained by high upfront installation costs. While these solutions offer long-term energy savings and enhanced thermal performance, budget-conscious developers and homeowners may hesitate to invest initially. This cost barrier can slow widespread adoption, particularly in smaller residential projects or regions where construction budgets are limited, despite the long-term benefits associated with energy efficiency and sustainable building practices.

Limited Awareness in Regional Areas

In regional and less urbanized areas, awareness of the benefits and importance of high-performance insulation remains limited. Many builders and homeowners are unfamiliar with energy efficiency advantages, long-term cost savings, and thermal comfort improvements. This lack of knowledge restricts adoption of advanced insulation materials, particularly in smaller towns and rural regions, slowing market penetration and limiting the impact of innovative, energy-efficient solutions across the broader construction landscape.

Material Compatibility Constraints

Some insulation materials may not be compatible with certain building structures, construction materials, or climatic conditions. These compatibility limitations restrict their application across diverse projects, especially in regions with unique environmental conditions. Builders may face challenges selecting suitable insulation types that meet both performance and regulatory requirements, which can hinder adoption. As a result, certain high-performance solutions may remain underutilized despite their benefits for energy efficiency and occupant comfort.

Competitive Landscape:

The Australia insulation materials market is moderately competitive, with numerous regional and international players supplying products across residential, commercial, and industrial sectors. Companies focus on innovation, sustainable materials, and energy-efficient solutions to differentiate themselves. Strategic collaborations with developers and contractors enhance market reach. Emphasis on R&D improves thermal, acoustic, and fire-resistant performance. Marketing and distribution strategies are tailored to regional demand and building practices. Sustainability drives adoption of eco-friendly, recyclable materials aligned with regulations. Continuous innovation and rising awareness of high-performance insulation solutions support steady growth. The landscape reflects ongoing efforts to diversify applications and meet evolving construction and environmental standards.

Recent Developments:

- In November 2024, Fletcher Insulation signed two new leases in Victoria, expanding its southeast Melbourne operations. New facilities at Dandenong South and Keysborough will support manufacturing, storage, and office space, strengthening the company’s capacity to produce and distribute high-performance insulation products across Australia.

- In June 2024, Armacell acquired E&M Industries’ engineering business in Western Australia, enhancing its industrial insulation and acoustic solutions. Operating from existing Perth facilities, the acquisition strengthens Armacell’s energy-efficient insulation offerings, supports solution-selling strategies, and expands its presence in the Australian and broader Asia Pacific insulation markets.

Australia Insulation Materials Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Mineral Wool/Rock Wool/Stone Wool, Polyurethane Foam, Polyethylene, Polyvinyl Chloride, Expanded Polystyrene (EPS), Extruded Polystyrene (XPS), Others |

| Applications Covered | Residential Construction, HVAC and OEM, Non-Residential, Wires and Cables, Automotive, Oil and Gas, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia insulation materials market size was valued at USD 2.22 Billion in 2025.

The Australia insulation materials market is expected to grow at a compound annual growth rate of 6.80% from 2026-2034 to reach USD 4.01 Billion by 2034.

Polyurethane held the largest market share with a 30% contribution, owing to its superior thermal insulation, versatility across residential and commercial applications, energy efficiency, and long-term durability, making it the preferred choice for modern construction projects.

Key factors driving the Australia Insulation Materials market include rising energy efficiency regulations, increasing urbanization and residential construction, growing demand for sustainable and high-performance insulation, and technological advancements enhancing thermal, acoustic, and fire-resistant performance.

Major challenges include high initial installation costs, limited awareness of insulation benefits in regional areas, and compatibility constraints of certain insulation materials with specific building structures, climates, or construction requirements.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)