Australia IoT Based Cold Chain Management Market Size, Share, Trends and Forecast by Component, Application, Technology, and Region, 2025-2033

Australia IoT Based Cold Chain Management Market Overview:

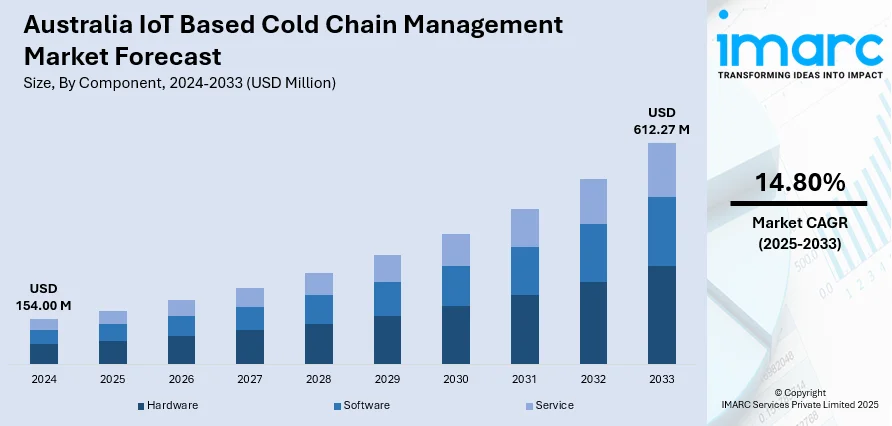

The Australia IoT based cold chain management market size reached USD 154.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 612.27 Million by 2033, exhibiting a growth rate (CAGR) of 14.80% during 2025-2033. The growth of e-commerce, particularly in food and beverage (F&B) and pharmaceuticals, is driving the adoption of Internet of Things (IoT)-based cold chain management solutions in Australia. Additionally, investments in smart infrastructure and digital technologies like IoT sensors and cloud platforms for enhancing operational efficiency, visibility, and competitiveness in cold chain logistics is contributing to the expansion of the Australia IoT based cold chain management market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 154.00 Million |

| Market Forecast in 2033 | USD 612.27 Million |

| Market Growth Rate 2025-2033 | 14.80% |

Australia IoT Based Cold Chain Management Market Trends:

Growth of E-Commerce and Direct-to-Consumer (DTC) Models

The swift expansion of e-commerce, especially in the F&B and pharmaceutical industries, is contributing to the acceptance of IoT-driven cold chain management solutions in Australia. With an increasing number of companies adopting direct-to-consumer (DTC) approaches for grocery and pharmaceutical deliveries, it is essential to preserve the quality of temperature-sensitive items during transit for client satisfaction and adherence to regulations. As the quantity of perishable items sent directly to individuals increases, e-commerce firms are progressively utilizing IoT technologies, including sensors and connected systems, to manage the cold chain effectively. These IoT systems offer real-time tracking and ongoing temperature monitoring, guaranteeing that products stay fresh and intact upon delivery. In a competitive marketplace, possessing a dependable cold chain solution offers a considerable benefit, enabling companies to enhance user confidence while guaranteeing that their products are transported in optimal conditions. The Australian Bureau of Statistics (ABS) reported that total online retail sales in May 2024 amounted to $4,155.7 million. With a yearly rise of 6.3%, the expansion of online retail underscores the growing need for e-commerce services, particularly in areas dependent on temperature-sensitive goods. The increase in e-commerce sales highlights the necessity of effective cold chain management, positioning IoT technology as a crucial resource for companies aiming to fulfill client demands and maintain adherence to industry regulations.

To get more information of this market, Request Sample

Investment in Smart Infrastructure and Digitalization

Australia's commitment to smart infrastructure and the broader movement towards digital transformation in various sectors, such as logistics and supply chain management, is accelerating the implementation of IoT-driven cold chain systems. In line with the Industry 4.0 trend, companies are making substantial investments in cutting-edge digital technologies like IoT sensors, global positioning system (GPS) tracking, and automation systems to improve operational visibility and efficiency. These technological innovations are especially significant in cold chain management, enabling the real-time tracking of temperature-sensitive goods throughout the entire supply chain. Integrating IoT devices with cloud services and data analysis tools allows businesses to enhance transportation routes, foresee possible delays, and consistently track the status of goods. This level of digital management not only boosts efficiency but also reduces operational expenses while enhancing the client experience by ensuring timely and secure product delivery. The increasing significance of these technologies is highlighted by the substantial growth of Australia's digital transformation market, which hit USD 18.5 billion in 2024 and is projected to expand at a compound annual growth rate (CAGR) of 18.4%, attaining USD 84.7 billion by 2033. This growth underscores a national commitment to upgrading infrastructure and adopting digital technologies, which is crucial for the rapid expansion of IoT-driven cold chain management systems across Australia. By embracing these technologies, companies enhance their competitive advantage by improving the reliability and efficiency of their cold chain operations, thereby contributing to the Australia IoT based cold chain management market growth.

Australia IoT Based Cold Chain Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, application, and technology.

Component Insights:

- Hardware

- Sensors

- RFID Tags

- GPS Devices

- Software

- Cloud Platforms

- Analytics Tools

- Service

- Consulting

- Maintenance

- Integration

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes hardware (sensors, RFID tags, and GPS devices), software (cloud platforms and analytics tools), and service (consulting, maintenance and integration).

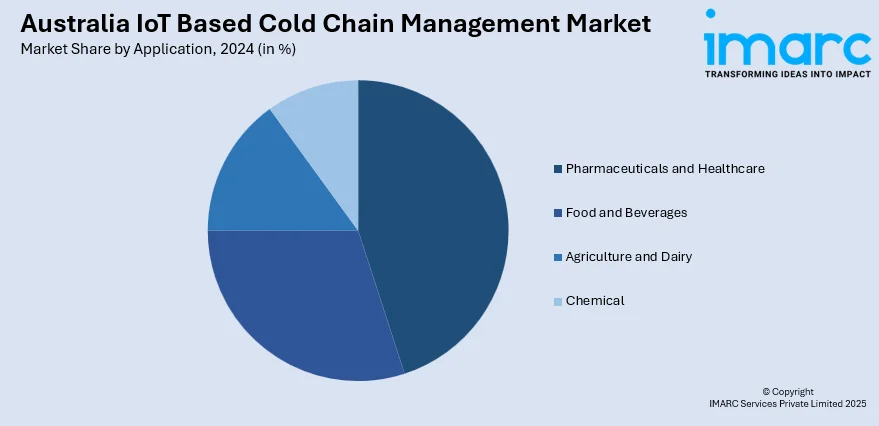

Application Insights:

- Pharmaceuticals and Healthcare

- Food and Beverages

- Agriculture and Dairy

- Chemical

The report has provided a detailed breakup and analysis of the market based on the application. This includes pharmaceuticals and healthcare, food and beverages, agriculture and dairy, and chemical.

Technology Insights:

- Bluetooth

- Cellular Network

- Satellite Network

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes Bluetooth, cellular network, and satellite network.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia IoT Based Cold Chain Management Market News:

- In April 2025, Satellite IoT was highlighted as a transformative force for Australian agriculture and logistics, enabling real-time data in remote areas through technologies like LEO satellites and AI. Key applications include precision water management, livestock monitoring, and cold chain optimization.

Australia IoT Based Cold Chain Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered |

|

| Applications Covered | Pharmaceuticals and Healthcare, Food and Beverages, Agriculture and Dairy, Chemical |

| Technologies Covered | Bluetooth, Cellular Network, Satellite Network |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia IoT based cold chain management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia IoT based cold chain management market on the basis of component?

- What is the breakup of the Australia IoT based cold chain management market on the basis of application?

- What is the breakup of the Australia IoT based cold chain management market on the basis of technology?

- What is the breakup of the Australia IoT based cold chain management market on the basis of region?

- What are the various stages in the value chain of the Australia IoT based cold chain management market?

- What are the key driving factors and challenges in the Australia IoT based cold chain management market?

- What is the structure of the Australia IoT based cold chain management market and who are the key players?

- What is the degree of competition in the Australia IoT based cold chain management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia IoT based cold chain management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia IoT based cold chain management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia IoT based cold chain management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)